Search

Recent comments

- religious war....

9 hours 36 min ago - underdogs....

9 hours 47 min ago - decentralised....

10 hours 10 min ago - economy 101....

20 hours 7 min ago - peace....

20 hours 55 min ago - making sense....

23 hours 33 min ago - balls....

23 hours 37 min ago - university semites....

1 day 25 min ago - by the balls....

1 day 39 min ago - furphy....

1 day 5 hours ago

Democracy Links

Member's Off-site Blogs

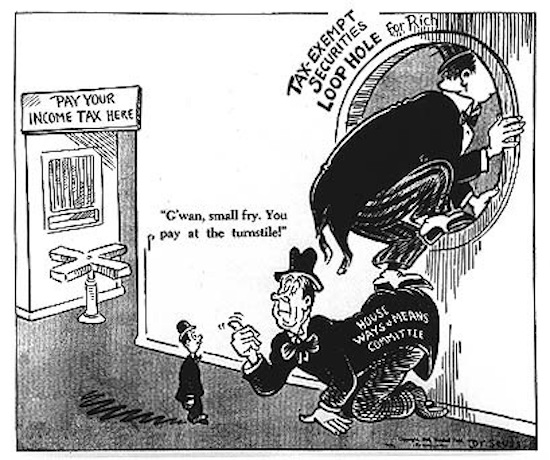

saving the rich from poverty…...

Since the creation of the US Federal Reserve over a century ago, every major financial market collapse has been deliberately triggered for political motives by the central bank. The situation is no different today, as clearly the US Fed is acting with its interest rate weapon to crash what is the greatest speculative financial bubble in human history, a bubble it created.

Global crash events always begin on the periphery, such as with the 1931 Austrian Creditanstalt or the Lehman Bros. failure in September 2008. The June 15 decision by the Fed to impose the largest single rate hike in almost 30 years as financial markets are already in a meltdown, now guarantees a global depression and worse.

BY F. William Engdahl

The extent of the “cheap credit” bubble that the Fed, the ECB and Bank of Japan have engineered with buying up of bonds and maintaining unprecedented near-zero or even negative interest rates for now 14 years, is beyond imagination. Financial media cover it over with daily nonsense reporting , while the world economy is being readied, not for so-called “stagflation” or recession. What is coming now in the coming months, barring a dramatic policy reversal, is the worst economic depression in history to date. Thank you, globalization and Davos.

Globalization

The political pressures behind globalization and the creation of the World Trade Organization out of the Bretton Woods GATT trade rules with the 1994 Marrakesh Agreement, ensured that the advanced industrial manufacturing of the West, most especially the USA, could flee offshore, “outsource” to create production in extreme low wage countries. No country offered more benefit in the late 1990s than China. China joined WHO in 2001 and from then on the capital flows into China manufacture from the West have been staggering. So too has been the buildup of China dollar debt. Now that global world financial structure based on record debt is all beginning to come apart.

When Washington deliberately allowed the September 2008 Lehman Bros financial collapse, the Chinese leadership responded with panic and commissioned unprecedented credit to local governments to build infrastructure. Some of it was partly useful, such as a network of high-speed railways. Some of it was plainly wasteful, such as construction of empty “ghost cities.” For the rest of the world, the unprecedented China demand for construction steel, coal, oil, copper and such was welcome, as fears of a global depression receded. But the actions by the US Fed and ECB after 2008, and of their respective governments, did nothing to address the systemic financial abuse of the world’s major private banks on Wall Street and Europe , as well as Hong Kong.

The August 1971 Nixon decision to decouple the US dollar, the world reserve currency, from gold, opened the floodgates to global money flows. Ever more permissive laws favoring uncontrolled financial speculation in the US and abroad were imposed at every turn, from Clinton’s repeal of Glass-Steagall at the behest of Wall Street in November 1999. That allowed creation of mega-banks so large that the government declared them “too big to fail.” That was a hoax, but the population believed it and bailed them out with hundreds of billions in taxpayer money.

Since the crisis of 2008 the Fed and other major global central banks have created unprecedented credit, so-called “helicopter money,” to bailout the major financial institutions. The health of the real economy was not a goal. In the case of the Fed, Bank of Japan, ECB and Bank of England, a combined $25 trillion was injected into the banking system via “quantitative easing” purchase of bonds, as well as dodgy assets like mortgage-backed securities over the past 14 years.

Quantitative madness

Here is where it began to go really bad. The largest Wall Street banks such as JP MorganChase, Wells Fargo, Citigroup or in London HSBC or Barclays, lent billions to their major corporate clients. The borrowers in turn used the liquidity, not to invest in new manufacturing or mining technology, but rather to inflate the value of their company stocks, so-called stock buy-backs, termed “maximizing shareholder value.”

BlackRock, Fidelity, banks and other investors loved the free ride. From the onset of Fed easing in 2008 to July 2020, some $5 trillions had been invested in such stock buybacks, creating the greatest stock market rally in history. Everything became financialized in the process. Corporations paid out $3.8 trillion in dividends in the period from 2010 to 2019. Companies like Tesla which had never earned a profit, became more valuable than Ford and GM combined. Cryptocurrencies such as Bitcoin reached market cap valuation over $1 trillion by late 2021. With Fed money flowing freely, banks and investment funds invested in high-risk, high profit areas like junk bonds or emerging market debt in places like Turkey, Indonesia or, yes, China.

The post-2008 era of Quantitative Easing and zero Fed interest rates led to absurd US Government debt expansion. Since January 2020 the Fed, Bank of England, European Central Bank and Bank of Japan have injected a combined $9 trillion in near zero rate credit into the world banking system. Since a Fed policy change in September 2019, it enabled Washington to increase public debt by a staggering $10 trillion in less than 3 years. Then the Fed again covertly bailed out Wall Street by buying $120 billion per month of US Treasury bonds and Mortgage-Backed Securities creating a huge bond bubble.

A reckless Biden Administration began doling out trillions in so-called stimulus money to combat needless lockdowns of the economy. US Federal debt went from a manageable 35% of GDP in 1980 to more than 129% of GDP today. Only the Fed Quantitative Easing, buying of trillions of US government and mortgage debt and the near zero rates made that possible. Now the Fed has begun to unwind that and withdraw liquidity from the economy with QT or tightening, plus rate hikes. This is deliberate. It is not about a stumbling Fed mis-judging inflation.

Energy drives the collapse

Sadly, the Fed and other central bankers lie. Raising interest rates is not to cure inflation. It is to force a global reset in control over the world’s assets, it’s wealth, whether real estate, farmland, commodity production, industry, even water. The Fed knows very well that Inflation is only beginning to rip across the global economy. What is unique is that now Green Energy mandates across the industrial world are driving this inflation crisis for the first time, something deliberately ignored by Washington or Brussels or Berlin.

The global shortages of fertilizers, soaring prices of natural gas, and grain supply losses from global draught or exploding costs of fertilizers and fuel or the war in Ukraine, guarantee that, at latest this September-October harvest time, we will undergo a global additional food and energy price explosion. Those shortages all are a result of deliberate policies.

Moreover, far worse inflation is certain, due to the pathological insistence of the world’s leading industrial economies led by the Biden Administration’s anti-hydrocarbon agenda. That agenda is typified by the astonishing nonsense of the US Energy Secretary stating, “buy E-autos instead” as the answer to exploding gasoline prices.

Similarly, the European Union has decided to phase out Russian oil and gas with no viable substitute as its leading economy, Germany, moves to shut its last nuclear reactor and close more coal plants. Germany and other EU economies as a result will see power blackouts this winter and natural gas prices will continue to soar. In the second week of June in Germany gas prices rose another 60% alone. Both the Green-controlled German government and the Green Agenda “Fit for 55” by the EU Commission continue to push unreliable and costly wind and solar at the expense of far cheaper and reliable hydrocarbons, insuring an unprecedented energy-led inflation.

Fed has pulled the plug

With the 0.75% Fed rate hike, largest in almost 30 years, and promise of more to come, the US central bank has now guaranteed a collapse of not merely the US debt bubble, but also much of the post-2008 global debt of $303 trillion. Rising interest rates after almost 15 years mean collapsing bond values. Bonds, not stocks, are the heart of the global financial system.

US mortgage rates have now doubled in just 5 months to above 6%, and home sales were already plunging before the latest rate hike. US corporations took on record debt owing to the years of ultra-low rates. Some 70% of that debt is rated just above “junk” status. That corporate non-financial debt totaled $9 trillion in 2006. Today it exceeds $18 trillion. Now a large number of those marginal companies will not be able to rollover the old debt with new, and bankruptcies will follow in coming months. The cosmetics giant Revlon just declared bankruptcy.

The highly-speculative, unregulated Crypto market, led by Bitcoin, is collapsing as investors realize there is no bailout there. Last November the Crypto world had a $3 trillion valuation. Today it is less than half, and with more collapse underway. Even before the latest Fed rate hike the stock value of the US megabanks had lost some $300 billion. Now with stock market further panic selling guaranteed as a global economic collapse grows, those banks are pre-programmed for a new severe bank crisis over the coming months.

As US economist Doug Noland recently noted, “Today, there’s a massive “periphery” loaded with “subprime” junk bonds, leveraged loans, buy-now-pay-later, auto, credit card, housing, and solar securitizations, franchise loans, private Credit, crypto Credit, DeFi, and on and on. A massive infrastructure has evolved over this long cycle to spur consumption for tens of millions, while financing thousands of uneconomic enterprises. The “periphery” has become systemic like never before. And things have started to Break.”

The Federal Government will now find its interest cost of carrying a record $30 trillion in Federal debt far more costly. Unlike the 1930s Great Depression when Federal debt was near nothing, today the Government, especially since the Biden budget measures, is at the limits. The US is becoming a Third World economy. If the Fed no longer buys trillions of US debt, who will? China? Japan? Not likely.

Deleveraging the bubble

With the Fed now imposing a Quantitative Tightening, withdrawing tens of billions in bonds and other assets monthly, as well as raising key interest rates, financial markets have begun a deleveraging. It will likely be jerky, as key players like BlackRock and Fidelity seek to control the meltdown for their purposes. But the direction is clear.

By late last year investors had borrowed almost $1 trillion in margin debt to buy stocks. That was in a rising market. Now the opposite holds, and margin borrowers are forced to give more collateral or sell their stocks to avoid default. That feeds the coming meltdown. With collapse of both stocks and bonds in coming months, go the private retirement savings of tens of millions of Americans in programs like 401-k. Credit card auto loans and other consumer debt in the USA has ballooned in the past decade to a record $4.3 trillion at end of 2021. Now interest rates on that debt, especially credit card, will jump from an already high 16%. Defaults on those credit loans will skyrocket.

Outside the US what we will see now, as the Swiss National Bank, Bank of England and even ECB are forced to follow the Fed raising rates, is the global snowballing of defaults, bankruptcies, amid a soaring inflation which the central bank interest rates have no power to control. About 27% of global nonfinancial corporate debt is held by Chinese companies, estimated at $23 trillion. Another $32 trillion corporate debt is held by US and EU companies. Now China is in the midst of its worst economic crisis since 30 years and little sign of recovery. With the USA, China’s largest customer, going into an economic depression, China’s crisis can only worsen. That will not be good for the world economy.

Italy, with a national debt of $3.2 trillion, has a debt-to-GDP of 150%. Only ECB negative interest rates have kept that from exploding in a new banking crisis. Now that explosion is pre-programmed despite soothing words from Lagarde of the ECB. Japan, with a 260% debt level is the worst of all industrial nations, and is in a trap of zero rates with more than $7.5 trillion public debt. The yen is now falling seriously, and destabilizing all of Asia.

The heart of the world financial system, contrary to popular belief, is not stock markets. It is bond markets—government, corporate and agency bonds. This bond market has been losing value as inflation has soared and interest rates have risen since 2021 in the USA and EU. Globally this comprises some $250 trillion in asset value a sum that, with every fed interest rise , loses more value. The last time we had such a major reverse in bond values was forty years ago in the Paul Volcker era with 20% interest rates to “squeeze out inflation.”

As bond prices fall, the value of bank capital falls. The most exposed to such a loss of value are major French banks along with Deutsche Bank in the EU, along with the largest Japanese banks. US banks like JP MorganChase are believed to be only slightly less exposed to a major bond crash. Much of their risk is hidden in off-balance sheet derivatives and such. However, unlike in 2008, today central banks can’t rerun another decade of zero interest rates and QE. This time, as insiders like ex-Bank of England head Mark Carney noted three years ago, the crisis will be used to force the world to accept a new Central Bank Digital Currency, a world where all money will be centrally issued and controlled. This is also what Davos WEF people mean by their Great Reset. It will not be good. A Global Planned Financial Tsunami Has Just Begun.

F. William Engdahl is strategic risk consultant and lecturer, he holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics, exclusively for the online magazine “New Eastern Outlook”.

READ MORE:

https://journal-neo.org/2022/06/21/global-planned-financial-tsunami-has-just-begun/

REE JULIAN ASSANGE NOW fiflflflflflfl‡‡‡‡‡‡‡‡›

- By Gus Leonisky at 22 Jun 2022 - 2:52pm

- Gus Leonisky's blog

- Login or register to post comments

when the state robs you….

People who have never even been charged with a crime can have their life savings taken away. That’s civil asset forfeiture.

BY JOHN KIRIAKOU

I am a fan of bad television. I admit it. I even DVR it. I watch an awful show on the National Geographic Channel every week about Customs and Border Protection (CBP) and how they intercept drugs and birds and food and other contraband from people arriving from abroad into the airports of New York, Atlanta and Miami.

I was watching an episode this week where an elderly Korean man arrived at JFK airport in New York with a few hundred dollars in his pocket.

For no apparent reason, he was pulled into secondary for a more comprehensive search. When the CBP officer went through the man’s wallet, he found four cashier’s checks, dated years earlier, that totaled $136,000. The man said that it was his life savings, he had been carrying it around for years, and that he had forgotten that the checks were on him.

Tough luck, CBP said. The money belongs to the government now. That’s civil asset forfeiture.

The man was never charged with a crime. But he still loses his life savings. That’s the way we do things in the United States.

Harvey Miller

Harvey Miller is known in the music industry as “DJ Speedy.” He’s a serious player in the music world, having worked with Beyonce, Jay-Z and other top pop stars. He is a wealthy and successful entrepreneur and entertainer. He also happens to be African-American.

Miller was driving recently from his home in Atlanta to his second home in Los Angeles. A sheriff’s deputy pulled him over in Oklahoma County, Oklahoma, for “not using his turn signal a full 100 feet before changing lanes.”

The deputy asked Miller what he was doing in Oklahoma. Miller said that he was a professional musician and he was on his way to his home in California. The deputy said that the story sounded “suspicious” and he asked if he could search the car.

Miller, who had no criminal record, refused. “No, you can’t search my vehicle,” he said. “What warrants you to search my vehicle?”

The cop wasn’t finished with Miller, however. He called in a K-9 unit; a K-9 “sniff” isn’t the same as a “search,” according to the Supreme Court. No permission — or warrant — is needed.

The cops claim that the dog “alerted” for possible drugs and they searched the car. Miller protested that he has never used drugs, he hadn’t been drinking and he had never been arrested. He had never broken the law.

The cops found no drugs. They did, though, find $150,000 in cash, which they seized, claiming that the money “smelled like marijuana.” They also claimed that of the $150,000, one $20 bill was fake and they arrested Miller.

He spent 12 hours in the county jail and was released without charge in the morning. But the cops kept the money, and they’re not giving it back.

Keeping the Money

This is not an unusual occurrence.

The Supreme Court, unfortunately, has ruled that civil asset forfeiture is perfectly legal. But there have been some lower court decisions and executive branch actions that could force Congress to address the issue, which is wildly unpopular among voters and rife with police abuse.

In August 2021, the Justice Department agreed to pay Keddins Etiennes, an independent filmmaker, a $15,000 settlement and to return to him $69,000 that the Drug Enforcement Administration (DEA) had seized from him.

Etiennes was passing through JFK with $69,000 tucked into a broken Xbox. He declared the money to DEA and CBP and said that he put it in the Xbox because he was shooting a documentary “in some shady neighborhoods” and he wanted to hide it from potential thieves. He didn’t think it would be DEA thieving from him.

After hiring an A-list Los Angeles attorney, DEA offered him 90 percent of the money back. Etiennes refused. In response, the Justice Department began investigating his finances, and it finally accused him of “structuring,” a crime whereby a person deliberately evades bank reporting regulations by making cash deposits or withdrawals of less than $10,000.

Etiennes wasn’t intimidated, and he told the Justice Department that he would fight them. Just before the deadline for filing a case against Etiennes, the Justice Department dropped the investigation and returned his money. The process took eight months.

On the heels of the Justice Department’s decision on Etiennes, the state of Maine became the fourth state in the country — along with New Mexico, Nebraska and North Carolina — to require criminal conviction before any property may be seized.

The bill’s sponsor, state Rep. Billy Bob Faulkingham, said, “It’s a very simple concept; you don’t lose your property unless you used it in the commission of a crime.”

Lee McGrath, senior counsel for Maine’s Institute for Justice, said the new law “ends an immense injustice and will ensure that only convicted criminals — not innocent Mainers — lose their property to forfeiture.”

I frankly don’t care what the Supreme Court says about civil asset forfeiture. It’s morally and ethically wrong. It’s stealing. It’s abusive. The law has to be changed.

I’m glad that four states have done the right thing. But that’s not good enough. Congress must take action immediately to end this injustice.

John Kiriakou is a former CIA counterterrorism officer and a former senior investigator with the Senate Foreign Relations Committee. John became the sixth whistleblower indicted by the Obama administration under the Espionage Act—a law designed to punish spies. He served 23 months in prison as a result of his attempts to oppose the Bush administration’s torture program.

The views expressed are solely those of the author and may or may not reflect those of Consortium News.

READ MORE:

https://consortiumnews.com/2022/06/22/john-kiriakou-robbed-by-law-enforcement/

READ FROM TOP.

THE RICH TRANSACT THEIR CASH VIA HIDDEN CHANNELS, APPROVED BY THE BAHAMAS AND OTHER HAVENS....

REE JULIAN ASSANGE NOW≈≈≈≈≈≈≈≈≈≈™!!!

the pigs' balls market bubble…..

By Alan Kohler

Bitcoin may be many bad things – speculative bubble, consumer of energy, vehicle for scams – but it is not a Ponzi scheme.

Charles Ponzi’s particular scam involved financing the returns for his investment fund with new money rather than actual investments; all Ponzi schemes come unstuck when asset values fall and new money dries up.

Bitcoin offers no returns, so it’s not a Ponzi scheme. But what it is, exactly, is more difficult to name. It’s both nothing and everything.

What I mean is that Bitcoin has no substance and is not inherently useful, unlike the objects of previous bubbles, such as Dutch tulips in 1636, the South Sea Company in 1711, Japanese real estate in 1989, or internet stocks in 2000.

Those other bubbles involved the frenzied over-pricing of an existing item that had some inherent utility, and continued to exist after the price crashed and the late speculators went bust.

The Bitcoin bubble

Bitcoin was created from thin air in 2008 and although it was supposed to be a new form of money, it’s clear that will never happen. It won’t be allowed to.

https://thenewdaily.com.au/opinion/2022/06/27/bitcoin-capitalisms-failure-kohler/

EXACTLY.

Like most countries that have tried to use other exchange currencies than the dollar, the Bitcoin though not a country, will be bombed and destroyed by the US government, by various means, including “bad press” and the US government “playing with” some Bitcoins in order to lower its value and attractiveness. Gold is still at the centre of trading and the West has used its leaky sieve to prevent Russian making a buck on its gold. All this does is lift the price of gold, which has to be held back by the IMF to make sure the US dollar does not sink below some turdy levels.

Presently, Putin is winning on the Ruble because the US sanctions have deprived him of Russia’s large American dollars reserves. But the West NEEDS raw materials from Russia. Thus the trade has to be made in Rubles, weakening the value of the dollar. Putin could have asked for duck poo, pigs’ balls or Bitcoins in exchange of the goods and he would have been winning as well. Asking to be paid in Rubles helps ordinary Russians weather the cost of the STUPID US/EU/UK sanctions.

The US dollar value is only sustained by THE US MILITARY MACHINE. Overall, the USA are in debt to the tune of more than $30 trillion. The value of the US MILITARY MACHINE COULD BE ESTIMATED AT $60 TRILLION, not so much in assets, but in THREATS to other nations.

Only nations like Russia can win the Russian roulette game with the USA. Unable to match the massive yearly US investment in weaponry amounts, Russia has invested wisely in smart “non-symmetrical” weapon systems that keep the Pentagon boffins awake at night.

Will bitcoins vanish? I guess not…. People will use them to bypass government toll-gates and taxes…. Not only crooks will use Bitcoins, but many banks are in deep with the new system that bypasses the US dollar.

READ FROM TOP......

FREE JULIAN ASSANGE NOW………..