Search

Democracy Links

Member's Off-site Blogs

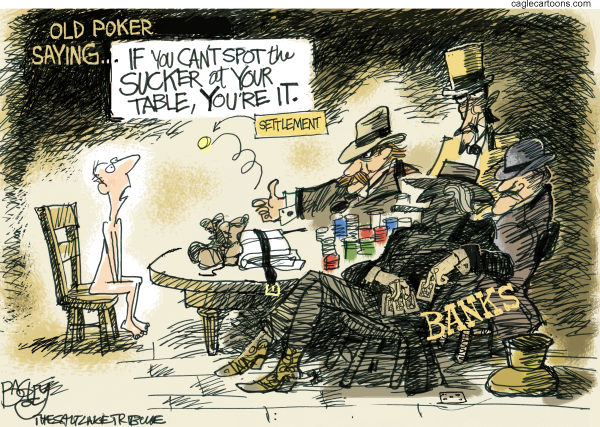

liars poker .....

I've been hesitant to write about the LIBOR scandal because what I want to say goes so much further. We now know that Barclays and other major global banks have been manipulating the calculation of LIBOR through the quotation data they provided to the British Bankers Association. What I suspect is that this is not a flaw but a feature of modern financial markets. And if it was happening in LIBOR for between 5 and 15 years, then the business model has been profitably replicated to many other quotation-based reference prices.

Price discovery is not a sexy function of markets, but it is critical to the efficient allocation of scarce capital and resources, and to the preservation of the long term wealth of investors and the economy as a whole. If price discovery is compromised by manipulation, then we will all be gradually impoverished and the economy will be imbalanced and unstable.

Over the past 25 years the forces of regulatory liberalisation and demutualisation of markets have allowed the largest global banks to set the rules, processes and infrastructure of global markets to their own self-interested requirements. Regulatory complexity and harmonisation benefit the biggest banks disproportionately, eroding the competitive stance of smaller, local banks and market participants. This has led to a very high degree of concentration in a very few banks in most markets that determine global reference rates for interest rates, currencies, commodities and investments. If those few collude with each other - as Adam Smith warned was always the result - then they impoverish us all.

We have allowed markets to evolve in ways that make supervision of markets almost impossible. Many instruments trade off-exchange or in multiple venues, making it nearly impossible for any single investor or regulator to supervise trading to prevent or detect manipulation or abuse. Many financial instruments are now synthetic compilations of underlying assets and derivatives, with multiple pricing components determined by reference to other prices or rates. Demutualisation and regualtory reforms stripped exchanges of the self-regulating interest in preventing manipulation and abuse by their members as mergers, profits and market share came to dominate governance objectives.

Off-exchange trading has been allowed to proliferate, creating massive ill-transparent and largely illiquid markets in almost every sector of finance. Pricing in these markets is based around calculated reference rates which, like LIBOR, are open to abusive quotation and data input practices. Many OTC derivatives are priced and margined using reference rates calculated against quotations unrelated to actual reported transactions. Synthetic securities such as ETFs are another example of an instrument that prices off a reference rate rather than the actual contents of an underlying asset portfolio. These instruments are open to consistent abusive pricing as a means of incrementally impoverishing those market participants who are the krill on which the global banks thrive.

How has it been possible for banks to grow from less than 4 per cent of the global economy to more than 12 per cent of the global economy without impoverishing others? How has it been possible for profits in the financial sector to be consistently higher than profits from other human endeavors with more tangible products or impacts on our daily lives - such as agriculture, transport, health care or utilities? How has it been possible that banks derive their profits not from the protected and regulated activities of deposit-taking and lending, but from the unsupervised and often unknowable escalation of off-balance sheet assets and liabilities? How has it been possible that pension savings have increased while pension returns have declined to the point where only bankers can expect a comfortable old age? Global banks have built the casinos and tilted the odds in the house's favour by rigging the data that determines the outcomes of most of the bets on the table. Every one of us that sits at the table long enough - whether saver, investor, borrower, taxpayer or pensioner - will be a loser. It is not a flaw; it is feature.

There is a reason that financial infrastructure used to be dominated by mutuals. Mutual gain and mutual liability created a natural discipline on excess and on rogue elements that would impoverish their peers.

There is a reason why trading was restricted to exchanges, and exchanges and clearing houses used to be self-regulating, and even had responsibility for resolution and liquidation of their members. Direct responsibility, authority and financial control meant that they could exert very powerful and immediate consequences on those members identified as abusing the market or investors.

The investigations into market rigging are just beginning. Paul Tucker opened the box yesterday when he admitted that he could not know whether the abuses discovered in setting LIBOR had spread to other synthetically calculated reference rates. As events unfold, it may be that we begin to appreciate just how deeply vulnerable we have become to predation by bankers with no stake in a local economy or in the local quality of life of the people they impoverish. A reckoning is needed, and then a rebalancing toward more local and mutual provision of essential services and market infrastructure that serves markets rather than those few bankers on the board.

As a start, regulators should consider punitive restrictions on the sale of instruments which price on reference rates unrelated to reported market transactions or underlying asset portfolios. Pricing should reflect real market transactions rather than guesstimates talking the banker's book.

We need to rethink as a society what banks are for, what exchanges are for, and what clearing houses are for. If they are for the profit of the few at the expense of the many now, that is because it is the business model we have permitted. If banks, markets and clearing are protected because they have a social function, we should make certain that social function is adding value. If it isn't, then we need some new models and some new rules.

meanwhile, down the road a piece …..

British and U.S. authorities are both now investigating Barclays and other banks for manipulating the London InterBank Offered Rate, an interest rate that is a benchmark for a host of financial products around the world. Regulators charge that the banks rigged the interest rate’s movements in order to profit and to make themselves look healthier during the financial crisis of 2008 than they actually were.

This comes on the heels of JP Morgan losing billions of dollars chasing profits with trades that were meant to reduce risk, and, of course, is just a few years removed from a crisis caused in large part by Wall Street malfeasance. But according to a survey by the whistleblower law firm Labaton Sucharow, Wall Street executives believe this is just part of the financial business. In fact, nearly one quarter of survey respondents said that financial services employees need to be unethical or engage in illegal behavior in order to be successful:

In a survey of 500 senior executives in the United States and the UK, 26 percent of respondents said they had observed or had firsthand knowledge of wrongdoing in the workplace, while 24 percent said they believed financial services professionals may need to engage in unethical or illegal conduct to be successful.

Sixteen percent of respondents said they would commit insider trading if they could get away with it, according to Labaton Sucharow. And 30 percent said their compensation plans created pressure to compromise ethical standards or violate the law.

Big banks, of course, have continued to fight reforms to the financial regulatory framework, even in the wake of the crash of 2008. But if this survey is any indication, Wall Street needs a mentality change, along with stricter supervision.

Wall Street Executives Believe Employees Need To Engage In Illegal Behavior To Succeed

in the words of the inimitable frank zappa …..

‘The illusion of freedom will continue as long as it's profitable to continue the illusion. At the point where the illusion becomes too expensive to maintain, they will just take down the scenery, they will pull back the curtains, they will move the tables & chairs out of the way & you will see the brick wall at the back of the theatre.’

- By John Richardson at 11 Jul 2012 - 8:10pm

- John Richardson's blog

- Login or register to post comments

Recent comments

34 min 3 sec ago

1 hour 32 min ago

1 hour 40 min ago

1 hour 48 min ago

4 hours 11 min ago

5 hours 33 min ago

7 hours 25 min ago

1 day 1 hour ago

1 day 3 hours ago

1 day 4 hours ago