Search

Recent comments

- bully don.....

2 hours 42 min ago - impeached?....

7 hours 29 min ago - 100.....

15 hours 42 min ago - epibatidine....

21 hours 33 min ago - cryptohubs...

22 hours 32 min ago - jackboots....

22 hours 40 min ago - horrid....

22 hours 48 min ago - nothing....

1 day 1 hour ago - daily tally....

1 day 2 hours ago - new tariffs....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

payup now .....

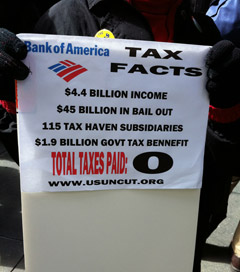

PayUpNow.org is an online effort to "uncut" the cutbacks by promoting boycotts of corporations who pay little or no federal income tax.

According to a US Senate subcommittee report, eliminating tax havens could save $100 billion a year. That's a conservative estimate. The Internal Revenue Service (IRS) calculated that companies and individuals are holding up to $5 trillion in foreign tax havens.

Some of the worst offenders include General Electric (GE), which had $10 billion in profits and received a tax rebate; Bank of America, whose financial statements, according to a Bloomberg report, were "so delusional that they invite laughter"; oil giant Exxon, which paid no US taxes; and Citigroup, with an astounding 427 foreign tax havens.

The list goes on and on. In scanning the Government Accountability Office's list of tax abusers, one is struck by the absence of companies WITHOUT tax havens, euphemistically referred to as "financial privacy jurisdictions." Indeed, only 17 of the 100 largest US companies were listed as tax-haven-free.

The $100 billion per year lost to the taxpayers would cover most of the $140 billion budget deficit faced by the 50 states.

Several of the tax evaders are featured at PayUpNow.org, with brief summaries of their recent tax escapades, products to avoid and links to online forms or email addresses to corporate management. The web site was developed by US Uncut members. A Facebook "Pay Up Now" page has also been created.

As noted on the Pay Up Now web site, every effort has been made to provide truthful, documented information, but errors and omissions are likely in such a sensitive area. Corporations are adept at tax strategy. A New York Times story said "G.E. is so good at avoiding taxes that some people consider its tax department to be the best in the world, even better than any law firm's."

Pay Up Now, Corporations: We're Organized, Aware of Your Tax Havens and Ready to Boycott

- By John Richardson at 24 Apr 2011 - 8:29pm

- John Richardson's blog

- Login or register to post comments

greasing the pigs .....

The US Senate couldn't muster the votes to end $2 billion a year in taxpayer subsidies for the five biggest US oil companies. The House had already voted to block efforts to repeal tax breaks for Big Oil, in sharp contrast to its vote to strip tax credits for small business health insurance.

The oil industry is the most profitable industry in the world. US oil companies earn about $3 billion in profits every week, yet get $4 billion in taxpayer subsidies every year. In the first quarter of 2011, Big Oil's profits were up 38% from the first quarter of 2010.

The industry's outsize profits didn't stop it from squealing like a stuck pig over proposals to trim $2 billion from its annual subsidies and use the revenue to reduce the deficit by about $21 billion over 10 years.

The oil companies tried to characterize the end of their subsidies as a "tax hike," despite growing and widespread recognition across the political spectrum that tax breaks are just another form of government spending, one of several ways to provide direct support for an industry. Before becoming Speaker, John Boehner (R-Ohio) admitted that "tax deductions, credits, and special carve-outs . . . what Washington sometimes calls tax cuts are really just poorly disguised spending programs...."

As a recent Washington Post editorial about such "tax expenditures" pointed out, "an astonishing amount of "spending"-more than $1 trillion annually-is accomplished through the tax code, by way of tax credits or deductions. But there is little conceptual difference between billions spent to directly subsidize particular programs and billions spent indirectly in tax preferences. Either way, it's money the government does not have, and that adds to the deficit."

Taxpayers Subsidize Big Oil, World's Most Profitable Industry