Search

Recent comments

- see also:

3 hours 33 min ago - calculus....

3 hours 47 min ago - UNAC/UHCP...

8 hours 27 min ago - crafty lingo....

9 hours 51 min ago - off food....

10 hours 25 sec ago - lies of empire...

11 hours 18 sec ago - no peace....

12 hours 7 min ago - berlinade....

12 hours 32 min ago - difficult...

14 hours 8 min ago - no nukes...

14 hours 16 min ago

Democracy Links

Member's Off-site Blogs

special appropriations...

budget

budget

What in America they call the State of the Union, in Australia we call the federal budget.

As surprising as it may seem, Australian budgets aren't really about money — they're about values.

As a case in point, a key part of next week's Budget will be an announcement about childcare, but the childcare measures won't start until 2022-23.

It's not clear that they'll need to be in the 2021-22 Budget in order to get approved.

Indeed, the Budget's formal title is Appropriation bill (No. 1) 2021-22. The Budget bill will deal only with appropriations for 2021-22.

But the theatre that has built up around the presentation of that bill — the Budget speech — has given it the space to deal with so much more.

Legally, the Budget needn't deal with muchLast year's speech mentioned values, twice. It spoke of our "cherished way of life", of the courage, commitment, and compassion of healthcare workers and volunteer firefighters, of our "invisible strength".

And it extended the low and middle income tax offset for another year.

Legally, the Budget bill can't include tax measures. That's outlawed by the Constitution.

Tax measures have to be introduced in separate legislation, measure by measure — or not be introduced at all. Our government can continue to collect tax at the existing rates for as long as it likes, unlike in Britain where tax collections form the core of the budget bill and need to be re-authorised every year.

In Australia government spending does need to be re-authorised every year but only spending which is for the "ordinary annual services" of government.

Everything else — the vast bulk of government spending, everything from Medicare to pensions to grants to the states to family support to support for private schools and private health insurance — is ongoing, approved on a never-ending basis under so-called "standing appropriations" or "special appropriations".

At the last count there were 240 such special appropriations, covering everything from the funding of universities to paid parental leave.

The Department of Finance says 167 of them are unlimited, meaning there is "no defined ceiling on total expenditure".

What's left, what actually needs to be re-approved in the Budget each year, is little more than the payment of rent and public service wages, suggesting that if the Senate had rejected "supply" (the Budget appropriation bill) during the 1975 constitutional crisis as it had threatened to do, the Whitlam government could have taxed and spent much as before, although it would have had to get private banks to advance public servants' wages, something it was investigating doing.

Practically, it deals with most thingsIt might be because it needs to do so little that the Budget has come to do so much.

Now the "forward estimates" for spending and revenue and the state of the economy go out for four years, and some of them for ten.

The Budget has become a statement of the government's values in part because it puts numbers on those values — how much it is prepared to spend on health compared to defence, how much it plans to spend on superannuation tax concessions for high earners compared to pensions for low earners.

Which makes it a statement of valuesAs with the US President's State of the Union speech, it's the only night of the year in which the government sets out clearly what stands for and what it plans to do.

An accident of history means it's the treasurer rather than the prime minister who delivers the statement of values, although the treasurer speaks for the prime minister, as Joe Hockey spoke for Tony Abbott in 2014 when he infamously declared his budget to be for "lifters, not leaners".

Josh Frydenberg's values will be apparent in how he responds to a surging iron ore price (last year's budget assumed US$55 a tonne and on a slightly different measure it's currently north of US$180) and much stronger than expected recoveries in jobs and the share market.

It would be tempting to wind back spending and push up taxes in order to close the budget deficit without seeing how far the recovery can run.

That Frydenberg says he won't — not until he gets the unemployment rate below 5 per cent and hundreds of thousands more Australians are in jobs — is a statement of values.

That he is reportedly planning to spend an extra $10 billion (over the four-year "forward estimates", not per year) on responding to the findings of the aged-care royal commission when the commission identified much greater needs might also be a statement of values.

As might the forecasts he makes for immigration, for the spending on mental health promised in response to the Productivity Commission inquiry, for the rollout of vaccines for Australians and vaccines for countries that need them more than Australia.

They'll all be part of a program that makes clear what the government stands for and against which it can be judged.

Peter Martin is a Visiting Fellow at the Australian National University's Crawford School of Public Policy. This article first appeared on The Conversation.

Read more:

assange2

assange2

- By Gus Leonisky at 5 May 2021 - 6:50am

- Gus Leonisky's blog

- Login or register to post comments

budget droppings...

The budget countdown is on (literally), with Treasurer Josh Frydenberg continuing to unveil major spending announcements and faux inspirational videos in the hours leading up to Tuesday night’s full reveal. Spending commitments are dropping prematurely, like the leaves on the Budget Tree, with multibillion-dollar announcements on both infrastructure ($10 billion over 10 years) and aged care ($10 billion, over four), along with $1 billion to extend JobTrainer for another year and $353 million over four years for women’s health – all put forward in the past 24 hours alone. Pre-emptive criticism is growing, however, from those who are expecting to miss out and those whose flagged amounts are not considered enough. And from Labor leader Anthony Albanese trying out talking points from his budget reply, which is clearly set to focus on the government’s tendency to announce and re-announce things without delivering much of anything.

The billions now being trumpeted for infrastructure and aged care are expected to form the centrepiece of the big spending, election-vibe budget, along with its promised focus on women. The latter is definitely not a cynical ploy to win back women voters, says new Minister for Women’s Economic Security Jane Hume in an AFR puff piece (prime minister for women Marise Payne is not in the country this week, acting instead in her foreign affairs role, today discussing Australia’s “robust response” to its war crimes with Afghanistan President Ashraf Ghani). Critics have already pointed out that spending in these areas doesn’t go nearly far enough. President of the Australian and New Zealand Society for Geriatric Medicine Dr John Maddison told ABC’s AM that $10 billion over four years was not enough for the system overhaul that aged care needs, noting that the royal commission had estimated a shortfall of almost $10 billion annually, as aged-care workers rallied outside Parliament House with oversized cut-outs of an eldely Scott Morrison’s head. The newly unveiled infrastructure package is full of re-announcements, according to Labor’s infrastructure spokeswoman Catherine King, who says a lot of the money is going to pre-existing projects that have overrun their budgets. Women’s workplace centres, meanwhile, are calling for the funding boostrecommended in the Respect @ Work report, warning they will be forced to close or drastically reduce services without it. There is little indication such a boost is forthcoming.

Frydenberg has also used today’s budget drops to try and clear up the government’s border reopening time line, after a weekend dispute between Prime Minister Scott Morrison and The Daily Telegraph over what exactlythe PM said the strategy was. The paper reported that he had said international borders would remain closed, with Australia looking to “eliminate” coronavirus. Morrison refuted the “elimination” claim on Sunday, adding that the borders will open “when it is safe to do so”. The treasurer has told Nine that the budget assumes borders will reopen some time in 2022, still far behind the original targets, while Finance Minister Simon Birmingham defended the lack of plan on Sky News, conceding that vaccinated Australians won’t be free to travel internationally before then (so much for the random promise of vaccinated, quarantine-free travel Morrison threw out less than a month ago).

In other border news, the government is currently defending its India travel ban against a challenge in the Federal Court, with lawyers for a 73-year-old Australian stranded in Bangalore arguing it is a common law right for citizens to enter Australia, that the Biosecurity Act cannot expressly override that right, and that the ban was not the “least intrusive” measure available, as required. It has been revealed that Health Minister Greg Hunt didn’t get fresh legal advice from the solicitor general, with the latest advice presented predating the ban by “many months”. But Justice Thomas Thawley – who has been a “bit prickly” to the plaintiff’s lawyer, Guardian Australia’s Paul Karp notes – has already rejected arguments that the criminal penalties were not “front and centre” in the minister’s mind when he made the announcement (noting they were in the late-night press release the government would like us to forget about). Thawley pointed out that the act does allow the health minister to infringe rights by banning Australians from leaving. He appears “likely” to uphold the validity of the travel ban, agreeing with Hunt’s counsel that it was “nonsensical” to argue that the act can’t control movements originating outside of Australia, and that to prevent travel bans such as the one at hand would open the door to questions over the validity of bans on aliens entering the country.

We may have a result on the case as soon as this afternoon, with the ban set to lift on Saturday either way. But it will no doubt be months before we have any clear answers on when that ban not in dispute – the one on us leaving the country – goes away.

Read more:

https://www.themonthly.com.au/today/rachel-withers/2021/10/2021/1620622033/budgets-and-borders

We are told that cash will fall on us by the semi-trailer truck load... in a couple of years...

forecasting the forecasts...

The federal government will release its budget this week.

The numbers in the budget will be based on "forecasts" of the economy.

Specifically, they will rely on forecasts for wages growth, inflation, employment, taxes, population, and commodity prices, among other things.

Some of the government's decisions about where to spend money, and how much to spend, will be based on those forecasts.

But what if the assumptions behind the forecasts turn out to be wrong?

Well, as it turns out, some have been wrong for years. And the consequences haven't been negligible.

The downward spiral (of wage growth)Let's look at a couple of the big ones.

Here's a graph showing the Australian Bureau of Statistics's Wage Price Index, which is a measure of wage growth.

Notice there has been a marked slowdown in the rate of wage growth in recent decades. It's currently sitting at a record low 1.4 per cent.

Read more:

https://www.abc.net.au/news/2021-05-09/federal-budgets-forecasts-have-relied-on-dodgy-assumptions/100126156

Read from top.

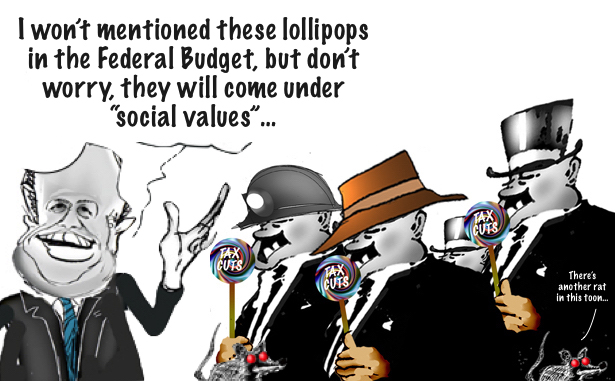

cartoon predictions...

Many Australians have responded with fury over a budget they saw as providing “tax cuts for the rich” and a lack of support for those struggling to get by.

Treasurer Josh Frydenberg will forge ahead with tax cuts due to deliver huge reductions for higher income earners in 2024.

The Federal Government has tried to keep the focus on the one-year extension of the Low and Middle Income Tax Offset (LMITO or “Lamington”), which is worth up to $1080 for singles and $2160 for couples earning under $126,000.

But budget papers confirmed the Stage 1 tax break could be axed next year, leaving these workers facing a higher tax bill.

Meanwhile, the Stage 3 cuts that remain in place for 2024 will introduce a single flat tax rate on every dollar earned between $45,000 and $200,000, benefiting Australia’s highest earners.

“Low income Australians get a once off handout,” said campaigner Dee Madigan on Twitter. “Rich people get an ongoing one through tax cuts. Not fair.”

Many said that the extra budget funding for domestic violence services and aged care support and increased JobSeeker payments were not enough.

Read more:

https://www.news.com.au/finance/economy/federal-budget/federal-budget-2021-australians-angry-over-tax-cuts-for-rich/news-story/e7e08aac753a5d6afe5d96751dc6e854

See cartoon at top....

losers and losers...

by Ben Hillier

The biggest winners in federal budget week were investors in mining giants BHP, Rio Tinto and Fortescue Metals. The record iron ore price of well over $200 per tonne had financial analysts estimating $65 billion in dividend payments to share owners this year, most of them overseas institutional investors.

These super-profits on sovereign resources, which successive governments, both Labor and Liberal, have refused to tax properly, put into the shade the so-called spending spree of the federal government. The outlay of an extra $24 billion per year is bizarrely being described in the media as somehow revolutionary—even when almost one-quarter of that “spending” is revenue forgone in business tax deductions and write-offs, making business owners the second big winners of budget week.

Others who continue to be recipients of government grace are those with housing investments and large amounts of financial wealth—by and large the top 20 percent of the population, who receive, according to new modelling from the Centre for Social Research and Methods, the lion’s share of the $60 billion per year windfall tax concessions from negative gearing, superannuation tax concessions, the capital gains tax discount and refunds from excess franking credits.

There’s almost nothing for the 116,000 homeless and the millions suffering mortgage and rental stress. And the government says prudence won’t allow it to lift the below poverty level unemployment entitlements by more than the already announced $25 a week. What bullshit.

The aged care sector, which will get an extra $4.5 billion per year over the next four years, is said to be a big budget winner. After the unbearable horror stories coming out of the royal commission, any extra money is welcome. But as Gerard Hayes, national president of the Health Services Union, commented, $10 billion had already been ripped out of the sector since the Liberals were elected in 2013. One top of that, he noted, “there is no commitment to permanent, better paid jobs”. No wonder the sector has trouble attracting workers.

The government—and pretty much everyone in the media—says that low- and middle-income earners are big winners because the tax offset measure introduced last year is being extended. That provides an end of year rebate of between $255 and $1,080. But the Treasury forecasts that consumer price inflation will outstrip wage rises, resulting in a 2.25 percent real pay cut for workers this year and a further 0.25 percent next year. The tax cut will make up for that zero percent of the time.

The greatest and most urgent challenge, climate change, received almost no attention in the budget. Nor did quarantine facilities. More than a year into a pandemic that has killed more than 3 million people, and the federal government has done next to nothing on this urgent front. But it made more than half a billion dollars available for its ongoing refugee detention regime at Christmas Island and for expanded mainland detention centres.

There’s always money for the largest democratic rights breacher in the country, ASIO, which gets a boost of $100 million a year. And the military, under last year’s Defence Strategic Update and Force Structure Plan, will receive $575 billion over the decade to 2029-30. As has become the norm in the 21st century, in the choice between bread and guns, guns win.

Mainly because of the projected increase in net government debt to nearly $1 trillion by 2025 and the elevation of federal spending to more than 27 percent of GDP, which will contribute to half of all economic growth next year, Australian Financial Review economics editor John Kehoe calls the budget “a revolution in macroeconomic policy management”.

It’s a revolution only if the frame through which you view macroeconomics is so narrow that a slight swing from one branch of the state (the Reserve Bank) to another (the Treasury) as a stimulator of growth has you wetting your pants.

If you work a regular job, this is not your revolution. So don’t get caught up in all this hype about a new order. Pragmatic shifts in recent years likewise created a big song but were of little substance. The progressive advocacy group GetUp!, for example, heralded a “seismic shift” after the 2017 federal budget, with “both sides of politics ... prioritising bold, progressive economic reform measures”.

That was after the federal government made a distinction between “good debt” and “bad debt”—that used to finance capital assets versus that used to fund recurrent expenditure. The rationale for the distinction was to separate debt that pays for itself by stimulating sustained economic growth and debt that is used to cover immediate expenses.

The shift was a cover for the government’s inability to run a surplus despite promising one forever. The growth of debt during the pandemic, while more significant in scale, is arguably less significant ideologically than the shift four years ago. Running deficits to stimulate growth and charge out of recession is standard practice. It’s exactly what treasurers John Howard and Paul Keating did in the early 1980s and what the ALP did coming out of the 1991 recession. The volume of stimulus has shocked this time around. But then again, so did the scale of the economic contraction in the middle of 2020.

Neoliberalism, the most abused term in economics and politics, must have been reported dead three times in the last thirteen years. But if it has died yet again, no-one told Josh Frydenberg. For him, the markets—those fragile institutions nurtured by capitalist states to allocate resources—reign supreme and continue to be used as the prime drivers, and discipliners, of human behaviour.

Again, if you work a regular job, neoliberalism’s alleged death will also pass you by. Housing policy remains a mass of tax breaks for investors, individual incentives for deposit savers and subsidies for owner-occupiers. And the big four banks—the leeches profiting the most from everyone else’s debt bondage—are reporting super profits again.

The unemployed remain locked in a labyrinth of obligations to private providers growing fat both from job seekers’ misfortunes and from their eventual placement in work—if they are lucky enough to find a job. The NDIS for most people similarly is a giant marketplace of scarcity.

Aged care, despite the squalor, will not be run for human need, the for-profit centres that oversee the death and malnutrition continuing with more government subsidies. Superannuation concessions now cost more than the aged pension, but that private financial behemoth rolls on as the government’s favoured option for retirees because it rewards people with higher incomes.

Pressure remains on the universities to be profit-making institutions. Financial deregulation continues, overseas financial service providers from certain jurisdictions getting the green light to operate here without a licence. Pharmaceuticals and medical research “monetisation” will be incentivised by a little more than half the current company tax rate, rather than the government just directly investing in needed areas—such as vaccine development.

And the $130 billion “phase three” tax cuts, which benefit only individuals earning more than $120,000 a year, are still in the wings. Plus the company tax rate continues to fall.

Budgets are always passed with bells and whistles sounding, governments insisting that workers are the real winners when mostly it’s more of the same gravy train for businesses and the rich. This year is little different. It’s not a revolution. It’s capitalism. It doesn’t change much.

Read more:

https://redflag.org.au/article/calling-bullshit-budget

Read from top

Free Julian Assange Now !!!!!!!!!!!!!!

cream for the top...

The coverage was positively glowing. Debt projected to be four times higher than at any point under Labor but nothing could silence the cheerleaders.

The Federal budget was the only news on anyone’s lips. Government debt is projected to blow out beyond $1 trillion, more than four times higher than at any point under Labor.

And yet, let’s just compare some coverage.

Some of the superlatives used to describe the Budget were: “Ute Beauty”; “Election Injection”; “Rebuild of Dreams”; “Super Spender”; “$1.6bn for the heartland”.

Maybe he meant “No business left behind”, as tax incentives were extended, to a value of $20.7 billion. There were many left behind:

- Aged care, which is receiving only half the investment recommended by the Royal Commission. Private aged care providers did well, though, with investments towards such as “support[ing] providers to adjust to a more competitive market”

- First-home buyers, as the Homebuilder scheme and Home Super Save Scheme extended and scaled-up will do nothing to put the brakes on the skyrocketing house market

- Anyone earning a wage, with budget estimates suggesting wage growth will remain below 3% until 2024-25 and beyond

- JobSeekers, who still receive 25% less than the poverty line

- Anyone caring about the climate, with the phrase “climate change” mentioned just once in the budget speech

- Recent migrants, who now face a four-year wait to access welfare payments

- Those on the NDIS, who have to contend with what amounts to Robodebt 2.0

- Public schools, where students will once more get about half as much funding per person as private school students. Nearly twice as many students attend public schools, but private schools will receive 50% more funding in the newest budget ($16 billion vs $11 billion)

- Anyone attending or working at universities, which were excluded from JobKeeper, with borders being closed until mid-2022 preventing international students enrolling, and now further funding cuts

Budget week funThere was plenty of other fun floating around in budget week.

There seemed to be cause for celebration that “stage 3 tax cuts [will be] cheaper”.

The tax cuts will be a lower cost to the budget because of the slowest wage growth in decades.

The tax cuts, which will be going to the highest-earning Australians, will still cost us all a whopping $17 billion instead of the projected $19 billion in the first year they take effect.

Steve Price at The Herald Sun worked himself into a lather that Daniel Andrews was still recovering from a broken spine.

The tax cuts will be a lower cost to the budget because of the slowest wage growth in decades.

The tax cuts, which will be going to the highest-earning Australians, will still cost us all a whopping $17 billion instead of the projected $19 billion in the first year they take effect.

Steve Price at The Herald Sun worked himself into a lather that Daniel Andrews was still recovering from a broken spine.

And finally …Finally, we can hark back to the good old days (last week) when there was still some outrage over Australian citizens being banned from returning to their own country.

The Australian Financial Review, in defending the government against “charges of racism”, pointed out that borders were closed with other countries.

Missing from the analysis was that Australian citizens were still allowed home when those borders closed, via repatriation flights and off-shore quarantine.

Read more:

https://johnmenadue.com/tamed-estate-debt-and-deficit-disaster-not-when-it-comes-to-the-coalition/

Read from top. I drew the toon without knowing what was "in the budget". My guess was that "business" and the rich were going to get the cream (or the lollipops) with the idea that the mouth watering was going to trickle down once through a defficient renal canal...

FREE JULIAN ASSANGE NOW !!!!!!!!!!!!!