Search

Democracy Links

Member's Off-site Blogs

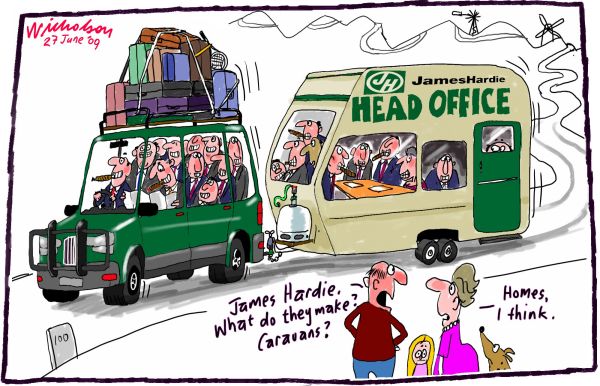

on the road to nowhere .....

So, it has come to this. A decade, a state government inquiry and litigation and appeals through every level of the legal system to conclude the bleeding obvious: that company directors are required to tell the truth.

Corporate governance experts have hailed Thursday's High Court judgment on James Hardie as a ''landmark decision'' that will alter the way in which directors should conduct themselves.

It is anything but that. Vitally important? Yes. Landmark? No.

The judgment merely reaffirms the law. It does not overturn or challenge the existing legislation but rather reinforces it.

Had the High Court found in favour of the Hardie Seven, it certainly would have been a landmark decision. For it would have been a bitter rebuke to asbestos victims and paved the way for company directors to absolve themselves of any responsibility for their decisions and actions.

The Australian Institute of Company Directors took a considered view of the judgment, declining to criticise the court while noting ''the case has potentially wide implications for directors, company secretaries and general counsel, in the understanding of their duties and responsibilities''.

The institute's chief executive, John Colvin, proffered that directors ''should apply their individual, considered judgment to matters that are highly significant to the company, especially issues with market sensitivity and that involve ASX disclosure".

As a motherhood statement, it ticks all the boxes. But in stating it, the clear inference is that some company directors have failed to grasp the fundamental principle that it is against the law to make false and misleading statements, regardless of whether they have been ill-advised by the company's management or anyone else.

"The case again puts the spotlight on the area of continuous disclosure and places additional emphasis on the need for boards to carefully consider whether statements made in their company's releases are appropriately qualified," Colvin said.

True to form, the institute this week attempted to switch the focus of the debate. ''In an environment where regulation and red tape is increasing, the role of a company director is becoming increasingly onerous and this is having a detrimental impact on board recruitment and retention,'' Colvin added.

The institute claimed about half of all directors who responded to a recent survey complained that judgments such the James Hardie and Centro cases have negatively affected their willingness to accept new board appointments.

Perhaps that's a blessing, for it could be argued such candidates clearly would be entirely unsuited or ill-equipped for the role.

Last June, the entire board of Centro Properties was found guilty of breaching the Corporations Act and not fulfilling their duties as directors after major errors in the accounts mortally wounded the company, torching billions of dollars in investors' funds.

In his 186-page judgment, Justice Middleton systematically demolished all the arguments put forward as a defence to the lax behaviour of the errant directors, who clearly failed to read the company's accounts before signing them.

If they didn't know or understand the accounts they were signing misrepresented the company's financial position, it was their duty to know, the judge declared.

The James Hardie case revolved around a press release, sent to the stock exchange, in February 2001 about the company's plan to shift its domicile to the Netherlands. The company stated it had established a foundation that would have ''sufficient funds to meet all legitimate compensation claims''.

There was an element of haste involved. Although Hardie for years had been considering what it referred to as ''separation'', cutting its asbestos liabilities adrift from the operating company, a soon-to-be-introduced change to the accounting standards added a sense of urgency.

Keeping the asbestos liabilities within the corporate structure would have created a drag on earnings for at least two decades.

It is worth remembering how Hardie got itself into this predicament. For most of the past century it produced asbestos products employed in a vast array of uses.

As the Hardie chairman John Reid said in 1978: ''Every time you walk into an office building, a home, a factory; every time you put your foot on the brake, ride a train, see a bulldozer at work … every time you do or see any of these things the chances are that a product from the James Hardie group of companies has a part in it.''

James Hardie was Australia's largest asbestos manufacturer with factories in each state, mines in South Africa and Canada, and factories in Indonesia and Malaysia.

It also harboured a dark secret. It had been aware since 1935 that asbestos was a killer and had received its first compensation claim for asbestosis as early as 1939.

Despite an escalation in claims in following decades, a damning Victorian government report in the late 1950s and mounting evidence about the deadly effects of asbestos in the 1970s, it wasn't until 1979 that James Hardie added a health warning to its products, and it continued manufacturing asbestos until 1987.

The company, along with the other major manufacturer CSR, made a fortune from asbestos. But the cost was enormous. It is estimated that by 2020, at least 55,000 Australians will have died from the ravaging effects of the asbestosis and mesothelioma.

By 2001, with escalating compensation claims, the company decided to protect its shareholders, again at the expense of its victims. The foundation, established to compensate all future asbestos victims, ran out of cash in three years. James Hardie left $293 million in the kitty for all future victims, at least $1.5 billion short of what was required.

The findings of the NSW government-inspired Jackson inquiry in 2004, after the compensation kitty was found bare, provided enough ammunition for the corporate regulator to take action.

Never to be accused of rushing things, it took the Australian Securities and Investments Commission three years to launch action, which it won overwhelmingly in the NSW Supreme Court before Justice Gzell.

The seven directors and the company secretary and legal counsel, Peter Shafron, appealed that decision, with the directors arguing Shafron had not advised them of crucial information relating to the potential future cost of claims and that the draft statement was not approved at the February 2001 board meeting. Shafron argued the firm's legal advisers were to blame for not advising him a crucial document should have been presented to the board and stock exchange. He also said that, as he was not an actuary, he could not be blamed for the incorrect estimate about future liabilities.

Essentially, when it came to apportioning blame, all eight had their fingers pointing in every direction other than their own. In a shock decision, the Court of Appeal found ASIC did not prove the seven directors had approved the draft statement at the meeting because the regulator failed to call a crucial witness.

But this week, the High Court overturned that ruling and it dismissed all of Shafron's arguments, including that he was not a company ''officer'' and so therefore couldn't be accused of failing in his duty as such.

For the past 11 years, Meredith Hellicar, who was a director at the fateful meeting but was appointed chairman after the death of Alan McGregor in 2004, has forcibly argued that the move to the Netherlands was to pursue a lower tax regime and had nothing to do with avoiding asbestos compensation.

That has been proven to be the lie that it always was. James Hardie paid more tax in the Netherlands than when it was domiciled in Australia. It since has shifted to Ireland.

The sly manner in which James Hardie, discussed at the February 2001 board meeting, attempted to massage public opinion was highlighted in this week's judgment as evidence the directors knew the true purpose of the Netherlands shift.

In a damning indictment into Australian business journalism, James Hardie decided to announce the offshore shift and asbestos separation with its financial results, because it knew it would receive soft treatment from business journalists.

Directors were told that management had ''sound relationships'' with seven senior business reporters and columnists from News Ltd and Fairfax who would be provided with ''deep background''. This newspaper was not on the list.

The strategy worked, for three years at least. Now Meredith Hellicar, Michael Brown, Michael Gillfillan, Martin Koffel, Gregory Terry, Geoffrey O'Brien, Peter Willcox and Peter Shafron face the agonising wait for their penalties.

- By John Richardson at 6 May 2012 - 6:33pm

- John Richardson's blog

- Login or register to post comments

Recent comments

16 min 57 sec ago

49 min 6 sec ago

1 hour 46 min ago

1 hour 50 min ago

3 hours 33 min ago

3 hours 44 min ago

3 hours 48 min ago

3 hours 56 min ago

16 hours 10 min ago

20 hours 37 min ago