Search

Recent comments

- peer pressure....

1 hour 9 min ago - strike back....

1 hour 15 min ago - israel paid....

2 hours 18 min ago - on earth....

6 hours 48 min ago - distraction....

7 hours 58 min ago - on the brink....

8 hours 7 min ago - witkoff BS....

9 hours 22 min ago - new dump....

21 hours 14 min ago - incoming disaster....

21 hours 22 min ago - olympolitics.....

21 hours 27 min ago

Democracy Links

Member's Off-site Blogs

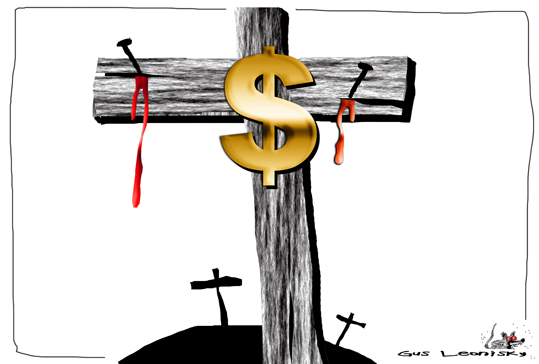

sanctions from god….

In God We Trust is a phrase that we regularly see on our change and bills, while also gracing several of our car license plates, our government buildings, and even as tattoos on people’s bodies. Despite efforts to remove In God We Trust from several places, the faith-based motto has stayed in our lives for centuries. This is because it has a background that goes far beyond being a novelty logo or recognized as part of our currency. It came into existence thanks to some strong Christians who felt a nation going through a painful, costly war needed a constant reminder about God and His provision, and this should be something we take note of every day. It even went into law, becoming an intricate part of our nation’s history for life.

https://www.crosswalk.com/faith/spiritual-life/in-god-we-trust-on-the-us-currency.html

May we venture to say that people have more trust in money than in god…. God is intangible and only feeds the birds. Money is food, clothing and shelter via some complex mechanisms of trust manipulation on the world markets.

This is where “economic sanctions” become two-edge swords.

In short the US federal banks control nearly all the economies of the planet via the value of the trust in the DOLLAR in regard to the amount of debts and goods exchanged between countries. Most of this is centralised in the Fed bank, Washington.

We know what happened to countries that tried to bypass this centralisation: Saddam Hussein wanted to trade oil in different currencies other than the dollar. The US invented pretexts to bomb the shit out Iraq to stop this. Gaddafi wanted to create a Pan-African banking system that was independent from the US dollar. He got shafted and Hillary Clinton is still laughing about it while having a dump.

The new kids off the block are the Crypto-currencies. And Guess what? The US government holds more Bitcoins than anybody else. Some have been acquired legally some not. Some cryptocurrency holdings of the US admins are secret, some are not.

So what happens with economic sanctions? Well, most serious economists think that they only “hurt” (if they do), on the very short term — but satisfy the sanctioners’s moral hubris in front of a gullible public demanding nuclear bombs on Russia, because of the frothing media. And because of the complexity of the money system, the importance of what is traded diminishes the strength of the sanctions.

Say for example, the EU uses (needs) about 40 per cent of Russian gas. The EU has to pay no matter what otherwise the gas gets turned off and the EU economy collapses. They have to pay in Rubles, now through a flimsy transparent system that flaunt the sanctions but keeps the sanctioning moralistic hubris alive….

In 2021, the US imported more than 200,000 barrels per day (bpd) of crude oil and 500,000 bpd of other petroleum products from Russia.

This represented three percent of US crude oil imports and one percent of the total crude oil processed by US refineries. By contrast, the US imported 61 percent of its crude oil from Canada, 10 percent from Mexico, and six percent from Saudi Arabia in the same year. But different oils use different refining system. Cutting down on imports from Russia could mean a VERY EXPENSIVE RETOOLING of processing other oils.

Meanwhile, RUSSIA does not mind who is buying its oil. Plenty of discreet buyers out there who don’t want to be part of the unilateral US “sanctions’. According to Reuters, since the beginning of the Ukraine Op, Russia has INCREASED its sales of oil by about 300,000 barrels a day. All this to be paid in Rubles, Yuans, gold or Bitcoins — and even US dollars….

About 600 Western commercial firms have quit Russia. This moralistic position is stupid but in the long run can only help Russia to reinvent its own manufacture of such goods. This represent a major dint in the world exchange economy.

Eventually, when Russia leaves Ukraine alone as Turdy Zelenskyyyy-y signs a deal with Russia, all the weird accounting of the West will have to come and fork out cash to Russia that has been officially payng its "debts" with IOUs...…

Thus sanctions affect the importance of the dollar. Independent system of payment are coming to the fore, say between China and Russia and other “non-aligned” countries. One can trade some goods for other goods without even mentioning the word “money” nor god…

And Russia has much goods that other people want: COAL, GAS, OIL, diamonds, “rare earths"…. you name it. In the whole thing, one could suggest that the US sanctions imposed on Russia were DESIGNED to hurt Europe (keep EU under the US hegemony) more than Putin…

Meanwhile the US debt to the world has grown like a cancer, somewhat equivalent to the number of US troops in your backyard. Few countries can call upon this humongous debt because the system designed by the Fed Bank is to make sure you are ALSO indebted to the system: The World Bank and the IMF have made sure of this: the global debt reaches a Record $226 Trillion in 2021. The GDP of the world is less than half of this — and the debt CAN NEVER BE REPAID. No-one is "FREE".... Meanwhile the derivative market — the playground of bankers — is now, wait for it, $1 quadrillion (according to serious investors)….

So, unless your pissy wages or your piddly pensions are indexed to inflation, the cost of living is getting beyond your means, before you wake up every morning.

All this shows you CAN NEITHER TRUST THE US dollar NOR GOD.

FREE JULIAN ASSANGE NOW !!!!!!!!!!!!!!!!

Gus Leonisky

Trusted economist....

- By Gus Leonisky at 26 Apr 2022 - 11:29am

- Gus Leonisky's blog

- Login or register to post comments

who owns the illusion of money?……..

The Federal Reserve Banks are not a part of the federal government, but they exist because of an act of Congress. Their purpose is to serve the public. So is the Fed private or public?

The answer is both. While the Board of Governors is an independent government agency, the Federal Reserve Banks are set up like private corporations. Member banks hold stock in the Federal Reserve Banks and earn dividends. Holding this stock does not carry with it the control and financial interest given to holders of common stock in for-profit organizations. The stock may not be sold or pledged as collateral for loans. Member banks also elect six of the nine members of each Bank's board of directors.

https://www.stlouisfed.org/in-plain-english/who-owns-the-federal-reserve-banks

October 06, 2021

The International Role of the U.S. DollarCarol Bertaut, Bastian von Beschwitz, Stephanie Curcuru1

For most of the last century, the preeminent role of the U.S. dollar in the global economy has been supported by the size and strength of the U.S. economy, its stability and openness to trade and capital flows, and strong property rights and the rule of law. As a result, the depth and liquidity of U.S. financial markets is unmatched, and there is a large supply of extremely safe dollar-denominated assets. This note reviews the use of the dollar in international reserves, as a currency anchor, and in transactions.2 By most measures the dollar is the dominant currency and plays an outsized international role relative to the U.S. share of global GDP (see Figure 1). That said, this dominance should not be taken for granted and the note ends with a discussion of possible challenges to the dollar's status.

There is widespread confidence in the U.S. dollar as a store of valueA key function of a currency is as a store of value which can be saved and retrieved in the future without a significant loss of purchasing power. One measure of confidence in a currency as a store of value is its usage in official foreign exchange reserves. As shown in Figure 2, the dollar comprised 60 percent of globally disclosed official foreign reserves in 2021. This share has declined from 71 percent of reserves in 2000, but still far surpassed all other currencies including the euro (21 percent), Japanese yen (6 percent), British pound (5 percent), and the Chinese renminbi (2 percent). Moreover, the decline in the U.S. dollar share has been taken up by a wide range of other currencies, rather than by a single other currency. Thus, while countries have diversified their reserve holdings somewhat over the past two decades, the dollar remains by far the dominant reserve currency.

The bulk of these official dollar reserves are held in the form of U.S. Treasury securities, which are in high demand by both official and private foreign investors. As of the end of the first quarter of 2021, $7.0 trillion or 33 percent of marketable Treasury securities outstanding were held by foreign investors, both official and private (see Figure 3a), while 42 percent were held by private domestic investors, and 25 percent by the Federal Reserve System. Although the share of Treasuries held by foreign investors has declined from almost 50 percent in 2015, the current foreign share of Treasury holdings is comparable to the share of euro-area government debt held by investors outside of the euro area (shown in Figure 3b) and higher than the foreign-held shares of British or Japanese government debt.

Foreign investors also hold substantial amounts of paper banknotes. As shown in Figure 4, the value of U.S. dollar banknotes held abroad has increased over the past two decades, both on an absolute basis and as a fraction of banknotes outstanding. Federal Reserve Board staff estimate that over $950 billion in U.S. dollar banknotes were held by foreigners at the end of the first quarter of 2021, roughly half of total U.S. dollar banknotes outstanding.

Additionally, many foreign countries leverage the effectiveness of the U.S. dollar as a store of value by limiting the movements of their currencies with respect to the U.S. dollar – in other words, using it as an anchor currency. As Ilzetzki, Reinhart, and Rogoff (2020) highlight, the dollar's usage as an anchor currency has increased over the past two decades. They estimate that 50 percent of world GDP in 2015 was produced in countries whose currency is anchored to the U.S. dollar (not counting the United States itself).3 In contrast, the share of world GDP anchored to the euro was only 5 percent (not counting the euro area itself). Moreover, since the end of the Ilzetzki et al. sample in 2015, this anchoring has changed little. One exception might be the re-anchoring of the the Chinese renminbi from the U.S. dollar to a basket of currencies. However, the U.S. dollar and currencies anchored to the U.S. dollar comprise over 50 percent of this basket. So in practice, the Chinese renminbi remained effectively anchored to the U.S. dollar according to the Ilzetzki et al. definition, because in 90 percent of months between January 2016 and April 2021 the renminbi moved less than 2 percent against the U.S. dollar.4

The U.S. dollar is dominant in international transactions and financial marketsThe international role of a currency can also be measured by its usage as a medium of exchange. The dominance of the dollar internationally has been highlighted in several recent studies of the currency composition of global trade and international financial transactions. The U.S. dollar is overwhelmingly the world's most frequently used currency in global trade. An estimate of the U.S. dollar share of global trade invoices is shown in Figure 5. Over the period 1999-2019, the dollar accounted for 96 percent of trade invoicing in the Americas, 74 percent in the Asia-Pacific region, and 79 percent in the rest of the world. The only exception is Europe, where the euro is dominant.

In part because of its dominant role as a medium of exchange, the U.S. dollar is also the dominant currency in international banking. As shown in Figure 6, about 60 percent of international and foreign currency liabilities (primarily deposits) and claims (primarily loans) are denominated in U.S. dollars. This share has remained relatively stable since 2000 and is well above that for the euro (about 20 percent).

With dollar financing in particularly high demand during times of crisis, foreign financial institutions may face difficulties in obtaining dollar funding. In response, the Federal Reserve has introduced two programs to ease crisis-induced strains in international dollar funding markets, thus mitigating the effects of strains on the supply of credit to domestic and foreign firms and households. To ensure that dollar financing remained available during the 2008-2009 financial crisis, the Federal Reserve introduced temporary swap lines with several foreign central banks, a subset of which were made permanent in 2013.5 During the COVID-19 crisis in March 2020, the Federal Reserve increased the frequency of operations for the standing swap lines and introduced temporary swap lines with additional counterparties.6 The Federal Reserve also introduced a repo facility available to Foreign and International Monetary Authorities (FIMA) with accounts at the Federal Reserve Bank of New York, which was made permanent in 2021.7 Both the swap lines and FIMA repo facility have enhanced the standing of the dollar as the dominant global currency, as approved users know that in a crisis they have access to a stable source of dollar funding. The swap lines were extensively used during the 2008-2009 financial crisis and the 2020 COVID-19 crisis, reaching outstanding totals of $585 billion and $450 billion, respectively (see Figure 7a). Although other central banks have also established swap lines, non-dollar-denomindated swap lines offered by the European Central Bank and other central banks saw little usage (see Figure 7b). This fact highlights how crucial dollar funding is in the operations of many internationally active banks.

Issuance of foreign currency debt—debt issued by firms in a currency other than that of their home country — is also dominated by the U.S. dollar. The percentage of foreign currency debt denominated in U.S. dollars has remained around 60 percent since 2010, as seen in Figure 8. This puts the dollar well ahead of the euro, whose share is 23 percent.

The many sources of demand for U.S. dollars are also reflected in the high U.S. dollar share of foreign exchange (FX) transactions. The most recent Triennial Central Bank Survey for 2019 from the Bank for International Settlements indicated that the U.S. dollar was bought or sold in about 88 percent of global FX transactions in April 2019. This share has remained stable over the past 20 years (Figure 9). In contrast, the euro was bought or sold in 32 percent of FX transactions, a decline from its peak of 39 percent in 2010.8

Overall, U.S. dollar dominance has remained stable over the past 20 yearsA review of the use of the dollar globally over the last two decades suggests a dominant and relatively stable role. To illustrate this stability, we construct an aggregate index of international currency usage. This index is computed as the weighted average of five measures of currency usage for which time series data are available: Official currency reserves, FX transaction volume, foreign currency debt instruments outstanding, cross-border deposits, and cross-border loans. We display this index of international currency usage in Figure 10. The dollar index level has remained stable at a value of about 75 since the Global Financial Crisis in 2008, well ahead of all other currencies. The euro has the next-highest value at about 25, and its value has remained fairly stable as well. While international usage of the Chinese renminbi has increased over the past 20 years, it has only reached an index level of about 3, remaining even behind the Japanese yen and British pound, which are at about 8 and 7, respectively.

Diminution of the U.S. dollar's status seems unlikely in the near termNear-term challenges to the U.S. dollar's dominance appear limited. In modern history there has been only one instance of a predominant currency switching—the replacement of the British pound by the dollar. The dollar rose to prominence after the financial crisis associated with World War I, then solidified its international role after the Bretton Woods Agreement in 1944 (Tooze 2021, Eichengreen and Flandreau 2008, Carter 2020).9

However, over a longer horizon there is more risk of a challenge to the dollar's international status, and some recent developments have the potential to boost the international usage of other currencies.

Increased European integration is one possible source of challenge, as the European Union (EU) is a large economy with fairly deep financial markets, generally free trade, and robust and stable institions. During the COVID-19 crisis, the EU made plans to issue an unprecedented amount of jointly backed debt. If fiscal integration progresses and a large, liquid market for EU bonds develops, the euro could become more attractive as a reserve currency. This integration could potentially be accelerated by enhancements to the EU's sovereign debt market infrastructure and introducing a digital euro. Additionally, the euro's prominent role in corporate and sovereign green finance could bolster its international status if these continue to grow. However, even with more fiscal integration, remaining political separation will continue to cause policy uncertainty.

Another source of challenges to the U.S. dollar's dominance could be the continued rapid growth of China. Chinese GDP already exceeds U.S. GDP on a purchasing power parity basis (IMF World Economic Outlook, July 2021) and is projected to exceed U.S. GDP in nominal terms in the 2030s.10 It is also by far the world's largest exporter, though it lags the United States by value of imports (IMF Direction of Trade Statistics, 2021-Q2). There are significant roadblocks to more widespread use of the Chinese renminbi. Importantly, the renminbi is not freely exchangeable, the Chinese capital account is not open, and investor confidence in Chinese institutions, including the rule of law, is relatively low (Wincuinas 2019). These factors all make the Chinese renmimbi—in whatever form—relatively unattractive for international investors.

A shifting payments landscape could also pose a challenge to the U.S. dollar's dominance. For example, the rapid growth of digital currencies, both private sector and official, could reduce reliance on the U.S. dollar. Changing consumer and investor preferences, combined with the possibility of new products, could shift the balance of perceived costs and benefits enough at the margin to overcome some of the inertia that helps to maintain the dollar's leading role. That said, it is unlikely that technology alone could alter the landscape enough to completely offset the long-standing reasons the dollar has been dominant.

In sum, absent any large-scale political or economic changes which damage the value of the U.S. dollar as a store of value or medium of exchange and simultaneously bolster the attractiveness of dollar alternatives, the dollar will likely remain the world's dominant international currency for the foreseeable future.

ReferencesBank for International Settlements. BIS Data Bank.

Boz, E., C. Casas, G. Georgiadis, G. Gopinath, H. Le Mezo, A. Mehl, and T. Nguyen (2020). "Patterns in Invoicing Currency in Global Trade." IMF Working Paper No. 20-126.

Carter, Z. (2020). The Price of Peace: Money, Democracy, and the Life of John Maynard Keynes. Random House.

Committee on the Global Financial System (CGFS), (2020). "U.S. dollar funding: an international perspective." BIS CGFS Papers No 65.

Dealogic, DCM Manager, http://www.dealogic.com/en/fixedincome.htm.

The Economist (2020). "Dollar dominance is as secure as American leadership." https://www.economist.com/finance-and-economics/2020/08/06/dollar-domina.... Accessed August 18, 2021.

Eichengreen, B. and M. Flandreau (2008). "The Rise and Fall of the Dollar, or When Did the Dollar Replace Sterling as the Leading International Currency?" NBER Working Papers No. 14154.

Judson, R. (2017). "The Death of Cash? Not So Fast: Demand for U.S. Currency at Home and Abroad, 1990-2016." International Cash Conference 2017.

Refinitiv, Thomson ONE Investment Banking with Deals module and SDC Platinum, http://www.thomsonone.com/.

Tooze, A. (2021). "The Rise and Fall and Rise (and Fall) of the U.S. Financial Empire." Foreign Policy https://foreignpolicy.com/2021/01/15/rise-fall-united-states-financial-empire-dollar-global-currency Accessed August 13, 2021.

Wincuinas, J. (2019). "The China position: Gauging institutional investor confidence." Economist Intelligence Unit. https://eiuperspectives.economist.com/financial-services/china-position-gauging-institutional-investor-confidence Accessed August 18, 2021.

READ MORE:

https://www.federalreserve.gov/econres/notes/feds-notes/the-international-role-of-the-u-s-dollar-20211006.htm

READ FROM TOP.

FREE JULIAN ASSANGE NOW..............