Search

Democracy Links

Member's Off-site Blogs

hallowed by history, but not by reason .....

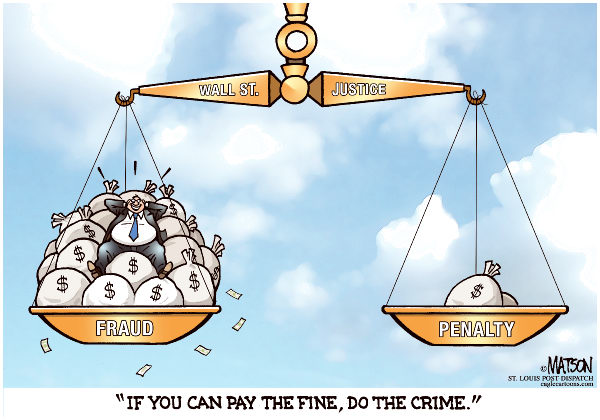

A federal judge in New York on Monday threw out a settlement between the Securities and Exchange Commission and Citigroup over a 2007 mortgage derivatives deal, saying that the S.E.C.'s policy of settling cases by allowing a company to neither admit nor deny the agency's allegations did not satisfy the law.

The judge, Jed S. Rakoff of United States District Court in Manhattan, ruled that the S.E.C.'s $285 million settlement, announced last month, is "neither fair, nor reasonable, nor adequate, nor in the public interest" because it does not provide the court with evidence on which to judge the settlement.

The ruling could throw the S.E.C.'s enforcement efforts into chaos, because a majority of the fraud cases and other actions that the agency brings against Wall Street firms are settled out of court, most often with a condition that the defendant does not admit that it violated the law while also promising not to deny it.

That condition gives a company or individual an advantage in subsequent civil litigation for damages, because cases in which no facts are established cannot be used in evidence in other cases, like shareholder lawsuits seeking recovery of losses or damages.

The S.E.C.'s policy - "hallowed by history, but not by reason," Judge Rakoff wrote - creates substantial potential for abuse, the judge said, because "it asks the court to employ its power and assert its authority when it does not know the facts."

Judge Rakoff also refers at one point to Citigroup as "a recidivist," or repeat offender, which has violated the antifraud provisions of the nation's securities laws many times. The company knew that the S.E.C.'s proposed judgment - that it cease and desist from violating the antifraud laws - had not been enforced in at least 10 years, the judge wrote.

The S.E.C. did not respond immediately to a request for comment on the judge's decision, which was released Monday morning. A Citigroup spokesman said the company was studying the decision and had no immediate comment.

Citigroup was charged with negligence in its selling to customers a billion-dollar mortgage securities fund, known as Class V Funding III. The S.E.C. alleged that Citigroup picked the securities to be included in the fund without telling investors, claiming that the securities were being chosen by an independent entity. Citigroup then bet against the investments because it believed that they would lose value, the S.E.C. said.

Investors lost $700 million in the fund, according to the S.E.C., while Citigroup gained about $160 million in profits.

The settlement established none of those allegations as fact, thereby making it impossible for the court to properly judge whether the settlement meets the required standard of being fair, adequate and in the public interest.

"An application of judicial power that does not rest on facts is worse than mindless, it is inherently dangerous," Judge Rakoff wrote in the case, S.E.C. v. Citigroup Global Markets. "In any case like this that touches on the transparency of financial markets whose gyrations have so depressed our economy and debilitated our lives, there is an overriding public interest in knowing the truth."

The S.E.C. in particular, he added, "has a duty, inherent in its statutory mission, to see that the truth emerges."

- By John Richardson at 29 Nov 2011 - 1:56pm

- John Richardson's blog

- Login or register to post comments

Recent comments

42 min 17 sec ago

1 hour 26 min ago

4 hours 10 min ago

4 hours 15 min ago

4 hours 28 min ago

7 hours 5 min ago

7 hours 28 min ago

9 hours 31 min ago

10 hours 59 min ago

1 day 5 hours ago