Search

Recent comments

- japan's gas....

30 min 54 sec ago - peacemonger....

1 hour 27 min ago - see also:

10 hours 28 min ago - calculus....

10 hours 42 min ago - UNAC/UHCP...

15 hours 23 min ago - crafty lingo....

16 hours 47 min ago - off food....

16 hours 56 min ago - lies of empire...

17 hours 55 min ago - no peace....

19 hours 3 min ago - berlinade....

19 hours 28 min ago

Democracy Links

Member's Off-site Blogs

dear... (insert your first name), sucker..

The Australian Competition Tribunal has overturned a decision by the competition watchdog to block AGL Energy from buying the New South Wales power assets of Macquarie Generation.

The tribunal says it will allow the $1.5 billion deal with some conditions.

The Australian Competition and Consumer Commission (ACCC) blocked AGL's takeover bid in March, saying it was likely to substantially reduce competition in the NSW retail electricity market.

AGL appealed against the decision, saying it had significant implications for the industry's future.

The ACCC said the acquisition would result in the three largest energy retailers in NSW owning a combined share of up to 80 per cent of electricity generation capacity.

It said that was likely to raise barriers to entry and expansion for other electricity retailers in NSW and therefore reduce competition.

- By Gus Leonisky at 25 Jun 2014 - 5:28pm

- Gus Leonisky's blog

- Login or register to post comments

"remains to be seen..."...

The sale of infrastructure assets would provide significant investment opportunities for super funds, which have consistently called for federal and state governments to facilitate more infrastructure investment opportunities.

As treasurer, Baird has overseen the sale of two major ports - Kembla and Botany - and the process is underway for the sale of a third, Newcastle. Industry super funds bought Port Botany, largely through IFM Investors.

The Baird model of selling brownfield infrastructure assets and using the proceeds to fund new infrastructure, such as the WestConnex road, has proved very successful, with federal and state governments talking about it as a model to imitate.

However, while the sale of ports has not received much public opposition, other assets such as energy distribution and social infrastructure are much more controversial, as the impact of potentially higher prices would be much more widely felt.

While former premier Barry O'Farrell made a pre-election commitment not to sell poles and wires, it is understood that Baird is a stronger proponent of their sale.

When asked about the issue at an event hosted by Citi in October last year, Baird was guarded:

"We've made our position on poles and wires very clear," he said. "The premier before the election said it wouldn't be undertaken, and clearly we have honoured that mandate. And winning back the community's trust is I think a key feature of any government.

"I think community trust in governments has been at an all-time low. So we're not in a position that we are changing that position. Clearly what we have said previously, that if there was to be any change, that would be something that would be sought with an electoral mandate. But we're not in a position where we're seeking that."

Baird is the most likely candidate to replace Barry O'Farrell as premier, after his main rival Gladys Berejiklian announced she would not stand. Whether O'Farrell's departure changes the NSW government's position on energy infrastructure remains to be seen.

http://www.financialstandard.com.au/news/view/39544730

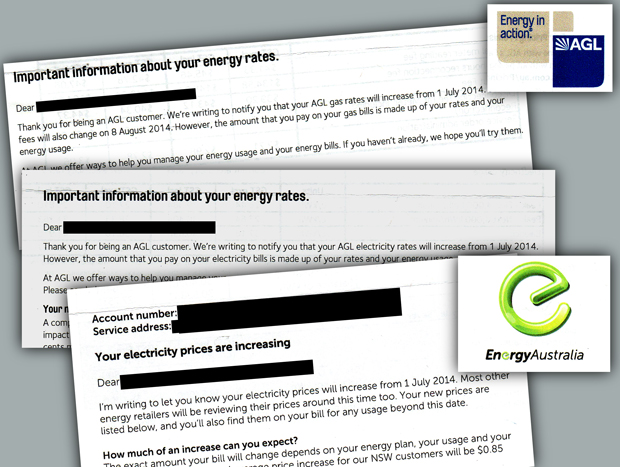

the beauty of a well-oiled sting... you pay less plus more.

Clive Palmer is insisting power companies prove they have reduced electricity prices by the full amount of the carbon tax in a legislative amendment the Palmer United party senators will insist upon before they will vote to repeal the tax.

Palmer had his first meeting with the prime minister, Tony Abbott, on Thursday morning after his dramatic announcement alongside the former US vice-president Al Gore on Wednesday.

The PUP leader is beginning to provide some details of the only condition he has put on his party’s support for the carbon tax repeal: that there be tougher legal requirements to ensure the repeal flows through to household bills.

“The Palmer United party amendments will provide an enforcement mechanism to ensure the generators and then the retailers are required by law to pass on the full benchmarked electricity and gas price falls associated with the carbon tax repeal,” Palmer said in a statement.

“This would go beyond government provisions which only give the Australian Competition and Consumer Commission enhanced monitoring arrangements.”

Industry groups were scrambling to try to understand what Palmer meant by the condition on Thursday, but Guardian Australia understands it will involve reversing the onus of proof – in some way requiring companies to show and certify that they have taken the full carbon price out, rather than just relying on the ACCC to monitor prices.

Sources say Palmer wants to hold Abbott to a promise he made last year.

“When this bill is passed, this government estimates that power prices will go down by 9%, gas prices will go down by 7%, and that means that the average power bill will be $200 a year lower and the average gas bill will be $70 a year lower,” Abbott said on 15 October.

http://www.theguardian.com/world/2014/jun/26/palmer-insists-power-prices-mandated-down-before-pup-repeals-carbon-tax

The beauty of a well-oiled sting... You pay less plus more. See top picture... In fact the energy companies can do the carbon pricing reduction dance with no trouble and tell you about it with no sweat, but you still will pay more — as more is the name of the game — with "fluctuations" to take care of the CPI, though should you be a lowly paid worker, your wage will stagnate below the CPI, but should you be a CEO, your "remuneration" would have jumped at least 20 percent above the CPI (per annum), by the time you read these lines.

Meanwhile global warming will burn your pants next summer.

the fact checker is narrow-minded...

It is my learned opinion that the fact checker at the ABC is very narrow minded, biased towards right-wing thinking and overall lazy... Sure he brings a lot of facts and figures and dazzles about as if he had a sparkler up his butt, but my opinion remains that he is often on a silly dose of opinionation himself. That is not "fact checking".

"Legislation to repeal the carbon tax is headed for the Senate, where crossbench Senators have indicated they will give the support needed for it to pass. The Government claims households will be significantly better off.

At a press conference on June 23, Prime Minister Tony Abbott said: "Every household right around Australia will benefit to the tune of $550 a year. So this is a $550 a year windfall to every household in Australia..."

ABC Fact Check looked at this issue in 2013. Mr Abbott made a similar comment then, but at the same press conference Enviblah blah blah blah...."

This study by the fact checker which ends up with a meek "overstated verdict" is basically based only on savings here and there passed on by the energy industry... This study does not take on the damage that THE ABOLITION OF THE PRICE ON CARBON can do to the future... The elimination of the Price on Carbon is basically installing a new tax on renewables which to say the least have become far more affordable, reliable and cleaner than burning coal alone. Thus electricity price from renewables will go up, as well as MORE CO2 will go in the atmosphere, increasing global warming by a related factor. More houses will burn in bush fires, more drought for farmers becoming in need of more assistance, increase in your general "insurance" bills, flood damage (like the recent "river upsurge" in Melbourne) — all this ADD UP TO YOUR TOTAL ENERGY CONSUMPTION COST, even if your energy bill is lower. Eventually, we will be paying a lot more for Tony Abbott's and Palmer dirty trick of the abolition of the carbon pricing... May their houses burn to the ground...

Tassie hydro going to the wall because of Abbott...

Hydro Tasmania has announced it is to cut about 100 jobs, citing the repeal of the carbon tax as a factor.

The state-owned power company attributed the cuts to the scrapping of the carbon tax, doubt over the future of the Renewable Energy Target, and a downturn in the consulting market.

In a statement, Hydro CEO Steve Davy said it would first look to reduce its workforce by natural attrition and a round of voluntary redundancies.

Hydro Tasmania has forecasted a profit of less than $20 million in the coming financial year.

This continues the trend of healthy profits in recent years, including a record pre-tax profit of $238 million for the last financial year.

But last year's windfall became a loss of almost $250 million when massive asset writedowns and the forced acquisition of the Tamar Valley Power Station was taken into account.

And today's statement declared that the outlook for the year ahead was challenging.

http://www.abc.net.au/news/2014-06-27/hydro-tasmania-to-cut-100-jobs/5555732

----------------------------

The challenge of course is the repeal of the carbon pricing which makes renewables, including hydro, less palatable to the financial markets... It's like giving the coal industry a free kick for just being there on the field.

Now I will ask a silly question: "Is Tasmania still "importing electricity from the mainland?" Hello?...

it's a scandal in fact...

Prime Minister Tony Abbott is right about one thing: the price of electricity has shot up and is now a lot higher than it should be. It's a scandal, in fact. Trouble is, the carbon tax has played only a small part in that, so getting rid of it won't fix the problem.

Until a rotten system is reformed, the price of electricity will keep rising excessively, so I doubt if many people will notice the blip caused by the removal of the carbon tax. (As for the price of gas, it will at least double within a year or two, as the domestic price rises to meet the international price, making the carbon tax removal almost invisible.)

So Abbott will be in bother if too many voters remember all the things he has said about how much the tax was responsible for the rising cost of living, how much damage the tax was doing to the economy and how much better everything would be once the tax was gone.

Read more: http://www.smh.com.au/comment/carbon-tax-merely-a-blip-in-power-price-scandal-20140715-zt7na.html#ixzz37bhMJIpK

reduction are on the way... yppee!...

The rising cost of using gas in Australia had been penned to go above inflation — itself about 3 per cent per annum — to a WHOPPING 17 pointsomething percent... But fear not, because of the carbon tax (pricing) repeal, the price increase will only be shy of 12 percent...

Isn't this marvellous? a full NINE PERCENTAGE points above inflation!!! Meanwhile some of Australia's companies are selling gas to overseas at the same inflated price, thus boosting their profits beyond shareholders beliefs and paying tax ... Well not paying too much tax in Aussieland as I believe a lot of these profits are GOING OVERSEAS as well...

We're screwed...

increases are on the way... yppee!...

A report commissioned by green groups has found that abolishing the Renewable Energy Target (RET) will increase profits to electricity companies by more than $10 billion.

The Federal Government has commissioned its own review of the RET, which is expected to recommend the target be reduced or abolished altogether.

The environmental groups' modelling also says household electricity prices would rise if the RET is scrapped or reduced.

Australian Conservation Foundation chief economist Dugald Murray says companies that own coal-fired power stations stand to increase profits by $9 billion between 2015 and 2030 if the RET is abolished.

The calculations are essentially based on increased market share with the wholesale price going up because companies are not competing as much with the renewable energy generators who can operate at a lower cost.

http://www.abc.net.au/news/2014-08-18/abolishing-renewable-target-will-increase-electricity-costs/5677972