Search

Democracy Links

Member's Off-site Blogs

joe 'on the nose' ....

A big reason Joe Hockey isn’t getting much support from independent observers like me in his battle to get the budget through the Senate is that so few of his contentious measures are worth fighting for.

If he were facing opposition from vested interests struggling to protect their privilege, or even just unthinking populism from the punters, it would be a different matter.

For a bit I thought I’d be in the trenches with him defending a plan to impose a temporary deficit levy on individuals with incomes above $80,000 a year but, as we now know, his boss insisted on lifting the threshold to a far-less-contentious $180,000 a year.

What would have made the lower threshold defensible is the inconvenient truth that so much of our present distance from budget surplus is explained by the folly of eight tax cuts in a row, the savings from which were skewed in favour of higher income-earners. This would have clawed back a bit of it.Advertisement

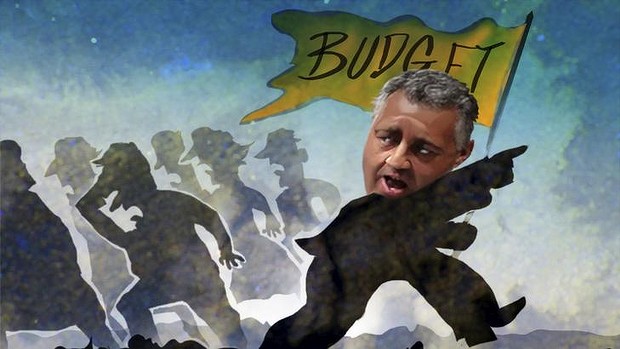

It’s remarkable anyone could put together a budget at once so unpopular and so lacking in Paul Keating’s “quality cuts”. Who did Hockey imagine would join him at the barricades apart from the mindlessly partisan commentators? (Even they haven’t been particularly vociferous – although the government hasn’t raised much of a banner to rally behind.)

In my initial assessment I said “I give Joe Hockey's first budgetary exam a distinction on management of the macro economy, a credit on micro-economic reform and a fail on fairness”.

Nothing wrong with the F, and the D on macro management has stood up well. The decision to announce a lot of measures that didn’t take much effect until the last year of the forward estimates, 2017-18, was a clever combination of macro-economic good sense – nothing to gain by hitting demand while it was expected to be weak – and a political necessity.

By delaying the start of so many measures until after the next election Hockey was able to claim the budget didn’t really break all the election promises Tony Abbott made when pushing his contention that a “budget emergency” could be fixed without pain.

It’s not part of my religion to insist politicians keep irresponsible promises they should never have made. But that’s not to say such blatant promise-breaking carries no political price. After all the fuss Abbott made about “Ju-liar” Gillard and his pretence about restoring trust in politicians, my guess is the price his government is paying is high. The pity is he could have won comfortably without such dishonesty.

On closer inspection, my C for micro reform was badly astray. Should have been an M for missed opportunity. There was a lot of cost shifting, but precious little that could be claimed to increase the efficiency with which the government delivers its many high-cost services or to reduce rent-seeking by private industries.

The greatest disappointment was that, after making a good start in eliminating handouts to the car makers and refusing to bail out fruit canners, Hockey dropped the ball on business welfare, thus leaving all his talk of ending “the age of entitlement” looking like nothing more than a shameful attack on the poor and disadvantaged.

One honourable exception was the decision to remove the always-indefensible subsidy to locally produced ethanol. Another was the plan to resume indexing the fuel excise.

Removing the carbon price involved allowing fossil-fuel industries to continue imposing external costs on the rest of the community and the intention to abolish the mining tax involves allowing much receipt of economic rent by foreigners to go grossly under-taxed.

That’s efficient?

Add to that the failure to remove the fuel excise credit, which constitutes a favour to miners and farmers but no one else, and you have to ask what hold the big three mining companies have over this government.

Similarly, take the cutting back on the age pension while doing nothing whatsoever to curb the excesses of the concessional tax treatment of superannuation, combine it with watering down the Future of Financial Advice Act despite the presence of gross information asymmetry, and you have to ask what hold the big four banks have over this government.

On its face, you could have expected the “deregulation” of university fees to bring significant gains in efficiency – but only if your understanding of economics had progressed no further than 101. To take a relatively small number of government-owned and still highly regulated agencies with a monopoly over credential-granting, allow them to set their own fees and then imagine an adequately competitive “market” would emerge isn’t economics, it's magical thinking.

Why no one is backing the budget

- By John Richardson at 4 Aug 2014 - 1:27pm

- John Richardson's blog

- Login or register to post comments

Recent comments

7 hours 53 min ago

8 hours 4 min ago

8 hours 16 min ago

9 hours 15 min ago

10 hours 5 min ago

11 hours 27 min ago

13 hours 9 min ago

13 hours 47 min ago

15 hours 48 min ago

17 hours 48 min ago