Search

Democracy Links

Member's Off-site Blogs

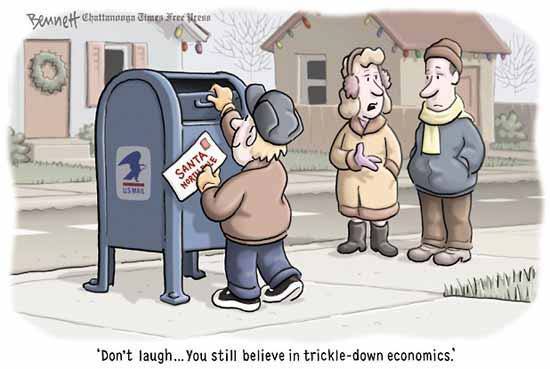

I believe in Santa too .....

Almost everyone on the left is paying close attention to Tim Wilson’s appointment to the Human Rights Commission. Even I have written about this outrage, this outrage I tell you.

It is a sideshow compared to what is happening in the Australian Tax Office.

Last year the then Labor government appointed Chris Jordan, a former chairman of KPMG in New South Wales, as Commissioner of Taxation. KPMG is one of the major accountancy firms and they make a lot of their money in tax ‘planning’ for business.

Last Friday the Liberal Government appointed Andrew Mills, a former partner in Greenwoods & Freehills, the largest specialist tax advisory firm in Australia, as a Second Commissioner. It makes its money from tax ‘planning’.

The Australian Tax Office is one of the key institutions of capitalism in Australia. It brings in about $350 billion a year for government. Its costs about $3 billion a year to run the ATO. Spend $3 billion, bring in $350 billion. Now much of that, like the $160 billion or so in taxes on salary and wages, is money for jam. Employers deduct it from wages and remit it to the ATO.

But some of it isn’t.

It is at the very big margins, the tax planners, the tax avoiders and the big time tax evaders where the ATO can bring in extra money through audits and the like. The biggest tax planners and tax avoiders are those businesses and their very rich owners that the Tax Office is now evidently open for.

This is the same Commissioner who is getting rid of 900 staff, about 4 percent of employees. This is the same Commissioner whose message to staff after the election was that the ATO is now open for business. Sound familiar?

Those 900 staff will in the main be the older more experienced staff who have had enough of the bullshit in the Office over the last decade. There will be a stampede for the packages.

Younger less experienced tax officers investigating or negotiating with multi-billion dollar companies and their million dollar advisers. That should work well.

And those staff who remain will be expected to work even harder and longer.

My guess is that the cost to revenue of sacking 900 tax officers is likely to be at least $2 billion a year, based on a marginal rate of return of about ten or so to one. That is a few schools or hospitals, or some funding for NDIS, an NDIS the Abbott government is now undermining. It could even cover some of the money that the reactionaries plan to claw back by pushing disabled people under 40 off their pension and on to Newstart.

Although the headline rate for company tax in Australia is 30 percent, the effective tax rate (company tax as a percentage of accounting profit) is around 20 percent according to the Productivity Commission and others. The average tax rate for employees is 22 percent.

For mining companies, because they get even bigger tax benefits than other companies, the effective tax rate is 13.9 percent. Nice work if you can get it.

Here’s the tax break up for 2012-13.

Chart 9: Australian Government tax mix, 2012-13

Most company tax is paid by a very small number of companies. Some Treasury analysis from January 2013.

Company income tax distribution

Most company income tax is paid by a relatively small group of large companies (Chart 12). For the 2009-10 income year, 63.9 per cent of company income tax was collected from the 0.5 per cent of incorporated taxpayers that earned more than $100 million in total income.

About 65% of business pays no income tax. According to Jim Killaly from the ATO, between 2005 and 2008 40% of big business paid no income tax and the figure after the GFC is almost certainly higher. The ATO no longer gives us those figures; however the number of non-taxable businesses has increased since the GFC.

So hidden in all the bleating about company taxes is the fact that most of it is borne by a few very very big companies, mainly Australian and foreign multinationals. The GFC saw some of those companies try to shift their losses from elsewhere into Australia or shift their profits from Australia to elsewhere.

In addition there is base erosion. An example is Google Singapore. When you put an ad on Google you contract with Google Singapore, not its Australian entity. Under the tax treaty with Singapore, Singapore has the sole taxing rights over the income its resident companies earn, subject to some qualifications not relevant here. The same is true for all the other 40 something tax treaties we have.

As a result of the GFC, according to the OECD, Australia’s revenue collections fell 4 percent of GDP compared to less than 2 percent in other countries.

This is because, even though many of those other OECD countries, unlike Australia, saw their economies go backwards, they draw more of their revenue from the consumption of workers than the profits of capital. It is also because their GDPs went backwards.

Company tax is very sensitive to economic conditions, not just because profits fall but because for those very big companies who actually pay it they may be able to make the same profit or more here but shift it for tax purposes out of Australia.

Australia’s tax collections as a percentage of GDP fell from 5 percent below the OECD average to 7 percent below.

With the economy slowing, revenue collections will slow further too. As the recent MYEFO put it:

Slower growth in real GDP, together with softer domestic prices and wages, have resulted in significantly lower nominal GDP, which has largely driven the reduction in tax receipts by more than $37 billion over the forward estimates.

So, one might have thought that any Government and Commissioner of Taxation would be kid eager to get as much revenue as legally possible. But that misunderstands the neoliberal and business mindset.

They might be keen to get as much money out of workers as they can. Thus the Business Council and others’ have vehemently pushed for increasing the rate of the Goods and Services Tax and broadening its base to include fresh food, education and health spending and to use the extra money to reduce the tax burden on business.

There are a whole range of ways to do this, including company tax cuts, tax reforms to push the burden more on to workers, and ‘savings’ on the expenditure side, that is cuts to social and welfare spending.

Another way is to capture the administration of the tax system. I wrote in the Asia-Pacific Tax Bulletin in 2008 about the neoliberal capture of tax policy. Now the next step in regulatory capture is the appointment of even more business friendly tax apparatchiks than the previous tax office regime. The Abbott government has plans to appoint more Second Commissioners from the private sector.

This may be the logic. Trickle down will increase revenue. The less tax we collect today from companies will magically produce more economic activity in the future. So having people in charge of the Australian Tax Office who ‘understand’ business and the realities they face is just what capital needs. To business, tax is just another cost and the lower the costs the higher the profit and the better off all of us will be.

I believe in Santa Claus too.

It is too early to judge the impact of the new ‘open for business’ ATO on company tax collections. Stay tuned. But instead of all this jumping up and down about Tim Wilson, maybe the left should be looking at the ATO, the agency which collects the revenue that funds, among other things, the Human Rights Commission and whether business has captured the Tax Office.

It's The Tax Office The Australian Left Should Be Worried About

- By John Richardson at 1 Jan 2014 - 12:47am

- John Richardson's blog

- Login or register to post comments

Recent comments

6 hours 50 min ago

11 hours 19 min ago

16 hours 23 min ago

20 hours 20 min ago

20 hours 32 min ago

20 hours 52 min ago

22 hours 46 min ago

1 day 8 hours ago

1 day 8 hours ago

1 day 8 hours ago