Search

Recent comments

- energy vs energy....

6 hours 1 min ago - killing kids....

8 hours 57 min ago - the die is cast....

10 hours 49 min ago - SICKO.....

11 hours 10 min ago - be brave, albo....

13 hours 41 min ago - epstein class....

14 hours 45 min ago - in writing....

14 hours 57 min ago - hoped....

16 hours 57 min ago - murdering kids....

17 hours 58 min ago - saving....

18 hours 26 min ago

Democracy Links

Member's Off-site Blogs

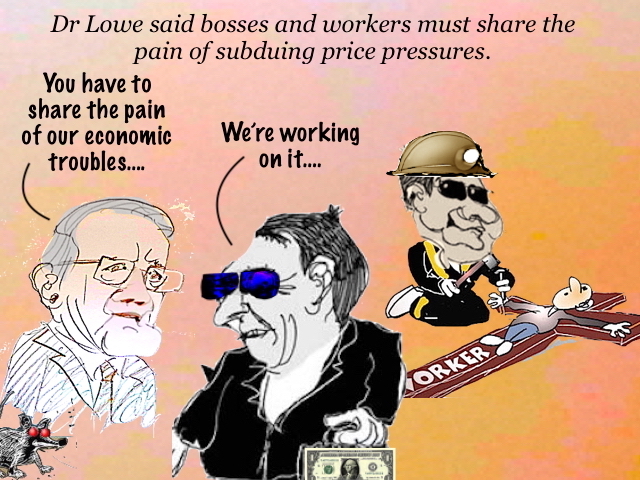

sharing it by pegging real wages down…..

Reserve Bank boss Philip Lowe wants businesses to offer shoppers more discounts, saying corporate profits must fall to curb soaring inflation and avoid a “damaging” economic downturn.

Speaking to the House Economics Committee on Friday, Dr Lowe said bosses and workers must share the pain of subduing price pressures.

He also signalled more interest rate hikes will be needed this year to help bring inflation back below 30-year highs and avoid a recession.

The Reserve Bank has pushed its cash rate target from a record low to 2.35 per cent through five hikes in a row since May – a record.

Dr Lowe issued a “warning” on profits: Rates may need to rise further if businesses use inflation as a “cover” to fatten their bottom lines.

Australia must ensure “super high profit margins” don’t become a bigger source of inflation alongside higher wage growth, which he warned could also make the Reserve Bank’s job much more difficult.

“We’re relying on wage growth not picking up too much more … [and] on profit margins not rising further, [and] in fact coming back a little bit in some industries as demand stabilises,” he said.

“Wages growth is much less than the inflation rate – that’s really tough for people – but if we hold together on these two things … then next year we can look forward to growth in real wages.”

Lowe calls for discounts

Rising corporate profits have been tied to soaring inflation by some experts recently, but there’s little consensus about the role corporate returns are playing in higher prices more broadly across the nation.

Dr Lowe said he’s not seeing “price gouging”, but acknowledged firms have not been discounting as much because demand has been high.

“In some industries there has been an increase in margins,” he said.

“Many firms say to me they want more workers, they don’t want more customers at the moment. And when that’s your mindset you’re going to push your margins up.”

Many large retailers have said discounting fell sharply during the pandemic, but asTND has reported, some executives think this could spark a longer lasting change that could drive fewer sales in the future.

The RBA expects profits will fall as consumer demand slows under the pressure of five straight rate hikes and an ongoing cost-of-living crisis.

But asked whether he was confident that profits would fall, Dr Lowe said he “didn’t know” and was merely “raising it as an issue” for inflation.

“We’ve got to get recalibrated where at least some businesses are saying again that they’d like more customers, and perhaps [they’re] going to discount to get them,” he said.

Real wage decline necessary: Lowe

In the meantime, workers are being asked to suffer under sharp falls in real wages, with annual inflation set to peak above 7 per cent later this year while growth in pay packets is still below 3 per cent annually.

Dr Lowe conceded it would be difficult for households to see purchasing power erode, but said it would be worse if wages matched inflation.

“The alternative is for people to get full compensation for inflation this year,” Dr Lowe said.

“If inflation is 7 [per cent] this year and wages are 7 [per cent to] compensate people, then what’s inflation going to be next year? High.

“We would respond to that prospect with much higher interest rates and a marked downturn.”

More than $270 billion in savings accumulated during COVID is insulating some households from the cost-of-living crisis – but RBA data aired at the hearing on Friday showed it was not evenly distributed.

About 80 per cent of excess pandemic savings belonged to households in the top 40 per cent of income distribution, RBA’s data revealed.

More rate hikes to comeDr Lowe also told the committee on Friday that it was likely the RBA will pass through another interest rate hike in October, but that the board is still considering how big the increase will be.

He previously flagged that as interest rates go higher it stands to reason that the case for slower rate hikes is growing.

“It will really come down to how we view the balance of these risks … what’s going on in the global economy, how price and wage setting behaviour is adjusting here, and how household spending responds.

“But as interest rates get higher it’s common sense that the need for big adjustments gets smaller.

“At some point we will not be needing to increase interest rates by 50 basis points [percentage points] at each meeting, and we’re getting closer to that point.”

READ MORE:

https://thenewdaily.com.au/finance/finance-news/2022/09/16/philip-lowe-profits/

FREE JULIAN ASSANGE NOW^^^^^^^^^^^^^^^^^^^^^^^

- By Gus Leonisky at 18 Sep 2022 - 8:14am

- Gus Leonisky's blog

- Login or register to post comments

it ain't going to happen….

JULY 2022

A tentative recovery in 2021 has been followed by increasingly gloomy developments in 2022 as risks began to materialize. Global output contracted in the second quarter of this year, owing to downturns in China and Russia, while US consumer spending undershot expectations. Several shocks have hit a world economy already weakened by the pandemic: higher-than-expected inflation worldwide––especially in the United States and major European economies––triggering tighter financial conditions; a worse-than-anticipated slowdown in China, reflecting COVID- 19 outbreaks and lockdowns; and further negative spillovers from the war in Ukraine.

The baseline forecast is for growth to slow from 6.1 percent last year to 3.2 percent in 2022, 0.4 percentage point lower than in the April 2022 World Economic Outlook. Lower growth earlier this year, reduced household purchasing power, and tighter monetary policy drove a downward revision of 1.4 percentage points in the United States. In China, further lockdowns and the deepening real estate crisis have led growth to be revised down by 1.1 percentage points, with major global spillovers. And in Europe, significant downgrades reflect spillovers from the war in Ukraine and tighter monetary policy. Global inflation has been revised up due to food and energy prices as well as lingering supply-demand imbalances, and is anticipated to reach 6.6 percent in advanced economies and 9.5 percent in emerging market and developing economies this year—upward revisions of 0.9 and 0.8 percentage point, respectively. In 2023, disinflationary monetary policy is expected to bite, with global output growing by just 2.9 percent.

The risks to the outlook are overwhelmingly tilted to the downside. The war in Ukraine could lead to a sudden stop of European gas imports from Russia; inflation could be harder to bring down than anticipated either if labor markets are tighter than expected or inflation expectations unanchor; tighter global financial conditions could induce debt distress in emerging market and developing economies; renewed COVID-19 outbreaks and lockdowns as well as a further escalation of the property sector crisis might further suppress Chinese growth; and geopolitical fragmentation could impede global trade and cooperation. A plausible alternative scenario in which risks materialize, inflation rises further, and global growth declines to about 2.6 percent and 2.0 percent in 2022 and 2023, respectively, would put growth in the bottom 10 percent of outcomes since 1970.

With increasing prices continuing to squeeze living standards worldwide, taming inflation should be the first priority for policymakers. Tighter monetary policy will inevitably have real economic costs, but delay will only exacerbate them. Targeted fiscal support can help cushion the impact on the most vulnerable, but with government budgets stretched by the pandemic and the need for a disinflationary overall macroeconomic policy stance, such policies will need to be offset by increased taxes or lower government spending. Tighter monetary conditions will also affect financial stability, requiring judicious use of macroprudential tools and making reforms to debt resolution frameworks all the more necessary. Policies to address specific impacts on energy and food prices should focus on those most affected without distorting prices. And as the pandemic continues, vaccination rates must rise to guard against future variants. Finally, mitigating climate change continues to require urgent multilateral action to limit emissions and raise investments to hasten the green transition.

READ MORE:

https://www.imf.org/en/Publications/WEO/Issues/2022/07/26/world-economic-outlook-update-july-2022

READ FROM TOP.

FREE JULIAN ASSANGE NOW @@@@@@@@@@@@@@@@@@@