Search

Democracy Links

Member's Off-site Blogs

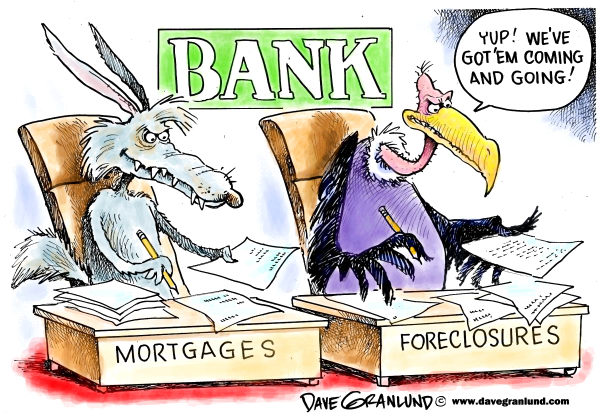

foreclosuregate .....

The foreclosure fraud crisis seems to escalate with each passing now. It is being reported that all 50 U.S. states have launched a joint investigation into alleged fraud in the mortgage industry. This is a huge story that is not going to go away any time soon.

The truth is that it would be hard to understate the amount of fraud that has gone on in the U.S. mortgage industry, and we are watching events unfold that could potentially rip the U.S. economy to shreds. Many are now referring to this crisis as "Foreclosure-Gate," and already it is shaping up to be the worst thing that has ever happened to the U.S. mortgage industry.

At this point, it seems inevitable that some financial institutions will go under as a result of this mess. In fact, by the end of this thing we might see a whole bunch of lending institutions crash and burn. This crisis is very hard to describe because it is just so darn complicated, but it is worth it to try to dig into this thing and understand what is going on because it has the potential to absolutely decimate the entire U.S. mortgage industry.

The truth is that there was fraud going on in every segment of the mortgage industry over the past decade. Predatory lending institutions were aggressively signing consumers up for mortgages that they knew they could never repay. Many consumers were also committing fraud because a lot of them also knew that they could never possibly repay the mortgages. These bad mortgages were fraudulently bundled up and securitized, and these securitized financial instruments were fraudulently marketed as solid investments.

Those who certified that these junk securities were "AAA rated" also committed fraud. Then these securities were traded at lightning speed all over the globe and a ton of mortgage paperwork became "lost" or "missing."

Then, when it came time to foreclose on these bad mortgages, a whole bunch more fraud started being committed.

- By John Richardson at 17 Oct 2010 - 6:48pm

- John Richardson's blog

- Login or register to post comments

Recent comments

3 hours 38 min ago

3 hours 52 min ago

12 hours 31 min ago

13 hours 46 min ago

14 hours 42 min ago

16 hours 50 min ago

17 hours 33 min ago

19 hours 4 min ago

19 hours 23 min ago

21 hours 3 min ago