Search

Recent comments

- dumb blonde....

4 hours 55 min ago - unhealthy USA....

5 hours 28 min ago - it's time....

5 hours 50 min ago - pissing dick....

6 hours 8 min ago - landings.....

6 hours 20 min ago - sicko....

19 hours 9 min ago - brink...

19 hours 25 min ago - gigafactory.....

21 hours 11 min ago - military heat....

21 hours 54 min ago - arseholic....

1 day 2 hours ago

Democracy Links

Member's Off-site Blogs

stock manipulation....

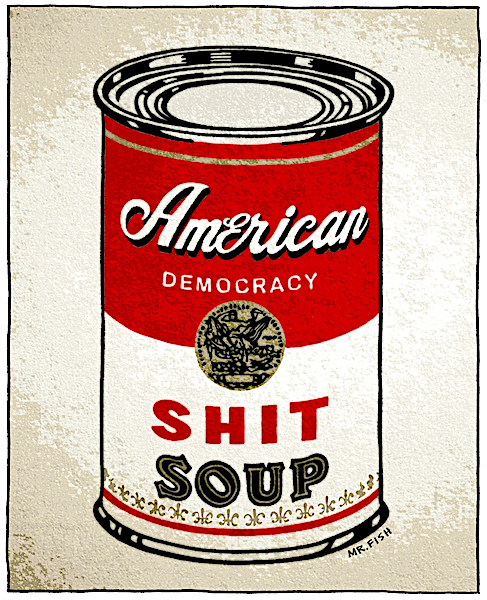

There comes a time in the history of a nation when extreme inequality turns into pillage. If economic power is concentrated so is political power, and the wealthy are able to do whatever they damn well please. They can lie, cheat, and steal because they know they won’t be held to account.

Have the super-rich now taken control of our political and economic systems? Some current news makes me worry.

By Les Leopold / Substack

They’ll stone you when you’re at the breakfast table.

They’ll stone you when you are young and able.

They’ll stone you when you’re tryin’ to make a buck.

They’ll stone you and then they’ll say good luck.

from “Rainy Day Women #12 and 35,” Bob Dylan

Let’s start with the food industry, the food cartel that includes General Mills, PepsiCo, and Tyson, which has been jacking up prices non-stop since 2020. Why are food prices up 25 percent since then?

These giants blame supply chains, the rising costs of labor, and the rising prices of other inputs required to produce and distribute their products. It’s not their fault, they say. But the real culprit, upon closer examination, is stock buybacks, another word for stock manipulation. These firms are fleecing shoppers by raising prices and then using the cash to buy back their own stocks, thereby increasing the market value of each share. Stock buybacks do not increase the value of a company, but they move money effortlessly to the largest Wall Street shareowners and to a company’s top executives, who receive most of their compensation via stock incentives.

As food prices shot up by 25 percent, “the ten largest grocery and restaurant brands have together returned or pledged to return more than $77 billion to shareholders,” reports Veronica Riccobene in her excellent article “Big Food, Big Profits, Big Lies.”

In related news, California fast-good giants have claimed that the state’s 2023 minimum wage law, which raised wages from $16 to $20 per hour, killed 10,000 jobs. A closer look, picked up by the LA Times, showed that the industry cooked the numbers by comparing employment in September with December. But in every year, September is in the peak dining out season, and in December people dine out least. When adjusted for seasonal variation or compared with the employment levels exactly one year earlier (both standard ways of measuring employment levels) the number of jobs actually increased by 7,000 after the minimum wage law was enacted.

Boeing recently crashed into the news again, when its CEO, Dave Calhoun, was roasted by a couple of congressional committees about its shoddy production processes. There were plenty of outraged performances, but none of the oh-so-self-righteous lawmakers had the cajónes to ask about the impact on safety of Boeing’s $61 billion in stock buybacks or about how about Calhoun hauled in $30 million in stock incentives while Boeing lost $1.6 billion in 2023. Is it possible that maybe, just maybe, Boeing financed those buybacks by laying off workers, moving work to lower-wage sub-contractors, and cutting safety corners? Radio silence from Congress. (See “Did Stock Buybacks Knock the Bolts Out of Boeing?”)

Then there’s the way Wall Street squeezes out new home buyers by gobbling up houses and turning them into rentals. (See “Wall Street to Working-Class Homebuyers: Fuggeddaboutdit!”)

Let’s not forget that John Deere recently announced moving jobs from the US to Mexico while feasting on government contracts and, of course, using job cuts to finance stock buybacks.

Do we have to even mention how Big Pharma is charging us more than it does Canadians, or how health insurance companies collude to fix prices, or how giant hospital chains over-charge us with impunity?

They rip us off to feed their profits, which then gets shipped to the richest of the rich via stock buybacks. Of the $3 trillion in after tax US corporate profits in 2022, about $1.31 trillion went to stock buybacks. In 1980 there were 13 US billionaires. Now there are 748.

None of this is accidental. Stock buybacks were deregulated in 1982. That’s when Wall Street began its financial war on workers and got filthy rich. (See my new book for the gory details.)

Corporate WelfareJust hearing that phrase makes me nauseous because it’s a stark reminder of how feeble we are. Progressives have been complaining about government giveaways to large corporations at least since the 1970s and the practice has only grown worse.

I’ll bet you already know how bad it is. We taxpayers give the oil industry about $20 billion a year in subsidies while BP, Shell, Chevron, Exxon Mobile and TotalEnergies plow $104 billion worth of dividends and stock buybacks into the pockets of their shareholders (2022). Wall Street may be getting as much as $800 million a day via the Federal Reserve, according to one report. I have yet to find a credible source that adds it all up. I’m guessing it’s well over a trillion dollars a year in direct subsidies, tax breaks, and financial market supports. To rub it in, the richest corporations have successfully lobbied for so many tax loopholes that they pay little or nothing at all. (See here and here.)

“But wait,” they tell us, “Tax cuts and subsidies create jobs.”

That’s the biggest and most painful lie of all. Since the deregulation of Wall Street, corporations have been on a job killing spree. Stock buybacks are financed with job cuts. More than 30 million of us have suffered through mass layoffs (defined as 50 or more workers let go at one time) since 1996. Kill the jobs, save some money, buy back your stocks, put the money in your pocket, rinse and repeat.

Working Class Revolt?We’re nowhere near any kind of organized mass uprising. But American workers are not stupid. They may not be able to spell out in detail how they are getting ripped off, but they know it’s happening. Most importantly, they understand that the government works for the rich and not for them. That’s why so many are willing to support train-wrecking outsiders who attack the government, even when they are anti-worker billionaire buffoons. In 1964, 77 percent of Americans had trust in the federal government. Now it’s 16 percent.

We’re living with the results of the collapse of countervailing working-class power. In 1955, 35 percent of the private sector workers were in labor unions. Today it’s only 6 percent. That means there is no organized mass of working-class folks with enough power to stop corporate looting.

I hate to be alarmist, but we’re really in bad shape and it is likely to get worse. Power is so tilted towards the rich that more and more people are giving up on politics, leaving the field open to the modern-day robber barons. This corrupt environment is a petri dish for conspiracy theories and hate.

Somehow, somewhere, a new working-class movement has to emerge. I’ve been begging progressive labor leaders to start a new organization that would fight against mass layoffs and for workers who are not in unions. (How about Workers United for Justice?)

While labor unions must organize shop by shop, they should also acknowledge that labor law is so tilted against workers, that it will be very difficult to make major inroads into the 94 percent with no union protection. We need a new parallel path to connect with these workers that doesn’t involve years and years of costly combat within a rigged labor law system.

Victims of mass layoffs are everywhere. They need a voice. They need an organization that will fight for them. If leaders like Shawn Fain of the United Auto Workers and Sara Nelson from the Flight Attendants reached out to non-union workers who are getting crushed by Wall Street stock buybacks, those workers just might come running.

Until we rebuild large scale working-class power, it’s going to be a very rough ride. If we have learned anything at all since 1980, it’s that greed begets greed. The super-rich always want more and they’re not shy about grabbing it, even if democracy crumbles all around them — and us.

This newsletter free. But if you’d like to donate by becoming a paid subscriber, all the funds go to the Labor Institute’s Political Economy for Workers program, and not to me. Same for my book royalties. Many thanks.

https://scheerpost.com/2024/06/24/les-leopold-capitalism-runs-wild-a-rant/

FREE JULIAN ASSANGE NOW....

it's time for being earnest.....- By Gus Leonisky at 25 Jun 2024 - 9:34am

- Gus Leonisky's blog

- Login or register to post comments

psyopcracy.......

By Joe Lauria

Cathy Vogan, executive producer of Consortium News‘ webcast CN Live!, coined a new term to describe rule by psyops, or psychological operations: psyopcracy. And Consortium News‘ existence is devoted to fighting it.

According to Wikipedia:

“Psychological operations (PSYOP) are operations to convey selected information and indicators to audiences to influence their emotions, motives, and objective reasoning, and ultimately the behavior of governments, organizations, groups, and individuals.

The purpose of United States psychological operations is to induce or reinforce behavior perceived to be favorable to U.S. objectives.”

William Casey, C.I.A. director under Ronald Reagan, said: “We’ll know our disinformation program is complete when everything the American public believes is false.”

Thus the American people are continuously subject to a number of psychological operations otherwise known as “the news.” Combating these false constructs of the world through media is Consortium News‘ mission.

U.S. intelligence officials feed journalists disinformation to create a false narrative that is intended to mislead the public and cover-up what is actually taking place.

The constant reinforcement of these lies becomes entrenched in the public mind and after time comes to be accepted as unquestionable truth.

Here’s an explanation of how the C.I.A. did it in Vietnam: SEE VIDEO

https://www.youtube.com/watch?v=UwerBZG83YM

Through such operations, the American people were led to believe for years that the United States was winning in Vietnam, when it was actually losing, as the Pentagon Papers proved.

Since then, many examples have followed of completely false stories being planted into people’s minds to start and keep a war going, the fake WMD narrative in Iraq perhaps the most infamous.

Today the wars people are being fooled about are in Ukraine and Gaza.

Sometimes a psyop doesn’t involve inserting false information, so much as leaving out what’s true.

The American people, and by extension people around the world, have been led to believe that an unprovoked Russian madman started the war in Ukraine.

That’s because they are purposely not told that the war actually began in 2014 after a U.S.-backed coup in Kiev led Russian speakers in Donbass to declare independence, after which the coup government militarily attacked them.

Other facts are removed from the story, such as Russia’s proposed treaties with the U.S. and NATO in December 2021 that would have prevented Russia’s intervention in the Ukrainian civil war.

The history of Israel’s ethnic cleansing of Palestine is also whitewashed to lead the U.S. public into believing that Israel is the “victim” that is only “defending itself.”

Robert Parry, the founder of this website, in March 2017 wrote the article, “How US Flooded the World with Psyops,” in which he reported for the first time:

“Newly declassified documents from the Reagan presidential library help explain how the U.S. government developed its sophisticated psychological operations capabilities that – over the past three decades – have created an alternative reality both for people in targeted countries and for American citizens, a structure that expanded U.S. influence abroad and quieted dissent at home.

The documents reveal the formation of a psyops bureaucracy under the direction of Walter Raymond Jr., a senior CIA covert operations specialist who was assigned to President Reagan’s National Security Council staff to enhance the importance of propaganda and psyops in undermining U.S. adversaries around the world and ensuring sufficient public support for foreign policies inside the United States.”

So many people are subject to psyops that telling the truth becomes a formidable task. You become the one that is out of step. You are the one that seems to be mad.

Consortium News‘s mission since 1995 has been to fight against psychological operations that have come to rule over Americans, convincing them of all manner of falsehoods, such as that their nation is motivated by humanitarian and democratic principles in the world rather than naked greed and a lust for domination.

And that the Ukraine war was unprovoked and Israel is just defending itself.

Help us fight the psyopcracy.....

https://consortiumnews.com/2024/06/22/help-us-fight-the-psyopcracy/

READ FROM TOP

FREE JULIAN ASSANGE NOW....

it's time for being earnest.....

the altar of profit.....

Global Debt Sacrifices the World’s Poor on the Altar of ProfitThe developing world owes a total of $29 trillion to richer nations. Fifteen countries spend more on interest payments than they do on education, and forty-six spend more on interest than they do on health. It’s time for a global debt reckoning.

Shortly before his assassination in 1987, Burkina Faso’s president, Thomas Sankara, issued a warning. Rich nations, he said, were deftly deploying debt to control the developing world. Sankara urged a united front against Africa’s creditors — the only way to fight back against the “technical assassins” of private creditors and multilateral lenders that had handed out money to unscrupulous leaders and then demanded steep cuts and sacrifices to ensure repayment, all in the guise of helping poorer countries. “Debt is a skillfully managed reconquest of Africa, intended to subjugate its growth and development through foreign rules,” Sankara told the assembled delegates of the Organization of African Unity.

Earlier this month, also in the guise of helping poorer countries, the International Monetary Fund (IMF) concluded a review of its deal with Burkina Faso. “The authorities are progressing in their fiscal consolidation efforts,” the IMF announced, with an approving nod to “the creation of fiscal space for priority spending.” In other words: the financial colonization of the world is back on track.

Sankara is long dead, but the system he railed against nearly forty years ago has only become more dominant. In a UN Trade and Development (UNCTAD) report earlier this year, the organization put the total debt burden of the developing world at $29 trillion dollars, a sum unlikely to come down any time soon as nations face high borrowing costs and as climate risks loom.

Sky-High Interest RatesPart of the problem is sky-high interest rates, which raise borrowing costs for countries selling debt right now. In a quixotic bid to tame inflation, developed-nation central banks from the Federal Reserve to the Bank of England have opted to keep these benchmark lending rates elevated and — for now at least — stuck there, forcing countries that want to attract investors to offer similarly elevated returns.

And those borrowing costs are showing up in the data. A combination of rates and mounting debt burdens has pushed annual interest payments to a staggering $847 billion, according to UNCTAD — a direct transfer of wealth from government coffers to (mostly) private investors. That’s double what it was a decade ago. UN data shows that fifteen nations spend more on interest payments than they do on education. Meanwhile, forty-six spend more on interest than they do on health.

Loan Shark–Infested WatersFortunately, when countries fall into debt distress, there’s a fail-safe. Unfortunately, it’s the IMF.

While the IMF frequently downplays its history of demanding deep spending cuts that sacrifice the poor for the good of the market (indeed, the IMF’s own internal research shows that such “structural adjustment” policy is counterproductive), the practice never really ended. In an Oxfam analysis released last year, the advocacy and research group found that for every dollar the IMF encouraged governments to spend on public services, it told them to cut six times as much through austerity measures. Late last year, Oxfam also calculated the total cost: over half of the world’s poorest countries will have to cut spending by a total of $229 billion over five years.

For developing nations, the upshot of all of this is that as debt burdens grow, they’re forced into belt-tightening austerity to pay back investors. When the debt burden gets too high, they’re forced into an IMF loan, which in turn forces them into more austerity to pay back investors yet again. When a dramatic economic crash follows, the IMF loans may roll over and the terms may get stricter as the IMF becomes a de facto insurance policy and enforcer for private investors.

The IMF did not respond to a request for comment for this story.

The Private MarketAnother piece that makes the issue so intractable is those same private investors. Whereas previous global debt relief efforts could write off bilateral debts (that is, country-to-country loans) and get rid of a good chunk of debt for the poorest nations, the debt crisis of 2024 isn’t so simple. Now, most developing-nation debt is held by private creditors who are universally unwilling to sacrifice a cent more than absolutely necessary.

The UN estimates that 61 percent of outstanding debt across developing nations is in private hands. Latin America is in the worst shape on this measure — fully 73 percent of the region’s debt is held by private investors. That makes negotiating a meaningful, large-scale end to the debt hangover challenging, verging on impossible.

None of this has escaped notice in Latin America itself. Just last week, marchers overturned cars and hurled Molotov cocktails in violent clashes on the streets of Buenos Aires to protest President Javier Milei’s brutal austerity measures (Milei, who named the dogs he cloned after libertarian economists, often showed up at campaign rallies brandishing a chainsaw and promising to slash spending). The Argentine demonstrators have joined a wave of anti-austerity movements across the world, from Kenya to Pakistan, as the reality of unpayable debt burdens bites harder.

Halfway MeasuresUnsurprisingly, the road ahead is littered with halfway measures. UNCTAD, for example, recommends everything from “make the system more inclusive” (symbolic and mostly meaningless) to “create an effective debt workout mechanism.” Any number of such mechanisms in virtually any combination would help: reforming the IMF and eliminating the unhinged system of surcharges, changes in credit rating company approaches that raise the cost of debt, and simplifying negotiations for countries in severe debt distress would all benefit the poorest nations. But it’s still not enough.

The solutions that would meaningfully change things — a massive debt forgiveness campaign, reparations for centuries of colonization, and a fundamental rewrite of the world’s financial architecture and trade rules — appear laughably far off. Some activists, however, retain a small degree of hope.

Jason Braganza, the executive director of the African Forum and Network on Debt and Development, says that he senses a debt reckoning ahead that will require some kind of forgiveness campaign.

“I feel that we’re not far from a moment of debt cancellation, but on a case-by-case basis,” he said in an interview with Jacobin, adding that the demands of climate change will only make the situation worse. “If we don’t fix the structural, systemic challenges, then we are going to start seeing countries saying, well, we cannot finance each other, we cannot finance a transition. We need cancellation.”

https://jacobin.com/2024/06/global-debt-poor-credit-austerity

READ FROM TOP