Search

Recent comments

- arseholic....

1 hour 56 min ago - cruelty....

3 hours 13 min ago - japan's gas....

3 hours 53 min ago - peacemonger....

4 hours 50 min ago - see also:

13 hours 51 min ago - calculus....

14 hours 5 min ago - UNAC/UHCP...

18 hours 45 min ago - crafty lingo....

20 hours 9 min ago - off food....

20 hours 18 min ago - lies of empire...

21 hours 18 min ago

Democracy Links

Member's Off-site Blogs

the value of trust .....

Wall St up and down as Aust dollar slumps …..

It has been another testing night on global financial markets.

Stock prices on Wall Street have slumped, then recovered, while the Australian dollar has been subjected to another drubbing.

- By Gus Leonisky at 17 Aug 2007 - 7:14pm

- Gus Leonisky's blog

- Login or register to post comments

Chips as cheap...

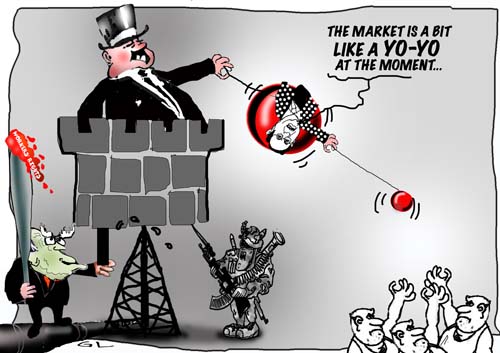

I drew this cartoon (see above) at least a couple of weeks ago... Before the "subprime" collapse in the US... There were signs that things were going to be a bit shaky on a larger scale. Although it needed not to be "so severe"... it had to be. I saw, or sniffed, many heavy financiers wanted a "correction" because they were ending up with to much illusions in their own real pockets — illusions mostly designed to cream the riff-raff from their little cash, little cash that in cosmic numbers end up to a sizeable loot... These rich people want real hard nuts in their squirel's nests... In fact, any movement in the stock market is beneficial to the few of the chosen elite, those who know how to bet mullah like peanuts shells on the high roller-floors of the casino of life...

Since the wobbles, Costello, Howard and the head of the Reserve Bank made a meal of idotic statements with predictable platitudes, as values went down like a Titanic on slow-mo. The whole thing was forseeable. especially the quake from the lending of unsecured moneys for real estate, in the US and here... As mentioned before on this site, the whole stack of card is build on the sand of far too much credit. Not only too much credit, also too many trade deficits cleverly devised to make government look good but hidden in national interest jargon to calm the consuming hordes.

Today, our Costello — or was it a financial wartlock — mentioned that "restrained wages acted as a calming factor", "wages that had been stable in Aussieland because of confidence in the economy", showed the price of their rotten fish... They're talking crap. Wages are pegged down by fear — fear of losing one's job in an uncertain framework for the ordinary person despite the "high employment" figures that count people working at least one hour a week... All because there is no safety net whatsoever below one's butt...

Yes, those with big bucks in their pocket will collect 200.00 bucks more as they pass through GO, while the ordinary punter who borrowed to play a losing round, loses his shirt and pants... and may go to jail...

In the picture above I show how the market is being played, with the rich guys being propped up by governments (including the assassination of workers rights and the release of "more cash" to calm things down), the rich guys also propped by invading armies and wars, and the mercantility of oil wells... as long as there is money at every turn.

The whole subtle collapse was tweaked with a "blame the Chinese for faulty goods" "coincidence"... In my books this was no "coincidence"... Had the stock market got that wobbly, without a hammering of the Chinese, the Chinese would have had the upper hand in this game of chips, since they own a lot of US dollars... They might have called the cards... They had to be sidelined with a bit of useless footwork (the "faulty" products would have had to be known for a long while...) Add two and two and somewhere someone is cashing five, while we loose one... Simple mathematics...

talking of safety nets Gus .....

from alan ramsey …..

No waiting for the future for top bananas

When the Howard Government sold off what was left of Telstra last year it put the proceeds of $17.6 billion in what it grandly called the Future Fund. We'd adopted the idea from Kiwiland, where the original had been called the New Zealand Superannuation Fund, but John Howard and Peter Costello thought Australians would embrace it more enthusiastically if they thought the Future Fund was "theirs", as the whole of Telstra had once been, and not just a monster pot of money to finance the superannuation of federal politicians, bureaucrats and our armed forces, which is what the FF really is.

Future Fund has a nice populist ring.

The fund already holds $52 billion. It's been fattened by budget surpluses from general taxation in the past two years, but it still has far to go to meet the Commonwealth's unfunded superannuation liability of about $100 billion, projected to reach $126 billion in 2020.

The fund's trust chairman is David Murray, former well-heeled head of the Commonwealth Bank - another people's asset long ago flogged off - and the fund is to be run by the Chicago-based Northern Trust Corporation, whose management fees will rake in for it an estimated $20 million a year.

Thank you, Australian taxpayers.

You cop it coming and going.

Two days ago Costello announced the Government will legislate to stop a Rudd Labor government "raiding" the Future Fund for national infrastructure, like its proposed broadband network. Well, here's a jolly tale about two others already effectively raiding it.

Andrew Rafty is a Mosman financial planner, son of Tony Rafty, OAM, World War II war artist and former Fairfax cartoonist. Andrew emailed me on Thursday: "I'm sorry, but I hope the following doesn't boil your blood too much. In your last two columns regarding the recent politicians' salary increase, you did not mention the increase in their superannuation entitlement, and the July 1, 2007, superannuation 'simplification' tax savings benefits from age 60. Most federal MPs are still members of the extremely generous Parliamentary Contributory Superannuation Scheme.

"John Howard's current pension entitlement is estimated at $217,000 a year. I have estimated his additional pension entitlement from the July 1 salary increase - indexed and 83 per cent reversionary - is worth another $14,500 a year to him and, after his death, $12,100 of it reverts to Mrs Howard, based on his estimated life expectancy of another 15.5 years and [the younger] Mrs Howard's of another 23 years.

"According to a major insurance company, it would cost approximately $360,000 to buy an indexed and reversionary pension of $14,500 a year from the private sector.

"Moreover, from July 1 this year, the 'simplified' superannuation legislation provides a 10 per cent rebate to the unfunded portion of the indexed parliamentary pension from age 60 - in Howard's case, a rebate of approximately $20,000 a year. Assuming 15.5 years further life expectancy this is equal to a total tax saving of $300,000. Plus, the latest salary increase provides an additional $22,000 rebate over the same 15.5 years. (These figures exclude the potential reversionary benefit to the longer-living Mrs Howard.)

"Costello's benefit, as with younger politicians, is potentially greater. His current taxpayer-funded pension is estimated at $147,000 a year. The recent salary increase will increase this entitlement by approximately $10,000 a year. To purchase a pension of $10,000 a year (indexed and reversionary) from the private sector would currently cost at least $430,000.

"On top of this, Costello's recent 'simplified' superannuation measures reduce his tax bill by approximately $15,000 a year from age 60. Given a 60-year-old has an average life expectancy of another 22 years, the total tax saving over the 22-year period to Peter Costello would exceed $300,000.

"So, with the salary increase - plus the tax breaks initiated by the Treasurer and estimated to exceed, in total, a combined, accumulative tax benefit to Howard and Costello of $600,000 from July 1, 2007 - the Remuneration Tribunal has indirectly awarded an equivalent capitalised retirement gift of approximately $800,000 to B1 and B2, who most probably will leave politics if the opinion polls prove correct."

All up, $1.4 million. For two of them.

What was that about boiling blood?

More cream cake for the fat kid

Wall St surges after Federal Reserve steps in

United States stocks have surged to end a turbulent week, after the Federal Reserve cut the discount rate it charges banks in an emergency move to stabilise credit markets and keep the economy on track.

-----------------

Gus: the kid , Fatboy Bigface, is so fat he can't walk. Actually he won't walk.. but he's hungry... Mum goes to the fridge and brings him a double slice of cream cake, a super-sized "diet" soda... and a tub of ice cream... "thanks mum"... His sister suffers from anorexia — possibly self inflicted, possibly from the sight of lazy brother mumbling that it's not his fault he's fat... "it's genetic"... She's trying to prove him wrong, but only harms herself in the process. But who cares... Next door, the neighbours are fighting as usual. The crockery is flying and crashing on the floor... With the remote, Fatboy turns the TV sound up a couple of notches... "Stuffyarface Hamburgers are best...". The music is enticing... Fatboy drools... and dreams of more lard...

Whatever...

Unison "surprise"...

Yes John,

am I the only moron on earth who wasn't "surprised" by the Fed move in the US — to undo the notches on the belt of the trousers of Fatboy... ??? Why is every report around the world saying "surprise!"?

More cheap than cheaper?

In the blog above "chips as cheap" I make this remark in regard to the stock market wobbles...

"The whole subtle collapse was tweaked with a "blame the Chinese for faulty goods" "coincidence"... In my books this was no "coincidence"... Had the stock market got that wobbly, without a hammering of the Chinese, the Chinese would have had the upper hand in this game of chips, since they own a lot of US dollars... They might have called the cards... They had to be sidelined with a bit of useless footwork (the "faulty" products would have had to be known for a long while...) Add two and two and somewhere someone is cashing five, while we loose one... Simple mathematics..."

The problem is complicated by our desire to pay nothing for anything. In fact despite "problems" with some of Chinese made goods, proportionally the picture is there is no more faulty Chinese-made goods than we manufacture ourselves (here and in the US), and probably less... But we're still prepare to hammer them for that. The truer picture is that even most of the Chinese themselves are working hard at providing quality and safe goods... — although I know of some crook stuff made in Tawain in the 70s that was pretty horrible but it set the trend and our taste for "cheap goods"...

In a report on tele, shot in front of a dedicated staff making safe toys in a Chinese factory, the reporter said there is a Chinese proverb going like this: "you get what you pay for..." As I have mentioned before there is a limit to the price at which even chinese goods can be made and it's more our fault as "consumers" (read retailers in search of cheap goods to flog in quantity at a higher margin — for example something that could be sold for 4 bucks with a 100% profit margin is sold at 6 bucks, but consumers would not be too worried for that, as should we be making the goods here, we may have to pay 25 bucks or more for it...)

------------------

The downside of the $39 DVD player

By Christopher Zinn

The case of the Chinese-made "toxic" bibs was always likely to engender more alarm than actual peril. In the wake of the Mattel toy recall, new tests emerged showing that vinyl bibs sold in the United States under the Koala Baby brand contained tiny traces of lead.

The amounts involved apparently violated the safety standards of the retailer Toys 'R' Us but not those of the US Government. The federal Consumer Product Safety Commission's tests found an infant would have to touch the bib at the unlikely rate of at least 2,500 times a day to absorb dangerous levels of lead.

The coincidence of baby product, lead and most of all "Made in China" guaranteed there would be a high profile recall by the retailer. An overreaction or sensible precaution?

Bundled with recent stories about other product safety issues from China - toys containing lead paint, textiles adulterated with formaldehyde and even toothpaste containing poisonous diethylene glycol - it's hardly surprising the alarm bells have gone off.

But the temptations of Chinese products are many and the customers keep coming. The $2 hammer, the $21 shirt and now even the $39 DVD player. These products might break, fray and jam but the bargain basement prices fit the ethos of our disposable age regardless of the impact on our own tool, textile and electronic industries.

------------------------

Gus: We're paying for what we pay for... and the correction in the stock market might have a secondary effect... More fat to the credit-kid to buy "more-safe" Chinese made goods...

personal debt milestone around the neck

Britons have racked up so much debt on loans and credit cards that the total borrowed now exceeds the entire value of the economy, new research shows today. The financial consultant Grant Thornton is forecasting that gross domestic product (GDP) will hit £1.33 trillion this year, less than the £1.35trn which was outstanding on mortgages, credit cards and personal loans in June.

The symbolic overtaking is the first time that the country's 60 million people owe more to the banks than the value of everything made by every office and factory in the country. It prompted a warning that personal borrowing was so out of control that many more people would be pushed over the "financial edge". The runaway housing market is the biggest reason why consumer debt has spiralled, totalling £1.131trn. Debt on personal loans and credit cards totals £214bn. Overall, individuals owe the staggering sum of £1,344,721,000,000.

collateral damage

The credit crunch has claimed its first high-profile resignation in the UK with the departure of Barclays' head of European collateralised debt obligations (CDOs), the explosive debt products that have helped to cause the meltdown.

Edward Cahill, who ran the European CDO business at Barclays Capital, Barclays' investment banking business, resigned on Monday. On Wednesday, two investment funds set up by his business had their credit ratings slashed by Standard & Poor's, the rating agency, because of losses from investments in US mortgage-backed securities.

other people's money

By FLOYD NORRIS

Published: October 16, 2007

The biggest banks in the United States, with active encouragement from the Treasury Department, unveiled a plan yesterday to keep the housing-related debt crisis from worsening.

The plan calls for the banks to create a new financing vehicle to try to restore confidence and reduce the risk of a market meltdown by propping up an important part of the debt markets. But the banks hope to take minimal risk and avoid actually investing any of their own money.