Search

Recent comments

- stenography.....

10 hours 3 min ago - black....

10 hours 1 min ago - concessions.....

11 hours 3 min ago - starmerring....

15 hours 8 min ago - unreal estates....

18 hours 54 min ago - nuke tests....

18 hours 58 min ago - negotiations....

19 hours 56 sec ago - struth....

1 day 8 hours ago - earth....

1 day 9 hours ago - sordid....

1 day 9 hours ago

Democracy Links

Member's Off-site Blogs

a brief history of taxation and the avoidance thereof...

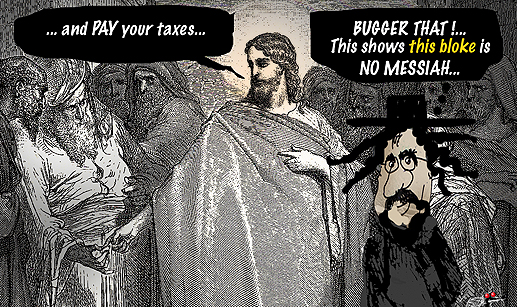

The latest tax evasion exposed by the Panama Papers is not a new occurrence. Back in history, even in the Bible legends, Jews had their doubts about the process of paying taxes to the Emperor. Jesus sorted out the problem by telling them to "render unto Caesar and to god the things that are god's" (Ἀπόδοτε οὖν τὰ Καίσαρος Καίσαρι καὶ τὰ τοῦ Θεοῦ τῷ Θεῷ), though the Emperor at the time was Tiberius. But the translations make allowances as the word Caesar means Emperor in Latin and covers a lot of them.

Apparently, according to three of the gospels, the Jewish questioners were impressed by the answer and being so satisfied they went away. I believe nothing of this and that Jesus explanation was a turning point for these smart people who decided that the guy Jesus was no messiah and plotted to get rid of him, no matter what, for this kind of blasphemy about cash.

Moving fast along history during which kings and nobility knew how to strip the poor people bare and loot other countries — to another continent where we settle in Boston. Here, the Tea Party destroyed a shipment of tea because they believe the Tea Act, which had passed on May 10 in the Parliament of great Britain, 1773, was subjecting them to "taxes without representation". Some of the American rebels actually disguised themselves as "native Indians" contrary to the law of the day. They could have been shot.

But this kerfuffle was more a case of mercantilistic favouritism (monopoly) by the Kingdom, for The East India Company which might have been the biggest multinational ever, with its own armies, ships and harbours around the planet :

The Act granted the Company the right to directly ship its tea to North America and the right to the duty-free export of tea from Britain, although the tax imposed by the Townshend Acts and collected in the colonies remained in force. It received the royal assent on May 10, 1773.

Colonists in the Thirteen Colonies recognized the implications of the Act's provisions, and a coalition of merchants, smugglers, and artisans similar to that which had opposed the Stamp Act 1765 mobilized opposition to delivery and distribution of the tea. The company's authorised consignees were harassed, and in many colonies successful efforts were made to prevent the tea from being landed.

So Someone called Dr Johnson (Samuel Johnson) wrote to the Americas and preached the value of taxation to the people in America...

The last of these pamphlets, Taxation No Tyranny (1775), was a defence of the Coercive Acts and a response to the Declaration of Rights of the First Continental Congress of America, which protested against taxation without representation. Johnson argued that in emigrating to America, colonists had "voluntarily resigned the power of voting", but they still had "virtual representation" in Parliament. In a parody of the Declaration of Rights, Johnson suggested that the Americans had no more right to govern themselves than the Cornish people. If the Americans wanted to participate in Parliament, said Johnson, they could move to England and purchase an estate.[11] Johnson denounced English supporters of America as "traitors to this country", and hoped that the matter would be settled without bloodshed, but that it would end with "English superiority and American obedience".

Samuel Johnson was a devoted zealot Anglican and a staunch Conservative of the Tory Party. He was a weirdo with what might have been (and described later) Tourette Syndrome.

His speech went so well that the American War of Independence started forthwith in April 1775. The British parliament back-pedalled and repealed most the "offending" taxes presented by the Carlyle Peace Commission to the Colony's Congress, but all was rejected. Too bloody late...

We know the rest. So taxation has been a sore point for rich people, especially American people. Poor people had to cough up no matter what on various taxes such as taxes on salt and other goods. The Rich people managed to amass big loots they did not want to share with Mother England.

Since this time taxation is still a sore point. Taxation has taken various format — while tax avoidance schemes and safe "legal" harbours for "illegal" cash have sprouted like weeds in your garden.

Gus Leonisky

Your local amateur tax commissionaire

- By Gus Leonisky at 11 Apr 2016 - 4:50pm

- Gus Leonisky's blog

- Login or register to post comments

an air of taxing superiority...

Samuel Johnson was a wordsmith who created a famous English dictionary and who could not stand fools — possibly including himself. He wrote long windy arguments, sometimes witty and often sharp, mostly to dazzle his audience and bore the pants out of the opposition.

Dr Johnson was a friend of someone called Boswell who was Scottish. Johnson saw the Scots and the Americans as inferior people. Some of Johnson's critics were not impressed, including a certain Horace Walpole writing to S. Conway in 1785:

Have you got Boswell's most absurd enormous book? (The Journal of a Tour to the Hebrides with Samuel Johnson) — The best thing in it a a bon mot by lord Pembroke. The more one learns of Johnson, the more preposterous assemblage he appears of strong sense [strong idiocy], of the lowest [biggest] bigotry and prejudices, of pride, brutality, fretfulness, and vanity — and Boswell is the ape of most of his faults...

In return Johnson praised his own disdain for inferior people in Boswell's Life:

Johnson: Rousseau, Sir, is a very bad man. I would sooner sign a sentence for his transportation, than that of any felon who has gone from the Old Bailey these many years. Yes , I would like to have him work in the plantations.

Boswell: Sir, do you think him as bad as Voltaire?

Johnson: Why, Sir, it is difficult to settle the proportion of iniquity between them.

But here we have to let Johnson explain why American taxes were essential for the kingdom. Here is a (short) extract of TAXATION NO TYRANNY:

The nation is, sometimes, to be mollified by a tender tale of men, who fled from tyranny to rocks and deserts, and is persuaded to lose all claims of justice, and all sense of dignity, in compassion for a harmless people, who, having worked hard for bread in a wild country, and obtained, by the slow progression of manual industry, the accommodations of life, are now invaded by unprecedented oppression, and plundered of their properties by the harpies of taxation.

We are told how their industry is obstructed by unnatural restraints, and their trade confined by rigorous prohibitions; how they are forbidden to enjoy the products of their own soil, to manufacture the materials which nature spreads before them, or to carry their own goods to the nearest market; and surely the generosity of English virtue will never heap new weight upon those that are already overladen; will never delight in that dominion, which cannot be exercised, but by cruelty and outrage.

But, while we are melting in silent sorrow, and, in the transports of delirious pity, dropping both the sword and balance from our hands, another friend of the Americans thinks it better to awaken another passion, and tries to alarm our interest, or excite our veneration, by accounts of their greatness and their opulence, of the fertility of their land, and the splendour of their towns. We then begin to consider the question with more evenness of mind, are ready to conclude that those restrictions are not very oppressive, which have been found consistent with this speedy growth of prosperity; and begin to think it reasonable, that they who thus flourish under the protection of our government, should contribute something toward its expense.

But we are soon told, that the Americans, however wealthy, cannot be taxed; that they are the descendants of men who left all for liberty, and that they have constantly preserved the principles and stubbornness of their progenitors; that they are too obstinate for persuasion, and too powerful for constraint; that they will laugh at argument, and defeat violence; that the continent of North America contains three millions, not of men merely, but of whigs, of whigs fierce for liberty, and disdainful of dominion; that they multiply with the fecundity of their own rattlesnakes, so that every quarter of a century doubles their numbers.

Men accustomed to think themselves masters do not love to be threatened. This talk is, I hope, commonly thrown away, or raises passions different from those which it was intended to excite. Instead of terrifying the English hearer to tame acquiescence, it disposes him to hasten the experiment of bending obstinacy, before it is become yet more obdurate, and convinces him that it is necessary to attack a nation thus prolifick, while we may yet hope to prevail. When he is told, through what extent of territory we must travel to subdue them, he recollects how far, a few years ago, we travelled in their defence. When it is urged, that they will shoot up, like the hydra, he naturally considers how the hydra was destroyed.

Nothing dejects a trader like the interruption of his profits. A commercial people, however magnanimous, shrinks at the thought of declining traffick and an unfavourable balance. The effect of this terrour has been tried. We have been stunned with the importance of our American commerce, and heard of merchants, with warehouses that are never to be emptied, and of manufacturers starving for want of work.

That our commerce with America is profitable, however less than ostentatious or deceitful estimates have made it, and that it is our interest to preserve it, has never been denied; but, surely, it will most effectually be preserved, by being kept always in our own power. Concessions may promote it for a moment, but superiority only can ensure its continuance. There will always be a part, and always a very large part of every community, that have no care but for themselves, and whose care for themselves reaches little further than impatience of immediate pain, and eagerness for the nearest good. The blind are said to feel with peculiar nicety. They who look but little into futurity, have, perhaps, the quickest sensation of the present. A merchant's desire is not of glory, but of gain; not of publick wealth, but of private emolument; he is, therefore, rarely to be consulted about war and peace, or any designs of wide extent and distant consequence.

Yet this, like other general characters, will sometimes fail. The traders of Birmingham have rescued themselves from all imputation of narrow selfishness, by a manly recommendation to parliament of the rights and dignity of their native country.

To these men I do not intend to ascribe an absurd and enthusiastick contempt of interest, but to give them the rational and just praise of distinguishing real from seeming good; of being able to see through the cloud of interposing difficulties, to the lasting and solid happiness of victory and settlement.

Lest all these topicks of persuasion should fail, the greater actor of patriotism has tried another, in which terrour and pity are happily combined, not without a proper superaddition of that admiration which latter ages have brought into the drama. The heroes of Boston, he tells us, if the stamp act had not been repealed, would have left their town, their port, and their trade, have resigned the splendour of opulence, and quitted the delights of neighbourhood, to disperse themselves over the country, where they would till the ground, and fish in the rivers, and range the mountains, and be free.

These, surely, are brave words. If the mere sound of freedom can operate thus powerfully, let no man, hereafter, doubt the story of the Pied Piper. The removal of the people of Boston into the country, seems, even to the congress, not only difficult in its execution, but important in its consequences. The difficulty of execution is best known to the Bostonians themselves; the consequence alas! will only be, that they will leave good houses to wiser men.

Yet, before they quit the comforts of a warm home, for the sound of something which they think better, he cannot be thought their enemy who advises them, to consider well whether they shall find it. By turning fishermen or hunters, woodmen or shepherds, they may become wild, but it is not so easy to conceive them free; for who can be more a slave than he that is driven, by force, from the comforts of life, is compelled to leave his house to a casual comer, and, whatever he does, or where ever he wanders, finds, every moment, some new testimony of his own subjection? If choice of evil be freedom, the felon in the galleys has his option of labour or of stripes. The Bostonian may quit his house to starve in the fields; his dog may refuse to set, and smart under the lash, and they may then congratulate each other upon the smiles of liberty, "profuse of bliss, and pregnant with delight."

To treat such designs as serious, would be to think too contemptuously of Bostonian understandings. The artifice, indeed, is not new: the blusterer, who threatened in vain to destroy his opponent, has, sometimes, obtained his end, by making it believed, that he would hang himself.

But terrours and pity are not the only means by which the taxation of the Americans is opposed. There are those, who profess to use them only as auxiliaries to reason and justice; who tell us, that to tax the colonies is usurpation and oppression, an invasion of natural and legal rights, and a violation of those principles which support the constitution of English government.

This question is of great importance. That the Americans are able to bear taxation, is indubitable; that their refusal may be overruled, is highly probable; but power is no sufficient evidence of truth. Let us examine our own claim, and the objections of the recusants, with caution proportioned to the event of the decision, which must convict one part of robbery, or the other of rebellion.

read the whole spiel: http://www.samueljohnson.com/tnt.html

Makes three word slogans appear tame, doesn't it?

a national sport, on a global scale...

In life, as the fatalistic proverb goes, only two things are certain: death and taxes. 'I love paying taxes', writes Aaron Tucker, so let's get over it!

IN THE land of the fair go why do we have such a problem with paying what is a relatively fair tax? Although the Aussie battler might love Kerry Packer’s comments around taxation we have to own up to the fact that without adequate funding we stand to lose many services that make this country so desirable.

Let’s just get this out in the open.

I love paying taxes.

No, I’m not in need of a psychiatric evaluation. Yes, I’m feeling fine today. No, my accountant doesn’t really agree with me.

In a country where in the 2010/11 financial year 9.6 per cent of all individuals that lodged a tax return owned a negatively geared property, avoiding tax is like a national sport.

read more: https://independentaustralia.net/politics/politics-display/tax-one-of-the-two-certainties-of-life-so-get-over-it,8885

Read Dr Johnson's Taxation no Tyranny from top...