Search

Democracy Links

Member's Off-site Blogs

looking after the hostile brothers ....

The failure of Keynesianism to address the collapse in profit rates across the developed world in the late 1960s and early 1970s saw neoliberalism become the dominant ideology and practice of economic policy of the one percent in those countries, with Pinochet, Thatcher, Reagan and Hawke leading the way. This is as true of tax as any other area of policy and practice.

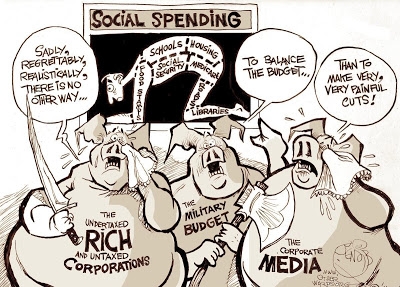

Tax is an extraction from surplus value. This wealth that workers create becomes profit, rent, interest, dividends and tax. The band of hostile brothers – productive capital, finance capital, landlords – battle each other for a share of the surplus value.

As profit rates decline the pressure to redistribute the surplus value going to the State to the other hostile brothers is great. Governments in the developed world have responded by reducing taxes on capital and to a lesser extent labour and with cuts to government spending and services. The extent of these ‘reforms’ depends on the severity of the economic crisis in the country concerned.

Australia’s economy has weathered the global storm so far, built on the back of the mining boom, long unpaid working hours and the long term shift in the share of national income going to capital from labour. The economic good times may be under challenge as both the mining boom slows and the logic and reality of the crisis that is inhered in the way capitalism is organised matures.

The wealth shift to capital and the rich is a pre-tax phenomenon and can only be addressed by changes in pre-tax rewards for labour, in other words increased real wages and more jobs. That requires a campaign of militant industrial action, and if that were to happen a flow on effect might be a re-invigoration of progressive tax demands (soak the rich till their pips squeak) and policies.

Tax is also an ideological tool of capital. The propaganda of equity, undermined in fact by the reality of tax trends in Australia and around the globe, hides the reality of both societal and tax inequality and the fundamental inequality that is capitalism, built as it is on the extraction of surplus value from workers by capital.

Tax teaching is an integral part of this ideological framework.

Black letter tax teaching reinforces the status quo because it asks no questions and poses no alternatives. This indeed is the reality not just of tax teaching but of much University pedagogy today – the commodification of knowledge and consequent pedagogical practices to train docile workers for the neoliberal world.

Even those whose teaching encompasses a critical perspective do so not from the point of view of challenging the exploitative relationship of capital over labour but reinforcing it by preaching the dead end in today’s economic climate of equity without addressing or understanding the fundamental drivers of capitalism and without raising the need and the necessity to overthrow capitalism through establishing a democratic society where production is organised to satisfy human need.

John Passant

- By John Richardson at 5 Aug 2013 - 11:58pm

- John Richardson's blog

- Login or register to post comments

Recent comments

7 hours 5 min ago

7 hours 49 min ago

8 hours 8 min ago

8 hours 16 min ago

8 hours 26 min ago

10 hours 34 min ago

11 hours 13 min ago

13 hours 25 min ago

15 hours 14 min ago

19 hours 25 min ago