Search

Democracy Links

Member's Off-site Blogs

deconstructing the privatisation scam ….

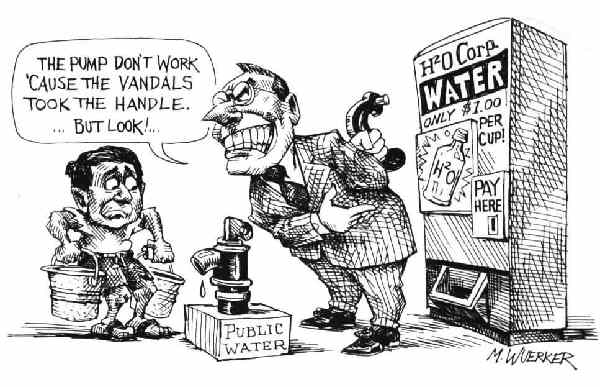

It is increasingly evident how pernicious the privatisation myth is. Two recent examples have underlined it: the failings in Australia’s privatised energy grid and the usurious pricing in airport car parks. Both examples demonstrated that it is folly to expect a public benefit to inevitably emerge from private profit seeking.

The federal government, feigning surprise, is mounting an inquiry into the profit margins of the energy companies. There should be no surprise. Businesses always maximise their profit margins; that is their basic operational discipline. And when they are offered a monopoly, or an oligopolistic position, such profiteering can be undertaken aggressively. It is essentially an invitation to be a parasite.

To understand the scam, let us look at how money is created. In broad outline, there are three kinds of capital: private, profit-making capital; government funding; and non-profit capital, such as the capital formed in cooperatives.

For several decades the lie has been broadcast that the only capital worth having is private capital — what I call the ‘privatisation myth’. Everything else has been depicted as discredited ‘socialism’. The fact that the financial system in the 19th century was in part created by non-profit enterprises (which is why words like ‘mutual’ and ‘provident’ proliferate in the names of older financial institutions) is ignored.

For example, this writer can remember absurd arguments that the New Zealand dairy cooperative Fonterra should be ‘privatised’, because cooperatives do not have sufficient access to the capital markets. Yet Fonterra is, with Nestle, the biggest and most successful dairy company in the world. Meanwhile, the ‘privatised’ Australian dairy industry is a collapsing mess.

There are several fallacies in the pro-private business argument. One is the claim that business is efficient whereas government is not. It is true that government is often not especially efficient, but that does not mean the converse applies. Business is often spectacularly wasteful to the extent that most companies go out of business within a decade if they are subject to genuine competitive forces. That, indeed, is why purchasing public assets is so attractive: competition is either weak or non-existent.

Another fallacy is what might be called the ‘profit circularity’: because profits are the only thing measured, they are thought to be the only things that exist.

The purpose of government funded public infrastructure is not to make profits but to lower the cost of doing business, sometimes called the socialisation of the means of production. Countries that are able to fund public education, roads, energy grids, water and sewerage and communications will outperform those that do not because businesses operating in such an environment will have lower costs.

“The benefits of public investment in social goods usually remain invisible because to know what the monetary effect is it would be necessary to know what would have happened if they were not there.”

The extraordinary advance of China, probably the most sustained economic growth in the history of the world, is an example of how this works, although big gaps remain in the health system. A large part of the United States’ success in the middle part of the 20th century was due to its previous heavy public investment in its infrastructure.

Such a lowering of costs will not, however, be measurable because no profit is recorded. The benefits of public investment in social goods usually remain invisible because to know what the monetary effect is it would be necessary to know what would have happened if they were not there. Yet as the Australian Industry Group is noting with its comments about the impact of soaring power prices on business, when those benefits are absent the effects are severe.

The privatisation fiction is evident when we compare the health sectors of the United States, Britain and Australia. In America, health spending is 17.8 per cent of GDP. In Britain and Australia it is about half that, 9 per cent of GDP. A raft of commentators conclude that America ‘spends’ twice as much on health as most other countries.

Yet the standards of health care in the three countries are roughly comparable. How can this be, if America ‘spends’ twice as much? The reason is that health costs are mostly socialised in Britain, which has a public health system. It is the same in Australia which has a mostly public health system.

But in America, where the health system is largely private, massive profits are generated. There has to be large outlays for health insurance, for instance. That shows up in the GDP statistics as ‘spending’. What is really going on is more profiteering.

It is to be hoped that the privatisation myth, which has dominated over the last 30 years, will increasingly be exposed as the scam it is. There may even be a push to re-nationalise important infrastructure (this writer would include the banks after their disgusting performance in the GFC). When these means of production are socialised the benefits accrue to all, including all businesses, and not just to the privateers and their investors.

David James is the managing editor of businessadvantagepng.com. This article was first published in Eureka Street on 3 April 2017. www.eurekastreet.com.au

Deconstructing the privatisation scam

- By John Richardson at 8 May 2017 - 6:53am

- John Richardson's blog

- Login or register to post comments

Recent comments

1 hour 50 min ago

7 hours 41 min ago

8 hours 39 min ago

8 hours 47 min ago

8 hours 55 min ago

11 hours 19 min ago

12 hours 41 min ago

14 hours 32 min ago

1 day 8 hours ago

1 day 10 hours ago