Search

Democracy Links

Member's Off-site Blogs

same old smoke & mirrors ...

from John Passant …

This is a Budget of smokers and mirrors.

Revenue rescue is in part built on slugging smokers an extra 12.5% in excise every year for the four years from 2017. This is well after the election so smokers won’t feel it when they cast their ballots on 2 July. This will raise, according to the Government, an extra $4.7 billion in revenue by 2020.

It is not often I agree with Tony Abbott. This tobacco excise increase is a tax on workers, the class that overwhelmingly and disproportionately smokes. Tobacco is an easy target because the excise increase can be wrapped in moralistic claptrap about cutting smoking rates to reduce long term costs in the health system. It may do that but it is basically a tax on that section of the working class addicted to tobacco.

There is no equivalent extra sin tax on high end wine and spirits, the poison of sections of the bourgeoisie. There is no understanding that to address working class addictions would require an understanding of the capitalist system that exploits and alienates workers rather than imposing neoliberal price signals to affect behaviour.

The government will also ‘attack’ tax avoiders through a diverted profits tax, similar to the tax the Tory government in the UK introduced in 2015. This will impose more tax on the likes of Google and their base erosion activities, bringing the revenue from Australian sources that is currently taxed in Singapore under Australia’s double tax treaty with that country into the Australian tax net. Basically it will catch those multinationals with global turnover greater than $1 billion (think Google and Apple as examples) and Australian revenue of greater than $25 million who shift their profits to jurisdictions that have company tax rates less than 24% (think Ireland, Singapore, Hong Kong, plus the various designated tax havens like the Cayman Islands, British Virgin Islands, Bermuda etc.) The kicker is that the rate of tax in these cases will be 40%, well above the standard 30% current company tax rate for MNEs.

The government estimates this tax will raise $100 million in its first years of operation and $200 million by 2019. $200m! This is small beer indeed! Estimates for example are that Google had $2 billion in revenue for Australian sources that it booked through Singapore a few years ago. So how much extra tax will it and the likes of Apple, which according to reports in the Financial review and elsewhere shifted somewhere around $26 billion over the decade to 2014 tax free out of Australia. The figures from these two companies alone make the extra $100 m to $200 m in tax from the DPT look like a thrashing with a feather.

The response of business to the previous attempt to address this tax planning (the Multinational Anti-Avoidance Law or MAAL) has been to try to scheme it.

Morrison estimates the ‘crack down’on tax avoidance will bring in an extra $3.9 billion. So if the DPT is bringing in a pittance, where is the money coming from? Some of it will be because of changed MNE behaviours, assuming they cannot scheme around the new laws, a big assumption, given they already doing that with the MAAL.

It looks like some at least of the money from the ‘crack down’ on tax avoidance will come from a new ATO task force of 1300 tax officers. This is a classic smoke and mirrors response.This is the same ATO that has just shafted 4400 staff, (almost 20% of its workforce) and has plans to get rid of more. The ATO has driven out thousands of experienced, internationally savvy staff and now will bring in an extra 1000 or so to do the job these staff could have and would have done. Smoke and mirrors, smoke and mirrors.

If extra ATO staff means an increase in revenue, doesn’t that mean sacking 4400 staff cut revenue collections from the big end of town?

More generally for the public service the fake economy of the misnamed ‘efficiency’ dividend will continue and there will be an extra $2 billion in funding cuts as a consequence, the sort of funding cuts that in the past have worked so well for the likes of ASIC and the ATO that they are now being partially overturned for those agencies.

The government is also ‘cracking down’ on superannuation concessions. The crack down through various caps on contributions and the like for the rich, will bring in an extra $6 billion over 4 years, of which $3 billion will go to low income superannuation contributors through a restored and modified Labor scheme the Abbott government abolished.

Let’s put this in perspective. The top 20% of income earners get about 57% of the $30 billion every year in superannuation concessions, i.e. about $17 billion a year or $70 billion over four years. The top ten percent get about 38% of the benefit, or close to $12 billion a year or $50 billion over 4 years. So in arithmetical terms the government is only clawing back one-eighth of the superannuation tax benefits going to the top ten percent of income earners, or one eleventh going to the top 20% of income earners.

The superannuation changes may see the well-off look for other tax favoured investments and negative gearing of rental properties with the attached capital gains tax 50% discount might well become a target for them. The government left these two areas, which cost the revenue more than $10 billion combined a year, untouched.

So, who were the tax winners? Small business gets a company tax cut from 1 July this year from 28.5% to 27.5%. By fiddling with the definition of small business from turnover of less this tax cut will be expanded over the next four years to include companies with a turnover of less than $100 million and then in 2026 all companies big and small will get a tax cut to 25%. That is pie in the sky stuff. Who knows what will happen in a years’ time let alone ten years’ time?

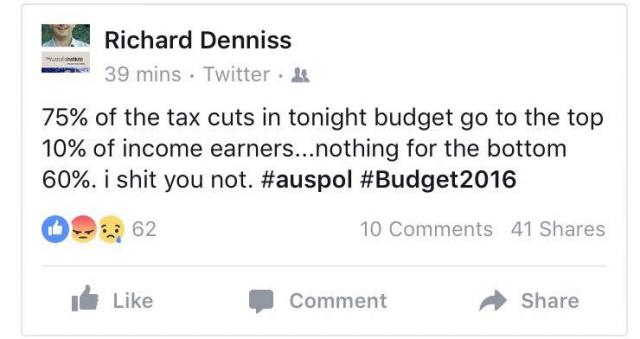

On top of that those individuals with incomes greater than $80,000 will get a tax cut. Currently those earning between $80,000 and $180,000 pay 37 cents in the dollar on that income. The government will move the start of that rate from $80,000 to $87,000. This is a return of bracket creep. It benefits the top 25% of income earners and for someone on $87,000 that benefit is about $6 a week.

For someone earning below $80,000 there is no tax cut and no benefit. The reason the vast majority of workers are not getting a return of bracket creep is it would cost too much from this government’s point of view. Those earning below $80,000 are a cash cow for the Turnbull government.

To put this in perspective, for someone earning $1 million the benefit of the tax cuts, according to Labor’s shadow Treasurer Chris Bowen, is over $20,000 a year or $400 a week.

The budget repair levy of 2% on those earning more than $180,000 will disappear from 1 July next year. They are getting a tax cut too.

The tax cuts for companies and for those earning more than $80,000 are an example of trickle down theory. Morrison claims the small business tax cuts will improve GDP by 1% ‘over time’. In fact that over time qualifier could be, according to Treasury officials, decades. There is no evidence historically to support the argument that if we cut taxes on the rich and capital this will produce a capitalist nirvana of higher wages and more jobs. In fact by allowing business to pocket more of the wealth they exploit from workers you only in the long term reinforce the system of exploitation and may well encourage investment in labour saving capital.

The other furphy in the tax cuts for small business is that small business is the engine of the economy. It is workers who create the profits capitalism is dependent on. Even looking at it through the rainbow glasses of capitalism, it is big business which creates the conditions for profitability through its productive activities. Small business is often just a retailer rather than a producer of goods and services.

The smoke and mirrors approach becomes obvious too when we look at health and education spending. The 2014 Abbott/Hockey budget cut over $80 billion planned expenditure from 2018 and after that on health and education. The Turnbull government is returning a few billion of these what are effectively cuts and claiming this is a victory for health and education. If so it is a pyrrhic victory. Health and education will be massively underfunded under this government in the years to come.

The government is also attacking welfare ‘cheats’. Most welfare over-payments are mistakes by the government agencies or sometimes the client. The level of welfare cheating is infinitesimal in comparison to business cheating – think the banks for example – and tax avoidance by business. Targeting welfare ‘cheats’ reinforces the lying stereotypes about the unemployed, the unwell and others and stirs up the baying blood suckers of the alienated right. A crackdown on disability pensioners will also go into the funding the shortfall.

The money will go to fund the National Disability Insurance Scheme shortfall, estimated to be $5 billion. In addition new social welfare recipients, such as new pensioners, will not receive the carbon tax ‘energy supplement’. This will ‘save’ $1.4 billion over 4 years.

Morrison announced changes to work for the dole which will see many unemployed people work for potential employers for between 15 and 25 hours a week for $100 a week. Let that sink in. These people will be paid in effect between $4 and $6 an hour. This is a crude attempt to reduce unemployment numbers and to cut wages of those employed in the industry on award or similar wages (for example on $20 an hour). This is slave labour.

The government has talked big on infrastructure. Again, be wary of the smoke and mirrors. All that extra 50$ on submarines is going to produce about 3000 jobs. The CSIRO will be co-partner in innovation, the same CSIRO sacking hundreds of climate change researchers. This just reinforces the shift of the CSIRO from socially useful research to producing trinkets for sale at a profit on the market. Smoke and mirrors anyone?

There will be $2 billion for dams. There will be $594 million for more preliminary work on the Melbourne to Brisbane inland railway. There is also the carrot of an extra $23 billion for the States and Territories for things like ‘the Sydney and Melbourne Metro projects, light rail in Parramatta, regional road and rail freight corridors across NSW and Victoria, and flood mitigation works in the Northern Territory.’The catch is that this extra funding is contingent on the States and Territories privatising major assets. More smoke and mirrors.

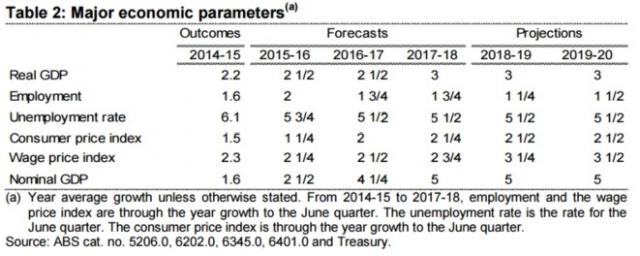

Here are some underlying economic predictions, taken from a chart in Business Insider, remembering that as Galbraith said economists exist to make astrologers look good.

While unemployment is predicted to drop to 5.5% from the current 5.7%, the reality is that there are about seven times as many unemployed as there are jobs available. This fall could in part be because of the work for the dole rort moving 30,000 unemployed a year off the dole and into internships.

The Budget also predicts that wage increases will be above inflation. This is not because of any outbreak in class struggle but because in part of deflation and the perhaps overoptimistic estimates of growth. Wages will remain just above what appears to be a possibly high prediction for CPI increases which ignores deflation and the structural drivers for it. Certainly the Reserve Bank decision to cut interest rates indicates they are worried about deflation but the Budget does not reflect that concern.

It looks too as if Universities will have their funding cut. They are already in crisis and cutting funding is just part of the long term plan to privatise or commercialise further the offerings from academia. While the government has not yet given the green light to Universities to set their own fees, the pressure from Vice Chancellors to do so in light of the funding cuts now and into the future will only increase. So too we will see more and more ‘restructuring’ away from less monetarily profitable areas of academia like the Arts to for example business offerings.

As Tim Dodd in the Financial Review puts it:

Higher fees, deregulated prices for popular courses and larger loan repayments are on the cards for university students after federal Education Minister Simon Birmingham released an options paper with Tuesday’s budget outlining his preferred path for higher education reform.

Overall the deficit will remain roughly the same this year at around $37 billion but will miraculously and inexplicably fall to $6 billion in a few years time. This might in part be because they are continuing to factor in savings from the 2014 Budget which have not yet won parliamentary approval.

More smoke and mirrors.

One the same day the government handed down its Budget the Reserve Bank cut interest rates from 2% to 1.75%. It did this ostensibly to address deflation. Prices in the quarter to March this year fell 0.2%. This was a result of falling petrol and food prices. A cut in interest rates won’t address those falls. What a cut will do is halt the rise in the $A and perhaps see it begin its long term downward trend again, making imports more expensive and exports cheaper.

It may also be that the RBA has concerns about the Australian economy as the mining boom comes to an end. The Budget predicts GDP growth this year to be 2.5% and the same next year, growing to 3% in later years. These figures depend in part on what happens in China and if the great recession in North America and Europe worsens again, as it could do, and if that worsening drags China further down.They are at best educated guesses.

Perhaps the greatest challenge facing humanity and by extension capitalism is climate change. There is nothing in this smoke and mirrors budget to address in any systemic way climate change or to move to renewable energy.

This is a government blinded by its own smoke and mirrors and the capitalist imperative of profit, profit, profit at the expense of satisfying human need.

A Budget of smokers and mirrors

- By John Richardson at 5 May 2016 - 9:00am

- John Richardson's blog

- Login or register to post comments

Recent comments

42 min 48 sec ago

1 hour 25 min ago

2 hours 23 min ago

4 hours 32 min ago

5 hours 59 min ago

20 hours 16 min ago

20 hours 14 min ago

21 hours 16 min ago

1 day 1 hour ago

1 day 5 hours ago