Search

Democracy Links

Member's Off-site Blogs

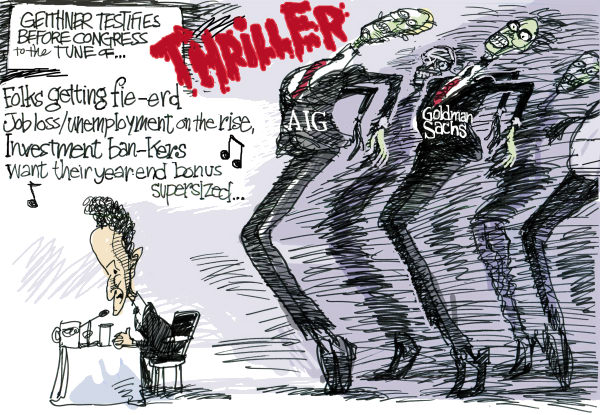

new steps, same old dance .....

Neuger's insane decision to bet billions in AIG collateral on the residential housing market was the other half of the story of AIG's death spiral. Fully $43.7 billion of the bailout monies paid to AIG's counterparties via the Maiden Lane facilities were tied not to Joe Cassano and AIGFP, but to the sec-lending operation. So is it plausible that AIG's senior management could have simply not understood where all those billions in revenues from AIGFP were really coming from all those years? I don't think so, but I know one thing for sure: it's definitely not plausible that AIG's senior management could have been unaware where the money was coming from from both Cassano's and Neuger's operations.

The recently-crowned head of international financial embarrassment AIG, Robert Benmosche, has launched a campaign to "restore morale" to his beleaguered employees, who are apparently a) cracking under the strain of public anger and b) having performance anxiety that may be linked to a fear that they will never again be allowed to make obscene and undeserved bonuses, so long as the taxpayer is writing their checks.

This is very sad, no doubt, and must be a terrible burden for anyone working on Wall Street to have to bear. So into the breach steps Benmosche, who became CEO of the firm last month. His new public mantra is that what happened to AIG isn't the fault of AIG, but rather the fault of the government regulators who allowed AIG to destroy itself and iceberg the hull of the American economy. This is how he put it:

"It's time the people in Congress stopped talking about you as the problem, because you're the solution," he said. "It's not your fault, it's their fault, it's the regulators' fault."

In reporting this story Bloomberg, following this quote, did not immediately add a phrase like, "Benmosche after uttering this appalling horseshit quickly stepped sideways so as to avoid the lightning bolt that rained down from the heavens, frying to a crisp two senior executives and the company's communications chief, Christine Pretto." Instead, Bloomberg saw fit to bolster Benmosche's insane argument by writing this:

The Office of Thrift Supervision "fell short" in its oversight of AIG's credit-default swaps, Scott Polakoff, a former acting director of the regulator told lawmakers at a hearing in March.

This is all part of a kind of new legend AIG is trying to sell to the public, which is that AIG was actually a very good, sound company that happened to be undone by a lone madman named Joe Cassano, whose tiny AIG Financial Products division destroyed the firm with its toxic CDS portfolio. According to this legend, the OTS should have caught wind of what Cassano was doing and put a stop to it, since it is clearly the job of the regulators, not senior management, to prevent the mismanagement of hundred-billion-dollar portfolios by corporate underlings. Because the government shirked those responsibilities, the more than 100,000 good employees of AIG ended up suffering when in fact they and AIG senior management was innocent of all wrongdoing.

Two things about this. One, let's not forget that AIG went out of its way to cherry-pick the weak and understaffed OTS as its primary regulator by chartering an S&L called the AIG Federal Savings Bank in Wilmington, Delaware back in 1999. By this little maneuver AIG got itself declared a thrift holding company, which made the OTS, which only had one insurance expert on its staff, the primary regulator for the world's largest insurance company.

Two, the notion that AIGFP was AIG's only problem is bananas. It may not even have been AIG's biggest problem. This legend obscures the fact that playing a nearly equal role in the demise of AIG was AIG's securities-lending business, headed by yet another bombastic narcissist (AIG must lead the world in the hiring of these to senior management) named Win Neuger. Neuger back in the earlier part of this decade issued a clarion call to his subordinates, announcing a plan he called "10 cubed" -- securing 1000 million (i.e. $1 billion) dollars a year in profits. Back in 2005 he told his staff that anyone who wasn't on board with the plan to make a billion in profits a year could hit the road, literally, saying, "If you do not want to be on this bus, it's a good time to step off."

But how does one make a billion in annual profits in the normally staid, risk-averse securities lending business? By taking the collateral from the securities you lend out and investing it not in low-risk or risk-free instruments like treasuries, but in residential mortgage backed securities!

This was a company that was tired of the boring, safe insurance business and decided not only to take its assets and bet them on the residential housing market, but to borrow massively and double and triple down on those bets. This was a systemic, company-wide insanity. So for Benmosche to blame all of this on the OTS is... well, it's characteristic of what these people are like. On some level they really believe that if the government is not kicking their doors in and wrapping them all up in hoods and zip-ties, then whatever they are doing is not only okay but good business.

Moreover, there's this about Benmosche's comments. It wasn't the OTS that kept Joe Cassano on the payroll for a million bucks a month for seven whole months after it was revealed that he had incurred tens of billions in losses via his CDS portfolio, among other things by steering independent auditors away from his books, and after he had twice declared publicly that he could not foresee even "one dollar" of losses. That would be AIG that did that (they didn't stop the payments until a month after the bailout).

And it wasn't the OTS that decided to keep Win Neuger around as the Chairman and CEO of AIG Investments to the present day. Hell, Neuger is still an Executive Vice President of AIG. We the taxpayer are probably going to be giving this guy a nice bonus this year, because AIG couldn't see fit to fire the man who single-handedly inspired $43 billion in bailout payments. It is for the right to increase compensation to valuable retained personnel like Neuger that Benmosche is now going to the mattresses with Kenneth Feinberg, Obama's special master in charge of executive pay.

It gets better. Benmosche's Knute Rockne address to the troops included a vote of reassurance to all those subordinates who might worry that the company's status as the ward of a bunch of pissed-off, pitchfork-ready taxpayers should not deter any man jack of them from passing up any ethically-dicey chance to make money. Are you worried about what he regulators might think? Well, Benmosche says, don't worry! Just put the ol' nose to the grindstone and keep cranking out that "creativity"!

Benmosche told employees not to be immobilized by concern that they will upset regulators.

"My fear is that you'll say, 'I don't know if Treasury wants it, I don't know if the Fed wants it, I don't know if the lawyers want it, I don't know whatever,'" he said. "If you sit there every day not making the right decisions to take us to the next level, we'll miss an opportunity."

The Benmosche interview proves what most of us have long suspected, that the trip these Wall Street dickwads all took to the financial woodshed last year has taught them absolutely nothing. They believe implicitly in their divine right to make gigantic gobs of money, even if that money has to be borrowed from all of us, even if it means the entire financial services industry has to be backstopped by government guarantees. And the sad thing is that even a brief sojourn in the desert of fiscal modesty might help not only politically, but help them not suck at their jobs so much -- but they don't want to hear it. They just don't get that it's exactly that hunger for big individual compensation that turns ordinary sane people into Joe Cassanos and Win Neugers. I mean, the clock hasn't even struck a year on AIG's bailout yet, and this clown is already whining in public that the government isn't letting him pay out giant bonuses.The level of cluelessness necessary for a move like that is off the charts, like Stephon Marbury-level insane.

I agree with Salzman, this is an easy call for Tim Geithner. Or, it would be, if Tim Geithner had balls between his legs, instead of a pair of Ford Foundation cufflinks his Daddy bought him as a present for his graduation from Dartmouth. This guy Benmosche should not only be fired immediately, he should be doused in barbecue sauce and dropped in a pool full of mako sharks. At the very least as a signal to the public that someone is paying attention, this guy has to go.

But would you bet money on that happening? I wouldn't.

- By John Richardson at 22 Aug 2009 - 7:05pm

- John Richardson's blog

- Login or register to post comments

Recent comments

13 hours 19 min ago

13 hours 17 min ago

14 hours 18 min ago

18 hours 23 min ago

22 hours 10 min ago

22 hours 13 min ago

22 hours 16 min ago

1 day 12 hours ago

1 day 12 hours ago

1 day 13 hours ago