Search

Recent comments

- dumb blonde....

2 hours 53 min ago - unhealthy USA....

3 hours 26 min ago - it's time....

3 hours 48 min ago - pissing dick....

4 hours 7 min ago - landings.....

4 hours 18 min ago - sicko....

17 hours 7 min ago - brink...

17 hours 23 min ago - gigafactory.....

19 hours 10 min ago - military heat....

19 hours 52 min ago - arseholic....

1 day 36 min ago

Democracy Links

Member's Off-site Blogs

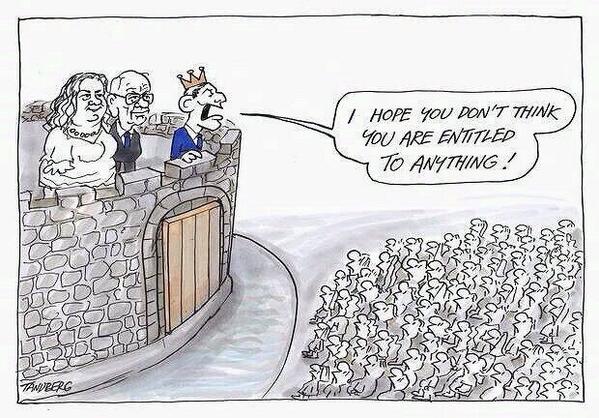

the age of entitlement .....

OK, so a 1% wealth tax on the top ten percent would yield by my back of the envelope calculations $30 billion, an inheritance tax on estates worth more than $2 m a couple of hundred million if not more, taxing trusts as companies (Joe Hockey suggested it a few years ago but has been silent ever since) billions, taxing the top one percent of income earners (those earning over $250000 a year) at 100% with a 75% rate for incomes between $150000 to $250000 would also yield billions.

Imagine how much a real super profits tax would bring in, especially if it were to apply not just to mining companies but to the banks too. We are talking tens of billions here.

Halving dividend imputation would produce billions too. That’s before we talk about increasing the company tax rate and getting rid of tax expenditures for business worth tens of billions.

Getting rid of the superannuation concessions for the top ten percent of income earners would save up to $10 billion, especially if coupled with abolishing or restricting negative gearing to stop switching from one rort to the next.

This could be just for starters.

Why aren’t these taxes on the rich on the agenda, instead of attacking pensioners, sacking tens of thousands of public servants, cutting public transport, health and education spending and slashing funding to the mildly critical ABC and the world ranking CSIRO? I’ll tell you why.

Because the priorities of this government, like all the governments before it, is profit, not people.

The Abbott government, like Labor before it, is involved in an attempt to shift massive amounts of wealth to the rich from labour and the poor.

- By John Richardson at 24 Apr 2014 - 8:26am

- John Richardson's blog

- Login or register to post comments

the bigger the lie .....

from Politicoz …..

Joe Hockey continued his pre-budget softening-up exercise with his speech at an event for the conservative magazine Spectator Australia yesterday. It went largely as expected. Australia's finances are unsustainable, he said, and the government is committed to repairing them.

On his list of 'Large and Fast Growing Programmes' he singled out the aged pension (1st), aged care (8th) and the Pharmaceutical Benefits Scheme (10th) as increasing faster than the economy is growing.

But he didn't mention defence spending, which is 2nd on that list and which is also increasing faster than GDP growth. Nor did he mention that the government's Direct Action climate policy was outside the terms of reference of his Commission of Audit, whose 900-page report is to be publicly released next week.

Also outside the Commission's ambit was Australia's extraordinary system of tax concessions to its wealthiest residents, the highest among developed nations relative to GDP. Superannuation tax concessions, for instance, are growing even faster than the aged pension despite costing the budget about the same amount.

The government has the burden of showing why it intends to cut spending without addressing tax concessions. It hasn't discharged it yet. Perhaps it will on 13 May.