Search

Recent comments

- economy 101....

6 hours 21 min ago - peace....

7 hours 10 min ago - making sense....

9 hours 48 min ago - balls....

9 hours 52 min ago - university semites....

10 hours 40 min ago - by the balls....

10 hours 54 min ago - furphy....

16 hours 9 min ago - nothing new....

16 hours 41 min ago - blood brothers....

17 hours 38 min ago - germanic merde....

17 hours 43 min ago

Democracy Links

Member's Off-site Blogs

on gold digging .....

from Crikey …..

Let it not be said that the financial planning industry is just interested in looking after themselves or view their clients simply as a resource to be exploited.

That, after all, would merely confirm the poor reputation the industry currently has in the wake of the Commonwealth financial planning scandal.

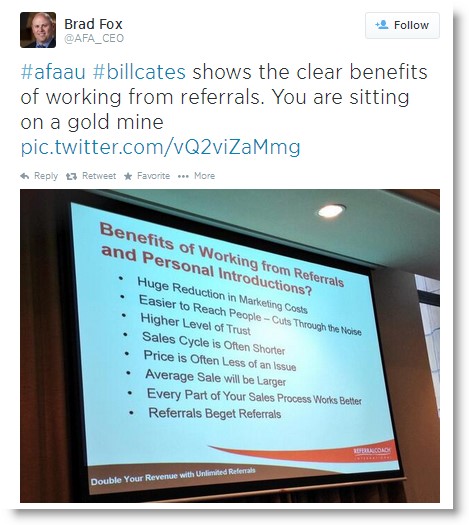

Although we were intrigued by the above tweet from March by the CEO of the Association of Financial Advisers, Brad Fox.

This is an industry that is trying - or at least some parts are trying - to become more like a profession and to regain the trust of the community, which was destroyed by rogue planners and years of conflicted remuneration and fee-gouging.

But can you imagine a doctor or lawyer referring to their patients as a "goldmine" just waiting to be exploited?

- By John Richardson at 2 Jul 2014 - 6:47pm

- John Richardson's blog

- Login or register to post comments

misleading...

GE Money has been fined $1.5 million for misleading customers about credit card limit increases.

The Australian Securities and Investments Commission (ASIC) took action against GE Capital Finance Australia, which trades as GE Money, for telling many of its customers that to activate their cards or apply for a credit limit increase, they had to consent to receiving invitations to raise their limit.

The Federal Court found GE Money had made false or misleading representations to more than 700,000 of its credit card customers, because such consents were not needed to apply for a card or increased limit.

The offending conduct happened in the first half of 2012, shortly before a federal government ban on unsolicited invitations to increase credit card limits came into effect.

The court concluded GE Money had deliberately tried to circumvent the intent of the laws through its conduct.

"The contraventions were serious and the reach of GE Capital's conduct was extensive and substantial," it ruled.

"[It] was a systematic and deliberate attempt to mislead cardholders into giving their consent to receive invitations for future credit increases so as to avoid losses of up to $6 million which were projected to be suffered by GE Capital as a result of the tightening regulatory environment."

http://www.abc.net.au/news/2014-07-03/ge-money-fined-for-misleading-customers/5569782