Search

Recent comments

- making sense....

26 min 44 sec ago - balls....

29 min 57 sec ago - university semites....

1 hour 18 min ago - by the balls....

1 hour 32 min ago - furphy....

6 hours 47 min ago - nothing new....

7 hours 19 min ago - blood brothers....

8 hours 16 min ago - germanic merde....

8 hours 20 min ago - englishit....

10 hours 4 min ago - kurdylord....

10 hours 14 min ago

Democracy Links

Member's Off-site Blogs

cooking with gas ....

from Crikey ….

Macfarlane swallows spin from gas industry on drilling ….

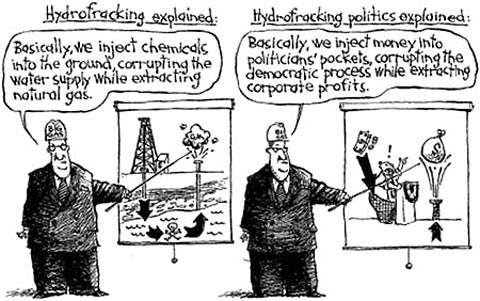

Winston Churchill once said, "never let a good crisis go to waste". The gas industry clearly agrees with him. It has taken a problem of its own making and turned it into a reason why Australians should ignore all their concerns about coal seam gas and let the industry drill wherever it likes. And if comments from our new federal Minister for Resources are to be believed, he has swallowed the industry’s spin hook, line and sinker.

Ian Macfarlane told a gas summit in Sydney on Thursday: ''Addressing the possibility of a gas shortage in New South Wales is one of the most important priorities.'' But before you can solve a problem you first have to understand it.

Industry problem 1: In pursuing higher profits, the industry has constructed large gas export facilities near Gladstone in Queensland. The rest of the world is willing to pay much higher prices for gas than Australians on the east coast are currently paying. When the gas industry links the eastern Australian gas market to the world market, consumers will have to match the price producers will be paid if they sell their gas overseas. The result is likely to be up to a tripling of wholesale gas prices.

Industry problem 2: At a time when prices (and hence profits) are about to go up, new restrictions like the two-kilometre buffer zone around residential areas in NSW have been introduced. This is going to make it harder to take advantage of the new, more profitable price and extract more gas.

The industry’s "solution" is inspired. Blame the price rise on the new restrictions and claim that if governments get rid of the restrictions, that will put downward pressure on prices. Not only does the industry avoid the blame for any price rises, but it gets to redirect the public outcry as political pressure to remove the restrictions.

The only problem with the industry's solution is that it does not stand up to even a small amount of scrutiny. Once the export facilities are up and running the price of gas for the east coast of Australia will be linked to the international price. The only thing that will change Australia’s gas price is changes in the international price.

Even if NSW removes all restrictions on CSG and allows gas wells all over Sydney and the rest of the state, this would only increase the world supply of gas by a relatively tiny amount -- and would only lower the world price by the tiniest of amounts. More domestic production is not going to stop the wholesale gas price from tripling.

The industry has also claimed that the reason gas prices are going to rise is because all the cheap gas has been extracted and the only gas remaining will cost more to extract. It may be true that the cost of extracting gas is going to rise in the future, but that is not what is going to determine the price of gas. Again, the price of gas will be determined by the world price and that means the wholesale price could triple.

The industry has also attempted to link the restrictions in NSW to a future gas shortage, making alarmist claims about a gas "crisis". The problem with this claim is that restrictions in NSW have nothing to do with the "shortage" of gas, which is not caused by a lack of supply but rather a massive increase in planned exports of gas. The industry is building facilities to send 1346 PJ of gas overseas. To put that in context, when these facilities are up and running they will almost triple world demand for Australian gas. A plan for a massive increase in exports seems like a strange thing to deal with a "shortage" of gas.

You have to admire the gas industry for its cunning in blaming the gas price rises that it created on the gas restrictions it wants to get rid of. The problem for our new Macfarlane is that the gas industry’s solution simply cannot solve the problem. Removing the restrictions on CSG extraction in NSW will not stop the wholesale price from tripling, nor will it stop the gas industry from exporting most of the east coast’s gas.

What the industry’s solution will do is put a lot of new CSG wells all over the state and potentially endanger the water supply and environment and put at risk productive farming land. Oh, and it will also make the gas industry a bucket load of extra profit.

Matt Grudnoff is a senior economist at The Australia Institute and author of Cooking up a price rise

- By John Richardson at 28 Sep 2013 - 5:53pm

- John Richardson's blog

- Login or register to post comments

hit by unseasonably warm weather...

Energy retailer and power generator AGL has posted a sharply lower interim profit, hit by unseasonably warm weather and discounting.

In the December half, net profit fell 27.1 per cent to $261 million.

Stripping out the impact of futures contract valuations, the underlying net profit fell a more modest 11.4 per cent to $242 million.

Earnings a share dropped 28.2 per cent to 46.9c. The interim dividend has been held steady at 30c a share.

AdvertisementAGL said it reconfirmed year to June guidance of a net profit of $560-$610 million. Most analysts have pencilled in a profit forecast unchanged from the previous year at $600-610 million.

A return to more normal weather patterns and declining customer "churn", where customers aggressively switch energy retailer, should help margins revive, it said. Recently, Origin Energy flagged an expectation of slowing discounting in the marketplace, which AGL appears to have supported with expectation of declining customer churn.

Read more: http://www.smh.com.au/business/warm-weather-discounting-hit-agl-bottom-line-20140226-33gil.html#ixzz2uNHhjkEE

Hum I can see the dilemma! But with the "global warming" conditions (hit by unseasonably warm weather!) summers will become like inside of ovens and air conditioning will rebalance this unseasonably warm winter weather that has lead to less energy usage... All's well in the best of the cooking worlds... The more coal we burn the warmer it's going to get and the more air conditioning units will rattle in the dongas... filling the pocket of the energy providers...

See also: the wooden spooners in RET...