Search

Democracy Links

Member's Off-site Blogs

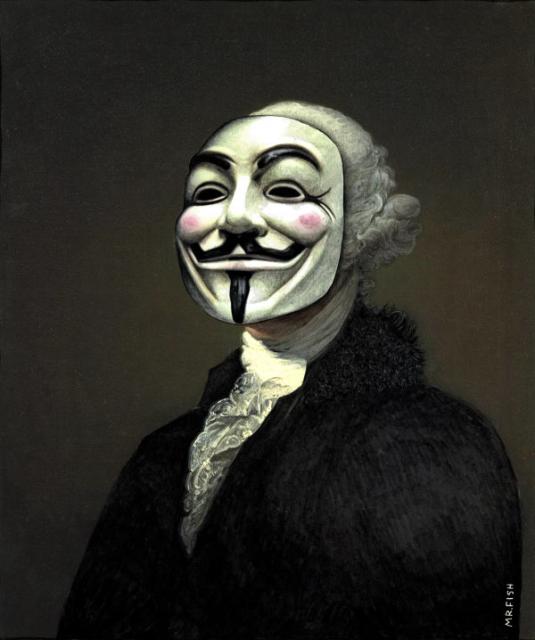

say you want a revolution .....

When you listen to street interviews with people in the troubled countries of the euro zone, a common complaint emerges: whereas some people waxed fat in the boom that preceded the crisis, it's ordinary workers who suffer most in the bust, and they and even poorer people who bear the brunt of government austerity campaigns intended to fix the problem.

In other words, achieving a well-functioning economy is one thing; achieving an economy that also treats people fairly is another. Economists and business people tend to focus mainly on economic efficiency; the public tends to focus on the fairness of it all.

Fail to fix the economy and almost everyone suffers. But offend people's perceptions of fairness and you're left with a dissatisfied, confused electorate that could react unpredictably.

The trick for governments is to try to achieve a reasonable combination of both economic efficiency and fairness. Fortunately, but a bit surprisingly, the need for this dual approach has penetrated the consciousness of the Organisation for Economic Co-operation and Development - the rich nations' club which is expanding its membership to include the soon-to-be-rich countries.

New research from the organisation deals with ways governments can get their budgets back under control without simply penalising the vulnerable and ways they can improve the economy's functioning and increase fairness at the same time.

Much of the concern about fairness in the hard-hit countries of the North Atlantic has focused on bankers. In the boom these people made themselves obscenely rich by their reckless, greedy behaviour, eventually bringing the economy down and causing many people to lose their businesses and millions to lose their jobs.

But their banks were bailed out at taxpayers' expense - adding to the huge levels of government debt the financial markets now find so unacceptable - and few bankers seem to have been punished. Some have even gone back to paying themselves huge bonuses.

It's a mistake, however, to focus discontent on the treatment of a relative handful of bankers. The fairness problem goes much wider. In most developed countries, the long boom of the preceding two decades saw an ever-widening gap between rich and poor.

In the United States, almost all the growth in real income over the period has been captured by the richest 10 per cent of households (much of it going to the top 1 per cent), so that most Americans' real income hasn't increased in decades.

It hasn't been nearly as bad in Australia. Low and middle household incomes have almost always risen in real terms, even though high incomes have grown a lot faster.

Looking globally, a lot of the widening in incomes has come from the effects of globalisation and, more particularly, technological change, which has increased the wages of the highly skilled relative to the less skilled. But a lot of the widening is explained by government policy changes, such as more generous tax cuts for the well-off.

The euro zone countries need not only to get on top of their budgets and government debt, but also to get their economies growing more vigorously. So the organisation has proposed structural reforms - we'd say microeconomic reforms - which can foster economic growth and fairness at the same time.

One area offering a ''double dividend'' is education. Policies that increase graduation rates from secondary and tertiary education hasten economic growth by adding to the workforce's accumulation of human capital while also increasing the lifetime income of young people who would otherwise do much less well.

Promoting equal access to education helps reduce inequality, as do policies that foster the integration of immigrants and fight all forms of discrimination. Making female participation in the workforce easier should also bring a double dividend.

Surprisingly - and of relevance to our debate about Julia Gillard's Fair Work Act - the organisation acknowledges the role of minimum wage rates, laws that strengthen trade unions, and unfair dismissal provisions in ensuring a more equal distribution of wage income.

It warns, however, that if minimum wages are set too high they may reduce employment, which counters their effect in reducing inequality. And reforms to job protection that reduce the gap between permanent and temporary workers can reduce wage dispersion and possibly also lead to higher employment.

Systems of taxation and payments of government benefits play a key role in lowering the inequality of household incomes. Across the membership of the organisation, three-quarters of the average reduction in inequality achieved by the tax and payments system come from payments. Means-tested benefits are more redistributive than universal benefits.

Reductions in the rates of income tax to encourage work, saving and investment need not diminish the inequality-reducing effect of income tax, provided their cost is covered by the elimination of tax concessions that benefit mainly high income earners - such as those for investment in housing or the reduction in the tax on capital gains. Getting rid of these would also reduce tax avoidance opportunities for top income earners.

So it's not inevitable that the best-off benefit most during booms and the worst-off suffer most in the clean-up operations after the boom busts. It's a matter of the policies governments choose to implement in either phase of the cycle.

You, however, may think it's inevitable that governments choose policies that benefit the rich and powerful in both phases.

But we're talking about the government of democracies, where the votes of the rich are vastly outnumbered by the votes of the non-rich. So if governments pursue policies that persistently disadvantage the rest of us, it must be because we aren't paying enough attention - aren't doing enough homework - and are too easily gulled by the vested interests' slick TV advertising campaigns.

- By John Richardson at 25 Jan 2012 - 8:30am

- John Richardson's blog

- Login or register to post comments

Recent comments

12 hours 19 min ago

13 hours 2 sec ago

13 hours 22 min ago

13 hours 40 min ago

14 hours 43 min ago

19 hours 55 min ago

20 hours 17 min ago

23 hours 13 min ago

1 day 12 hours ago

1 day 14 hours ago