Search

Democracy Links

Member's Off-site Blogs

from bread to breadcrumbs .....

The Australian economy is going gangbusters, according to the latest figures.

Annual growth is 4.3%. Inflation is low. Interest rates continue to fall. Unemployment is at 4.9%.

Most European and North American countries would kill for an economy like ours.

And yet the Labor Government’s standing in the polls this week is back to just 26%. The same poll shows that the Coalition under Tony Abbott, the most unpopular Oppositon leader since Alexander Downer, (OK, I made that up, but it is possible) would win 57% of the two party preferred vote.

Labor would be wiped out. If the swing against Labor were uniform – it won’t be – the Opposition would win over well 100 seats in the 148 seat House of Representatives. The ALP could end up with around just 40 members, with perhaps none from Queensland. Bye bye Rudd and Swan…

Why is it that with the economy going so well, people are so angry, apparently with Labor?

I don’t think it is just or even the ‘Gillard lies’ factor. I don’t think it is sexism. I think it is something more fundamental than that.

The global financial crisis wiped a fair amount off the savings and superannuation of many working people. It threatened many in the middle class with ruin, or even worse to some of them, falling into the working class.

While the reality of being forced from being a fish shop owner to being a fish market labourer didn’t happen for most in the middle class, it did arise as a real threat in their minds. Their worst nightmare became a possibility.

The focus of that fear became anger with the Gillard government about the carbon tax change of heart, anger about foreigners and refugees, anger about Aborigines, about unions, about ‘high’ wages…

On top of that, that same middle class and workers have seen inequality worsen. Gina Rinehart earns receives in one second what a worker on the minimum wage earns in a week. She gets in a minute what that workers is paid in a year. In the fifteen minutes or so it has taken me to write this article so far, Gina Rinehart is getting more than the Prime Minister will in a year.

According to the ACTU the top 20% own 61% of the wealth and the bottom 20% own 1%.[1]

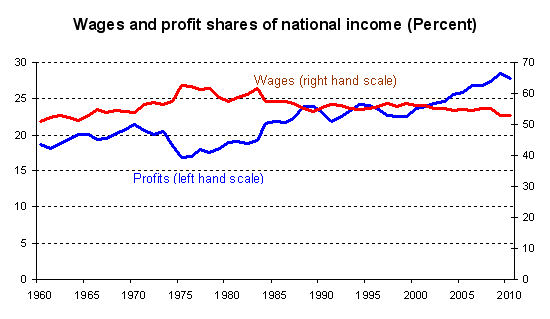

There has been a shift of wealth to capital from labour. The share of national income going to capital is at its highest since records were kept. That going to labour is at its lowest. This has been a long term trend.

Ian McAuley has captured this graphically in New Matilda over a longer period of time showing that the trend for profits as a share of national income has been more or less consistently upwards since about the mid-1970s (see graph at top).

I suspect it is no accident that as profit rates around the developed world and in Australia fell, this shift of wealth from labour to capital occurred.

The OECD’s key country findings for Australia in its Divided We Stand report included the fact that the share of national income of the richest one percent increased from 4.8% in 1980 to 8.8% in 2008.[3] For the richest 0.1% their share trebled, from 1% to 3%.[4]

While the earnings gap between the top 10% and bottom ten% of workers increased by one fifth, the tax system ‘offset’ only about half that increase.[5] This is indicative of deeper tax changes since 1980 in Australia. Tax has become less progressive.[6] Progressivity and average tax rates have fallen, and the redistributive effect of tax has weakened, in part because of the flattening of tax rates.[7] In other words the rich got richer and the tax system got less progressive.

As to tax, according to the ACTU ‘[households in the top 20% of the income distribution pay an average of 34.5% of their incomes in taxes; households in the bottom 20% pay 26.7%.’[8] This seems a small difference between the rich and poor for a supposedly progressive tax system. The trend to flatter taxes – in other words a more regressive tax system – has been a long term one.[9] In looking at the trends since 2000 the ACTU says that personal income tax has become flatter. [10]

The OECD has confirmed what the Occupy people around the world could tell you – the gap between rich and poor is getting worse.[11] Indeed, in Australia, the top 10% saw their income grow 4.5% per year since the mid-80s.[12] This was the biggest growth of any of the OECD countries. For the bottom ten percent the figure was 3% per year, also a high rate of growth by comparison. While the Treasurer in his The Monthly magazine diatribe against the three mining amigos made much of the fact that “poorest 10% in Australia have grown at more than double the average for developed economies in recent decades,’[13] he conveniently did not mention that those at the top end had seen their income grow even more, 1.5% per annum more. Compounding a 1.5% difference (4.5% versus 3%) over more than 20 years creates a huge disparity. As Peter Martin in the Sydney Morning Herald explained:

[T]he compounding effect of the different rates has opened up a very wide income gap. A family taking home $30,000 in the mid-1980s would be earning $68,000 today if income had grown 3 per cent per year. A family earning $30,000 enjoying a 4.5 per cent rate of growth would be earning $103,000 today.[14]

So the rich have got richer and the rest of us haven’t kept pace with them. Maybe that explains partly why people are pissed off.

We are working almost the longest hours in any country in the OECD – somewhere around 43 hours per week – and the benefits are going overwhelmingly to the boss.

OK, some of the doubters will say, but at least, with unemployment below 5%, most people have a job. The Roy Morgan analysis of unemployment is more reliable in it doesn’t exclude people who work only one hour a week, unlike official government figures. Throw in underemployment and things don’t look that rosy.

Roy Morgan estimates the real unemployment figure at more than 9%. There are also a large number of people who want to work more hours but can’t. Roy Morgan says that for the month of March this year:

Unemployment was 9.3% (down 0.4% since February 2012) — an estimated 1,120,000 Australians were unemployed and looking for work..

A further 7.9% (unchanged) of the workforce were working part-time looking for more work (underemployed) — 959,000 Australians.

In total 17.2% (down 0.3%) of the workforce, or 2.08 million Australians, were unemployed or underemployed.

Although the figures of 4.3% growth over the last year look good, as the figures above seem to show, the boom is not being shared. In fact its is very uneven. Western Australia, The Northern Territory Queensland grew well WA by 14% and Queensland about half that. New South Wales, Victoria and South Australia are just plodding along, below the long term average of 3%. Let’s not mention Tasmania.

So as well as growth across the country going to the rich, it is also geographically concentrated in the mining states.

One final thing. Employment has become more precarious over the last few decades. People no longer have secure jobs. So as the mining boom forces the Aussie dollar up to high levels, it makes manufacturing less competitive. From Qantas to Toyota and to the Kurri Kurri aluminium smelter and Hastie, blue collar and manufacturing and some construction workers have been losing their jobs.

The unions have of course surrendered without any real industrial fight.

Maybe the combination of working longer hours for the boss, of seeing Gina Rinehart treble her wealth while workers on the minimum wage get a paltry $17 a week increase, of being in insecure employment, of unemployment being higher than official figures suggest, of seeing household prices increase faster than wages, of the bosses having it all their own way in the one sided class war, maybe these things are contributing to a general sense of unease and anger which no amount of spin from Gillard and others is going to placate.

[1] David Neal, Cassandra Govan, Mike Norton and Dan Ariely, ‘Australian attitudes towards wealth inequality and the minimum wage’ ACTU 15 April 2011 at 2. <http://www.actu.org.au/Images/Dynamic/attachments/7201/ACTU-Report-Inequality-and-Minimum-Wage.pdf>.

[2] Ian McAuley, ‘Abbott’s phony class war’ New Matilda 11 May 2012 <http://newmatilda.com/2012/05/11/abbotts-phoney-class-war>.

[3]OECD, Divided We Stand: Why Inequality Keeps Rising (OECD, Paris, 2011) <http://www.oecd.org/document/51/0,3746,en_2649_33933_49147827_1_1_1_1,00.html>. ‘Country note: Australia’ <http://www.oecd.org/dataoecd/50/48/49177643.pdf>.

[4] Ibid.

[5] Ibid.

[6] Ibid.

[7] Ibid.

[8] Matt Cowgill, ACTU Research Officer, ‘The tax system & attitudes to taxation’ ACTU Working Australia Tax Paper No. 1 15. <http://www.futuretax.gov.au/content/taxforum/statements/union/Australian_Council_of_Trade_Unions_att_1.pdf>.

[9] ACTU, Paying our way: Restoring fairness to personal income tax ACTU Working Australia Tax Paper No. 4, 5 <http://www.actu.org.au/Images/Dynamic/attachments/7201/ACTU_Tax_Paper_4.pdf>.

[10] Ibid.

[11] OECD, above n 3.

[12] Peter Martin, ‘Top earners taking bigger slice of the pie’ The Sydney Morning Herald 5 December 2011 <http://www.smh.com.au/business/top-earners-taking-bigger-slice-of-the-pie-20111205-1ofhm.html>.

[13] Wayne Swan, ‘The 0.01 Per Cent: The Rising Influence of Vested Interests in Australia’ The Monthly March 2012 http://www.themonthly.com.au/rising-influence-vested-interests-australia-001-cent-wayne-swan-4670.

[14] Peter Martin, above n 12.

- By John Richardson at 11 Jun 2012 - 7:20pm

- John Richardson's blog

- Login or register to post comments

Recent comments

4 hours 24 min ago

5 hours 48 min ago

5 hours 57 min ago

6 hours 56 min ago

8 hours 4 min ago

8 hours 29 min ago

10 hours 5 min ago

10 hours 13 min ago

12 hours 30 min ago

13 hours 38 min ago