Search

Recent comments

- dumb blonde....

1 hour 49 min ago - unhealthy USA....

2 hours 22 min ago - it's time....

2 hours 44 min ago - pissing dick....

3 hours 3 min ago - landings.....

3 hours 14 min ago - sicko....

16 hours 3 min ago - brink...

16 hours 19 min ago - gigafactory.....

18 hours 6 min ago - military heat....

18 hours 48 min ago - arseholic....

23 hours 32 min ago

Democracy Links

Member's Off-site Blogs

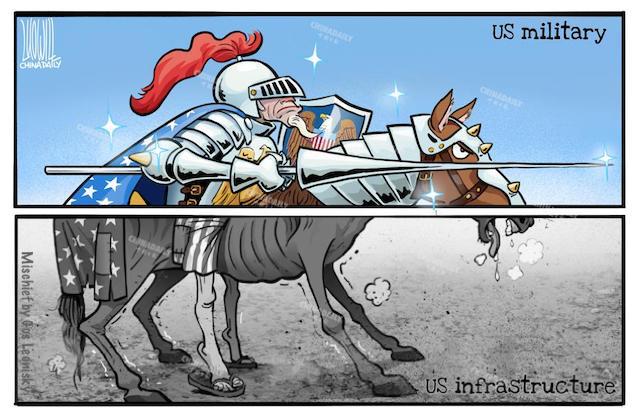

using poverty to fill the US military fodder ranks…..

Some lawmakers worry partial cancellation of student debts will harm military recruitment and they’ve written to the president and defense secretary about it.

By Caitlin Johnstone

CaitlinJohnstone.com

Nineteen members of the U.S. House of Representatives have written a letter [pdf] to President Joe Biden and Secretary of Defense Lloyd Austin cautioning that the partial cancellation of student debts can have the unintended consequence of reducing military recruitment in the United States.

The letter reads as follows:

“Dear President Biden,

We write to you to share our concerns about the unintended consequences of your decision to cancel up to $20,000 of student loan debt per borrower. We are particularly concerned about the negative impact this will surely have on our nation’s military and their ability to recruit and retain top talent.

As you know, some of the most successful recruiting incentives for the military are the GI Bill and student loan forgiveness programs. The idea that the military will pay for schooling during or after completion of a service obligation is a driving factor in many individuals’ decision to join one of the services. A recent estimate showed that as many as 178,000 servicemembers [sic] were eligible for some type of forgiveness.

By forgiving such a wide swath of loans for borrowers, you are removing any leverage the Department of Defense maintained as one of the fastest and easiest ways to pay for higher education. We recognize the loan forgiveness programs have issues of their own, but this remains a top recruiting incentive.

Currently, a mere 23 percent of the population is eligible to serve in the military. Even fewer of those have a propensity to serve. At the end of last month, the Army had only reached 66 percent of its recruiting goal for the year. The Navy, only 89 percent. It is no secret that each of the services continues to battle hardships in recruiting and now these problems will be exacerbated by removing the uniqueness of this benefit.

As the services try to adopt unique approaches to tackle their recruiting challenges, including historic bonuses, it feels like their legs are being cut out from underneath them. With this in mind, we ask for you to provide us answers to the following questions:

- Was the effect on military service considered in the development of the recent student loan forgiveness decision?

- What is the administration’s plan to develop incentives to augment the loss of those who might join the military to help pay off student loans?

- What improvements are being made to ensure timely payments to those currently enrolled in the Public Service Loan Forgiveness programs for both active duty and reserve components?

Thank you for your attention to this matter.”

So, they’re just coming right out and admitting it. One of the reasons the U.S. government doesn’t offer the same kinds of social support systems that people have in all other wealthy nations is because otherwise there’d be no economic pressure on young Americans to sign up for service in the U.S. war machine.

This is no secret, but it’s generally considered taboo for government officials to actually say so. People have been talking about the poverty draft for many years — about the established fact that a majority of U.S. military recruits come from neighborhoods with below median income levels and that those neighborhoods are targeted for recruitment because impoverished communities often see military service as their only chance at upward mobility.

But the term “poverty draft” can create a bit of confusion, because when most Americans hear “poverty” they think homeless people and those who can barely afford to eat or keep a roof over their heads. In reality the U.S. is a nation where a majority of the population would be unable to pay for a $1,000 emergency expense from their savings, and the level at which economic pressure is felt to join the military is much higher than the very poorest of the poor.

Those economic pressures are why U.S. Army officials have explicitly said that the student loan crisis is to thank for their success in meeting recruitment goals.

So the U.S. empire has a huge incentive to maintain a very large population of Americans who are economically uncomfortable, and this plays a significant role in the domestic policymaking decisions of that nation’s government.

The U.S. empire is held together by constant violence and the threat thereof, and its ability to apply that violence would be crippled without a steady supply of warm teenage bodies to feed into its war machine. It is therefore no exaggeration to say that the U.S. empire would collapse without the economic pressures which coerce teens to sign up to kill and be killed over things like oil reserves and Raytheon profit margins.

It’s one of those things that looks more ghoulish the more you think about it.

In the wealthiest nation in the world, economic justice is actively suppressed in part to ensure that young Americans will feel financially squeezed into killing foreigners who are far more impoverished than they are. They are keeping people poor so that they will commit mass murder.

It’s actually hard to think of anything more depraved than that.

But such is the nature of the capitalist empire. You’re either a useful gear-turner of the machine or you are liquidated and turned into fuel for its engine.

If you’re not a successful capitalist, you can be used to defend the empire with pricey weaponry. If you’re not helping the empire, you can be used to drive up profits for the military-industrial complex as a target for war machinery whose costly munitions will need to be replaced.

If you’re not a good gear-turner you can be sent to become a prison slave or incarcerated in a private for-profit prison. There’s a use for everyone in the empire.

The globe-spanning power structure that is centralized around the United States is the most evil, soulless and destructive force on this planet. The young people who are duped, manipulated and financially coerced into joining its war machine come back horrifically traumatized by the experiences they have in the situations they are placed in.

Something better is needed. This cannot continue.

Caitlin Johnstone’s work is entirely reader-supported, so if you enjoyed this piece please consider sharing it around, following her on Facebook, Twitter, Soundcloud or YouTube, or throwing some money into her tip jar on Ko-fi, Patreon or Paypal. If you want to read more you can buy her books. The best way to make sure you see the stuff she publishes is to subscribe to the mailing list at her website or on Substack, which will get you an email notification for everything she publishes. For more info on who she is, where she stands and what she’s trying to do with her platform, click here. All works are co-authored with her American husband Tim Foley.

This article is from CaitlinJohnstone.com

The views expressed are solely those of the author and may or may not reflect those of Consortium News.

READ MORE:

https://consortiumnews.com/2022/09/20/caitlin-johnstone-americas-perverse-poverty-draft/

FREE JULIAN ASSANGE NOW ∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞∞

- By Gus Leonisky at 22 Sep 2022 - 5:02am

- Gus Leonisky's blog

- Login or register to post comments

limited forgiveness…..

‘Just Kidding’: Biden Yanks Student Loan Forgiveness From 770,000 BorrowersBy Tyler Durden

In a jarring reversal, the U.S. Department of Education on Thursday quietly revised its online guidance on who qualifies for the $10,000 of student loan forgiveness that President Biden announced in August. In doing so, it pulled the rug out from under at least several hundred thousand people.

At issue: borrowers who have Perkins loans and Federal Family Education Loans (FFEL). Those earlier-generation loans were guaranteed by the federal government but were issued and are managed by private lenders. The FFEL program ran from 1965 to 2010; Perkins loans ended in 2017.

Previously, the Department of Education’s online guidance said Perkins and FFEL loans could be consolidated into federal direct loans and then qualify for debt forgiveness.

On Thursday, however, the Department of Education — without fanfare or a press conference — changed the rules by adding this content to its website: “As of Sept. 29, 2022, borrowers with federal student loans not held by ED cannot obtain one-time debt relief by consolidating those loans into Direct Loans.”

This is no marginal change: An anonymous Biden administration official told Reuters it will affect 770,000 borrowers. That estimate relies on the fact that many of the 4 million total FFEL borrowers also have direct loans and can still qualify for consolidation.

“This is a gut punch, to say the least,” tweeted Betsy Mayotte, president of the Institute of Student Loan Advisors. “This is one of the most harmful decisions I’ve seen come out of the Ed in a long time.”

The Education department says it’s “assessing whether there are alternative pathways to provide relief to borrowers with federal student loans not held by ED.”

The harsh withdrawal of the debt forgiveness from nearly a million or more Americans came on the same day that Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina asked a federal judge to impose an immediate temporary restraining order on entire the debt forgiveness scheme.

The suit specifically attacks the forgiveness of FFEL loans, arguing that doing so deprives private lenders of assets and “the ongoing payments that those loans generate.”

In their lawsuit, the states also more broadly allege that Biden is overstepping his authority by using the 2003 HEROES Act to wipe away the debt. That legislation focused on aiding active duty military service members serving in the war on terror.

“It is inconceivable, when it passed the HEROES Act, that Congress thought it was authorizing anything like the Administration’s across-the-board debt cancellation, which will result in around half a trillion dollars or more in losses to the federal treasury,” the six state attorneys general wrote in their filing.

The estimated cost of the debt forgiveness scheme has already soared in just the first month after it was announced. The Congressional Budget Office says it will cost at least $400 billion over three decades, far above earlier estimates of $300 billion.

Biden’s loan forgiveness proclamation was in keeping with a 2020 campaign pledge, and the announcement was clearly timed to maximize its impact on the midterm election. However, after Thursday’s jolting move by the Biden administration, some 770,000 to 4 million borrowers may be feeling a little less confident in Democratic governance.

READ MORE:

https://www.activistpost.com/2022/09/just-kidding-biden-yanks-student-loan-forgiveness-from-770000-borrowers.html

READ FROM TOP.

FREE JULIAN ASSANGE NOW.............................