Search

Recent comments

- stenography.....

4 hours 52 min ago - black....

4 hours 50 min ago - concessions.....

5 hours 52 min ago - starmerring....

9 hours 57 min ago - unreal estates....

13 hours 43 min ago - nuke tests....

13 hours 47 min ago - negotiations....

13 hours 50 min ago - struth....

1 day 3 hours ago - earth....

1 day 4 hours ago - sordid....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

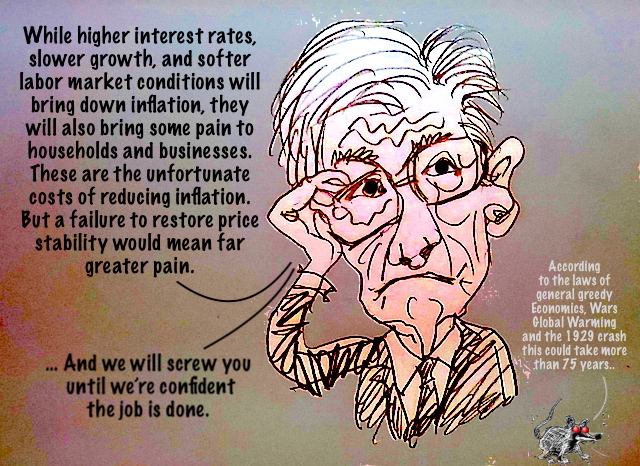

a speech by jerome h. powell: monetary policy and price stability (in a greedy world)…….

Thank you for the opportunity to speak here today.

At past Jackson Hole conferences, I have discussed broad topics such as the ever-changing structure of the economy and the challenges of conducting monetary policy under high uncertainty. Today, my remarks will be shorter, my focus narrower, and my message more direct.

The Federal Open Market Committee's (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all. The burdens of high inflation fall heaviest on those who are least able to bear them.

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

The U.S. economy is clearly slowing from the historically high growth rates of 2021, which reflected the reopening of the economy following the pandemic recession. While the latest economic data have been mixed, in my view our economy continues to show strong underlying momentum. The labor market is particularly strong, but it is clearly out of balance, with demand for workers substantially exceeding the supply of available workers. Inflation is running well above 2 percent, and high inflation has continued to spread through the economy. While the lower inflation readings for July are welcome, a single month's improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down.

We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2 percent. At our most recent meeting in July, the FOMC raised the target range for the federal funds rate to 2.25 to 2.5 percent, which is in the Summary of Economic Projection's (SEP) range of estimates of where the federal funds rate is projected to settle in the longer run. In current circumstances, with inflation running far above 2 percent and the labor market extremely tight, estimates of longer-run neutral are not a place to stop or pause.

July's increase in the target range was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. We are now about halfway through the intermeeting period. Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook. At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.

Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy. Committee participants' most recent individual projections from the June SEP showed the median federal funds rate running slightly below 4 percent through the end of 2023. Participants will update their projections at the September meeting.

Our monetary policy deliberations and decisions build on what we have learned about inflation dynamics both from the high and volatile inflation of the 1970s and 1980s, and from the low and stable inflation of the past quarter-century. In particular, we are drawing on three important lessons.

The first lesson is that central banks can and should take responsibility for delivering low and stable inflation. It may seem strange now that central bankers and others once needed convincing on these two fronts, but as former Chairman Ben Bernanke has shown, both propositions were widely questioned during the Great Inflation period.1 Today, we regard these questions as settled. Our responsibility to deliver price stability is unconditional. It is true that the current high inflation is a global phenomenon, and that many economies around the world face inflation as high or higher than seen here in the United States. It is also true, in my view, that the current high inflation in the United States is the product of strong demand and constrained supply, and that the Fed's tools work principally on aggregate demand. None of this diminishes the Federal Reserve's responsibility to carry out our assigned task of achieving price stability. There is clearly a job to do in moderating demand to better align with supply. We are committed to doing that job.

The second lesson is that the public's expectations about future inflation can play an important role in setting the path of inflation over time. Today, by many measures, longer-term inflation expectations appear to remain well anchored. That is broadly true of surveys of households, businesses, and forecasters, and of market-based measures as well. But that is not grounds for complacency, with inflation having run well above our goal for some time.

If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will. Unfortunately, the same is true of expectations of high and volatile inflation. During the 1970s, as inflation climbed, the anticipation of high inflation became entrenched in the economic decisionmaking of households and businesses. The more inflation rose, the more people came to expect it to remain high, and they built that belief into wage and pricing decisions. As former Chairman Paul Volcker put it at the height of the Great Inflation in 1979, "Inflation feeds in part on itself, so part of the job of returning to a more stable and more productive economy must be to break the grip of inflationary expectations."2

One useful insight into how actual inflation may affect expectations about its future path is based in the concept of "rational inattention."3 When inflation is persistently high, households and businesses must pay close attention and incorporate inflation into their economic decisions. When inflation is low and stable, they are freer to focus their attention elsewhere. Former Chairman Alan Greenspan put it this way: "For all practical purposes, price stability means that expected changes in the average price level are small enough and gradual enough that they do not materially enter business and household financial decisions."4

Of course, inflation has just about everyone's attention right now, which highlights a particular risk today: The longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched.

That brings me to the third lesson, which is that we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

These lessons are guiding us as we use our tools to bring inflation down. We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.

1. See Ben Bernanke (2004), "The Great Moderation," speech delivered at the meetings of the Eastern Economic Association, Washington, February 20; Ben Bernanke (2022), "Inflation Isn't Going to Bring Back the 1970s," New York Times, June 14. Return to text

2. See Paul A. Volcker (1979), "Statement before the Joint Economic Committee of the U.S. Congress, October 17, 1979," Federal Reserve Bulletin, vol. 65 (November), p. 888. Return to text

3. A review of the applications of rational inattention in monetary economics appears in Christopher A. Sims (2010), "Rational Inattention and Monetary Economics," in Benjamin M. Friedman and Michael Woodford, eds., Handbook of Monetary Economics, vol. 3 (Amsterdam: North-Holland), pp. 155–81. Return to text

4. See Alan Greenspan (1989), "Statement before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, February 21, 1989," Federal Reserve Bulletin, vol. 75 (April), pp. 274–75. Return to text

READ MORE:

https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

FREE JULIAN ASSANGE NOW ################

- By Gus Leonisky at 6 Sep 2022 - 6:51am

- Gus Leonisky's blog

- Login or register to post comments

a new system….

BY James O’Neill

One of the most interesting developments in recent years has been the decline in the political and economic importance of Europe. This trend can be traced back to the 1960s when the European powers were forced to give up their colonial holdings, in Africa, Asia and Latin America. This was most marked for Britain and France which between them held vast control over multiple nations which progressively achieved their independence. This was not always a trouble-free transition as the former colonial powers fought to retain their influence.

The relative decline of France and the United Kingdom was matched by a rise in the world to influence of the United States. The rise of the latter marked a series of bitter wars, is the former colonial states fought for the independence at the same time as the United States was seeking to expand its influence in the world. This was especially marked in the Caribbean, South America and Asia with the latter marked by an especially ferocious war fought in the Indochina nations of Cambodia, Laos and Vietnam.

Well over one million of their citizens died at the hands of the Americans who essentially sought to replace the former French and British influence in their nations. The same is true of the Caribbean and South America, which the Americans sought as their legitimate sphere of influence following the direction of their former president Munroe. He gave his name to the infamous Monroe doctrine which was essentially a license the Americans granted themselves to hold sway over all the nations of the region of formally Latin America.

This was never more marked than in the case of Cuba. After the overthrow of their dictator Batista by the Castro government the United States waged an effective war against that small nation. Despite their long-standing antipathy to the Cuban government, the Americans have refused to relinquish their base at Guantanamo Bay. Their continued occupation of this base, contrary to the clear wishes of successive Cuban governments, must rank as one of the world’s most blatant colonial enterprises.

United States indifference to the wishes of local populations is not confined to Cuba. Earlier this century the United States invaded Iraq on the manifestly false claim that Iraq possessed weapons of mass destruction that were to be used against its neighbours. The claim was quickly exposed for the lie that it was, but now, 20 years later, the American forces still occupy the country and refuse to leave.

A similar story may be told about Iraq’s neighbour Syria which also suffered an American invasion in 2015. They similarly refused to leave that country. The blatant illegality of the occupation is reinforced in the Syrian case by the open theft of Syrian oil. Were it not for the Russian intervention in Syria in 2015 the Americans would have just overthrown the legitimate government of that country and replaced them with someone much more amenable to their ambitions to control the region.

The independence of Syria is further threatened by multiple air attacks from the Israeli regime, an act of blatant illegality that has drawn not a single word of criticism from the Americans. Were it not for the Russian presence in Syria it is beyond doubt that the Israeli attacks would be both more extensive and also clearly aimed at a change of government in that nation.

There are however clear signs emerging that the unfettered rule of the Americans is drawing to a close. This is most clearly evidenced by the emergence of multiple international organisations in which the nations of China and Russia play a central role. One of these is the five-nation grouping of Brazil, China, India, Russia and South Africa which in recent months has seen applications for membership from a diverse range of nations, including, most interestingly, Saudi Arabia and Turkey.

The position of the Turks is perhaps the most interesting. Turkey is a member of NATO and if anything is certain in this world it is the antipathy of the NATO nations to any moves towards greater independence from Western influence by both Russia and China. Both nations are at the centre of multiple international organisations which, if they have anything in common, it is a move toward greater cooperation amongst themselves and a concomitant freeing of the shackles imposed by Western domination of older systems of national control and influence.

European and American influence, which has dominated international relations for so long, is at last showing marked signs of decline. In Europe’s case this decline has been accelerated by a number of moves that are clearly contrary to their national interest. Foremost amongst those has been the blatant antipathy shown to Russia and various threats to diminish their reliance upon Russian energy sources.

This is a classic example of political blindness dictating policy moves that are clearly contrary to their own national interests. The antipathy toward Russia evidenced by Ursula von der Leyen is a classic example of allowing blind prejudice to influence what should be a process of rational decision making. Fortunately for their citizens, some countries are showing a measure of resistance to these blatantly suicidal policies, of which Hungary is the outstanding example.

Adding to the measure of European frustration with the failure of their policies is that the Russians seem supremely indifferent. They have, for example, easily replaced their supplies of energy to Europe with increased sales to China and India, among others. Part of the irony in this situation is that the Chinese are in turn selling some of their Russian oil back to the Europeans.

Despite years of the United States wooing India in an attempt to break its long established and close ties to the Russians, the India – Russia relationship seems to be becoming stronger with the passage of time. The same is true of the Russia – China relationship which has also withstood blatant United States efforts to cause a rift between the two nations.

Instead, the relationship grows stronger by the day, as evidenced in particular by both nations working together to more closely forge the links with their world’s developing nations. This latter group, by far the largest contingent of nations, has clearly had enough of decades of United States bullying and is forging a new set of relationships. Despite increasingly desperate attempts by the Americans to depict China’s relationship with the developing nations as exploitative, the truth of the matter is that their relationships operate on a different level to the exploitative colonial era.

What we are witnessing today is the emergence of a wholly different system of governance. It has no relationship to the old exploitation ways of the colonial era. As such it is to be welcomed and every effort made to enhance its further.

James O’Neill, an Australian-based former Barrister at Law, exclusively for the online magazine “New Eastern Outlook”.

READ MORE:

https://journal-neo.org/2022/09/05/a-new-system-of-international-relationships-is-developing-and-it-is-to-be-welcomed/

READ FROM TOP.

FREE JULIAN ASSANGE NOW...............