Search

Democracy Links

Member's Off-site Blogs

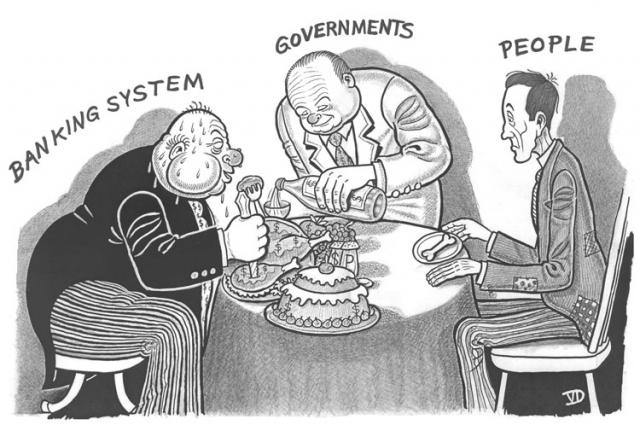

banksters .....

Last week in Washington we got a rare look inside the global private banking industry, whose high purpose it is to gather up the assets of the world's wealthiest people and many of its worst villains, and shelter them from tax collectors, prosecutors, creditors, disgruntled business associates, family members and each other.

Thursday's standing-room-only hearing on tax haven banks and tax compliance was held by the US Senate's Permanent Subcommittee on Investigations, chaired by Michigan Senator Carl Levin, a regular critic of tax havens - except when it comes to offshore leasing companies owned by US auto companies.

He presented the results of his Committee's six-month investigation of two of Europe's most venerable financial institutions - LGT Group, the largest bank in Liechtenstein and the personal fiefdom of Crown Prince Hans-Adam II and the royal family, with more than $200 billion in client assets; and UBS, Switzerland's largest bank and the world's largest private wealth manager, with $1.9 trillion in client assets and nearly 84,000 employees in fifty countries, including 32,000 in the United States.

The theatrics included videotaped testimony by Heinrich Kieber, a Liechtenstein computer expert in a witness protection program with a $7 million bounty on his head, for supplying a list of at least 1, 400 LGT clients - some say more than 4,500 - to tax authorities in Europe and the United States; two former American clients of LGT, who took the Fifth Amendment; Martin Liechti, head of UBS international private banking for North and South America, who'd been detained in Miami since April, and who also took the Fifth; Douglas H. Shulman, our sixth IRS commissioner in eight years, who conceded that offshore tax evasion must be a "serious, growing" problem even though the IRS has no idea how large it is; and Mark Branson, CFO of UBS's Global Wealth Management group, who apologized profusely, pledged to cooperate with the IRS (within the limits of Swiss secrecy) and surprised the Committee by announcing that UBS has decided (for the third time since 2002) to "exit" the shady business of providing new secret Swiss accounts to wealthy Americans.

There were also several other potential witnesses whose importance was underscored by their absence. Peter S. Lowy, of Beverly Hills, another former LGT client who'd been subpoenaed, is a key member of the Westfield Group, the world's largest shopping mall dynasty, which operates fifty-five US malls and 118 others around the world, is worth more than $12.4 billion, holds the lease on the World Trade Center, has many other properties in Australia and Israel, and was recently awarded a $3 billion project for the UK's largest shopping mall, in time for the 2012 Olympics.

His lawyer, the renowned Washington fixer Robert S. Bennett, reported that Lowy was "out of the country" and would appear later, probably also just to take the Fifth. Perhaps he traveled to Australia, where his family is also reportedly facing an LGT-related tax audit. (Bennett's law partner, David Zornow, the head of Skadden, Arps' White Collar Crime practice, represents UBS's Liechti.) Steven Greenfield, a leading New York City toy vendor whose business had been personally recruited by the Crown Prince's brother, went AWOL and did not bother to send a lawyer. LGT Group declined to follow UBS's contrite example and also failed to appear.- By John Richardson at 28 Jul 2008 - 10:31pm

- John Richardson's blog

- Login or register to post comments

Recent comments

1 hour 52 min ago

3 hours 40 min ago

7 hours 52 min ago

9 hours 9 min ago

9 hours 14 min ago

20 hours 59 sec ago

22 hours 57 min ago

1 day 49 min ago

1 day 1 hour ago

1 day 3 hours ago