Search

Democracy Links

Member's Off-site Blogs

a sign of the crimes .....

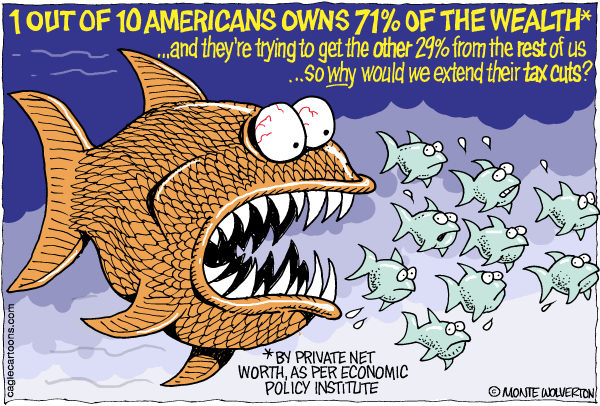

For the 400 US taxpayers with the highest adjusted gross income, the effective federal income tax rate - what they actually pay - fell from almost 30% in 1995 to just under 17% in 2007, according to the IRS.

And for the approximately 1.4 million people who make up the top 1% of taxpayers, the effective federal income tax rate dropped from 29% to 23% in 2008. It may seem too fantastic to be true, but the top 400 end up paying a lower rate than the next 1,399,600 or so.

That's not just good luck. It's often the result of hard work, as suggested by some of the strategies in the following pages. Much of the top 400's income is from dividends and capital gains, generated by everything from appreciated real estate - yes, there is some left - to stocks and the sale of family businesses.

As Warren Buffett likes to point out, since most of his income is from dividends, his tax rate is less than that of the people who clean his office.

- By John Richardson at 10 Apr 2011 - 2:12pm

- John Richardson's blog

- Login or register to post comments

Recent comments

19 min 14 sec ago

2 hours 27 min ago

3 hours 54 min ago

18 hours 11 min ago

18 hours 9 min ago

19 hours 11 min ago

23 hours 16 min ago

1 day 3 hours ago

1 day 3 hours ago

1 day 3 hours ago