Search

Democracy Links

Member's Off-site Blogs

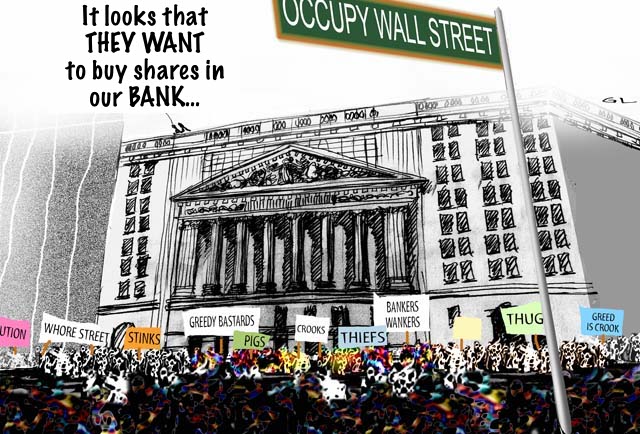

public banking.............

On Fox Business, Shark Tank’s Kevin O’Leary touted North Dakota’s remarkable pro-growth environment with the Nation’s fastest growing GDP per capita. While O’Leary praised North Dakota for its pro-business policies and oil and energy production, he also praised the State for its sovereign public bank, which may seem antithetical for a Reaganite Conservative. Kevin O’Leary deserves scrutiny for being a paid spokesman for FTX, after previously calling crypto garbage, but it is nice to hear a pro-business conservative make a free market case for public banking. O’Leary, who opposed the bank bailouts, considers public banking, a more fiscally responsible alternative to putting the tax payers on the line for reckless banking decisions and moral hazard. There is also much less risk of bank runs, than with fractional reserve banking, where banks are only required to hold a fraction of deposits.

BY ROBERT STARK

There is irony in how some of the strongest populist policies are in conservative Red States like North Dakota, which also has restrictions on mega corporations owning agriculture, much like Alaska’s citizen dividend from oil extraction. On the other hand, the leftwing Jacobin, had an op-ed in support for public banking, granting credit to founding North Dakota’s Public Bank, in 1919, to a leftwing farmers movement. This movement was in response to wheat farmers being preyed upon by private bankers, with the objective of creating a bottom up economy, where the common man could have access to credit, and not be reliant upon Wall Street. Though this left-populist, localist, agrarian, movement, including the Non-Partisan League, were very different from what is considered leftwing today. Overall, there is crossover support for public banking, besides Reagan Conservative, Kevin O’Leary, including the leftist site Jacobin, and Ellen Brown and economist, Michael Hudson, proponents of public banking, in that early 20th Century populist tradition.

While the media and central bankers are downplaying the financial crisis, and even lying that the banks are solvent, there is basically a slow motion crash and bank run, with a flight of deposits from small to large banks. US Bank deposits fell by $12.5 billion over a recent week, and since the beginning of the Fed rate hikes in March of 2022, there has been almost $1 trillion ($967.5 billion) in bank deposit outflows, the greatest recorded outflow ever. 722 US banks also reported unrealized losses, exceeding 50% of capital, because when Fed rates were close to zero, banks used uninsured deposits to both invest in securities and purchase bonds. However, unrealized losses surged when rates rose.

This banking crisis is already worse than the bank failures of 08, with First Republic Bank the 2nd largest bank failure, Silicon Valley 3rd, and Signature Bank the 4th largest in history. Even though 150 banks failed during the Financial Crisis in 2008, this year’s 4 bank failures already equate to nearly the entire amount of assets that financial institutions held during the banking crisis of ’08 and ’09. There is also a risk of a derivatives tsunami, as 25 large US banks have a whopping $247 trillion in derivatives, including regional banks like First Republic. Warren Buffett called derivatives, financial weapons of mass destruction, that could trigger an implosion of the entire financial system.

READ MORE:

IN PREPARATION TO THE DIGITIZ(S)ATION OF MONEY, MANY LOCAL BANK BRANCHES ARE CLOSING ..... MANY CASH MACHINES ARE NOT RUN BY BANKS....

- By Gus Leonisky at 13 May 2023 - 7:51am

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

5 hours 3 min ago

5 hours 35 min ago

6 hours 33 min ago

6 hours 37 min ago

8 hours 20 min ago

8 hours 31 min ago

8 hours 35 min ago

8 hours 42 min ago

20 hours 57 min ago

1 day 1 hour ago