Search

Democracy Links

Member's Off-site Blogs

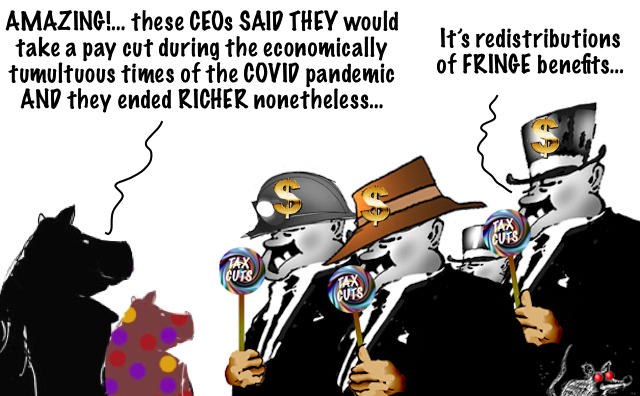

some shifted their remuneration under the guise of a pay cut.....

From tech and transport to hotels and media, chief executives in almost every industry across the US proclaimed they would take a pay cut during the economically tumultuous times of the pandemic.

But new research has shed light on why many of those cuts might have been better called "redistributions".

Researchers from the University of Melbourne, University of Sydney, and University of New South Wales examined the changes to chief executive (CEO) compensation between 2019 and 2020 and found evidence that some shifted their remuneration under the guise of a pay cut.

One of the researchers, associate professor Danika Wright from the University of Sydney, said she began looking into the issue while in lockdown.

"There was all this news about CEOs cutting their pay and I was just intrigued and it led to me going down this rabbit hole," she said.

The research revealed that while some bosses genuinely took reductions in total compensation, companies with powerful executives and weaker corporate governance often restructured pay packages to ensure a CEO's overall earnings were unaffected.

"The high-level finding was the average pay for a CEO did not go down," Dr Wright said.

Pay to perksThe research, published in The Review of Corporate Finance Studies, and which did not name specific companies or leaders, found executives often held the power to determine their own compensation and were able to shift parts of their pay package to perks.

University of Melbourne's Attila Balogh, who led the research, said he chose to look at company reports from the United States, rather than Australia, because the US had stronger disclosure laws.

"Companies have to provide detailed disclosure about CEO compensation and it's regulated and detailed. It's still pretty murky, but disclosure requirements in Australia are less stringent," Dr Balogh said.

According to the research, about 353 of all chief executives in the S&P 1,500 took a salary cut in 2020. The average cut was $US167,000.

But salary is separate from other forms of pay.

In 2019, compensation listed under "other pay" in a company's annual report, accounted for 2.8 per cent of a chief executive's total compensation.

By the end of 2020, it had doubled.

Examples of "other pay" include deferred compensation, payments into pension funds, dividend payments on restricted stock, use of corporate assets like a private jet, and work-from-home expenses that could include renovating a home office.

Dr Balogh said "one of the most egregious" forms of "other pay" he found was the use of dividends.

Executives are often set targets for their company, if they meet those targets they are often rewarded with shares in the company over the long term. Those shares can also pay a dividend.

"When they own them, they get dividends, but one company paid the dividends before the CEO owned the shares," he said.

"Our findings indicate firms exploited the fact that some compensation items in the 'other pay' category are difficult for the public to comprehend and therefore scrutinise."

One company paid dividends of almost $US350,000 on stock the chief executive did not yet own.

Similar trends with ASX companiesRachel Waterhouse is the chief executive of the Australian Shareholders' Association and agreed that "greater transparency in executive remuneration is important to maintaining investor trust".

But she argued Australia had some of the strongest company reporting rules in the world and that the "other pay" category of CEO remuneration was "generally less opaque than in the US".

"However, there is room for improvement, particularly in simplifying remuneration reporting to make it accessible to retail investors."

Ms Waterhouse admitted reporting could be inconsistent and complex, obscuring the rationale behind pay.

"Uniform and transparent disclosure of all remuneration components, including those listed under 'other', would enhance scrutiny and build confidence in executive pay structures."

An analysis of Australian executive pay in 2020 by CGLytics found 61 of ASX 300 companies reported cuts to director or CEO remuneration from March to August 2020.

Of those, 54 companies disclosed the pay cut percentage, 35 reduced CEO base salaries, 17 reduced both the base salary and cash bonuses, and two companies cut only the cash bonus.

But the analysis found CEO pay cuts had minimal impact on overall executive earnings — accounting for just 2 per cent of total compensation.

Chief's power and weak corporate governanceCorporate boards are set up to work on behalf of shareholders to keep decisions made by executives in check.

The researchers said an increase in 'other pay' mainly occurred at companies "with powerful CEOs and weak monitoring by institutional investors".

Dr Balogh said some boards were "insufficiently independent" from the chief executive or were not vigilant enough at monitoring compensation.

"We also looked at ownership structure – if there's a large number of shareholders and could influence decisions — but lots of tiny shareholders then the CEO is more likely to get away with something like this," he said.

But the inverse was also true.

Companies that announced genuine salary and compensation cuts for their CEOs had boards with strong governance and oversight.

Salary and pay are differentMs Wright said what she wanted the public to know was that a chief executive's salary and their salary package, were different.

For many ordinary working people their salary was 100 per cent of their income, but for an executive it made up about 10 per cent.

"The salary is not the package, and when they [chief executives] commit to a salary decrease but shift their total pay and end up taking a lot more through perks."

Ms Wright also said not all the payments were unjustified.

The use of a corporate jet for instance could be explained by the fact travel was disrupted during the pandemic, and expenses on personal security at home were likely due to the board wanting to protect the safety of the person in the top job.

"There's a nuance to some of this. But I think it's just when it's such murky reporting after the fact," she said.

"Let's go back to where this all started, literal press releases saying 'we're all in this together'. It's very challenging for people who bought that narrative at the start to realise that it might not have played out like that 12 months later."

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

HYPOCRISY ISN’T ONE OF THE TEN COMMANDMENTS SINS.

HENCE ITS POPULARITY IN THE ABRAHAMIC TRADITIONS…

- By Gus Leonisky at 28 Dec 2024 - 6:37am

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

14 min 59 sec ago

23 min 55 sec ago

1 hour 32 min ago

1 hour 41 min ago

16 hours 28 min ago

16 hours 51 min ago

22 hours 11 min ago

22 hours 50 min ago

22 hours 57 min ago

1 day 1 hour ago