Search

Democracy Links

Member's Off-site Blogs

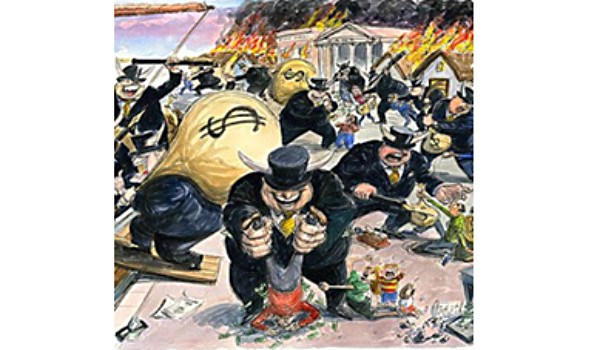

on banksters ...

The financial services royal commission has revealed more than anyone banked on.

Vasily Zhukovsky, a Russian poet and translator who flourished in the first half of the 19th century, believed that the execution of criminals should afford a degree of religious uplift. He recommended hanging the miscreant behind a curtain while clergy and a choir sang hymns and the public kneeled amid solemn mystery. In this way, neither indecent pleasure in the grisly spectacle nor an offender’s “swaggering and pluck in the face of death” would subvert the majesty of the law and the higher feelings its exercise incited.

Zhukovsky’s vision cannot fail to remind us of the equally solemn proceedings of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. Of course we do not wish the evil-doers hanged, or even too thoroughly knouted, but like the kneeling citizens of the poet’s imagination we feel a certain elevation as our own swaggerers go down, and the fair go is forcefully asserted in our sovereign’s name. We’re singing from the same hymnbook. The Lord shall destroy them (and their exquisite apparel and haircuts and grooming) in his displeasure, and the fire shall consume them (and their Ferraris). Deliver us from evil. Blessed are the meek. Forgive us our schadenfreude, but of course we’re feeling elevated.

The first witness to appear at the royal commission was Karen Cox. Questioned by Rowena Orr QC, the counsel assisting the commissioner, Ms Cox put before the inquiry a startling array of sharp practices. She spoke plainly. She was concrete, direct and to the point, intelligent, rational and articulate. She was everything one has a right to expect in a CEO or other high-ranking corporate executive on a salary of a million dollars or more.

If Ms Orr, as relentless as a woodpecker, and Kenneth Hayne QC, the bony and lugubrious commissioner, were grateful for her contribution they gave no sign of it. Yet they would have done well to bring her back from time to time over the next few weeks: not to add to the abundant information she’d provided, but merely to stand as an example of a decent human being – an old-fashioned sort of human being who spoke from the head and the heart without apparent artifice. Her mind and character seemed to have been formed independently of corporate fashion or its faux values, and at a safe distance from the bullshit that in modern management does for language and truth.

Alas, Ms Cox is not a corporate executive and it’s a fair bet that her salary is a great deal less than a million dollars. Poor soul, she is merely the coordinator of the Financial Rights Legal Centre. She told the commission of the various devastating effects of corporate misconduct. When at last she was allowed to leave the witness box, it was as if ordinary, intelligent life left with her, and a much murkier form arrived.

First up, counsel prised from NAB’s representative certain facts about what the bank called an “Introducer Program”. That the program earned NAB $24 billion in home loans was one of the facts. Another was that the desire to earn commission was pretty well the only qualification an “introducer” needed: that, and knowing someone who wanted a home loan. The “flawed” program gave rise to bribery, forgery and fakery. A NAB “mobile banker of the year” has been charged by police with 49 counts of obtaining property by deception and other offences (including, it seems, buying a Ferrari F430 from the proceeds of crime), and an “introducer” with whom he is friendly is facing the same 49 charges. Under questioning from the QC, the NAB man conceded that people did “step outside their responsibility guidelines”. Of what these guidelines consisted was unclear, but what lay on the other side of them, according to NAB’s submission, was “inappropriate”. “Inappropriate conduct” was how the bank described it. Ms Orr asked if that was a reasonable description of the conduct. The man from the bank wanted to say that it was, in the main, though … “Let’s be frank,” said Ms Orr, “there was fraudulent conduct.”

Each day brought forth more evidence of rorting, rip-offs and incompetence. AMP and the Commonwealth Bank vied for leadership in the business of charging fees for services never provided. CBA took the practice a step further and charged dead people for financial planning advice. The commission heard of brazen crimes and sneaky little trickeries that netted millions. Customers were lied to. The corporate regulator was lied to. Financial planners gave folk expert advice that ruined them. There was mismanagement on top of deceit.

As the commission finds more and more dirt we tend to forget how much had already been dug up. In the course of the past decade many millions have been paid in compensation to ripped-off customers and millions more in fines. ASIC, though widely regarded as too friendly with the companies it investigates, if not in actual collusion with them, gathered $118.5 million in 2016–17 alone. Bankers have been jailed, dozens of dodgy planners sacked. And this, as countless people inside and outside the industry knew, was the result of only shallow digging.

The government’s refusal to hold a royal commission despite the evidence of such widespread hornswoggling always looked curious; coupled with their resistance to the so-called FoFA reforms and their perennial hostility to industry super funds, it looked suspiciously as if they believed their interests aligned more sweetly with those of the financial industry than with the public’s. Of course, some citizens, especially those watching from behind the curtain of class envy that notoriously gives rise to such hallucinations, might see the merest outline of a palsy-walsy relationship between the higher reaches of government and the top end of town. But even if such arrangements could be shown to exist, the correct designation for them is “cultural issue” – a term so splendidly foggy, pompous and exhausted the problem starts to go away even before you fork out half a million to PwC or someone like them to come up with a process to resolve the issue going forward.

Twenty-five years ago, when the banks were righting themselves after the near-fatal indulgences that followed the first decade of deregulation, the captains of the financial services industry – like captains throughout the corporate world – spoke solemnly of their social responsibilities. Corporate social responsibility, or CSR, sat neatly with the company “mission statement”, the “vision statement”, and commitment to the “triple bottom line”, along with such refrains as “transparency”, “accountability”, “sustainability” and commitment to “stakeholders”. Soon no self-respecting business (or school or football club, for that matter) could do without these “commitments”, and a book by Tom Peters, like a Gideon’s Bible, in every desk drawer. Among big businesses, the familiar line became that if they did not want the dead hand of government regulation to return they must regulate themselves. They must practise CSR, live up to their values and align them with their goals (and vice versa) and, in keeping with a value proposition, deliver value to their valued customers and all their other stakeholders. These might be taken as the moral guidelines of neoliberalism: the lines outside which witness after witness has admitted to the royal commission their companies have stepped.

They are only “guidelines”, after all. It’s not as if they’re foundations. There was nothing to stop corporations with rape and pillage on their minds from declaring an unshakeable commitment to the highest ethical standards. On the other hand, no doubt when they wrote integrity and social responsibility into their mission statements, preached them in their training sessions and their advertising, and peppered every speech and press release with references to their “culture” and their “values”, many other companies genuinely believed in what they were doing and tried to live by the standards they set themselves.

But no example of good behaviour or of bad should obscure the fact that at the bottom of management ideology there lies the hollow doctrine of “stakeholder theory”. The theory, which encompasses the “stakeholder theory of ethics”, holds that a company dedicated to profits, dividends and salaries can be equally dedicated to the welfare of consumers, employees, society at large, the environment, and so on. The pledges to “all our stakeholders” are getting harder to sell to employees who, for all the promises and all the retraining, outsourcing and category management initiatives, and all the demands for “flexibility”, haven’t seen a wage rise for a decade and a half. Employees being consumers and a part of everything that goes under the name of “social”, they at least are entitled to say corporate social responsibility is as fraudulent as anything the bloke with the Ferrari was allegedly into.

More interesting – and, in the longer run, possibly more useful – than the commission’s discovery of ever more scams and follies has been seeing corporate ideology and management practices unpicked, and the fantasy exposed. To watch is to see all but confirmed the truth of Rose Michael’s suggestion, made in an essential essay after three years working at one of the banks two decades ago, that “maybe … work is not about outcomes, but process: job creation, job justification. Perhaps this is not the negative side effect but the quintessence of corporate life.” For people working in the Matrix that Michael described, or even in our “outcomes-based” education system, this must be a shocking thought. What is management about if not outcomes? Without outcomes the whole thing would be a joke. Life would be a joke. What next? Value propositions of no value? Action plans that inhibit action? “I have never before seen people work so hard at doing nothing,” Rose Michael wrote. And management language being the medium of nothingness, if you watch the commission you will never see people work so hard at saying nothing.

At times it has been hard to tell if a witness is dissembling or no longer has the ability to answer in sensible terms. In the space of a minute or so, a manager from CBA referred to an issue, a potential issue, potential unknown issues, sizing an issue and scoping the size of an unknown issue. Looking like she was drowning in quicksand, or at least wishing that she was, ANZ’s chief risk officer of digital and wealth responded to questions with long agonising silences in which she might have been assembling a prudent answer or just trying to find in the verbiage of her professional life some words related to the reality the QC was trying to interrogate.

What we are seeing from the wealth management industry at the royal commission is but a localised manifestation of a condition endemic to managerialism wherever it is practised. When it was revealed in the United States last month that the giant telco AT&T had paid Donald Trump’s lawyer, Michael Cohen, $600,000 dollars for a little help with a prospective merger, the company CEO said that engaging Cohen, though within the law and “entirely legitimate”, was a “very serious misjudgement”.

Caught out on a shonky manoeuvre with a shady operator under federal investigation, that can only have been motivated by a desire to gain advantage whatever the moral cost, the CEO baulks at personal moral responsibility and puts the “misjudgement” down to a failure of the company’s “vetting processes”.

And that is what the royal commission is turning up repeatedly: all the moral failures, all the failures to comply, all the rip-offs were failures not of human bastardry or weakness, but of process. And as with the industry, so with the regulator: all the processes were expressed in language so ingeniously meaningless, so calculated to disguise or make legitimate what was clearly illegitimate, they never used and never heard words, like “swindle”, “dupe”, “cheat” or “scam”, that might have woken them to the truth.

Don Watson is an award-winning author and former speechwriter for Paul Keating. His books include Death Sentence: The Decay of Public Language, Recollections of a Bleeding Heart: A Portrait of Paul Keating PM, American Journeys, The Bush, the Quarterly Essay ‘Enemy Within: American Politics in the Time of Trump’ and There It Is Again, a collection of his writing.

https://www.themonthly.com.au/issue/2018/june/1527775200/don-watson/pack-bankers

- By John Richardson at 7 Aug 2018 - 5:25pm

- John Richardson's blog

- Login or register to post comments

Recent comments

3 hours 12 min ago

3 hours 26 min ago

8 hours 7 min ago

9 hours 31 min ago

9 hours 39 min ago

10 hours 39 min ago

11 hours 47 min ago

12 hours 12 min ago

13 hours 48 min ago

13 hours 56 min ago