Search

Democracy Links

Member's Off-site Blogs

organising crime .....

from Crikey …..

Coalition embraces big bank gouge that even Howard rejected

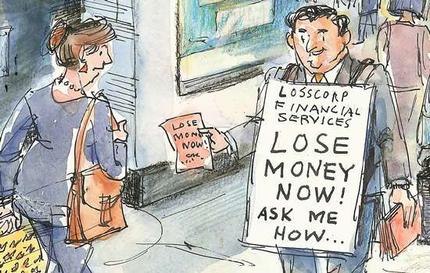

The government's winding back of the Future of Financial Advice reforms will legalise conduct by financial planners that has long been banned and hand a major win to the big banks and AMP - one that even the Howard government rejected, Crikey can reveal.

Draft regulations to reverse the Future of Financial Advice reforms established by Labor were released by Assistant Treasurer Arthur Sinodinos last week as the Coalition rushes to remove reforms that took years of consultations, parliamentary inquiries and reviews to develop, trying to do as much as possible via regulation in order to avoid parliamentary scrutiny.

Among the government's changes, however, will be one that doesn't merely reverse the FOFA reforms but would legalise conduct that has been prohibited for many years, was the subject of major action by the Australian Securities and Investments Commission against AMP in 2006 and that even the Howard government insisted on keeping prohibited.

In 2006, ASIC launched an investigation into the practices of AMP's financial planners, who were recommending clients switch to AMP products without comparing the returns AMP products would offer to the returns of products clients were already using, such as industry super funds, which might have been higher. Clients expecting objective advice about what would yield the best returns or best suit their needs were being told only about AMP's products. AMP argued its planners' advice was consistent with the requirement to provide advice in the client's best interests because it had obtained clients' consent to confine advice only to what was on AMP's "Approved Products and Services List", or APSL. AMP later admitted it instructed its planners:

"... if the client understands and agrees that advice would be limited to the products on the APSL, AMPFP Planner was permitted to give advice to the client about those products on the APSL but was not permitted to give any advice about the client’s existing product."

ASIC rejected the rationale that clients could agree to narrow the scope of advice so that it wasn't in their best interests and secured an enforceable undertaking from AMP to end the practice. AMP undertook to require that planners provide advice both on the products they recommended and the client's existing products, enabling a fair comparison.

Not long afterward, the body representing retail super funds, the Investment and Financial Services Association (now the Financial Services Council), began lobbying to dump the prohibition. The Howard government had begun a consultation process in 2006 for its Corporate and Financial Services Regulation Review and IFSA, representing the interests of the big banks and AMP who effectively control retail super, complained about ASIC's action and demanded that:

"... an adviser and their client must be allowed to determine the extent and coverage of personal advice. Advisers should be allowed to limit personal advice to products that the adviser is allowed to advise on, such as those on an approved list, or to the client’s specific personal circumstances."

The retail sector calls it "scalable advice", and it's a highly lucrative area of financial management: many clients approach financial planners because they've acquired a lump sum (for example, inheritance) and want to know what they should do with it; "scalable advice" would enable a planner to advise that the client should put it into a product on the planner's company's list, rather than recommending, for example, it be used to pay off existing debts that might be better overall for the client.

But the Howard government rejected IFSA's demand, and its reform package didn't include any such amendments.

The Sinodinos package, however, includes exactly what IFSA wanted, claiming in the explanatory memorandum that it will "better facilitate the provision of scaled advice to reduce uncertainty and enable cost-effective scaled advice to be provided to consumers". The regulations now explicitly provide that there is nothing that "prevents a client from agreeing the subject matter of the advice sought by the client with the provider". Retail funds and planners will be able to do exactly what AMP was banned from doing.

The financial planning sector and the retail sector insist that clients will be protected because planners will still be required to consider clients' "best interests". But Sinodinos's reforms water that down, too -- indeed, the explanatory memorandum actually has an unsubtle heading "Reduced best interests obligation". It removes the current "catch-all" provision of the strengthened FOFA best interests requirements for planners, reducing the "best interests obligations" to six specific steps, including only to make "reasonable inquiries" if the planner feels a client hasn't fully disclosed all relevant information about his or her circumstances. There will no longer be an additional requirement that planners ensure they have "taken any other step that, at the time the advice is provided, would reasonably be regarded as being in the best interests of the client, given the client's relevant circumstances".

It all means a huge win for retail super funds and planners who now don't need to tell clients that a product they're pushing them into will perform more poorly or generate higher fees than the product they're currently in, as long as they can get clients to agree to narrow the scope of advice to their own products.

It was a gouge too far even for the Howard government -- but the Abbott government wants to deliver it.

- By John Richardson at 7 Feb 2014 - 7:42pm

- John Richardson's blog

- Login or register to post comments

Recent comments

39 min 47 sec ago

5 hours 51 min ago

6 hours 14 min ago

9 hours 10 min ago

22 hours 18 min ago

1 day 22 min ago

1 day 48 min ago

1 day 52 min ago

1 day 3 hours ago

1 day 3 hours ago