Search

Democracy Links

Member's Off-site Blogs

puss-in-boots .....

from Crikey: an update on our rooted regulator …..

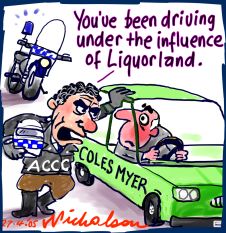

ACCC all jawboning and no action over petrol prices

Michael Pascoe writes: ‘Well whip me with a feather – ACCC chairman Graeme Samuel is telling the media he has told the naughty petrol companies that he will tell the media they are naughty if they don’t reduce petrol prices in a week. When did we step through the looking glass?

It’s a pretty sad state of affairs for the consumer watch puppy to be in when it has to resort to jawboning about jawboning petrol prices.

It’s also an embarrassment for the ACCC to admit there’s something amiss in the petrol market when it waved through the very change that is now the prime suspect – the rise and rise of Coles and Woolworths in yet another area of retailing. The Terror quotes FuelTrac to point the finger:

Profit margins have widened sharply since Coles and Woolworths increased discount vouchers from 4c a litre to 10c, prompting petrol industry watchdog FuelTrac to accuse them of manipulating bowser prices to pinch back the savings.

"The fuel discount isn't costing them anything and people are running around filling up trolleys with $80 worth of groceries they don't need to pay the same as what they should be paying for petrol," FuelTrac's Geoff Trotter said. "Graeme Samuel has been asleep to this for too long."

Samuel defends that charge by saying half the market still isn’t Coles and Woolworths – give ‘em time, give ‘em time -- but that belies the effect that the retail duopolists have had on all petrol stations.

The Colesworths discount docket offer has seriously damaged the opposition, robbing them of pricing power. Now that margins have briefly blown out, it would be unrealistic to expect the weaker parties to suddenly give any away.

Colesworths spokesfolk deny any link between their current 10 cents a litre discount offer and the pump price. The Mandy Rice-Davies rule applies.

The ACCC’s website contains all manner of information about petrol price cycles, how prices are set and such, the output of numerous inquiries over the years. Those inquiries predate the ACCC-approved march of Woolworths and Coles into the market.

Maybe it’s time for a new chapter: The application of jawboning about jawboning when the system ceases to function.

meanwhile, Geoff Dixon’s printing press has also been leading a charmed life …..

Qantas reduces fuel charge by $5 ….. gee, thanks

Adam Schwab writes: “The oil price is 32% off its peak levels, so Qantas has decided to reduce its controversial fuel surcharge on some routes . . . by a grand total of $5 which is less than 5%. But wait, there's more: the surcharge -- of $370 return for some routes -- will remain in place for all flights to Europe, the US, Canada, South America, South Africa and India.

The recent surcharge reduction will only apply to flights to Asia, New Zealand and domestic routes. The pitiful reduction is akin to a millionaire leaving a $2 tip on a $500 meal.

As justification for the meagre decrease, Qantas executive general manager, John Borghetti claimed that "despite hedging and surcharges, [Qantas is] still under-recovering the cost of fuel price increases by hundreds of millions of dollars, even with the recent drop in jet fuel prices."

However, Borghetti’s claim was contradicted yesterday a Macquarie Bank report which claimed that Qantas is on track a record profit figure of more than $1 billion this year. (Macquarie would have a fair understanding of Qantas: Chinese Walls aside, the bank is deeply involved with the potential PE buyout of Qantas with Allco Equity Partners and Texas Pacific Group.) Quite simply, Qantas (which operates in monopoly or duopoly markets for some of its routes) is creaming consumers, frequent fliers and travel agents with an unnecessary surcharge – all the while the ACCC has not so much lifted a finger to protect consumers and the tourism industry.

However, Qantas isn’t only hurting consumers, it is also doing its bit to damage Australia’s fragile tourist sector (which Crikey noted on Monday was the worst performing tourism market in the work). Yesterday, Tourism Minister, Fran Bailey, stepped in, calling on Qantas to increase capacity on the under-serviced Pacific Route. Currently, Qantas shares a very cosy duopoly with United Airlines over the Pacific and has intentionally kept capacity low to maintain a near 100% load. Capacity is so tight that some business travellers have not even been able to secure a business class seat to the US, despite the cost being around $16,000 for a return trip to New York (compared with around $10,000 for a return trip of a similar distance to London).

Unnecessary fuel surcharges, record profits, price gouging in a duopoly – where the bloody hell are you Graeme Samuel?

but, on the other side of the street …..

ACCC’s morning scorecard: threats against, threats by, and one union finedMichael Pascoe writes: “What a busy day for Australian Competition and Consumer Commission chairman Graeme Samuel in the popular press this morning…

One tabloid has Telstra threatening Samuel with a High Court challenge, the others are all beating the bejaysus out of the threat to "name" petrol companies (what, we don’t know who they are?) and along the way they've managed to get a union fined for trying to run a closed shop. All that’s missing is a slap at the tokenism of Qantas’s fuel surcharge reduction.

The $125,000 fine awarded against the Communications, Electrical and Plumbing Union in the Federal Court yesterday is the issue that receives the least coverage but could well be the most important.

Only the AFR seems to have the story, but the ACCC’s application of the Trade Practices Act is another turn of the federal government’s anti-union screws.

The ACCC was after a $250,000 fine but judge Neil Young only went half that distance in clobbering the CEPU for trying to enforce a closed shop.

The Fin’s Matthew Drummond reports the judge found that Edison Mission agreed with the CEPU in 2001 that only contractors who had signed an agreement with the union would be employed in the construction of a new power station at Loy Yang.

The CEPU was caught as an accessory because it aided and abetted Edison’s conduct. Edison has settled its side of the case with ACCC and is awaiting a penalty hearing next month.

What makes the story bigger news is the claim that agreements like the CEPU-Edison deal are still common in other industries. There are a lot more potential prosecutions out there if the ACCC goes looking.

- By John Richardson at 17 Jan 2007 - 10:45pm

- John Richardson's blog

- Login or register to post comments

Recent comments

14 min 14 sec ago

2 hours 44 min ago

5 hours 43 min ago

6 hours 46 min ago

7 hours 29 min ago

8 hours 57 min ago

9 hours 8 min ago

10 hours 26 min ago

10 hours 28 min ago

1 day 58 min ago