Search

Democracy Links

Member's Off-site Blogs

beware the wide boys .....

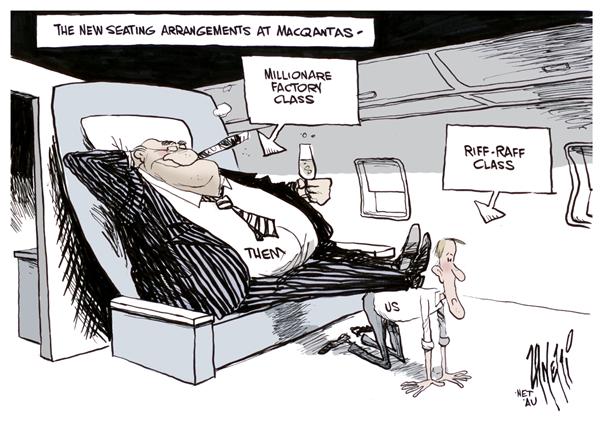

Before we’re overwhelmed by the drama of Qantas’s potential dismemberment, it’s fair to ask: who ran the roo down and set it up for the chop?

This is where the present and immediately past CEOs will look suitably serious, wearily shake their heads and blame the workforce, other airlines, the weather, the economy, European crises, viruses, the oil price, foreign governments, the Australian government, the alignment of the stars, the flight patterns of penguins – any and everything except themselves and the decisions they’ve made.

And the board of directors standing behind them will nod gravely, pat their appointments on the back and metaphorically say:” Never mind, poor dear, have another million for your troubles.”

Yet the above list of challenges (with the possible exception of the penguins) simply is the business. Managing it profitably and sustainably is the CEO’s very well-paid job. In the case of Alan Joyce’s predecessor, Geoff Dixon, it was his excessively well-paid job.

It’s easy for the CEOs’ apologists to claim that the aviation business itself is insane and loss making, trotting out the usual Warren Buffet story about what should have been done to the Wright brothers. But well-run airlines still make money – including well-run full service “legacy” airlines.

It’s not fair to do a straight comparison of privately-owned Qantas with, say, privately-owned Cathay Pacific – among other things, Qantas has the advantage of a wonderfully profitable domestic franchise that Cathay doesn’t while Cathay has a more flexible and less expensive workforce – but both airlines have had to manage the same big challenges by buying the right sort of aircraft at the right time and flying the routes their customers want with the service their customers demand.

Cathay has managed to do that profitably for its shareholders, while Qantas has just fessed-up to losing the thick end of half a billion dollars in one year on its international flights.

That’s quite an achievement, one that isn’t managed overnight. Which is why a broader coronial inquiry is reasonable into who might have killed the international roo before some wide boys might get hold of it, break it up, sell off the bits and flick the remnants.

Talk to some of the old Qantas hands and there’s plenty of blame to go round with Dixon and Joyce being apportioned plenty. They’re not necessarily right, but they make a good case.

Those who know much more about aviation than I do claim Qantas made mistakes in building up a hodgepodge fleet of different aircraft types with attendant higher servicing and parts costs. Blame the Dixon era.

Now Qantas is stuck with an aging fleet that is fuel expensive and is deferring the 380s it needs to be competitive while giving its first 787 to Jetstar. Blame Joyce.

A recent Financial Times story introduced me to the delightful chess term “zugzwang” – being in the position of having to make a move but when any move will put the player in a worse position. It might appear that Joyce is in Zugzwang Central.

To have a viable international full-service offering, Qantas needs new, more fuel-efficient aircraft and to fly the routes people want. The recent Qantas history has been one of surrendering routes one after the other and it is continuing to do so. On its current trajectory, Qantas’ international network will consist of New Zealand – or less.

But buying new planes costs money and would eat into the cash Joyce seems to be hoarding for his Jetstar ambitions – or for making the company an attractive target for carve up. And making routes work requires marketing and service levels that win customers, plus local knowledge. It’s expensive and if you don’t do it really well, you can lose even more money and cop a golden parachute.

One of the complaints about the James Strong/Geoff Dixon period was that the top levels of management were filled with executives without international experience, people who had no idea of how to turn an aircraft around as efficiently as possible in a foreign port and with little understanding of or feel for foreign markets. It was a takeover of international Qantas by domestic TAA (Trans Australia Airlines).

That could be the bleating of embittered former staff, but you can hear those stories from people who remain gainfully employed and respected in international aviation.

Qantas remains a great international brand – cue Dustin Hoffman’s Rainman – but management has been unable to capitalise on that, as demonstrated by the massive loss and shrinking network.

Then there’s the problem of Qantas’ industrial relations. Parts of its workforce are very expensive indeed on any international comparison, most obviously the cost of its CEOs and its baggage handlers. Both are paid much more than those at the competition. Baggage handling is a semi-skilled occupation but Qantas bag tossers are paid considerably more than the average wage. They can earn more than teachers and nurses.

You can blame a strong union for that – or Qantas management for not doing what the job title implies: managing. As for the obscene level reached by Geoff Dixon’s pay packet – a multiple of his airline peers’ salaries - that’s all the board’s own work.

For the baggage handling costs, the option exists for outsourcing that part of the operation. If the workforce won’t come with airline on the competitive journey, it needs to be changed.

There’s a danger that the separation of Qantas international and the announcement of that big loss is desired to frighten the workforce into greater flexibility but has managed to make the company a target instead. The adversarial model employed these many years – shades of old school IR – demonstrably hasn’t worked. Maybe because it hasn’t been adversarial enough, maybe because the workforce just doesn’t believe the CEO. In either case, the CEO has to take responsibility.

And talking of suspicion, the one that Qantas has been subsidising the success of Jetstar’s growth is widely spread among the Roo’s workforce. That an aircraft that Qantas needs – the 787 – is going to the low cost carrier rankles with those who still think the Qantas brand is worth something.

Inheriting a world-class business and overseeing its creeping demise is nothing to be proud of. Cannibalising part of the old Qantas business with a low cost alternative was necessary, but pushing that cannibalisation to the point of exterminating the parent becomes dangerous.

As the sharks circle, threatening to slice and dice for a quick profit and run, the board should have plenty to ponder deeply.

- By John Richardson at 14 Jun 2012 - 6:11pm

- John Richardson's blog

- Login or register to post comments

Recent comments

48 min 49 sec ago

11 hours 4 min ago

15 hours 24 min ago

20 hours 45 min ago

22 hours 39 min ago

1 day 8 min ago

1 day 2 hours ago

1 day 2 hours ago

1 day 18 hours ago

1 day 18 hours ago