Search

Democracy Links

Member's Off-site Blogs

so much for lifting .....

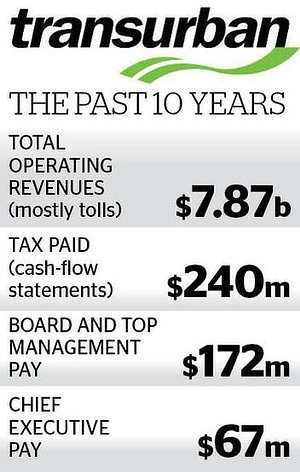

Australia's monopoly toll road operator Transurban paid $3 million tax last year despite racking up $1 billion in tolls from motorists.

As the debate rages over "lifters and leaners" in the wake of Treasurer Joe Hockey's federal budget, the Transurban financial statements for 2014 put in stark relief the paltry income tax contributions which some large corporations are making to the Commonwealth coffers.

Transurban Holdings Limited, the umbrella company which holds the lucrative toll-road assets in Sydney and Melbourne, notched up $1 billion in toll revenues last year. The company was able to achieve this thanks to the way in which it structures its financial accounts and runs high debt levels. Some $344 million was paid in interest on Transurban's massive $6.8 billion in borrowings.

Interest payments are tax deductible and have the effect of bringing down profits from which tax is ultimately paid. Earnings (before interest, tax, depreciation and amortisation charges) came in at $759 million.

Actual income tax paid was just $3 million, down from $12 million last year.

The tax paid was less than Transurban chief executive Scott Charlton was paid – $4.9 million.

Directors and top management were paid $17 million last year and $21 million the year before.

The share market reacted positively to the results on Tuesday morning. This is a fabulously profitable company. Revenues were $1.15 billion in total, and costs were just $391 million (for EBITDA of $759 million). Finance costs were $470 million.

Transurban delivered a fiscal 2014 dividend of 35¢ per share and reaffirmed guidance for a fiscal 2015 dividend of 39¢ per share.

Infrastructure companies have traditionally been very low income tax payers thanks to the way in which they are structured. Fairfax Media ran a story last year pointing out that Sydney Airport, despite billions in revenues, had not paid tax for 10 years since it was privatised and sold to Macquarie Bank.

The airport investment was structured as a highly geared trust. Tax payments are incumbent upon investors who receive the distributions, many of which are domiciled in tax havens overseas.

In the case of Transurban, its assets are 11 toll-roads such as Melbourne's CityLink, which joins three of Melbourne's major motorways and Sydney's Westlink M7 (it operates six of the nine roads in the Sydney orbital network).

As these government concessions are to operate roads for decades, Transurban's business model is to pay only interest on its debts for the early years, and to take other costs also in the earlier years and not begin to pay down the principal in the debts until much later.

Among other things this structuring achieves the objective of paying very little tax for decades.

In the 10 years before this latest result, Transurban recorded revenues of $6.86 billion, EBITDA of $3.9 billion and tax expense of just $297 million.

None of the figures above includes GST and payroll tax.

Transurban pays just $3 million tax, despite collecting $1 billion in tolls

- By John Richardson at 6 Aug 2014 - 11:51pm

- John Richardson's blog

- Login or register to post comments

Recent comments

53 min 19 sec ago

1 hour 7 min ago

2 hours 21 min ago

4 hours 43 min ago

6 hours 50 min ago

7 hours 34 min ago

9 hours 49 sec ago

10 hours 3 min ago

10 hours 28 min ago

20 hours 17 min ago