Search

Recent comments

- corrupt....

2 hours 34 min ago - laughing....

4 hours 28 min ago - meanwhile....

5 hours 57 min ago - a long day....

7 hours 51 min ago - pressure....

8 hours 38 min ago - peer pressure....

23 hours 57 min ago - strike back....

1 day 3 min ago - israel paid....

1 day 1 hour ago - on earth....

1 day 5 hours ago - distraction....

1 day 6 hours ago

Democracy Links

Member's Off-site Blogs

moscow remains open to resolving the Ukraine conflict diplomatically....

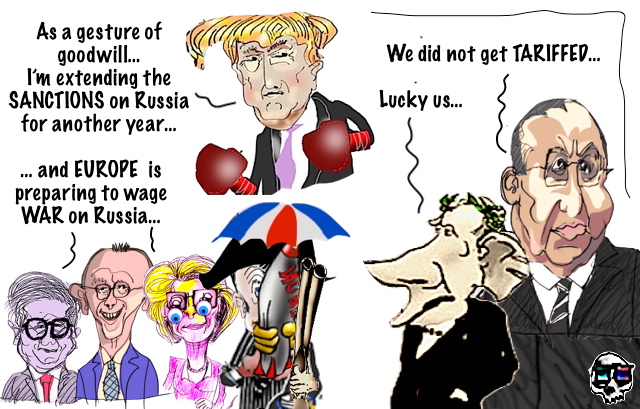

President Donald Trump has prolonged US sanctions on Russia for another year, based on the supposition that Moscow still poses a serious threat to the country’s national security.

Washington placed punitive restrictions on Russia after it absorbed Crimea following a referendum held in 2014, and later over Moscow’s alleged meddling in American elections. The sanctions were drastically expanded following the escalation of the Ukraine conflict in February 2022.

The latest extension approved by Trump and dated April 10, 2025, has been posted to the Federal Register’s website, announcing the “Continuation of the National Emergency With Respect to Specified Harmful Foreign Activities of the Government of the Russian Federation.”

It refers primarily to Executive Order 14024 signed by former President Joe Biden in April 2021 in response to an “unusual and extraordinary threat to the national security, foreign policy, and the economy of the United States” presumed to be posed by Russia.

Among the “harmful” activities ascribed to Russia in the document are “efforts to undermine the conduct of free and fair democratic elections and democratic institutions in the United States and its allies and partners.”

Some of Moscow’s other alleged transgressions are attempts to “undermine security in countries and regions important to United States national security; and to violate well-established principles of international law, including respect for the territorial integrity of states.”

Late last month, the US president lamented that there was still “a lot of ill will between” Ukraine and Russia.

Trump has also threatened to impose new sanctions on Moscow if he deems Russia responsible for any failure in ceasefire talks on the Ukraine conflict.

Commenting on Trump’s threat, Kremlin spokesman Dmitry Peskov said last week that “our dialogue with the American side is ongoing,” and that Moscow remains open to resolving the Ukraine conflict diplomatically.

In mid-March, the US president proposed a pause on strikes against energy infrastructure, which was publicly supported by both Moscow and Kiev. Russia has accused Ukraine of breaching the ceasefire, but has reiterated its aim to uphold the partial truce in order to build relations with the US.

https://www.rt.com/news/615683-trump-extends-russia-sanctions/

================

Euro-Atlantic international organizations have failed to deliver stability and security to the region, and now their members are preparing for a major new war, Russian Foreign Minister Sergey Lavrov has said.

The top diplomat delivered the remarks on Saturday during a Q&A session at the Antalya Diplomacy Forum in Türkiye. Lavrov criticized what he described as “Euro-Atlantic structures,”including the EU and Organization for Security and Co-operation in Europe (OSCE), stating that the groups have ultimately failed to deliver on their proclaimed goals.

“The security issues after the Second World War in our common region were defined in terms of Euro-Atlantic logic. NATO and the EU were essentially European,” Lavrov said.

“The EU recently signed an agreement with NATO. The EU is now part of Euro-Atlantic policy – there is no doubt about that – including making its territory available for the alliance’s plans to move to the East, to the South, I don’t know where else,” he added, apparently referring to the Joint Declaration on EU-NATO Cooperation inked in early 2023.

I believe all these Euro-Atlantic structures have failed. They have failed to strengthen security and stability.

The Euro-Atlantic structures have ultimately succeeded in precisely the opposite, stoking international tensions and “remilitarizing Europe,” Lavrov suggested. “All the efforts of this Euro-Atlantic community are focused on preparing for a new war. Germany, together with France and Great Britain, is leading this process,” he added.

Lavrov’s remarks come after a meeting of the so-called “coalition of the willing,” a group of Kiev’s backers predominantly consisting of NATO and EU nations, held earlier this week.

The defense chiefs from the member states discussed the potential deployment of a “peacekeeping” force to Ukraine, with the idea spearheaded by the UK and France.

The latest gathering failed to yield any tangible result, with EU top diplomat Kaja Kallas admitting that “different member states have different opinions and the discussions are still ongoing.”

While UK Secretary of Defense John Healey insisted that the opinions of the groups were “well developed,” multiple of his counterparts publicly questioned the idea, raising concerns about the goals, mission and mandate of the potential deployment.

Moscow has repeatedly warned the West against deploying troops to Ukraine under any pretext, specifically objecting to forces from any NATO countries ending up in the country.

Last month, former Russian President and the deputy head of Russia’s Security Council Dmitry Medvedev said that the potential emergence of any NATO “peacekeepers” in Ukraine would mean a war between the bloc and Russia.

https://www.rt.com/russia/615682-euro-atlantic-war-lavrov/

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

MAKE A DEAL PRONTO BEFORE THE SHIT HITS THE FAN:

NO NATO IN "UKRAINE" (WHAT'S LEFT OF IT)

THE DONBASS REPUBLICS ARE NOW BACK IN THE RUSSIAN FOLD — AS THEY USED TO BE PRIOR 1922. THE RUSSIANS WON'T ABANDON THESE AGAIN.

THESE WILL ALSO INCLUDE ODESSA, KHERSON AND KHARKIV.....

CRIMEA IS RUSSIAN — AS IT USED TO BE PRIOR 1954

TRANSNISTRIA WILL BE PART OF THE RUSSIAN FEDERATION.

A MEMORANDUM OF NON-AGGRESSION BETWEEN RUSSIA AND THE USA.

EASY.

THE WEST KNOWS IT.

- By Gus Leonisky at 13 Apr 2025 - 3:47pm

- Gus Leonisky's blog

- Login or register to post comments

grandstanding incompetence....

https://www.youtube.com/watch?v=psWRUBwEABU

The WEST Has Underestimated Russia's Military PowerFrance and the UK want to lead a “coalition of the willing” into Ukraine, once this conflict will be over, in order to deter the Russians from attacking again. In this video, we’ll discuss why and how this may happen. Also, we’ll look at what the Russian response is to the “coalition of the willing”. Also, Russia seems to prepare for the return of the Western companies in some form.

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

trading week....

THE FLIGHT FROM THE DOLLAR HAS BEGUN, CHAOS IS IN THE US DEBT MARKET, GOLD IS RISING IN PRICE

Tatyana Kulikova

The past trading week (April 7-11) in the financial markets was marked by sky-high volatility (that is, huge amplitudes of fluctuations in quotations), not seen since covid, and in some parameters (for example, in the range of intraday fluctuations of the main American stock index S&P 500) – even since 2008.

Traders closely followed the news from the “trading front” and many times changed their mood between panic and euphoria. Market movements have been further enhanced by algorithmic trading, the role of which has increased greatly in recent years, in particular through the application of artificial intelligence.

However, if you look at the results for the week as a whole, nothing particularly noteworthy happened in most of the major world markets: weekly changes in quotes were more or less within the norm, especially considering that it was a week of upward correction after a deep dip of the previous week.

Read also

Cheap oil forces Russia to pull the last cartridge out of the clip – a killer discount

Sergey Vetchinin: The supply race between exporters is a new reality

In particular, the Brent quote (what worries us the most) changed by just over $1 per barrel (fell from 66 to 64.7).

However, there is one important segment where everything is bad: the US government bond market and the dollar in the foreign exchange market. Yields on 10-year US government bonds soared by 50 basis points (bps) over the week, from 4.0% to 4.5%. The US dollar index against the world’s leading currencies fell from 103 to 99.8; In particular, the euro against the dollar rose from 1.09 to 1.13.

It is not the levels reached by the quotes that are important here. The yield of 4.5% on American 10-year bonds was observed not so long ago – in February of this year, and in January it even reached the level of 4.8% at the moment. True, these levels were held only for a short time at that time; And if the quotes remained here for a long time, then big problems would begin in the American economy.

Nevertheless, the speed of yield growth is much more important than the levels: an increase of 50 bps over the week is a lot for US government securities. But the most important thing is the direction of movement of this yield during the crisis, which is completely atypical and hints at a “paradigm shift” in global financial markets: US government securities are no longer considered as a protective asset.

After all, before the current episode of market volatility, the opposite behavior of US government bonds was typical: they always rose in price in anticipation of a recession, as well as in case of any other market crashes, as a result of “risk aversion”, that is, their yields fell.

Sometimes it looked paradoxical: US government bond yields fell even when market turbulence was caused by a downgrade in the US sovereign rating.

The only significant exception to this rule occurred during the total collapse of the markets in the spring of 2020.

It was associated with the failure of a speculative strategy widely used by hedge funds (“basis trade”: buying government securities with the simultaneous sale of futures on them; this is done in order to make a profit from the minimum difference in the quotes of the asset and futures for it).

Read also

“Mercedes” from Lukashenka. Will the German auto industry withstand competition with the Old Man

Vasily Koltashov: We need to take everything we need from the West, without looking back at the “rules”

This strategy is usually perceived as almost risk-free, so hedge funds use it with huge leverage (i.e., borrowed funds); But if it leads in the wrong direction, then they incur huge losses and begin to abruptly exit this strategy by selling government bonds.

At first, many thought that something similar had happened now, that is, that the fall of US government bonds (and therefore the growth of their yields) was caused primarily by the collapse of the basis trade strategy. Probably, something like this really happened (we will learn later from the statistics), but there is every reason to believe that this factor is not the main one.

And the main one is that non-residents began to abruptly withdraw from American assets and, mainly, from government bonds. This is confirmed by the fact that the US dollar is now falling against almost all currencies – both developed and developing.

This is also a very atypical behavior. During periods of turbulence in financial markets, the dollar usually strengthened; this was due to the fact that capital fled from the periphery (especially emerging markets) to the major currencies and, above all, to the US dollar.

Now, the U.S. currency and government bonds are behaving as if the U.S. were a risky “emerging market” rather than the center of the global financial system: during a period of turbulence in the markets, capital fled not to the U.S., but out of it. That is, the markets now quite specifically doubt the reliability of the United States and the current global financial system based on the American dollar.

And it is no coincidence that over the past week, gold quotes soared sharply – from 3,036 to 3,237 dollars per troy ounce; This is by a wide margin the maximum “at the close of the week”.

The previous historical maximum “at the close of the week” was $3,081 per ounce. In addition, on Friday, April 11, the historical maximum “at the moment” was once again updated – $ 3,245 per ounce.

The latest news about banks, bank cards, savings and financial markets is in the topic of Svobodnaya Pressa.

Finance & BankingThe economist explained why the key rate cannot always be at a high level

The Russian stock market has fallen significantly

Nabiullina spoke about inflation in Russia

The economist explained the statement of the Central Bank on the key rate

https://www.theinteldrop.org/2025/04/13/the-flight-from-the-dollar-has-begun-chaos-is-in-the-us-debt-market-gold-is-rising-in-price/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.