Search

Democracy Links

Member's Off-site Blogs

the great rattus lie ....

According to the line flogged relentlessly for the last six years by the federal Coalition and the mainstream media, the Howard-Costello years – 1996 to 2007 – were a period of wonderful money management.

“The Government of John Howard now looks like a lost golden age of reform and prosperity” is a favourite Tony Abbott mantra.

Like countless propositions repeated ad nauseum by Australia’s media, the opposite is the truth. In fact, the Howard years are widely regarded outside Australia as dismally disappointing.

Or, according to some, like veteran economics writer Kenneth Davidson:

“What has happened under Costello’s watch is a major financial disaster.”

In 1996, Treasurer Peter Costello inherited an economy in promising shape. The tax system had been overhauled, the public service had been trimmed to size and the budget returned to structural surplus after decades of deficits.

Australia’s economy strengthened remarkably through the Hawke-Keating period. The world watched in awe as Paul Keating deregulated the banks, floated the Aussie dollar, reduced tariffs on imports, “snapped the stick” of inflation, moved from centralised wage-fixing to enterprise bargaining and privatised publicly-owned non-monopolies.

From about the 20th-ranked economy in 1982, Australia had risen by 1996 to sixth in the world - behind only the United Arab Emirates, Norway, Singapore, Japan and the United States.

That’s measured by the variables: income, growth, wealth, jobs, inflation, interest rates, taxes, economic freedom and credit ratings.

By 2007, however, at the end of the wasted Howard years, Australia had slipped back in the rankings to 10th place.

This was masked, at the time, by global growth and an extraordinarily acquiescent media. But while Howard and Costello alternately blundered and dozed, Australia (with Japan and the USA) was overtaken by Iceland, Luxembourg, Switzerland, Taiwan, Hong Kong and China.

Most of these had lower interest rates, greater support for enterprises and smarter investment strategies - and hence more people employed and stronger growth.

There was no excuse for this deterioration. The structural reforms of the Hawke and Keating years built the foundation for Australia to beat the world - as eventually happened in 2010, when Australia rocketed to the top of the world’s economies.

Six serious blunders cost Australia dearly.

The first was selling off productive assets. These included airports, the National Rail Corporation, Dasfleet, Telstra, the remaining share of the Commonwealth Bank and many other valuable enterprises.

Had Australia retained some or all of these cash-yielding assets, current angst over debt may well have been allayed.

The second serious failure was failing to invest in infrastructure needed for future development. The funds were certainly available, especially as the mining boom accelerated.

The third was failing to lift compulsory superannuation savings to strengthen retiree security.

The Keating Government had planned to increase contributions from 9% to 15%, so baby boomers could enjoy retirement on incomes close to weekly earnings.

“Anyone born in the 1940s can’t now be in the system long enough,” Mr Keating lamented. “It’s impossible now to look after the baby boomers. Impossible.”

Chief executive of superannuation fund Cbus David Atkin agreed:

“There’s no doubt that the delay in introducing higher contributions is impacting on baby boomers.”

The fourth was selling 167 tonnes of Australia’s gold reserves at near rock bottom prices just before the price rose spectacularly. According to one assessment, the fire sale returned just $2.4 billion. Had the gold been sold in 2011, when the nation needed cash during the global financial crisis, it would have fetched about $7.4 billion.

The fifth disaster was losing more than $4.5 billion gambling in foreign exchange markets between 1997 and 2002.

According to Kenneth Davidson:

“…foreign banks have walked away with a fortune as a result of the Treasury’s failed attempt at picking currency winners.”

Further damning analysis has been offered by Alan Kohler and News Weekly. But for most of the last ten years this was effectively covered up.

The sixth was squandering the proceeds of asset sales and the vast rivers of revenue from booming industries by handing it out to middle and high income earners as election bribes.

According to a Treasury report in 2008, between 2004 and 2007, the mining boom and a robust economy added $334 billion in windfall gains to the budget surplus. Of this, the Howard Government spent, or gave away in tax cuts, $314 billion, or 94 per cent.

Sales of businesses yielded another $72 billion. And yet Australia’s cash in the bank when Howard left office was a pathetically low 7.3% of GDP.

Several other countries were much higher: Chile 13.0%, Sweden 17.4%, Finland 72.5%, United Arab Emirates 100.8% and Norway 138.8%.

Constant crowing by the cocky Coalition about the strong surplus it left is laughable. Even Algeria [20.9%], Bulgaria [10.2%] and Kazakhstan [14.4%] had better books in 2007 than Australia.

Peter Hartcher summarised the disaster succinctly in 2009:

Yet the truth is that tax revenues were gushing into the Treasury so powerfully that the vaults were bursting - Howard and Costello could deliver surpluses and still spend rashly and irresponsibly.

Howard spent $4 billion on his own ‘cash splash’ in his final budget, and promised another $4 billion in his election campaign, in the middle of a boom. In other words, there was no economic rationale whatsoever. On the contrary, Howard’s handouts were helping to overheat the economy. These payouts were economic vandalism and political bribes designed to buy votes.

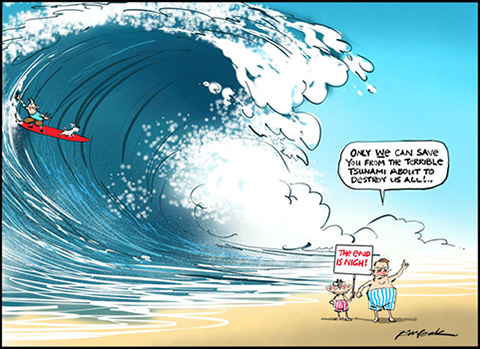

The Coalition will continue to declare: “You can trust us with the economy. We ran things well before.”

Don’t believe them. They didn’t.

They were, in fact, utterly incompetent.

We Really Must Talk About The Howard & Costello Economic Disaster

- By John Richardson at 16 Sep 2013 - 12:51am

- John Richardson's blog

- Login or register to post comments

Recent comments

17 min 6 sec ago

2 hours 16 min ago

2 hours 26 min ago

2 hours 36 min ago

3 hours 30 min ago

3 hours 55 min ago

4 hours 3 min ago

5 hours 6 min ago

6 hours 12 min ago

7 hours 11 min ago