Search

Recent comments

- a speech never made....

6 hours 32 min ago - wardonald...

8 hours 5 min ago - MAGA fools

17 hours 25 min ago - the ugliest excuse to go to war.....

1 day 3 hours ago - morons....

1 day 5 hours ago - idiots...

1 day 5 hours ago - no reason....

1 day 6 hours ago - ask claude...

1 day 9 hours ago - dumb blonde....

1 day 17 hours ago - unhealthy USA....

1 day 17 hours ago

Democracy Links

Member's Off-site Blogs

twaddling self-importance...

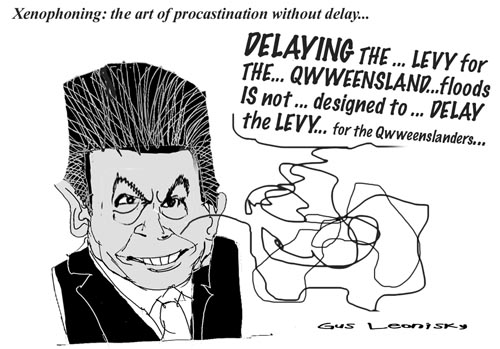

Nick Xenophon is refusing to be treated the government's fool a second time as the independent senator continues to hold out on the controversial flood levy.

Labor needs the senator's vote if it wants parliament to approve its $1.8 million taxpayer impost. [note the SMH editor missed a few zeros... it's 1.8 BILLION]

But Senator Xenophon is not prepared to back the levy on a promise state governments, especially Queensland, will consider taking out disaster insurance.

"A few months ago I may have been happy with that approach," he told ABC Radio on Tuesday.

That was before he was "completely dudded" by the government's commitment to a food labelling review.

"It's a case of fool me once, shame on you, fool me twice shame on me."

- By Gus Leonisky at 22 Feb 2011 - 8:43am

- Gus Leonisky's blog

- Login or register to post comments

xenophoningly...

bidding for cover...

The Federal Government's controversial flood levy legislation has passed by one vote in the House of Representatives.

As expected, it passed with the support of crossbenchers Tony Crook, Bob Katter, Adam Bandt and Andrew Wilkie.

But the Government does not yet have enough votes for the levy to pass the Senate.

To do that it needs the support of independent Senator Nick Xenophon, who says he will not promise his vote unless the states are forced to take out full disaster insurance.

http://www.abc.net.au/news/stories/2011/02/24/3147764.htm

----------

Gus: so far it appears to me Xenophon's attitude has more to do with "revenge' rather than good policy... Let's hope he sees the light. States taking on full insurance on behalf of private citizens and public infrastructures would cost a packet and, knowing insurance gambling mentality, they would not be loosing out. So is Xenophon doing the bidding for the insurance industry, at this stage? He would be a fool to do this...

predictable...

THE New Zealand government and private insurers are facing a tough round of negotiations over whether Christchurch's deadly earthquake was an aftershock from the bigger, but less damaging, quake that shook the region last September.

While the outcome will make little difference for those directly affected by Tuesday's earthquake, it could determine who will shoulder the bulk of insurance payments.

With forecasts that the total cost could top $12 billion, insurance executives from Suncorp, one of Australia's biggest insurers, yesterday said the market for earthquake cover was likely to be ''changed forever''.

http://www.smh.com.au/business/classification-of-quake-worth-billions-in-claims-20110223-1b5p0.html

see comment above, Mr Xenophon...

good man...

The Federal Government's flood levy legislation now looks likely to pass into law after independent Senator Nick Xenophon struck a deal to secure his backing for the bill in the Upper House.

"States that fail to take out insurance or fail to set up other measures like a properly resourced disaster fund, will have their access to Federal disaster funds cut back in the future," Senator Xenophon said.

However the new rules do not apply to the recovery costs for the Queensland floods or Cyclone Yasi.

The Government has not yet confirmed the deal.

The bill has already passed the House of Representatives and Senator Xenophon's vote was the last one needed for it to pass the Senate.

http://www.abc.net.au/news/stories/2011/03/03/3154159.htm

see toon at top...