Search

Democracy Links

Member's Off-site Blogs

tough times .....

from Crikey …..

Oz bankers luxuriate on the public purseAdam Schwab writes:

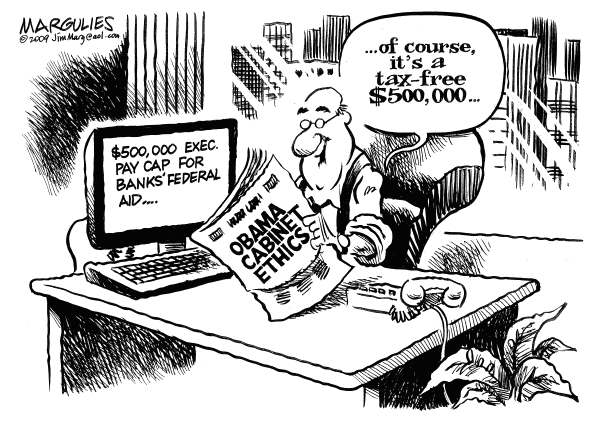

For our nation's bankers, Australia really is the lucky country. As the Obama administration moves to cap executive pay at companies which have been bailed-out by the US Government, Kevin Rudd appears too mesmerised by our high earning oligopoly of bankers to dare do anything which may curb their excessive risk-taking.Yesterday, Australia's most ineffective Minister, Senator Nick Sherry, stated that: "the US moves to cap executive salaries is interesting but not relevant to Australia as we have not had the problems with the banking system that have occurred in the US -- namely, there have been no bail-outs of Australia banks."

While Sherry's comments may be true in a purely technical sense, Fairfax's Michael West had a far better grasp of reality this morning, noting that:We are in a different world now, thanks to the global financial crisis, and there is no longer justification for multi-million dollar executive salaries in banking when the risk is borne by the taxpayer. The risk/reward nexus is gone…

There is no reason why Kevin Rudd, if he is at all fair dinkum about his ''social capitalism'', and the new era of responsibility, cannot impose a similar cap for those riding on the taxpayer's back.Macquarie, especially, lies in this camp.

Not only does it access both guarantees but it is protected by the short-selling ban to the detriment of those companies which are not. And it is the steward of essential services such as airports, roads and utilities which it controls thanks to assorted government concessions.While Australian banks have not had to resort to US and UK style bail-outs or quasi-nationalisation, that is partially a function of the grotesque, fee-gouging stranglehold which they have been able to enjoy over the past decade. More importantly, unlike the US and UK property market, the Australian property sector has remained reasonably buoyant (so far). Despite those crucial advantages, Australian banks have still managed to lose billions through dud acquisitions (Suncorp), irresponsible commercial lending (all, but in particular CBA), US mortgages (NAB) and complete managerial incompetence (ANZ).

Further, as West noted, Australian banks have had both their funding and the Australian deposits guaranteed by the taxpayer. This may not be a bail-out in the sense of being handed cash to remain solvent, but a guarantee certainly has a monetary value. It is also noted that Australian banks were not forced to accept government (read: taxpayer) assistance. They could have told the Government to shove off, and used their obvious superior intellect to continue to earn outsized profits during these slightly more difficult times.But they didn't do that. Not even the likes of Macquarie, who pay their alleged genius executives upwards of $30 million annually. Instead, the Australian banks greedily lapped up taxpayer guarantees, lowering their cost of funding. (As West noted, seven Australian banks have sold more than $US34.4 billion of state-backed notes since November 28, when the AAA-rated sovereign backing come into play).

Given that Australian banks are now being supported by taxpayer guarantees, the logical implication is that bankers are in effect, no different to public servants. What Kevin Rudd and Nick Sherry should be doing is requiring any bank which accesses taxpayer assistance to alter their pay structures to resemble that of the public service. For example, no bank CEO who receives any taxpayer assistance should earn more than treasury boss, Ken Henry. Remember: no-one is forcing the banks to accept taxpayer assistance, if they want to go it alone they are welcome to refuse taxpayer assistance and continue to pay executives whatever they like.Of course, Sherry's reluctance to do anything about banker salaries is hardly out of character. Despite being Australia's first ever corporate governance Minister and presiding over one of the greatest stockmarket falls in history, Sherry's website reveals little has been achieved in almost 18 months. In 2009, Sherry’s media releases list the announcement of a new citizenship coin, statements regarding lost superannuation and a criticism of Malcolm Turnbull. During 2008, the only thing that seemed to inspire Sherry was a short-selling ban, largely to protect the value of banking stocks. Oh, and there's also the announcement of a new coin to mark the Scout Centenary.

There is now little doubt that in Kevin Rudd and Nick Sherry, Australian bankers have loyal friends indeed.- By John Richardson at 6 Feb 2009 - 11:02pm

- John Richardson's blog

- Login or register to post comments

Recent comments

5 hours 8 min ago

5 hours 25 min ago

9 hours 25 min ago

12 hours 10 min ago

12 hours 54 min ago

1 day 7 hours ago

1 day 8 hours ago

1 day 10 hours ago

1 day 10 hours ago

1 day 11 hours ago