Search

Democracy Links

Member's Off-site Blogs

the games of chicken...

Since the financial crisis, central banks have slashed interest rates, purchased vast quantities of sovereign bonds and bailed out banks. Now, though, their influence appears to be on the wane with measures producing paltry results. Do they still have control?

Once every six weeks, the most powerful players in the global economy meet on the 18th floor of an ugly office building near the train station in the Swiss city of Basel. The group includes United States Federal Reserve Chair Janet Yellen and her counterpart at the European Central Bank (ECB), Mario Draghi, along with 16 other top monetary policy officials from Beijing, Frankfurt, Paris and elsewhere.

The attendees spend almost two hours exchanging views in a debate chaired by Bank of Mexico Governor Agustín Carstens. Waiters serve an exquisite meal and expensive wine as the central bankers talk about the economy, growth and market prices. No one keeps minutes, but the world's most influential money managers are convinced that the meetings help expand their knowledge in important ways. "We learn what makes our counterparts tick," says one attendee.

These closed-door meetings, which are held on Sunday evenings, have a long tradition. But ever since many central banks lowered their interest rates to almost zero, bought up sovereign debt and rescued banks, a new, critical undertone has crept into the dinner conversations. Monetary experts from emerging economies complain that the measures taken by Europeans and Americans are pushing unwanted speculative money their way. Western central bankers say they have come under growing political pressure. And recently, when the host of the meetings -- head of the Basel-based Bank for International Settlements Jaime Caruana -- speaks in one of his rare public appearances, he talks about "chronic post-crisis weakness" and "risk." Monetary institutions, says Caruana, are at "serious risk of exhausting the policy room for manoeuver over time."

These are unusual words, especially now that the world's central bankers, five years after the Lehman crash, are more powerful than ever. They set interest rates and control the money supply, oversee governments and banks and, like Bank of England Governor Mark Carney, are treated a bit like movie stars by the public.

To an extent unprecedented in postwar history, monetary watchdogs -- who are not elected and are usually independent of their countries' governments -- determine what happens in politics and on the markets. They are the new "masters of the universe." Yet their internal discussions on the effects of their power do not give the impression of resounding success. Growth is limping along in the world's major economies; banks, households and governments are deeply in debt; and the bankers' so-called unconventional monetary policy is running up against its limits everywhere.

Most of the important financial games are now played with derivatives... Central Banks play a limited role in this gambling den... Thus say Central banks will create a trillion dollar rescue package for financial institution, most of which are already involved in a game (games) of chicken, now worth more than $1500 trillions... Make the sums. When there is a bad call that can shift the "derivative" market one or two per cent EITHER WAY, it means that the "official" world financial game has lost between 15 and 30 trillions dollars... Somewhere, somehow, someone has made a killing, while the Central Banks have to stop the bleeding by printing more cash, the majority of which will be used to play more games of chicken... My simplistic view...

Gus Leonisky

Your local economist

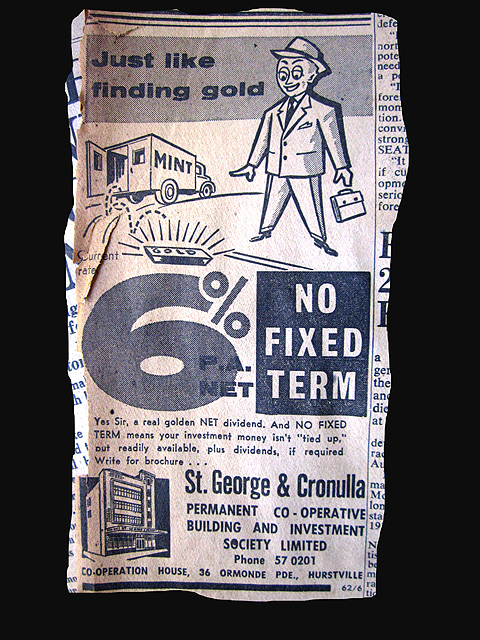

ps: I believe that the "St George and Cronulla Permanent" etc, in the advert above, is the precursor of the St George Bank...

- By Gus Leonisky at 16 Apr 2014 - 9:33pm

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

2 hours 29 min ago

5 hours 48 min ago

9 hours 55 min ago

15 hours 11 min ago

15 hours 13 min ago

17 hours 23 min ago

17 hours 54 min ago

1 day 13 hours ago

1 day 15 hours ago

1 day 15 hours ago