Search

Recent comments

- war criminals.....

41 min 24 sec ago - aussieoil.....

1 hour 30 min ago - sobering....

2 hours 13 min ago - iran's....

3 hours 44 min ago - blind interceptors....

4 hours 3 min ago - ARTIFINTEL....

5 hours 43 min ago - don't mention it....

6 hours 42 min ago - fear godot....

6 hours 46 min ago - no regeem change....

7 hours 32 min ago - blind maddow....

7 hours 42 min ago

Democracy Links

Member's Off-site Blogs

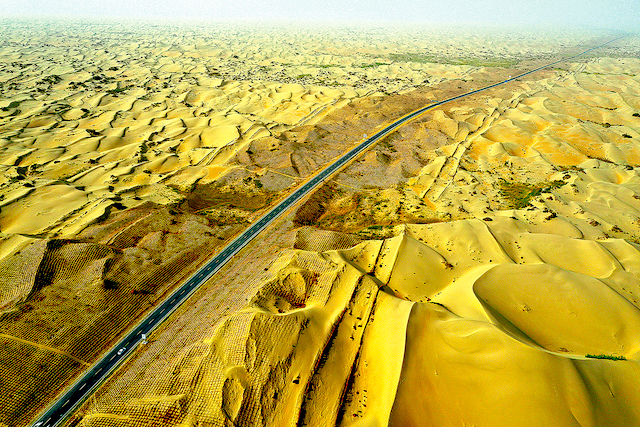

a road through….

At the G7 Summit in Germany, on June 26, 2022, U.S. President Joe Biden made a pledge to raise $200 billion within the United States for global infrastructure spending.

It was made clear that this new G7 project—the Partnership for Global Infrastructure and Investment (PGII)—was intended to counter the Chinese Belt and Road Initiative (BRI). Given Biden’s failure to pass the Build Back Better bill (with its scope being almost halved from $3.5 trillion to $2.2 trillion), it is unlikely that he will get the U.S. Congress to go along with this new endeavor.

The PGII is not the first attempt by the U.S. to match the Chinese infrastructure investment globally, which initially took place bilaterally, and then after 2013 happened through the Belt and Road Initiative (BRI). In 2004, as the U.S. war on Iraq unfolded, the United States government set up a body called the Millennium Challenge Corporation (MCC), which it called an “independent U.S. foreign assistance agency.” Before that, most U.S. government development lending was done through the United States Agency for International Development (USAID), which was set up in 1961 as part of then-President John F. Kennedy administration’s charm campaign against the Soviet Union and against the Bandung spirit of non-alignment in the newly assertive Third World.

Former U.S. President George W. Bush said that USAID was too bureaucratic, and so the MCC would be a project that would include both the U.S. government and the private sector. The word “corporation” in the title is deliberate. Each of the heads of the MCC, from Paul Applegarth to Alice P. Albright, has belonged to the private sector (the current head, Albright is the daughter of former U.S. Secretary of State Madeleine Albright).

The word “challenge” in MCC refers to the fact that the grants are only approved if the countries can show that they meet 20 “policy performance indicators,” ranging from civil liberties to inflation rates. These indicators ensure that the countries seeking the grants adhere to the conventional neoliberal framework. There are also great inconsistencies among these indicators: for instance, the countries must have a high immunization rate(monitored by the World Health Organization), but at the same time they must follow the International Monetary Fund’s requirements for a tight fiscal policy. This essentially means that the public health spending of a candidate country should be kept low, resulting in the required number of public health workers not being available for the immunization programs.

The U.S. Congress provided $650 million to the MCC for its first year in 2004, as a U.S. government official told me; in 2022, the amount sought was more than $900 million. In 2007, when Bush met with Nambaryn Enkhbayar, the former president of Mongolia, to sign an MCC grant, he said that the Millennium Challenge Account—which is administered by MCC—“is an important part of our foreign policy. It’s an opportunity for the United States and our taxpayers to help countries that fight corruption, that support market-based economies, and that invest in the health and education of their people.” Clearly, the MCC is an instrument of U.S. foreign policy, but its aim seems to be not so much to tackle the Sustainable Development Goals of the United Nations (on hunger, health and education), as Bush said, but to ensure extension of the reach of U.S. influence and to inculcate the habits and structures of U.S.-led globalization (“market-based economies”).

In 2009, then-U.S. President Barack Obama developed a “pivot to Asia,” a new foreign policy orientation that had the U.S. establishment focus more attention on East and South Asia. As part of this pivot, in 2011, former U.S. Secretary of State Hillary Clinton gave an important speechin Chennai, India, where she spoke about the creation of a New Silk Road Initiative. Clinton argued that the United States government, under Obama’s “pivot to Asia,” policy was going to develop an economic agenda that ran from the Central Asian countries to the south of India, and would thereby help integrate the Central Asian republics into a U.S. project and break the ties the region had formed with Russia and China. The impetus for the New Silk Road was to find a way to use this development as an instrument to undermine the Taliban insurgency in Afghanistan. This U.S. project floundered due to lack of congressional funding and due to its sheer impossibility, since Afghanistan—which was the heart of this road project—could not be persuaded to submit to U.S. interests.

Two years later, in 2013, the Chinese government inaugurated the Silk Road Economic Belt project, which is now known as the Belt and Road Initiative (BRI). Rather than go from North to South, the BRI went from East to West, linking China to Central Asia and then outward to South Asia, West Asia, Europe and Africa. The aim of this project was to bring together the Eurasian Economic Community (established in 2000) and the Shanghai Cooperation Organization (set up in 2001) to work on this new, and bigger project. Roughly $4 trillion has been invested since 2013 in a range of projects by the BRI and its associated funding mechanisms (including the Asian Infrastructure Investment Bank and the Silk Road Fund). The investments were paid for by grants from Chinese institutions and through debt incurred by the projects at rates that are competitive with those of Western infrastructure lending programs.

The U.S. government’s “Indo-Pacific Strategy Report” (2019) notes that China uses “economic inducements and penalties” to “persuade other states to comply with its agenda.” The report provides no evidence, and indeed, scholars who have looked into these matters do not see any such evidence. U.S. Admiral Philip S. Davidson, who previously commanded the U.S. Indo-Pacific Command, told the U.S. Congress that China is “leveraging its economic instrument of power” in Asia. The MCC, and other instruments, including a new International Development Finance Corporation, were hastily set up to give America an edge over China in a U.S.-driven contest over the creation of infrastructure investment globally. There is no doubt that the MCC is part of the broad Indo-Pacific strategy of the United States to undermine Chinese influence in Asia.

Only a handful of countries have thus far received MCC grants— starting with Honduras and Madagascar. These are often not very large grants, although for a country the size of Malawi or Jordan, these can have a considerable impact. No large countries have been drawn into the MCC compact, which suggests that the United States wants to give these grants to mainly smaller countries, to strengthen their ties with the United States. Nepal’s accession to the MCC must be seen in this broader context. Although the discovery of uranium in Nepal’s Upper Mustang region in 2014 seems to play an important role in the pressure campaign on that country.

In May 2017, Nepal’s government signed a BRI framework agreement, which included an ambitious plan to build a railway link between China and Nepal through the Himalayas; this rail link would allow Nepal to lessen its reliance on Indian land routes for trade purposes. Various projects began to be discussed and feasibility studies were commissioned under the BRI plan. These projects, more details for which emerged in 2019, were the extension of an electricity transmission line and the creation of a technical university in Nepal, and of course, construction of a vast network of roads and rail, which included the trans-Himalayan railway from Keyrung to Kathmandu.

During this time, the United States entered the picture with a full-scale effort to disparage the BRI funding in Nepal and to promote the use of MCC money there instead. In September 2017, the government of Nepal signed an agreement with the United States called the Nepal Compact. This agreement—worth $500 million—is for an electricity transmission project and for a road maintenance project. At this point, Nepal had access to both BRI and MCC funds and neither of the parties seemed to mind that fact. This provided an opportunity for Nepal to use both these resources to develop much-needed infrastructure, or as former Prime Minister Madhav Kumar Nepal told me in 2020, his country could get new loans from the Asian Development Bank.

After both deals had been signed, a political dispute broke out within Nepal, which resulted in the split of the Communist Party of Nepal and the fall of the left government. One major issue on the table was the MCC and its role in the overall Indo-Pacific strategy of the United States, which seems to be targeted against China.

This article was produced by Globetrotter.

- By Gus Leonisky at 6 Jul 2022 - 12:35pm

- Gus Leonisky's blog

- Login or register to post comments

australia china friendship society…...

The Belt and Road Initiative (BRI) is a major contributor to economic growth in areas that have been ignored by other development programs, said Daryl Guppy, president of the Australia China Business Council's Northern Territory sub-council.

Guppy said he believes the BRI has four dimensions of benefit to boost growth in the post-pandemic era: hard, trade, soft and capital infrastructure.

BRI's hard infrastructure includes long-term investments in high-speed rails, roads and bridges that have accelerated the development of Central Asia as an economic force and changed the way underdeveloped geographic areas are able to access global markets.

The BRI also impacts the mechanisms of cross-border trade and trade settlement by removing friction points. This enables greater participation in economic activity and reduces corruption, Guppy said.

Low-cost and efficient, trade settlement is the essential foundation of economic growth that enables small businesses to grow and drives an increase in prosperity, he added.

The soft infrastructure of the BRI sets the foundation for the digital economy, which is where real economic growth will come from in the post-pandemic era, Guppy said, because it removes the drag of intermediaries in the trade transaction process.

Also, because it breaks down the barriers that inhibit economic growth, Guppy added, the BRI boosts shared prosperity. Further opening of the capital account, debt markets and the liberalization of investment conditions are part of currency integration, a precursor to the growth of China's capital markets.

A guideline for green development of the Belt and Road Initiative was released by China's National Development and Reform Commission on March 28. The green development pattern of jointly building the Belt and Road will be formed by 2030, according to the commission's announcement.

The Australia China Business Council welcomed in March 2022 the publication of a key policy document that sets out comprehensive guidance to governments, project companies and financial institutions involved in the BRI and emphasizes cooperation on green finance, technology and standards, said David Olsson, national president of the council.

Olsson said he expects Australian companies with expertise in energy transition technologies, environmental services, smart grid management, project design, project management and green finance will continue to be active and engaged.

There is no credible emissions pathway towards limiting global warming to 1.5°C without significant movements from China over the next decade to accelerate its energy transition and decarbonisation. China, as the main finance and trade partner of many of the BRI countries, can play a key role in the green and low-carbon transition of their economies, Olsson said.

He said the ASEAN region is one region where China and Australia both have strong business engagements and it has the most potential for BRI collaboration. Australian companies have long-established presences in Hong Kong. They see potential to leverage Hong Kong's role as a major financial center and business hub to participate in BRI projects, particularly to support green economic development, in the Greater Bay Area.

Adam Handley, a partner and China Markets Leader at MinterEllison, noted that China's BRI can bring a range of opportunities for Australian enterprises across a broad range of sectors, industries and Australian enterprises of all sizes.

The areas where Australian enterprises can get involved in the BRI include project financing, design, procurement, construction, sales and application of Australian know-how, according to Handley.

The BRI presents an opportunity for Australian enterprises in the agribusiness, infrastructure and energy sectors to expand export markets but also attract domestic investment capital, Handley said.

"Chinese investment has played a major role in supporting economic growth within my own home State in Western Australia. Since the significant increase in interest in investing in Australia from 2007, Western Australia has benefited from a significant number of Chinese investments in energy and other sectors," Handley said.

Those investments have created thousands of local jobs and generated hundreds of millions of dollars in taxation and royalty revenues for the people of Western Australia as well as bringing about know-how, he added. In some sectors, like in the processing of Western Australia's magnetite iron ore, this has helped open new export markets for the region.

"I would like to think that Australia can take a fresh look at what the modern BRI framework offers for Australian businesses, particularly in our geographic region. I don't think it is a question whether current agreements remain or don't, but how our governments can reengage to work out what opportunities in BRI are beneficial for Australia to be involved in," Handley said.

Duncan Calder, past National and West Australia president of the Australia China Business Council and ambassador for Australia China Friendship Society West Australia, emphasized the importance of people-to-people relationships in promoting the bilateral ties of China and Australia.

Calder believes that people-to-people and organization-to-organization relationships can help to enhance government to government relationships. He said he has many close and loyal Chinese friends supporting each other during difficult times in their lives. He is just one example of hundreds of thousands of Australian people who have close Chinese friends.

Close relationships between Chinese and Australian people have driven trade, investment, artistic, cultural and sporting interactions, which is very critical to strengthen the Australia-China relationships, Calder said.

READ MORE:

https://www.chinadaily.com.cn/a/202207/07/WS62c60f4ca310fd2b29e6acf1_4.html

READ FROM TOP.

FREE JULIAN ASSANGE NOW......

the sand trap…..

FROM LE MONDE

Construction, cosmetics, industry, electronics…

Unavoidable, the sand is everywhere.

It takes 200 tons of aggregate to build a house,

3,000 tons for a hospital,

30,000 tons for every kilometre of asphalt.

Sand is today the most consumed natural resource after water.

And global demand, at 3.2 billion tonnes per year in 2020, is soaring.

However, most grains of deserts are not exploitable, too round and too fine to enter into the composition of concrete.

To meet the needs, marine sediments are sucked up, rivers are dredged, beaches are emptied and quarries are dug to the detriment of the environment and the people who live there.

From the fjords of Greenland to the construction sites of Ile-de-France, via the banks of the Ganges, Le Monde explores, over six consecutive days, the ecological, economic and social issues of this material that has become essential.

SAND DEALERS

A six-part investigation into the rampant exploitation of a strategic resource

EPISODE 1

In India, "the sand mafias have the power, the money, the weapons"

Entrepreneurs, local notables and corrupt police take advantage of the boom in construction to exploit resources outside of any legal framework.

EPISODE 2

The sand, wealth and curse of the Maldives

TO BE RELEASED SEPTEMBER 5

EPISODE 3

In Greenland, sand as a new horizon

TO BE RELEASED SEPTEMBER 6

EPISODE 4

In Florida, an endless fight for the survival of the beaches

TO BE RELEASED SEPTEMBER 7

EPISODE 5

Cape Verde's sand 'looters'

TO BE RELEASED SEPTEMBER 8

EPISODE 6

The insatiable appetite for sand in Greater Paris

TO BE RELEASED SEPTEMBER 9

READ MORE:

https://www.lemonde.fr/planete/visuel/2022/09/04/marchands-de-sable-enquete-sur-l-exploitation-effrenee-d-une-ressource-strategique_6140159_3244.html

TRANSLATION BY JULES LETAMBOUR.

READ FROM TOP.

FREE JULIAN ASSANGE NOW........................