Search

Democracy Links

Member's Off-site Blogs

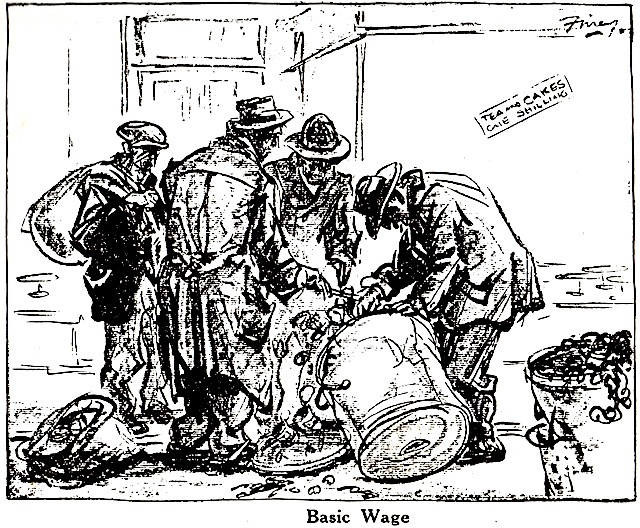

reserve bank in a can....

enough is enough — bring him home......

Increasing interest rates hasn’t quite done the job; now we are told we need to increase unemployment to curtail inflation! Roll on the lunacy of conventional central banking and treasury inflation policy. Can some lessons never be learned?

In 1989, I was a junior member of the Hawke Government Caucus Economic Policy Committee. We regularly wrestled with Treasurer Paul Keating over directions he was taking. The debate was always robust, civil and informed.

I will never forget on one occasion Paul forcefully telling us that “the only way out of poverty is to get a job!” He was 100 per cent correct and nobody questioned the assumption. The focus had to be on reducing unemployment at all costs!

RBA lunacy rolls on

By Neil O'Keefe

By then the flow on from the massive devaluation of 1986 was beginning to seriously hurt. Australia had no previous experience with a floating currency and our economy was not responding “rationally” to the opportunity at the time.

The nation was only just beginning to embark on the massive restructure of technology, skills and capital required to take advantage of the opportunity. The much vaunted “J-curve” was still an apparition on the horizon. Treasury couldn’t understand and account for the “lag” effect of Australian businesses and investors trying to work out what was going on.

The terms of trade and balance of payments were worsening by the month and the “banana republic” was looking like a realistic scenario. So began the march of rising interest rates needed to attract offshore capital to bridge the gap. So serious did it become that many businesses finished up with rates as high as 20% for commercial loans; and housing loans quickly became a cocktail averaging 15-17%.

On the ground as local MP’s we could see the effect beginning to crunch the housing industry and everything that flowed from it. I remember heavy media coverage of a specially convened meeting of our Economic Policy Committee which was calling on the Treasurer to begin pulling off the rates – it had all gone to far!

In one of Paul’s wonderful turns of phrase that evening his media response was to hold the line and describe us an “embroidery on the fabric!” Not too much later it became “the recession we had to have!”

Then came the job of bringing us back from the brink; unemployment back up to 10 per cent and inflation running at 11% with interest rates at 15%. The rest is history. Australians took a massive hit but held in there. 30 years later we have all reaped the benefits of a long period of managed growth with relatively low unemployment and historically low interest rates. All helped along by a healthy flow of immigration.

Surely, we can learn something from all this. Our current dilemma is not caused by the massive long term, structural failure of an insulated, hesitant nation afraid of Asia and wedded to the old Empire – not only culturally – but also for trade and investment.

We took 15 years to begin standing on our own two feet and embracing our new place in the world as part of Asia. Apart from Japan (which had already been there) these leading Asian economies have been growing at 6-8% p.a. for years while we panicked about a potential wages explosion if growth got ahead of 3%.

The current circumstances have been caused by a short-term global pandemic with flow through exposures that we have to respond to – supply chain and labour shortages – but issues that will quickly moderate.

Instead of needing to increase interest rates to absurd levels to attract capital we now have over $3 trillion sitting in super funds – a long term capital reserve that just did not exist in our economy 40 years ago.

It is probably already too late. I suspect the failure to understand “lag effect” is again in place and we may have overshot the mark for a second time. Sure, there have been other policy failures which are front and centre now. The massive housing shortage caused by government having abandoned investment in public housing is obvious to us all now. But the responses are beginning to happen and again the building industry will be the key accelerator – but with a much better social focus now that public housing is back in the game.

To most people I would think sacking workers seems “counter intuitive” to growing the economy. It certainly does to me. Under no circumstances should any of us accept a theory that we need more people out of work to restore opportunity in our economy. We simply do not need a sustained attack on the jobs of people at the bottom end of the labour market to keep our inflation and growth at 3%.

We have got unemployment down to 3.5 per cent; let’s try to do even better. The interest rates will fix themselves!

https://johnmenadue.com/rba-lunacy-rolls-on/

- By Gus Leonisky at 22 Jul 2023 - 5:21am

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

11 hours 57 min ago

12 hours 13 min ago

14 hours 4 sec ago

14 hours 42 min ago

19 hours 26 min ago

20 hours 42 min ago

21 hours 23 min ago

22 hours 19 min ago

1 day 7 hours ago

1 day 7 hours ago