Search

Democracy Links

Member's Off-site Blogs

on the money .....

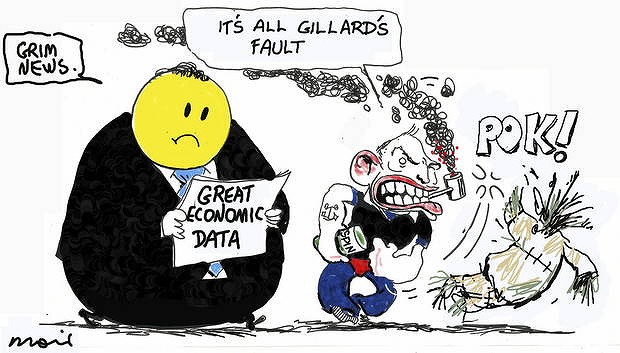

Tony Abbott and the opposition must be careful their wrecking-ball approach doesn't rebound and hurt them.

It's strike one against Tony Abbott's scare campaign on the carbon tax and mining tax. "Australia reported its economy was the fastest-growing in the developed world in the first three months of 2012, sweeping aside growing gloom," reported The Wall Street Journal this week.

With the new taxes due to take effect in three weeks, the facts on the health of the Australian economy show a very different country to the one that, if Abbott is right, should rightfully be cringing in fearful anticipation.

The national accounts and the employment figures this week showed an economy in robust health, creating jobs at a solid clip. While the US economy grew by 0.46 per cent in the three months to the end of March, Australia's grew by 1.3 per cent. It was the fastest pace in four years.

In the course of the full 12 months, where the American economy expanded by 2 per cent, Australia's grew by 4.3. It is Australia's 20th consecutive year of growth, making it unique among the rich countries.

"We sit over here, scratching our heads and asking ourselves, 'How do these guys do it?'," the president of the Progressive Policy Institute in Washington, Will Marshall, a Democrat-affiliated think tank, told the Herald recently.

While the US generated 69,000 new jobs in May, Australia generated 38,900. That is, Australia created about half as many jobs in a workforce only one-twelfth the size. The US unemployment rate was unchanged at 8.1 per cent. Australia's rose from 4.9 per cent to 5.1 as more people, encouraged to enter the workforce, started looking for jobs.

And the "wrecking ball" that Abbott and the opposition have warned time and time again is going to smash its way through the economy? There was no sign of it, not yet, anyway. Business investment surged, mainly in the mining sector. Household spending was even stronger.

What happened to the desolate, tumble-weed strewn ghost economy you'd expect as firms and families run for cover in fear of the economic Armageddon so long foretold by the Abbott of Doom?

Certainly, the international business advisory firm of Dun & Bradstreet must have been left off the Coalition's mailing list. Because when it released its Global Risk Indicator a couple of weeks ago it advised its clients that: "Australia is one of the safest trade and foreign investment destinations globally, ranking alongside Canada, Germany, Norway, Sweden and Switzerland, according to an analysis of 131 countries.

"Australia's rating also makes it the best ranked country in the Asia-Pacific region, ahead of Hong Kong, Singapore and New Zealand."

Rather than any kind of wasteland, Wayne Swan described the Australian economy to the Herald yesterday as "the sweet spot". The Treasurer said: "We have sustainable growth, contained inflation, solid consumption, and we've still got an elevated savings rate. It doesn't get much better than that."

He's right. World markets quickly reassessed Australia in a more positive light. Even Joe Hockey had trouble finding fault with the good economic news. "The Coalition welcomes these numbers, it wants these numbers to continue and it expects the government to do everything it can to make these numbers a reality for the rest of the year," he told reporters. Of course, there soon followed the inevitable "but".

Said Hockey: "But we fear that the carbon tax, the mining tax, and the government's own incompetence is going to make that a challenge."

This illuminates a problem for the government, but an even bigger problem for the opposition.

The problem for the government is that it doesn't get any better than this. After reaching "the sweet spot", the unfolding eurozone crisis threatens to harm the world economy and Australia will suffer with it. The Australian economy will likely continue to be the envy of the world, and the Reserve Bank's cuts to interest rates are a pre-emptive stimulus. Yet the opposition will seek to link any decline to the effects of the carbon and mining taxes.

The problem for the opposition is that the good news demonstrates the limits to its strategy of doomism. Hockey was left with nothing to say except to look hopefully to future doom. What if Armageddon arrives in three weeks, and nothing happens? Because that is the likely outcome. Just like Labor's scare campaign against the Howard government's GST package, it will prove to be largely hollow.

The Treasury forecasts that the carbon tax will cut economic growth by 0.1 per cent below what it would be otherwise. Imperceptible, in other words. There will be some dislocation and some distress, but it will be nothing like the horror story that the opposition has been telling.

Greg Combet spelt out the problem that the Abbott opposition confronts. In Parliament's question time last week, the Minister for Climate Change said of Abbott:

"He predicts the death of manufacturing, the death of the auto industry, the death of mining, the death of the coal industry, the death of the nickel industry, unimaginable cost increases, unimaginable power price increases, apples, fruit, mincemeat, chops, T-bone steaks - all out of reach; there is no way anyone will be able to buy anything.

"There is doom for families, doom for pensioners, older people, younger people, babies, the middle-aged - they are all doomed. And none of it is true. No one over on that side of the House believes him either. No one believes him. They put their money where they think the markets are really going."

What did Combet mean by this? He quoted Abbott as saying that "a carbon tax means death to the coal industry". Combet continued: "Yet the trouble is, the coal and minerals industries are experiencing record growth. The Bureau of Resources and Energy Economics has reported that there is over $500 billion worth of capital expenditure in the investment pipeline.

"It is not just big companies that are investing; it is also many small investors, including many members of Parliament who have a lot of confidence in the future of the industry."

He named seven opposition members who had invested in coal companies since the Gillard government announced the carbon price: Malcolm Turnbull, Josh Frydenberg, John Alexander, Stuart Robert, Ken O'Dowd, Teresa Gambaro and Michael Keenan.

"Publicly, their leader talks mining stocks down; privately, they snap up the investments … His whole campaign is a complete fraud. As July 1 approaches he is going to get more and more desperate, because he will have no credibility left."

Abbott thought that it wouldn't come to this. When he started his vociferous fear campaign, he was convinced that the minority government would have lost its footing and fallen by now. But it has not and he now confronts a serious credibility challenge.

He knows the risk. He knows that we'll wake up on July 2 and the sky will not have fallen and we'll still be eating T-bone steak. He's already started to adjust his rhetoric accordingly, a pre-emptive exit from the trap of his own making.

Instead of the long-promised "wrecking ball", Abbott has now begun to liken the carbon tax to a python. "It's going to be a python squeeze rather than a cobra strike," he said on Monday. So no sudden death, apparently.

"But it is going to hurt from day one and as time goes by it's just going to get worse and worse and worse and the only way to fix it is to change the government."

Abbott's dilemma is likely to compound. Because he has sworn an oath in blood that he will repeal the carbon tax and the mining tax. But if the taxes come into effect, and nothing terrible comes to pass, and Australia continues to succeed, why bother? Why put companies through the cost and inconvenience of dismantling all the changes they'll have put in place already?

The Abbott opposition needs more than doomism. It needs a bigger story to tell. It needs not just to damn the government. The vacuity of the opposition's response to the good economic news this week exposed exactly the need - it needs to be able to say: The Australian economy is doing OK, and here's how we will make it better.

Doomism is a course of diminishing returns in the face of economic success. The Coalition needs a plan to extend Australia's prosperity, not just to pretend it's not there. To use the fashionable argot of our time, the Coalition needs a positive narrative about itself and its purpose.

This week we heard from a couple of opposition frontbenchers the beginning of a search for some positive alternatives. Its foreign affairs spokeswoman, Julie Bishop, sketched a Coalition plan to embark energetically on a wide range of new free trade agreements.

Questioning the wisdom of complacently sitting back to allow the mining boom to do Australia's export promotion, she proposed not only more trade deals but also more diplomatic posts around the world to maximise Australia's options.

And the opposition finance spokesman, Andrew Robb, told the Financial Review that he was working on three policy papers to be announced in the coming weeks. One would explore the feasibility of improving the farming output of northern Australia to turn it into a so-called "food bowl". Another would be on water management and a third on the management of foreign investment.

The Abbott opposition needs to show that it can build, not just destroy. It needs an alternative to doomism, and it needs it soon. The first strike against the carbon tax scare story has been delivered, and it's not even July 1 yet.

- By John Richardson at 9 Jun 2012 - 7:40pm

- John Richardson's blog

- Login or register to post comments

Recent comments

6 hours 34 min ago

8 hours 27 min ago

9 hours 31 min ago

10 hours 3 min ago

10 hours 40 min ago

11 hours 5 min ago

11 hours 15 min ago

12 hours 27 min ago

14 hours 49 min ago

1 day 34 min ago