Search

Recent comments

- stenography.....

13 hours 4 min ago - black....

13 hours 2 min ago - concessions.....

14 hours 3 min ago - starmerring....

18 hours 8 min ago - unreal estates....

21 hours 55 min ago - nuke tests....

21 hours 58 min ago - negotiations....

22 hours 1 min ago - struth....

1 day 11 hours ago - earth....

1 day 12 hours ago - sordid....

1 day 12 hours ago

Democracy Links

Member's Off-site Blogs

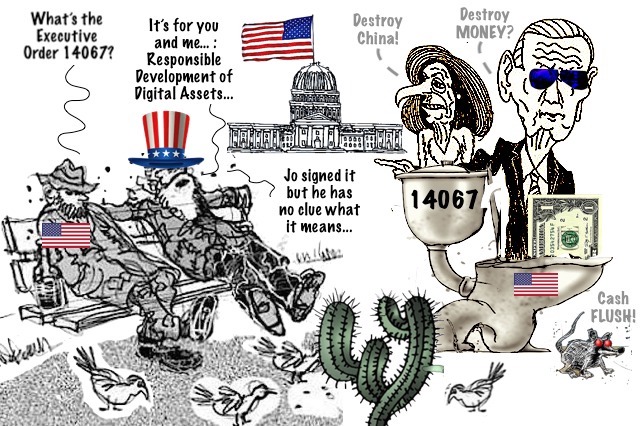

the teleprompting lawyers wrote the damn thing and jo had no clue about what he had signed……...

By the authority vested in me as President by the Constitution and the laws of the United States of America, it is hereby ordered as follows:

Section 1. Policy. Advances in digital and distributed ledger technology for financial services have led to dramatic growth in markets for digital assets, with profound implications for the protection of consumers, investors, and businesses, including data privacy and security; financial stability and systemic risk; crime; national security; the ability to exercise human rights; financial inclusion and equity; and energy demand and climate change. In November 2021, non-state issued digital assets reached a combined market capitalization of $3 trillion, up from approximately $14 billion in early November 2016. Monetary authorities globally are also exploring, and in some cases introducing, central bank digital currencies (CBDCs).

While many activities involving digital assets are within the scope of existing domestic laws and regulations, an area where the United States has been a global leader, growing development and adoption of digital assets and related innovations, as well as inconsistent controls to defend against certain key risks, necessitate an evolution and alignment of the United States Government approach to digital assets. The United States has an interest in responsible financial innovation, expanding access to safe and affordable financial services, and reducing the cost of domestic and cross-border funds transfers and payments, including through the continued modernization of public payment systems. We must take strong steps to reduce the risks that digital assets could pose to consumers, investors, and business protections; financial stability and financial system integrity; combating and preventing crime and illicit finance; national security; the ability to exercise human rights; financial inclusion and equity; and climate change and pollution.

Sec. 2. Objectives. The principal policy objectives of the United States with respect to digital assets are as follows:

(a) We must protect consumers, investors, and businesses in the United States. The unique and varied features of digital assets can pose significant financial risks to consumers, investors, and businesses if appropriate protections are not in place. In the absence of sufficient oversight and standards, firms providing digital asset services may provide inadequate protections for sensitive financial data, custodial and other arrangements relating to customer assets and funds, or disclosures of risks associated with investment. Cybersecurity and market failures at major digital asset exchanges and trading platforms have resulted in billions of dollars in losses. The United States should ensure that safeguards are in place and promote the responsible development of digital assets to protect consumers, investors, and businesses; maintain privacy; and shield against arbitrary or unlawful surveillance, which can contribute to human rights abuses.

(b) We must protect United States and global financial stability and mitigate systemic risk. Some digital asset trading platforms and service providers have grown rapidly in size and complexity and may not be subject to or in compliance with appropriate regulations or supervision. Digital asset issuers, exchanges and trading platforms, and intermediaries whose activities may increase risks to financial stability, should, as appropriate, be subject to and in compliance with regulatory and supervisory standards that govern traditional market infrastructures and financial firms, in line with the general principle of "same business, same risks, same rules." The new and unique uses and functions that digital assets can facilitate may create additional economic and financial risks requiring an evolution to a regulatory approach that adequately addresses those risks.

(c) We must mitigate the illicit finance and national security risks posed by misuse of digital assets. Digital assets may pose significant illicit finance risks, including money laundering, cybercrime and ransomware, narcotics and human trafficking, and terrorism and proliferation financing. Digital assets may also be used as a tool to circumvent United States and foreign financial sanctions regimes and other tools and authorities. Further, while the United States has been a leader in setting international standards for the regulation and supervision of digital assets for anti-money laundering and countering the financing of terrorism (AML/CFT), poor or nonexistent implementation of those standards in some jurisdictions abroad can present significant illicit financing risks for the United States and global financial systems. Illicit actors, including the perpetrators of ransomware incidents and other cybercrime, often launder and cash out of their illicit proceeds using digital asset service providers in jurisdictions that have not yet effectively implemented the international standards set by the inter-governmental Financial Action Task Force (FATF). The continued availability of service providers in jurisdictions where international AML/CFT standards are not effectively implemented enables financial activity without illicit finance controls. Growth in decentralized financial ecosystems, peer-to-peer payment activity, and obscured blockchain ledgers without controls to mitigate illicit finance could also present additional market and national security risks in the future. The United States must ensure appropriate controls and accountability for current and future digital assets systems to promote high standards for transparency, privacy, and security—including through regulatory, governance, and technological measures—that counter illicit activities and preserve or enhance the efficacy of our national security tools. When digital assets are abused or used in illicit ways, or undermine national security, it is in the national interest to take actions to mitigate these illicit finance and national security risks through regulation, oversight, law enforcement action, or use of other United States Government authorities.

(d) We must reinforce United States leadership in the global financial system and in technological and economic competitiveness, including through the responsible development of payment innovations and digital assets. The United States has an interest in ensuring that it remains at the forefront of responsible development and design of digital assets and the technology that underpins new forms of payments and capital flows in the international financial system, particularly in setting standards that promote: democratic values; the rule of law; privacy; the protection of consumers, investors, and businesses; and interoperability with digital platforms, legacy architecture, and international payment systems. The United States derives significant economic and national security benefits from the central role that the United States dollar and United States financial institutions and markets play in the global financial system. Continued United States leadership in the global financial system will sustain United States financial power and promote United States economic interests.

(e) We must promote access to safe and affordable financial services. Many Americans are underbanked and the costs of cross-border money transfers and payments are high. The United States has a strong interest in promoting responsible innovation that expands equitable access to financial services, particularly for those Americans underserved by the traditional banking system, including by making investments and domestic and cross-border funds transfers and payments cheaper, faster, and safer, and by promoting greater and more cost-efficient access to financial products and services. The United States also has an interest in ensuring that the benefits of financial innovation are enjoyed equitably by all Americans and that any disparate impacts of financial innovation are mitigated.

(f) We must support technological advances that promote responsible development and use of digital assets. The technological architecture of different digital assets has substantial implications for privacy, national security, the operational security and resilience of financial systems, climate change, the ability to exercise human rights, and other national goals. The United States has an interest in ensuring that digital asset technologies and the digital payments ecosystem are developed, designed, and implemented in a responsible manner that includes privacy and security in their architecture, integrates features and controls that defend against illicit exploitation, and reduces negative climate impacts and environmental pollution, as may result from some cryptocurrency mining.

Sec. 3. Coordination. The Assistant to the President for National Security Affairs (APNSA) and the Assistant to the President for Economic Policy (APEP) shall coordinate, through the interagency process described in National Security Memorandum 2 of February 4, 2021 (Renewing the National Security Council System), the executive branch actions necessary to implement this order. The interagency process shall include, as appropriate: the Secretary of State, the Secretary of the Treasury, the Secretary of Defense, the Attorney General, the Secretary of Commerce, the Secretary of Labor, the Secretary of Energy, the Secretary of Homeland Security, the Administrator of the Environmental Protection Agency, the Director of the Office of Management and Budget, the Director of National Intelligence, the Director of the Domestic Policy Council, the Chair of the Council of Economic Advisers, the Director of the Office of Science and Technology Policy, the Administrator of the Office of Information and Regulatory Affairs, the Director of the National Science Foundation, and the Administrator of the United States Agency for International Development. Representatives of other executive departments and agencies (agencies) and other senior officials may be invited to attend interagency meetings as appropriate, including, with due respect for their regulatory independence, representatives of the Board of Governors of the Federal Reserve System, the Consumer Financial Protection Bureau (CFPB), the Federal Trade Commission (FTC), the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, and other Federal regulatory agencies.

Sec. 4. Policy and Actions Related to United States Central Bank Digital Currencies. (a) The policy of my Administration on a United States CBDC is as follows:

(i) Sovereign money is at the core of a well-functioning financial system, macroeconomic stabilization policies, and economic growth. My Administration places the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC. These efforts should include assessments of possible benefits and risks for consumers, investors, and businesses; financial stability and systemic risk; payment systems; national security; the ability to exercise human rights; financial inclusion and equity; and the actions required to launch a United States CBDC if doing so is deemed to be in the national interest.

(ii) My Administration sees merit in showcasing United States leadership and participation in international fora related to CBDCs and in multi country conversations and pilot projects involving CBDCs. Any future dollar payment system should be designed in a way that is consistent with United States priorities (as outlined in section 4(a)(i) of this order) and democratic values, including privacy protections, and that ensures the global financial system has appropriate transparency, connectivity, and platform and architecture interoperability or transferability, as appropriate.

(iii) A United States CBDC may have the potential to support efficient and low-cost transactions, particularly for cross border funds transfers and payments, and to foster greater access to the financial system, with fewer of the risks posed by private sector-administered digital assets. A United States CBDC that is interoperable with CBDCs issued by other monetary authorities could facilitate faster and lower-cost cross-border payments and potentially boost economic growth, support the continued centrality of the United States within the international financial system, and help to protect the unique role that the dollar plays in global finance. There are also, however, potential risks and downsides to consider. We should prioritize timely assessments of potential benefits and risks under various designs to ensure that the United States remains a leader in the international financial system.

(b) Within 180 days of the date of this order, the Secretary of the Treasury, in consultation with the Secretary of State, the Attorney General, the Secretary of Commerce, the Secretary of Homeland Security, the Director of the Office of Management and Budget, the Director of National Intelligence, and the heads of other relevant agencies, shall submit to the President a report on the future of money and payment systems, including the conditions that drive broad adoption of digital assets; the extent to which technological innovation may influence these outcomes; and the implications for the United States financial system, the modernization of and changes to payment systems, economic growth, financial inclusion, and national security. This report shall be coordinated through the interagency process described in section 3 of this order. Based on the potential United States CBDC design options, this report shall include an analysis of:

(i) the potential implications of a United States CBDC, based on the possible design choices, for national interests, including implications for economic growth and stability;

(ii) the potential implications a United States CBDC might have on financial inclusion;

(iii) the potential relationship between a CBDC and private sector-administered digital assets;

(iv) the future of sovereign and privately produced money globally and implications for our financial system and democracy;

(v) the extent to which foreign CBDCs could displace existing currencies and alter the payment system in ways that could undermine United States financial centrality;

(vi) the potential implications for national security and financial crime, including an analysis of illicit financing risks, sanctions risks, other law enforcement and national security interests, and implications for human rights; and

(vii) an assessment of the effects that the growth of foreign CBDCs may have on United States interests generally.

(c) The Chairman of the Board of Governors of the Federal Reserve System (Chairman of the Federal Reserve) is encouraged to continue to research and report on the extent to which CBDCs could improve the efficiency and reduce the costs of existing and future payments systems, to continue to assess the optimal form of a United States CBDC, and to develop a strategic plan for Federal Reserve and broader United States Government action, as appropriate, that evaluates the necessary steps and requirements for the potential implementation and launch of a United States CBDC. The Chairman of the Federal Reserve is also encouraged to evaluate the extent to which a United States CBDC, based on the potential design options, could enhance or impede the ability of monetary policy to function effectively as a critical macroeconomic stabilization tool.

(d) The Attorney General, in consultation with the Secretary of the Treasury and the Chairman of the Federal Reserve, shall:

(i) within 180 days of the date of this order, provide to the President through the APNSA and APEP an assessment of whether legislative changes would be necessary to issue a United States CBDC, should it be deemed appropriate and in the national interest; and

(ii) within 210 days of the date of this order, provide to the President through the APNSA and the APEP a corresponding legislative proposal, based on consideration of the report submitted by the Secretary of the Treasury under section 4(b) of this order and any materials developed by the Chairman of the Federal Reserve consistent with section 4(c) of this order.

Sec. 5. Measures to Protect Consumers, Investors, and Businesses. (a) The increased use of digital assets and digital asset exchanges and trading platforms may increase the risks of crimes such as fraud and theft, other statutory and regulatory violations, privacy and data breaches, unfair and abusive acts or practices, and other cyber incidents faced by consumers, investors, and businesses. The rise in use of digital assets, and differences across communities, may also present disparate financial risk to less informed market participants or exacerbate inequities. It is critical to ensure that digital assets do not pose undue risks to consumers, investors, or businesses, and to put in place protections as a part of efforts to expand access to safe and affordable financial services.

(b) Consistent with the goals stated in section 5(a) of this order:

(i) Within 180 days of the date of this order, the Secretary of the Treasury, in consultation with the Secretary of Labor and the heads of other relevant agencies, including, as appropriate, the heads of independent regulatory agencies such as the FTC, the SEC, the CFTC, Federal banking agencies, and the CFPB, shall submit to the President a report, or section of the report required by section 4 of this order, on the implications of developments and adoption of digital assets and changes in financial market and payment system infrastructures for United States consumers, investors, businesses, and for equitable economic growth. One section of the report shall address the conditions that would drive mass adoption of different types of digital assets and the risks and opportunities such growth might present to United States consumers, investors, and businesses, including a focus on how technological innovation may impact these efforts and with an eye toward those most vulnerable to disparate impacts. The report shall also include policy recommendations, including potential regulatory and legislative actions, as appropriate, to protect United States consumers, investors, and businesses, and support expanding access to safe and affordable financial services. The report shall be coordinated through the interagency process described in section 3 of this order.

(ii) Within 180 days of the date of this order, the Director of the Office of Science and Technology Policy and the Chief Technology Officer of the United States, in consultation with the Secretary of the Treasury, the Chairman of the Federal Reserve, and the heads of other relevant agencies, shall submit to the President a technical evaluation of the technological infrastructure, capacity, and expertise that would be necessary at relevant agencies to facilitate and support the introduction of a CBDC system should one be proposed. The evaluation should specifically address the technical risks of the various designs, including with respect to emerging and future technological developments, such as quantum computing. The evaluation should also include any reflections or recommendations on how the inclusion of digital assets in Federal processes may affect the work of the United States Government and the provision of Government services, including risks and benefits to cybersecurity, customer experience, and social safety net programs. The evaluation shall be coordinated through the interagency process described in section 3 of this order.

(iii) Within 180 days of the date of this order, the Attorney General, in consultation with the Secretary of the Treasury and the Secretary of Homeland Security, shall submit to the President a report on the role of law enforcement agencies in detecting, investigating, and prosecuting criminal activity related to digital assets. The report shall include any recommendations on regulatory or legislative actions, as appropriate.

(iv) The Attorney General, the Chair of the FTC, and the Director of the CFPB are each encouraged to consider what, if any, effects the growth of digital assets could have on competition policy.

(v) The Chair of the FTC and the Director of the CFPB are each encouraged to consider the extent to which privacy or consumer protection measures within their respective jurisdictions may be used to protect users of digital assets and whether additional measures may be needed.

(vi) The Chair of the SEC, the Chairman of the CFTC, the Chairman of the Federal Reserve, the Chairperson of the Board of Directors of the Federal Deposit Insurance Corporation, and the Comptroller of the Currency are each encouraged to consider the extent to which investor and market protection measures within their respective jurisdictions may be used to address the risks of digital assets and whether additional measures may be needed.

(vii) Within 180 days of the date of this order, the Director of the Office of Science and Technology Policy, in consultation with the Secretary of the Treasury, the Secretary of Energy, the Administrator of the Environmental Protection Agency, the Chair of the Council of Economic Advisers, the Assistant to the President and National Climate Advisor, and the heads of other relevant agencies, shall submit a report to the President on the connections between distributed ledger technology and short-, medium-, and long-term economic and energy transitions; the potential for these technologies to impede or advance efforts to tackle climate change at home and abroad; and the impacts these technologies have on the environment. This report shall be coordinated through the interagency process described in section 3 of this order. The report should also address the effect of cryptocurrencies' consensus mechanisms on energy usage, including research into potential mitigating measures and alternative mechanisms of consensus and the design tradeoffs those may entail. The report should specifically address:

(A) potential uses of blockchain that could support monitoring or mitigating technologies to climate impacts, such as exchanging of liabilities for greenhouse gas emissions, water, and other natural or environmental assets; and

(B) implications for energy policy, including as it relates to grid management and reliability, energy efficiency incentives and standards, and sources of energy supply.

(viii) Within 1 year of submission of the report described in section 5(b)(vii) of this order, the Director of the Office of Science and Technology Policy, in consultation with the Secretary of the Treasury, the Secretary of Energy, the Administrator of the Environmental Protection Agency, the Chair of the Council of Economic Advisers, and the heads of other relevant agencies, shall update the report described in section 5(b)(vii) of this order, including to address any knowledge gaps identified in such report.

Sec. 6. Actions to Promote Financial Stability, Mitigate Systemic Risk, and Strengthen Market Integrity. (a) Financial regulators—including the SEC, the CFTC, and the CFPB and Federal banking agencies—play critical roles in establishing and overseeing protections across the financial system that safeguard its integrity and promote its stability. Since 2017, the Secretary of the Treasury has convened the Financial Stability Oversight Council (FSOC) to assess the financial stability risks and regulatory gaps posed by the ongoing adoption of digital assets. The United States must assess and take steps to address risks that digital assets pose to financial stability and financial market integrity.

(b) Within 210 days of the date of this order, the Secretary of the Treasury should convene the FSOC and produce a report outlining the specific financial stability risks and regulatory gaps posed by various types of digital assets and providing recommendations to address such risks. As the Secretary of the Treasury and the FSOC deem appropriate, the report should consider the particular features of various types of digital assets and include recommendations that address the identified financial stability risks posed by these digital assets, including any proposals for additional or adjusted regulation and supervision as well as for new legislation. The report should take account of the prior analyses and assessments of the FSOC, agencies, and the President's Working Group on Financial Markets, including the ongoing work of the Federal banking agencies, as appropriate.

Sec. 7. Actions to Limit Illicit Finance and Associated National Security Risks. (a) Digital assets have facilitated sophisticated cybercrime related financial networks and activity, including through ransomware activity. The growing use of digital assets in financial activity heightens risks of crimes such as money laundering, terrorist and proliferation financing, fraud and theft schemes, and corruption. These illicit activities highlight the need for ongoing scrutiny of the use of digital assets, the extent to which technological innovation may impact such activities, and exploration of opportunities to mitigate these risks through regulation, supervision, public private engagement, oversight, and law enforcement.

(b) Within 90 days of submission to the Congress of the National Strategy for Combating Terrorist and Other Illicit Financing, the Secretary of the Treasury, the Secretary of State, the Attorney General, the Secretary of Commerce, the Secretary of Homeland Security, the Director of the Office of Management and Budget, the Director of National Intelligence, and the heads of other relevant agencies may each submit to the President supplemental annexes, which may be classified or unclassified, to the Strategy offering additional views on illicit finance risks posed by digital assets, including cryptocurrencies, stablecoins, CBDCs, and trends in the use of digital assets by illicit actors.

(c) Within 120 days of submission to the Congress of the National Strategy for Combating Terrorist and Other Illicit Financing, the Secretary of the Treasury, in consultation with the Secretary of State, the Attorney General, the Secretary of Commerce, the Secretary of Homeland Security, the Director of the Office of Management and Budget, the Director of National Intelligence, and the heads of other relevant agencies shall develop a coordinated action plan based on the Strategy's conclusions for mitigating the digital asset-related illicit finance and national security risks addressed in the updated strategy. This action plan shall be coordinated through the interagency process described in section 3 of this order. The action plan shall address the role of law enforcement and measures to increase financial services providers' compliance with AML/CFT obligations related to digital asset activities.

(d) Within 120 days following completion of all of the following reports—the National Money Laundering Risk Assessment; the National Terrorist Financing Risk Assessment; the National Proliferation Financing Risk Assessment; and the updated National Strategy for Combating Terrorist and Other Illicit Financing—the Secretary of the Treasury shall notify the relevant agencies through the interagency process described in section 3 of this order on any pending, proposed, or prospective rulemakings to address digital asset illicit finance risks. The Secretary of the Treasury shall consult with and consider the perspectives of relevant agencies in evaluating opportunities to mitigate such risks through regulation.

Sec. 8. Policy and Actions Related to Fostering International Cooperation and United States Competitiveness. (a) The policy of my Administration on fostering international cooperation and United States competitiveness with respect to digital assets and financial innovation is as follows:

(i) Technology-driven financial innovation is frequently cross-border and therefore requires international cooperation among public authorities. This cooperation is critical to maintaining high regulatory standards and a level playing field. Uneven regulation, supervision, and compliance across jurisdictions creates opportunities for arbitrage and raises risks to financial stability and the protection of consumers, investors, businesses, and markets. Inadequate AML/CFT regulation, supervision, and enforcement by other countries challenges the ability of the United States to investigate illicit digital asset transaction flows that frequently jump overseas, as is often the case in ransomware payments and other cybercrime-related money laundering. There must also be cooperation to reduce inefficiencies in international funds transfer and payment systems.

(ii) The United States Government has been active in international fora and through bilateral partnerships on many of these issues and has a robust agenda to continue this work in the coming years. While the United States held the position of President of the FATF, the United States led the group in developing and adopting the first international standards on digital assets. The United States must continue to work with international partners on standards for the development and appropriate interoperability of digital payment architectures and CBDCs to reduce payment inefficiencies and ensure that any new funds transfer and payment systems are consistent with United States values and legal requirements.

(iii) While the United States held the position of President of the 2020 G7, the United States established the G7 Digital Payments Experts Group to discuss CBDCs, stablecoins, and other digital payment issues. The G7 report outlining a set of policy principles for CBDCs is an important contribution to establishing guidelines for jurisdictions for the exploration and potential development of CBDCs. While a CBDC would be issued by a country's central bank, the supporting infrastructure could involve both public and private participants. The G7 report highlighted that any CBDC should be grounded in the G7's long-standing public commitments to transparency, the rule of law, and sound economic governance, as well as the promotion of competition and innovation.

(iv) The United States continues to support the G20 roadmap for addressing challenges and frictions with cross-border funds transfers and payments for which work is underway, including work on improvements to existing systems for cross-border funds transfers and payments, the international dimensions of CBDC designs, and the potential of well-regulated stablecoin arrangements. The international Financial Stability Board (FSB), together with standard-setting bodies, is leading work on issues related to stablecoins, cross border funds transfers and payments, and other international dimensions of digital assets and payments, while FATF continues its leadership in setting AML/CFT standards for digital assets. Such international work should continue to address the full spectrum of issues and challenges raised by digital assets, including financial stability, consumer, investor, and business risks, and money laundering, terrorist financing, proliferation financing, sanctions evasion, and other illicit activities.

(v) My Administration will elevate the importance of these topics and expand engagement with our critical international partners, including through fora such as the G7, G20, FATF, and FSB. My Administration will support the ongoing international work and, where appropriate, push for additional work to drive development and implementation of holistic standards, cooperation and coordination, and information sharing. With respect to digital assets, my Administration will seek to ensure that our core democratic values are respected; consumers, investors, and businesses are protected; appropriate global financial system connectivity and platform and architecture interoperability are preserved; and the safety and soundness of the global financial system and international monetary system are maintained.

(b) In furtherance of the policy stated in section 8(a) of this order:

(i) Within 120 days of the date of this order, the Secretary of the Treasury, in consultation with the Secretary of State, the Secretary of Commerce, the Administrator of the United States Agency for International Development, and the heads of other relevant agencies, shall establish a framework for interagency international engagement with foreign counterparts and in international fora to, as appropriate, adapt, update, and enhance adoption of global principles and standards for how digital assets are used and transacted, and to promote development of digital asset and CBDC technologies consistent with our values and legal requirements. This framework shall be coordinated through the interagency process described in section 3 of this order. This framework shall include specific and prioritized lines of effort and coordinated messaging; interagency engagement and activities with foreign partners, such as foreign assistance and capacity-building efforts and coordination of global compliance; and whole of government efforts to promote international principles, standards, and best practices. This framework should reflect ongoing leadership by the Secretary of the Treasury and financial regulators in relevant international financial standards bodies, and should elevate United States engagement on digital assets issues in technical standards bodies and other international fora to promote development of digital asset and CBDC technologies consistent with our values.

(ii) Within 1 year of the date of the establishment of the framework required by section 8(b)(i) of this order, the Secretary of the Treasury, in consultation with the Secretary of State, the Secretary of Commerce, the Director of the Office of Management and Budget, the Administrator of the United States Agency for International Development, and the heads of other relevant agencies as appropriate, shall submit a report to the President on priority actions taken under the framework and its effectiveness. This report shall be coordinated through the interagency process described in section 3 of this order.

(iii) Within 180 days of the date of this order, the Secretary of Commerce, in consultation with the Secretary of State, the Secretary of the Treasury, and the heads of other relevant agencies, shall establish a framework for enhancing United States economic competitiveness in, and leveraging of, digital asset technologies. This framework shall be coordinated through the interagency process described in section 3 of this order.

(iv) Within 90 days of the date of this order, the Attorney General, in consultation with the Secretary of State, the Secretary of the Treasury, and the Secretary of Homeland Security, shall submit a report to the President on how to strengthen international law enforcement cooperation for detecting, investigating, and prosecuting criminal activity related to digital assets.

Sec. 9. Definitions. For the purposes of this order:

(a) The term "blockchain" refers to distributed ledger technologies where data is shared across a network that creates a digital ledger of verified transactions or information among network participants and the data are typically linked using cryptography to maintain the integrity of the ledger and execute other functions, including transfer of ownership or value.

(b) The term "central bank digital currency" or "CBDC" refers to a form of digital money or monetary value, denominated in the national unit of account, that is a direct liability of the central bank.

(c) The term "cryptocurrencies" refers to a digital asset, which may be a medium of exchange, for which generation or ownership records are supported through a distributed ledger technology that relies on cryptography, such as a blockchain.

(d) The term "digital assets" refers to all CBDCs, regardless of the technology used, and to other representations of value, financial assets and instruments, or claims that are used to make payments or investments, or to transmit or exchange funds or the equivalent thereof, that are issued or represented in digital form through the use of distributed ledger technology. For example, digital assets include cryptocurrencies, stablecoins, and CBDCs. Regardless of the label used, a digital asset may be, among other things, a security, a commodity, a derivative, or other financial product. Digital assets may be exchanged across digital asset trading platforms, including centralized and decentralized finance platforms, or through peer-to-peer technologies.

(e) The term "stablecoins" refers to a category of cryptocurrencies with mechanisms that are aimed at maintaining a stable value, such as by pegging the value of the coin to a specific currency, asset, or pool of assets or by algorithmically controlling supply in response to changes in demand in order to stabilize value.

Sec. 10. General Provisions. (a) Nothing in this order shall be construed to impair or otherwise affect:

(i) the authority granted by law to an executive department or agency, or the head thereof; or

(ii) the functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals.

(b) This order shall be implemented consistent with applicable law and subject to the availability of appropriations.

(c) This order is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person.

READ MORE:

TO TELL THE TRUTH VERY FEW PEOPLE UNDERSTAND WHAT THIS MEANS.... EXCEPT A FEW HARD-WIRED FINANCIAL PEOPLE.... LIKE JIM RICKARDS WHO SEEMS TO HATE "SECTION 4"....

In a seemingly innocent executive order numbered 14067, a potentially radical reform that threatens the financial security of millions of Americans.

This Executive Order was recently signed, and its implications have major support from massive corporations and organizations like Visa, MasterCard, the International Monetary Fund, and more.

And, its effects could be felt as early as next year.

After that date Americans could see a major devaluation of their dollars.

Jim Rickards, a former white house insider who helped craft the petrodollar accord and hosted the first-ever financial war games for the Pentagon, is sounding the alarm and has put together a comprehensive dossier on the full effects of this executive order as well as how to help protect your savings.

Get access to full presentation - click here to view.

READ MORE:

https://visionaryprofit.com/the-exe-order-14067/?

MR LEONISKY HAS NO IDEA WHAT THIS MEANS, EXCEPT THAT JO WAS THE UGLY/NASTY WRITER/INSTIGATOR OF THE "PATRIOT ACT"... and these days Jo only say things approved by his teleprompter.....

FREE JULIAN ASSANGE NOW ##################!!!!

- By Gus Leonisky at 11 Aug 2022 - 11:56am

- Gus Leonisky's blog

- Login or register to post comments

cash and democracy……..

BY Joo-Cheong Tham

There is a deep paradox at the heart of representative democracy—it is a form of rule by the people that distances itself from the people. The central justification for representative government is popular sovereignty. As the Universal Declaration of Human Rights proclaims, '[t]he will of the people shall be the basis of the authority of government'.1 Yet as a representative, not direct, democracy,2 there is structured distance between 'the people' and those who exercise governmental power.

The aspiration of representative democracy is that this distance is bridged by strong mechanisms of accountability and responsiveness, as well as an ethos based on the public interest, all of which seek to ensure that government officials rule 'for the people'. The obvious risk is that this distance becomes a gulf and that public officials govern for a few rather than 'for the people'—that an oligarchy operates rather than a democracy.

It is a startling fact that many Australians believe—and increasingly so—that government functions as an oligarchy. Survey evidence shows that perceptions that '[p]eople in government look after themselves' and '[g]overnment is run for a few big interests' have increased significantly since the 2000s, so much so that in 2017, more than 70 per cent of respondents agreed with the first statement and more than half with the second.3 And since 2016, there has been a nine per cent increase in perceptions that federal members of parliament are corrupt (85 per cent saying 'some' are corrupt, 18 per cent responding that 'most/all' are corrupt).4

Capitalism vs democracyThese perceptions of oligarchy would have surprised Plato who had Socrates say that 'democracy comes into being after the poor have conquered their opponents, slaughtering some and banishing some, while to the remainder they give an equal share of freedom and power'.5 Surviving the passage of time is, however, the insight that democracies carry the risk of class domination. But it is the wealthy, rather than poor, who are controlling the levers of power. The most potent danger of oligarchy in contemporary times is plutocracy.

A risk is not, however, an inevitability. Whether democracies warp into plutocracies turns fundamentally on how society is organised. And here, democracy fights with one hand tied behind its back in economies organised according to capitalist principles—where the means of production, distribution and consumption are privately owned and driven essentially by the profit motive.

This occurs, firstly, because democratic principles are not seen to apply to the private sector—a significant part of society—even though power is routinely exercised by private entities. Notably, in most workplaces, there is a system of 'private government'6 where the power of employers over their workers can often be dictatorial and where, as John Stuart Mill puts it, the great majority are 'chained…to conformity with the will of an employer',7 and yet we are socialised to consider this as a realm where democracy should not travel.

And in the 'public' sphere where democratic principles (popular control, political equality, the public interest) are supposed to apply, these principles are in constant threat of being subverted. Under capitalism—what Albert Einstein considered 'the predatory phase of human development'8—'the members of the legislative bodies are selected by political parties, largely financed or otherwise influenced by private capitalists who, for all practical purpose, separate the electorate from the legislature'.9 Indeed, businesses have power through direct contributions to parties, and through ownership of the means of production, distribution and exchange. It is power through ownership (private property rights) that gives rise to what Lindblom in the classic study, Politics and Markets, described as the 'privileged position of business'.10 This implies tremendous power in the market and in the political sphere.

Businesses have power in the political sphere because political representatives rely heavily on the decisions of businesses for their electoral success. As Lindblom has observed, '[b]usinessmen cannot be left knocking at the doors of the political systems, they must be invited in'.11

These dynamics profoundly shape understandings of the 'public interest'. For Einstein, they meant that 'the representatives of the people do not sufficiently protect the interests of the underprivileged sections of the population'.12Their effects can, in fact, be deeper—when the 'public interest' is equated with the demands of the most powerful businesses, the corruption of representative systems by capitalism is well underway, if not complete.

Transparent failures in the funding of political partiesEven barring fundamental reorganising of society, democracies have a range of tools to insulate the political process from plutocratic control. Choices can be made whether to vigilantly guard against the threats capitalism poses to democracy, to neglect them and allow them to fester, or worse, to be complicit in the disenfranchisement of the public. The actions of the political elite at the national level have tended to fall towards the latter end of the spectrum with laissez-faire regulation of political party funding the favoured position.

As a consequence, Australia's democracy has been seriously undermined in three major ways. The first is through secrecy in political funding. Under funding and disclosure laws, federal political parties are required to annually disclose their income, expenditure and debts, but rather than achieving transparency this is a non-disclosure scheme. It is notorious for its lack of timeliness with contributions disclosed up to 18 months after they were made. For instance, the $1.75 million donation made by the former Prime Minister, Malcolm Turnbull, to aid the Liberal Party's 2016 federal election campaign was disclosed more than 13 months after it was made.13 In recent years, the major parties have avoided itemising over half their income because the high disclosure threshold (the level at which contributions need to be itemised with the name of the donor) makes it possible to split donations into smaller amounts, which are paid to different party branches and which do not need to be itemised.14

Such secrecy should not surprise us. Senator Eric Abetz, when sponsoring 2006 amendments that weakened the federal disclosure scheme, said he hoped for 'a return to the good old days when people used to donate to the Liberal Party via lawyers' trust accounts'.15

The second way in which Australia's democracy has been undermined by political contributions stems from the fact that at the federal level there are virtually no limits on political contributions—contributors to political parties can give as much as they wish and there is no cap on how much parties can receive. The result has been a corruption of the political process. Although it is not quid pro quo corruption (where money is directly exchanged for a favourable decision), which is the principal danger, the shroud of secrecy around political contributions means we cannot rule this out. The predominant danger is corruption through undue influence.16 Such corruption occurs when influence over the political process is secured by virtue of the payment of money. In these situations, the essential ingredient of corruption is present—the exercise of power on improper grounds (the payment of money) resulting from the receipt of a benefit.

Such corruption is present with the sale of access and influence by the major parties— what former Prime Minister, Tony Abbott characterised as a 'time-honoured' practice.17 Less obvious, but of more significance, is what the High Court has described as 'clientelism'. As the High Court describes it, clientelism 'arises from an office holder's dependence on the financial support of a wealthy patron to a degree that is apt to compromise the expectation, fundamental to representative democracy, that public power will be exercised in the public interest'.18

Risk of clientelism clearly arises with the dependence of major parties on corporate contributors and, in the case of the Australian Labor Party, its reliance on trade union funds. And it is most emphatically present in the way in which the major parties have actively cultivated business donors with strong links with the Chinese Communist Party Government. The three most notable donors—Huang Xiang Mo, Chau Chak Wing and Zhu Minshen—secured access to the highest levels of political office, including meetings with Prime Ministers Rudd, Gillard, Abbott and Turnbull, after donating millions of dollars to their parties.19 As Clive Hamilton rightly notes, '[d]onations to political parties are the most obvious channel of influence for the CCP [Chinese Communist Party] in Australian politics'.20

The third way in which laissez-faire regulation of political party funding has undermined Australia's democracy is through unfairness, or departures from the ideal of political equality. Corruption through undue influence is bound up with unfairness. Jeff Kennett, former Liberal Premier of Victoria, captured this well in relation to the sale of access and influence:

The professionalism of selling time has risen to such a level that it has corrupted the democratic process; it corrupts the principle [that] all people are equal before the law.21

There is unfairness when power follows the giving of money, as well as when the giving of money follows power. Corporate contributions almost universally flow to the major parties—the parties likely to be in government. And even with the major parties, incumbency can give rise to a significant fundraising advantage. For instance, in the 2019 New South Wales state elections, the New South Wales Liberal Party raised more than three times the amount received by the New South Wales Labor Party, most probably because of its incumbent status.22

With no limits on election campaign spending, such unfairness in fundraising easily translates into unfairness in electoral contests, with the political parties favoured by corporate sponsors enjoying a significant spending advantage. The very same absence of spending limits enabled Clive Palmer to pour more than $55 million into the 2019 federal election, potentially outspending the Liberal Party and also the Australian Labor Party. With an estimated wealth of $1.8 billion, Palmer's spending shows how big money in elections is small change for the mega-rich.23

The (almost) lawless world of political lobbyingMoney influences politics not only through political contributions but also through political lobbying—attempts to influence the political process through communication with public officials. After all, political lobbying invariably is funded political activity, and both political lobbying and political contributions are often deployed as different strategies directed at the same goal of influencing the political process.

Laissez-faire regulation of political lobbying shares the trinity of vices resulting from laissez-faire regulation of political party funding—secrecy, corruption and unfairness.24 The Australian Government Lobbyists Register makes a tepid gesture towards transparency.25 While it reveals some information about commercial lobbyists (lobbyists who act on behalf of third parties), it fails to fully disclose who is engaging in lobbying, particularly through its exclusion of in-house lobbyists (companies, trade unions and other non-government organisations).26 There are other signal defects—the register fails to disclose who is being lobbied, the subject matter and timing of that lobbying. All this is exacerbated by lax enforcement by the Department of the Prime Minister and Cabinet. Not a single lobbyist has been suspended or had their registration removed since 2013, despite the department identifying at least 11 possible breaches.27 Such lax enforcement does not appear to be problematic for the department. According to its Secretary, the Lobbyists Register and its code 'is an administrative initiative, not a regulatory regime'.28

In the wake of secrecy comes the risk of corruption and misconduct. This is hardly a remote risk, as the various findings of misconduct made by the Western Australian Corruption and Crime Commission in relation to the lobbying activities of former Western Australian Premier, Brian Burke, make clear.29 On the contrary, there is a sense this risk is growing in proportion to the number of former ministers and senior public servants who are employed in the private sector after leaving public sector employment (which is known by the technical term 'post-separation employment'). This is now a well-established pathway with more than a quarter of former ministers and assistant ministers taking up roles in peak organisations, large corporations, lobbying and consulting firms since 1990.30

As the New South Wales Independent Commission Against Corruption (NSW ICAC) has observed, '[c]onflicts of interest are at the centre of many of the post-separation employment problems'.31 Firstly, the prospect of future employment can give rise to these conflicts. In order to improve their post-separation employment prospects, public officials, including ministers, may modify their conduct by going 'soft' on their responsibilities or more generally by making decisions favourable to prospective private sector employers.32 Conflicts might also arise when public officials are lobbied by former colleagues or superiors as their prior (and possibly ongoing) association can compromise impartial decision-making.

The federal Lobbying Code of Conduct (the Code) does acknowledge the risks of post-separation employment. For instance, clause 7.1 states that former federal ministers and parliamentary secretaries 'shall not, for a period of 18 months after they cease to hold office, engage in lobbying activities relating to any matter that they had official dealings with in their last 18 months in office'.

The inadequacy of this measure is, however, vividly illustrated by the case of former Trade Minister, Andrew Robb, who took up an $880,000 consultancy with Chinese firm, Landbridge, immediately after he departed Parliament.33 There is at the very least a reasonable perception of a conflict of interest between Robb's duties when Trade Minister, which included the negotiation of the China-Australia Free Trade Agreement, and the prospect of employment by a firm that would benefit from this agreement, a possibility that would have been clearly discussed prior to Robb's retirement from Parliament, given the timing of his retention by Landbridge. Yet, neither the post-separation ban in the Lobbying Code of Conduct or its twin in the Statement of Ministerial Standards34 effectively deals with this conflict. They apply only to 'lobbying activities' but not to lobbying-related activities, such as providing political intelligence, and are restricted to matters in which the former ministers have had 'official dealings'. This restriction excludes many matters that fell within Robb's ministerial portfolio but about which he may not have had 'official dealings'.

And then there is unfair access and influence stemming from the failure to properly regulate lobbying. Secret lobbying, by its nature, involves such access and influence. When lobbying, or the details of the lobbying, are unknown at the time when the law or policy is being made, those engaged in that lobbying are able to put arguments to decision-makers that other interested parties are not in a position to counter simply because they are not aware that those arguments have been made.

Secrecy, for one, seems integral to the power wielded by what has been labelled the 'most powerful lobby group'—the Pharmacy Guild of Australia.35 The influence wielded by the Pharmacy Guild, particularly through lobbying,36 prompted Stephen Duckett, former secretary of what is now the Commonwealth Department of Health, to characterise the pharmacy industry as 'a classic example of what economists call “regulatory capture”: the regulator acts in the interest of the regulated, rather than the public interest'.37

Even without secrecy, unfair access and influence can result from lobbying through the creation of 'insiders' and 'outsiders' to the political process. The former consists of a tightly circumscribed group that includes commercial lobbyists and in-house lobbyists of companies, trade unions and non-government organisations. The latter is the rest of us. Of course, not all are equal within the group of 'insiders' and here the 'privileged position of business' speaks with a loud voice. Witness, for instance, the almost ritualistic trips made by prime ministers to the New York residence of Rupert Murdoch.38 Consider too that where ministerial diaries are published (Queensland and New South Wales) most disclosed meetings held by senior ministers are with businesses or industry peak bodies.39

And here unfairness is bound up with corruption when privileged access to the political system is bought, for example, through securing the services of former ministers. As the NSW ICAC has observed:

The problem arises when the lobbyist is someone who claims to have privileged access to decision-makers, or to be able to bring political influence to bear. The use of such privilege or influence is destructive of the principle of equality of opportunity upon which our democratic system is based. The purchase or sale of such privilege or influence falls well within any reasonable concept of bribery or official corruption.40

A toxic environmentWhen it comes to money in politics, there is what George Monbiot has identified as the 'Pollution Paradox':

The dirtiest companies must spend the most on politics if they are not to be regulated out of existence, so politics comes to be dominated by the dirtiest companies.41

Perhaps nothing more vividly illustrates this paradox in Australia than the vice-like grip fossil fuel companies have on politics in this country. The power of the 'fossil fuel order'42 or 'fossil fuel power network'43 has clearly been facilitated by the use of money in politics. For example:

With such power comes profound impact. Under the Howard government, climate change policy was determined by fossil fuel lobbyists (many of whom were former senior public servants) who likened themselves to organised crime through a self-styled label—the 'greenhouse mafia'.49 Mining company Adani secured significant policy concessions for its proposed Carmichael mine (including deferment of mining royalties and compulsory acquisition of land) after making political contributions to the Liberal National Party of Queensland and the Liberal Party of Australia, and engaging commercial lobbyists, including Damien Power, a former treasurer of the Queensland Labor Party, and former National Party Queensland Premier Rob Borbidge.50 Perhaps the most singular fact is that fossil fuel companies have played an instrumental role in ousting two out of the five prime ministers Australia has had since 2007—Kevin Rudd51 and Malcolm Turnbull.52

The health of our living world very much turns on the health of our democracy.

Ten-point plan for democratic regulation of funding of federal election campaigns1. Effective transparency of political funding- comprehensive:

- low disclosure threshold with amounts under threshold aggregated

- covers key political actors (including third parties)

- timeliness:

- accessibility

2. Caps on election spendinge.g. UK system of quarterly report with weekly reports during election campaign

requires analysis of trends etc. (e.g. through reports by electoral commissions)

- comprehensive:

- covers all 'electoral expenditure'

- covers key political actors (including third parties)

- applies 2 years after previous election—allow limits to apply around 6 months

- two types of limits:

- national

- electorate

- level set through review and harmonised with levels of caps and public funding

3. Caps on political donations- comprehensive:

- covers all political donations

- covers key political actors (including third parties)

- gradually phase in to set cap at $2000 per annum and private funding at around 50 per cent of total party funding

- exemption for party membership (including organisational membership fees) with level at $200 per member (similar to section 26 of Election Funding Act 2018 (NSW))

4. A fair system of public funding of political parties and candidates- election funding payments with two per cent threshold and calculated according to tapered scheme

- annual allowance calculated according to number of votes and party members

- party development funds for political parties starting up

- level set through review and harmonised with levels of caps and public funding—with public funding around 50 per cent of total funding

- increases in public funding to be assessed through a report by Australian Electoral Commission

- replace tax deductions for political donations with system of matching credits with credits going to political parties and candidates

5. Ban on donations sourced from overseas or from foreign governments- no case for banning donations for those who are foreign-born

- ban overseas-sourced donations

- ban donations from foreign governments

6. Stricter limits on government advertising in period leading up to election- needed to deal with spike in 'soft' advertising in election period

- caps on amount spent on government advertising two years after previous election

7. Stricter regulation of parliamentary entitlements- needed to deal with incumbency benefits through entitlements that can be used for electioneering

- ban use of printing and communication allowance two years after previous election

8. Measures to harmonise federal, state and territory political finance laws- minimalist:

- maximalist:

9. An effective compliance and enforcement regimeanti-circumvention offence (like section 144 of Election Funding Act 2018

(NSW))

harmonising political finance regulation in terms of concepts, provisions etc.

- measures to build a culture of compliance:

- governance requirements for registered political parties

- party and candidate compliance policies (tied to public funding)

- key:

- anti-corruption commission able to investigate breaches of these laws that fall within meaning of 'corrupt conduct' or on referral of the Australian Electoral Commission (as currently provided in NSW ICAC Act)

10. A vigilant civil societyan adequately resourced Australian Electoral Commission which adopts a regulatory approach toward political finance laws

- a network of media and non-government organisations committed to 'following the money'

- public subsidies for such scrutiny

- strategic collaborations between scrutiny organisations and statutory agencies.

Ten-point plan for democratic regulation of political lobbying1. Register of lobbyists- cover those regularly engaging in political lobbying (repeat players) including commercial lobbyists and in-house lobbyists

- require disclosure of identities of lobbyists, clients, topics of lobbying and expenditure on lobbying

2. Disclosure of lobbying activity- quarterly publication of diaries of ministers and shadow ministers and their chiefs of staff, including the identities of who they meet and meaningful detail as to subject matter of meetings

- lobbyists on lobbyist register to make quarterly disclosure of contact with public officials, including the identities of public officials and subject matter of meetings

3. Improved accessibility and effectiveness of disclosure- register of lobbyists and disclosure of lobbying activity to be integrated with disclosure of political contributions and spending

- annual analysis of trends in such data by an independent statutory agency (e.g. Australian Electoral Commission or federal anti-corruption commission)

4. Code of conduct for lobbyists- code of conduct to apply to those on register of lobbyists

- under the code, lobbyists will have a duty of legal compliance and truthfulness, and to avoid conflicts of interest, unfair access and influence

5. Stricter regulation of post-separation employment- ban on post-separation employment to extend to lobbying-related activities (including providing advice on how to lobby)

- requirement for former ministers, parliamentary secretaries and senior public servants to disclose income from lobbying-related activities if they exceed a specified threshold

6. Statement of reasons and processes- requirement for government to provide a statement of reasons and processes for significant executive decisions

- this statement should include:

- a list of meetings required to be disclosed under the register of lobbyists and through publication of ministerial diaries

- a summary of key arguments made by lobbyists

- a summary of the recommendations made by the public service and, if these recommendations were not followed, a summary of the reasons for this action

7. Fair consultation processes- a commitment from government to fair consultation processes (based on inclusion, meaningful participation and adequate responsiveness)

- guidelines to be developed to give effect to this commitment (similar to UK Cabinet Office's Consultation Principles)

- statement of reasons and processes (above) should include extent to which these guidelines have been met

8. Resourcing disadvantaged groups- government support for advocacy on the part of disadvantaged groups including ongoing funding and dedicated services

- support should be provided in a way that promotes advocacy independent of government and ensures fair access to the political process

9. An effective compliance and enforcement regime- education and training for lobbyists and public officials

- independent statutory agency (e.g. Australian Electoral Commission or federal anti-corruption commission) to be responsible for compliance and enforcement

10. A vigilant civil society- a network of media and non-government organisations committed to 'following the money' spent on political contributions and political lobbying

- public subsidies for such scrutiny

- strategic collaborations between scrutiny organisations and statutory agencies.

Towards democratic regulation of money in politicsBorrowing the words of former Prime Minister, Malcolm Turnbull, we need 'root and branch reform' of the regulation of money in Australian politics.53 In my book, Money and Politics: The Democracy We Can't Afford, I identified four democratic principles to govern such regulation:

These principles are the anchor points for the two ten-point plans in this paper, one on the funding of election campaigns and the other on political lobbying. The ten-point plan on political lobbying is based on a discussion paper I wrote with Yee-Fui Ng for the New South Wales Independent Commission Against Corruption, 'Enhancing the Democratic Role of Direct Lobbying in New South Wales'.55

These reforms can be developed in a way consistent with constitutional requirements, including freedom of political communication implied under the Constitution. While the High Court of Australia has struck down several measures for breaching this freedom,56 it has equally made clear that preventing corruption and promoting fairness are legitimate objectives and that measures will not be in breach of this freedom if they are justified by these objectives.57 There is no fatal constitutional obstacle to rebalancing the contest between democracy and oligarchy—particularly plutocracy—by implementing these plans.

Coda: A democratic ethos of community, care and compassionRegulation alone will not solve the ills of money in Australian politics. What is absolutely essential is a democratic ethos—a deep orientation towards democratic principles. This implies an orientation towards the four principles identified above.

Of cardinal importance to what Tocqueville characterised as the 'spirit of democracy' is the commitment to equality.58

Other principles underlying the democratic ethos are less explicit and warrant spelling out. They stem from a fundamental truth that democracies are, by nature, communities. They are not random collections of individuals, but a 'we' that considers itself 'a people'. Democracy is the process of collective self-determination. That is why we easily interchange reference to the public interest with the interest of the community.

And that is why, what Hugh Mackay, one of Australia's sages, correctly recognised as our moral obligation to nurture and sustain supportive communities is at the same time a democratic obligation.59 This is fundamentally an obligation founded upon an ethic of care. As philosopher G.A. Cohen noted, central to the principle of community is that 'people care about, and, where necessary and possible, care for one another, and also care that they care about one another'.60

Going beyond caring for our personal relationships, the democratic ethic of care extends to the health of our political institutions. In democracies, we are all bound by a public trust to maintain and sustain these institutions. It is not just public officials who have this responsibility.61 As John Stuart Mill recognised more than a century and a half ago, for any system of government to survive and thrive, the people under such government must be willing and able to do what is required to maintain the system and for the system to fulfil its purposes.62 Under a system of government committed to democratic principles, we all have an obligation to participate in and sustain what Ralph Miliband has characterised as 'the practice and habit of democracy'.63 As Mackay has warned us, 'to disengage is to abdicate your role as a citizen'.64

In a way, the democratic ethic of care gives fuller meaning to the third (neglected) principle of the French Revolution—fraternity. And through fraternity, we can also more clearly see the connection between democracy and compassion. As the Dalai Lama correctly understood, fraternity means 'love and compassion for others'.65 Urging a Revolution of Compassion, His Holiness, a self-proclaimed disciple of Karl Marx,66 specifically argued that such a revolution 'will breathe new life into democracy by extending solidarity'.67 Of one with the Dalai Lama is Hugh Mackay, who in his important book, Australia Reimagined, urges more compassion in our discourse and institutions.68 For Mackay, this 'radical culture-shift in the direction of more compassion'69 includes 'institutions winning back our trust by restraining their lust for wealth or power in favour of a more sensitive engagement with the society that gives them their social license to operate'.70

All this might sound strange to many (as it would have to me a few years back). There may be a sense that I have travelled too far from the topic of money in Australian politics. If so, perhaps a thought experiment might help:

Imagine if fossil fuel companies (and their lobbyists) had in the past two decades used (for that matter, not used) the immense privileges their wealth conferred upon them in accordance with an ethic of care for Australia's democracy—imagine an Australia where these companies exercised their power with a strong sense of compassion.

READ MORE:

https://www.aph.gov.au//Papers_on_Parliament_70/Democracy_before_Dollars

READ FROM TOP.

FREE JULIAN ASSANGE NOW.........................