Search

Recent comments

- whistleblow.....

11 hours 25 min ago - demosocialism....

20 hours 38 min ago - front cover up....

20 hours 52 min ago - the trick....

1 day 7 hours ago - bibi's wants.....

1 day 13 hours ago - gas snap....

1 day 16 hours ago - challenge....

1 day 17 hours ago - too late....

1 day 18 hours ago - spilling....

1 day 19 hours ago - US bullshit.....

1 day 19 hours ago

Democracy Links

Member's Off-site Blogs

the price of fish and gold: goldfish....

PANIC?

THE SYSTEM IS RIGGED.

We know this…

THE SYSTEM IS RIGGED TO MAKE THE RICH RICHER.

… so?

THE SYSTEM IS RIGGED TO MAKE YOU POORER.

We guess this…

WHAT ARE YOU GOING TO DO ABOUT IT?

Nothing...

CORRECT. NOTHING.

Why?

YOU ARE TRAPPED IN BETWEEN CREDIT AND WELFARE.

Hello?

YOU OWN NOTHING…

What?

THIS HAS BEEN THE PLAN FROM THE WEF (WORLD ECONOMIC FORUM) WHICH WAS DEVELOPED TO BECOME REALITY IN 2030, BUT IT’S ALREADY HERE.

What?

HAVE A LOOK AT YOUR HOUSE DEEDS... YOU DON’T OWN YOUR HOUSE. YOU OWN THE DEBT. THE BANK OWNS THE HOUSE UNTIL THE LAST DIME IS PAID. AND YOU ARE STRUGGLING...

I know that….

LOOK AT YOUR CAR LOAN REPAYMENTS…

Sure…

SEEN YOUR WAGES SHRINK IN BUYING POWER?

Yes.

NOW SEE THE INTEREST RATES GO HIGHER ….

Not as high as inflation…

EXACTLY.

The government and the FEDs are working to reduce the gap...

PIGS ARE FLYING OVERHEAD...

And the Biden government has added nearly 2 million new jobs...

YEP. PEOPLE ARE WORKING SEVERAL JOBS TO MAKE ENDS MEET... WELL PAYING JOBS HAVE GONE...

So?

THE MAJORITY OF THE PEOPLE, MAY BE NOT YOU, ARE SLOWLY BEING PUSHED INTO A STATE OF SLAVISH-INSECURITY.

Not me mate, I work for cash often….

DID YOU NOT KNOW THAT CASH WILL SOON BECOME A “THING OF THE PAST” — PHASED OUT AS ALL TRANSACTIONS (SMALL AND BIG) BECOME DIGITISED?

Including my social welfare benefits?

EVERYTHING… BY END OF JUNE, ALL TRANSACTIONS ABOVE 1,000 EUROS CANNOT BE DONE IN CASH. PENALTY FOR USING CASH, UP TO 20 YEARS IN PRISON.

You’re kidding me!

THAT’S THE IDEA….

So, what can we do?

DO WHAT?

Get out of this system?

YOU’RE TRAPPED. ONLY A FEW CAN ESCAPE. YOU’RE NOT IT.

May as well enjoy life…

MAY AS WELL… UNTIL THEY TAKE YOUR JOY AWAY…. ALL REPLACE BY ENTERTAINMENT AND NEWS...

Eat, shit, sleep, work... Nothing new....

YEP. MORE OF THE SAME....

SEE ALSO:

no need for you exist…… nothing new…..

https://www.youtube.com/watch?v=i4P0n9YS0_E

FREE JULIAN ASSANGE NOW

- By Gus Leonisky at 1 May 2023 - 4:33am

- Gus Leonisky's blog

- Login or register to post comments

"a good thing".....

by INTEL-DROP

Fed Deliberately Throttling US Economic Growth, Jerome Powell Tells Pranksters

The Federal Reserve has embarked on a series of interest rate hikes designed to cool inflation. These efforts have met with mixed success, nearly sparking a massive banking collapse last month. Does Fed officials’ public rhetoric match their private sentiments? A pair of Russian pranksters decided to find out.

The United States stands on the brink of a recession, and a number of shocks either domestically or internationally will push the economy over the edge, Federal Reserve Chairman Jerome Powell has revealed.

Speaking to legendary Russian pranksters Vladimir ‘Vovan’ Kuznetsov and Alexei ‘Lexus’ Stolyarov, Powell also confirmed the Fed’s role in deliberately holding back economic growth and taking other “painful” measures to try to get a grip on inflation.

“What we’re going to find in 2022 was that growth was positive but modest. It was subdued, so you know, one percent, that level. In terms of this year, most forecasts call for the US economy to grow, but at a pretty subdued level – so growth of less than one percent, let’s say,” the Fed chairman said, speaking to who he thought was Ukrainian President Volodymyr Zelensky in a video call.

“But we would tell you that a recession is almost as likely as very slow growth. That’s a fact, and I think that is partly because of us having rates quite a bit. But this is what it takes to get inflation down. To get inflation off of – we had inflation at its highest level in forty years – to get inflation to come down we need a period of slower growth so the economy can cool off, so that the labor market can cool off, so that wages can cool off. That’s how inflation comes down. That’s the only way we know to bring inflation down. And it can be painful but we don’t know of any painless way for inflation to come down,” Powell said.

Global RisksAccording to the Fed chairman, the future of the economy depends on a number of factors, some of which can be foreseen, others not.

“When growth is very slow already, any kind of a shock, any kind of a negative event, whether it be problems with a new Covid strain, or some kind of a terrible event in Ukraine, a turn that we don’t want to see in Ukraine, something like that, some kind of a negative shock – that could put the US economy in recession,” Powell said.

“You ask for risks, the risks are clearly what happens in Ukraine is really going to matter, and clearly what happens in China will matter. In the United States I think we have a risk from this thing you’re reading about – the debt ceiling, you know there’s going to be a big confrontation in the next few months,” the official added, referring to the battle in Congress on legislation to raise the amount of debt the US can legally rack up.

Labor Market Weakening, US Facing Labor ShortagesPowell also confirmed that the US labor market is “weakening,” and that wage growth is falling, but said that’s actually a “good thing.”

“There are some modest signs that the labor market is weakening, for example the number of hours worked per week ticked down a very small amount. That is a sign of a slight softening in labor market conditions. That is true. In addition, wages which have been very, very high…the increases have been declining a little bit, and that’s a good thing, because too high wage inflation causes price inflation. Our mandate is for price inflation, not wage inflation,” the Fed chairman said.

Powell blamed older Americans for dropping out of the labor market and retiring, supposedly because “they don’t want to take any risk on Covid.” They and others who have dropped out have led to a labor shortage, which “makes it hard to get inflation down.”

The state of the economy became a hot topic of debate last year, when the US entered two consecutive quarters of negative growth – which strictly speaking is the definition of a recession. Biden administration officials profusely refused to admit that the US had entered a recession, with the US finishing off last year with growth of 1.1 percent, according to official data. On Thursday, the Department of Commerce reported that growth remained steady during the first three months of 2023, hitting 1.1 percent during the quarter.

The Federal Reserve has faced flak from detractors for slowing growth and nearly causing a repeat of the 2007/2008 banking crisis last month by raising interest rates, which reduced the value of Treasury bonds and forced several major commercial banks into bankruptcy.

READ MORE:

https://www.theinteldrop.org/2023/04/28/fed-deliberately-throttling-us-economic-growth-jerome-powell-tells-pranksters/

READ FROM TOP

SEE ALSO:

https://www.youtube.com/watch?v=cFdc1aP4elc

FREE JULIAN ASSANGE NOW............

duping the public....

BY Eric Zuesse

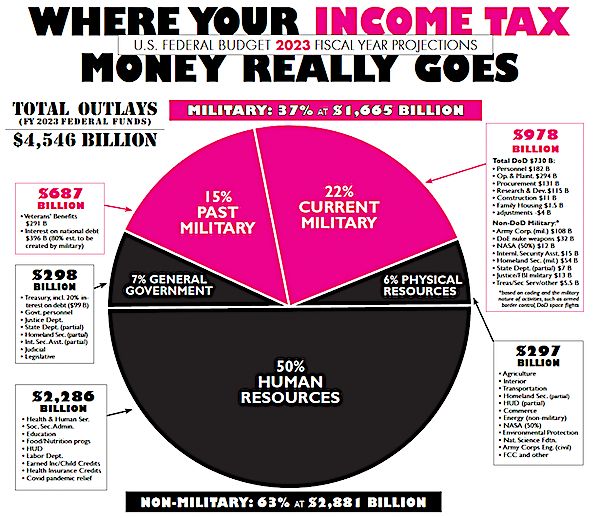

America, which nominally spends around 37% of the world’s military expenses, but actually spends around 50% by financing some of its necessary military expenses in other-than-military (i.e., non-Pentagon) categories, such as the Veterans Affairs, Homeland Security, Justice Department, and U.S. Treasury Department, has, ever since the 1975 termination (and American defeat) in its war against Vietnam, had a long history of losing wars that it had expected to win, and of Pyrrhically (or futilely) ‘winning’ other wars (such as against Iraq, and Libya) that produced nothing but destruction — all costs, and no benefits, to anybody (except to the billionaires in American-and-allied oil, gas, armaments, and high-tech companies). The biggest winners of America’s recent wars have actually been America’s billionaires (look at this graph, which shows that ever since the 1991 termination of the Cold War on Russia’s side, America’s armaments-makers’ profits soared, instead of plunged). But the targeted countries (such as Afghanistan, Iraq, Libya, Ukraine until Obama grabbed it in 2014, Syria, Iran, Venezuela, etc.) experience only destruction from America’s aggressions (coups, invasions, sanctions, etc.), and the American public experience only taxes (and a few corpses, plus many crippled former troops).

All of this is done in order to jack-up, even yet higher, America’s economic inequality (boosting the billionaires’ armament-firms, at everybody else’s expense) — it just grinds the public down, in order to further-enrich America’s billionaires. And none of those invaded countries had ever invaded or threatened to invade the United States! This isn’t merely evil, but it’s been pure waste.

In fact: the U.S. ‘Defense’ Department is the ONLY unaudited Department of the U.S. federal Government; and, routinely, trillions of dollars spent there have gone to persons unknown, for purposes unrecorded. And, yet, the U.S. military is the most-respected of all American institutions, by the (incredibly deceived) American people (since the same billionaires control the press who control the armaments-makers and the extraction-corporations — and select and promote the winning politicians).

By contrast, ever since Vladimir Putin came to power in Russia on the final day of the 20th Century (31 December 1999) — and immediately told Russia’s billionaires that they’d never again control Russia (like they had done under Yeltsin, who was himself controlled by the CIA) and that they would be prosecuted if they even tried to — Russia has never lost a war that it participated in, and hasn’t produced evil results like America has done in America’s 50 “Military Operations” since 1 January 2000. That’s according to Wikipedia’s list. However, the U.S. Congressional Research Service’s 8 March 2022 list of U.S. invasions (including increases in existing invasions), titled “Instances of Use of United States Armed Forces Abroad, 1798-2022”, lists and briefly describes 175 U.S. invasions between the start of 2000 and up till Russia’s invading Ukraine in 2022 (in response to America’s coup that grabbed Ukraine in 2014). That CRS list includes a total of 297 such invasions after WW II (i.e., during 1945-2022, a 77-year period). 244 of the 297 invasions occurred after the Soviet Union ended in 1991 and prior to Russia’s invading Ukraine. Prior to 1945, there were only a total of 163 U.S. invasions, between 1798 and 1945. That’s 147 years. And, then, in the 77-years between 1945 and 2022, there were 297. Obviously, the U.S. Government is insanely aggressive, ever since Truman, under the influence of his hero Eisenhower, started the military-industrial complex in 1947. It took over the country.

The U.S. ‘Defense’ Department (or Pentagon) is the organization that shells out trillions of U.S. taxpayer dollars to buy the phenomenally overpriced products of firms such as Lockheed Martin; and, as a result, Russia, which never privatized its armaments-production but retained Government-control over all of its armaments-manufacturers, doesn’t need to worry about the country’s billionaires when deciding how much and what to spend on its weapons — and (also unlike the U.S.) it does audit where that money went, and who got each ruble that was spent. So: the difference is like the difference between night and day (just as the results have been).

Here are the latest Wikipedia lists of how much each country spent on the “Military” during the latest official year (but notice that the figures shown for the U.S. are ONLY what the Pentagon’s budget was — it’s a considerable deceit, a big understatement):

List by the Stockholm International Peace Research Institute (SIPRI)

2022 Fact Sheet (for 2021)[1]

SIPRI Military Expenditure Database[5]

Rank Country Spending

(US$ bn) % of GDP % of Global Spending

World total 1,981 2.4 100%

1 United States 778.0 3.7 39%

2 China 252.0 1.7 13%

3 India 72.9 2.9 3.7%

4 Russia 61.7 4.3 3.1%

5 United Kingdom 59.2 2.7 3.0%

6 Saudi Arabia[a][b] 57.5 8.4 2.9%

7 Germany 52.8 1.4 2.7%

8 France 52.7 2.1 2.7%

9 Japan 49.1 1.0 2.5%

10 South Korea 45.7 2.8 2.3%

11 Italy 28.9 1.6 1.5%

12 Australia 27.5 2.1 1.4%

13 Canada 20.8 1.3 1.1%

14 Israel 21.7 5.6 1.1%

15 Brazil 19.7 1.4 1.0%

List by the International Institute for Strategic Studies

2022 edition of “The Military Balance” from the International Institute for Strategic Studies (IISS)

Top 15 Defence Budgets 2021[6]

Rank Country Spending

(US$ bn)

1 United States 738.0

2 China 193.3

3 India 64.1

4 United Kingdom 61.5

5 Russia 60.6

6 France 56.8

7 Germany 51.3

8 Japan 49.7

9 Saudi Arabia 48.5

10 South Korea 40.4

11 Australia 31.3

12 Italy 29.3

13 Brazil 22.1

14 Canada 20.0

15 Israel 19.9

For example, to consider SIPRI’s figures: America’s (way understated) 778.0 was 12.6 times larger than Russia’s 61.7; and, if the U.S. military expenditures that had been paid for out of other federal Departments than the Defense Department were to have been included into the U.S. number, that would have instead been around at least a 50% higher figure: 1,167+, or at least 19 times as high as Russia had spent that year on its military. Was America getting a military that was 19 times better than Russia’s?

—————

Investigative historian Eric Zuesse’s new book, AMERICA’S EMPIRE OF EVIL: Hitler’s Posthumous Victory, and Why the Social Sciences Need to Change, is about how America took over the world after World War II in order to enslave it to U.S.-and-allied billionaires. Their cartels extract the world’s wealth by control of not only their ‘news’ media but the social ‘sciences’ — duping the public.

READ MORE:

https://theduran.com/how-and-why-russia-has-come-to-be-such-a-military-powerhouse-2/

READ FROM TOP.

SEE ALSO:

pentagonistan.....

FREE JULIAN ASSANGE NOW............

induced crash.....

Is The Federal Reserve Trying To Cause An Economic Depression?By Michael Snyder

They actually did it. Even though banks are collapsing, the commercial real-estate market is imploding, home sales are plunging, and large companies are laying off workers all over America, the Federal Reserve just decided to raise interest rates even higher. This is nothing less than economic malpractice. They know that higher rates are crushing the economy, but they apparently believe that more pain is needed. Officials at the Fed just hiked rates another 25 basis points, and they are now the highest that they have been since August 2007…

The Federal Reserve on Wednesday raised its benchmark interest rate by a quarter of a point, but opened the door to a long-awaited pause in the most aggressive tightening campaign since the 1980s.

The unanimous decision puts the key benchmark federal funds rate at a range of 5% to 5.25%, the highest since August 2007, from near zero a little more than one year ago. It marks the 10th consecutive rate increase aimed at combating high inflation.

When the Fed raised rates that high in 2007, it didn’t exactly work out so well, did it?

The next year we plunged into the worst economic downturn since the Great Depression.

Now a new economic crisis has begun, and even CNN is admitting that higher rates will make things even worse…

Meanwhile, investors are still coming to terms with the rapid run-up in rates, which sparked a huge sell-off in US government bonds and stocks last year.

Banks that failed to adequately prepare have been hammered. The shifting landscape paved the way for the collapse of Silicon Valley Bank in March and First Republic Bank this week.

More pain could be on the way. The commercial real estate sector, which is very sensitive to high interest rates, looks particularly vulnerable — its problems made worse by a glut of empty office buildings in the wake of the pandemic.

In particular, higher rates will put even more pressure on hundreds of banks that are already teetering on the brink of insolvency.

Retirement Account Guide — FREE REPORTAnd when banks are struggling to survive, they get really tight with their money, and that is why we are now facing a big time credit crunch…

“The data suggest a credit crunch has started,” Morgan Stanley analyst Mike Wilson said during a recent episode of the firm’s “Thoughts on the Market” podcast.

During a credit crunch, banks significantly raise their lending standards, making it difficult to acquire a loan. Borrowers may have to agree to more stringent terms like high interest rates as banks try to reduce the financial risk on their end. Fewer loans, in turn, would lead to less big-ticket spending by consumers and businesses.

If the goal of the Federal Reserve was to curtail economic activity, what they had already done is already working.

So there was no need to hike rates even more.

Just look at some of the things that have happened over the past few days. For example, FedEx Freight has announced that they will be permanently closing 29 locations…

FedEx Freight is closing 29 locations later this year and will begin another round of furloughs for some employees at the end of May, the company announced Monday.

FedEx Freight plans to close the locations and consolidate its operations into other locations effective Aug. 13. When asked about where the locations set for closure are, a FedEx spokesperson said the company did not have “that information to share at this time.”

And Vice Media has announced that it is “preparing to file for bankruptcy”…

Vice Media is preparing to file for bankruptcy – after attempts to find a buyer for a company once valued at $5.7 billion appeared to be going nowhere.

More than five companies have expressed interest in acquiring Vice, The New York Times reported on Monday, but the chances of a sale are seen as increasingly remote.

The decline of Vice comes a little over a week after BuzzFeed News announced its closure, and three months after Vox laid off 130 people, representing 7 percent of staff.

Even GM is feeling the stress of this economic environment. According to USA Today, earlier efforts to reduce their workforce were not sufficient, and so they will be giving the axe to hundreds of contract employees…

General Motors terminated “several hundred” contract employees who worked at its Global Technical Center in Warren, Michigan, and other locations this weekend in its bid to shave $2 billion from its budget by the end of next year.

The cuts come nearly a month after 5,000 salaried employees agreed to a voluntary separation package that GM said would help it achieve close to 50% of its cost-cutting target this year alone and prevent further involuntary cuts.

Meanwhile, more retailers continue to go belly up.

In particular, I was greatly saddened to hear that Tuesday Morning “is going out of business and closing all of its stores”…

Do officials at the Federal Reserve not understand what is going on out there?

It is a bloodbath, and they just made things even worse.

And it isn’t just us. Economic activity is rapidly slowing down all over the world, and officials at the Fed have chosen this moment to sabotage the central hub of the entire global economy.

If we plunge into an economic depression, the entire planet will feel the pain.

We better hope for a miracle from somewhere else, because economic conditions are deteriorating a little bit more with each passing day, and officials at the Fed have made it abundantly clear that they do not plan to help us.

Michael’s new book entitled “End Times” is now available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

About the Author: My name is Michael and my brand new book entitled “End Times” is now available on Amazon.com. In addition to my new book I have written six other books that are available on Amazon.com including “7 Year Apocalypse”, “Lost Prophecies Of The Future Of America”, “The Beginning Of The End”, and “Living A Life That Really Matters”.

READ MORE:

https://www.activistpost.com/2023/05/is-the-federal-reserve-trying-to-cause-an-economic-depression.html

GUS IS A RABID ATHEIST AND A CARTOONIST SINCE 1951

READ FROM TOP.

SEE ALSO:

pentagonistan.....

FREE JULIAN ASSANGE NOW............