Search

Democracy Links

Member's Off-site Blogs

providing some further relief to home loan borrowers .....

The Reserve Bank of Australia has cut interest rates, taking the cash rate below 4 per cent for the first time in two years.

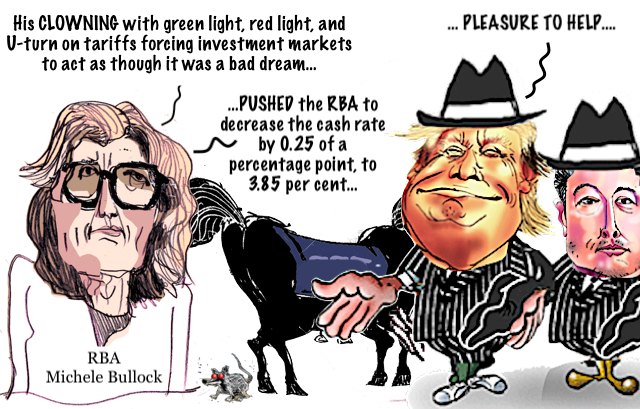

At its May meeting, the RBA's monetary policy board decided to decrease the cash rate by 0.25 of a percentage point, to 3.85 per cent.

Following the decision, the Australian dollar dropped from around 64.5 US cents to 64.2 US cents, as expectations of further interest rate cuts rose.

"With inflation expected to remain around target, the board therefore judged that an easing in monetary policy at this meeting was appropriate," the RBA board said in its statement.

"The board considered a severe downside scenario and noted that monetary policy is well placed to respond decisively to international developments if they were to have material implications for activity and inflation in Australia."

Read more on the RBA's May rate cut:It is the second cut to rates this year, providing some further relief to home loan borrowers after 13 rate hikes between May 2022 and November 2023, when the cash rate was left on hold until a cut in February this year.

Why did the Reserve Bank cut interest rates?After the February board meeting, US President Donald Trump's "Liberation Day" tariff announcement ignited global trade disputes and rocked financial markets, leading some to forecast even deeper rate cuts, although the ensuing tariff delays saw expectations pared back.

In its post-meeting statement, the board acknowledged that inflation has fallen substantially from its peak, while the outlook remains uncertain.

"Uncertainty in the world economy has increased over the past three months and volatility in financial markets rose sharply for a time," the statement read.

"While recent announcements on tariffs have resulted in a rebound in financial market prices, there is still considerable uncertainty about the final scope of the tariffs and policy responses in other countries. Geopolitical uncertainties also remain pronounced.

"These developments are expected to have an adverse effect on global economic activity, particularly if households and firms delay expenditure pending greater clarity on the outlook.

"This has also contributed to a weaker outlook for growth, employment and inflation in Australia.

"That said, world trade policy is changing rapidly, thereby making the central forecasts subject to considerable uncertainty."

The RBA's official cash rate was last below 4 per cent in May 2023, before it was raised to 4.1 per cent at the June 2023 meeting.

What will the interest rate cut mean for borrowers?

Lenders were quick to announce they would pass on the interest rate reduction to home loan customers, with major banks NAB, Commonwealth Bank, ANZ and Westpac all announcing cuts to variable mortgage rates, which will come into effect in coming weeks.

Financial comparison site Canstar estimated that on a $1 million loan, minimum monthly repayments would reduce $114 to $6,328.

On a $500,000 mortgage, repayments would drop $76 to $3,164.

The estimates were based on an owner-occupier making principal and interest repayments, with 25 years left on the loan as of this month, on an average variable rate for existing borrowers of 6.06 per cent (prior to the 0.25 percentage point cut).

"I know this period of relatively high interest rates has been, and continues to be challenging for many households and businesses, but it was essential we brought inflation down because inflation hurts everyone," RBA governor Michele Bullock said in a press conference after the May meeting.

"The strategy that we took to achieve this was different to that of some other central banks, who took rates much higher than we did.

"The board accepted the trade off that, leaving the cash rate where it was would bring inflation down more gradually, but without a big increase in unemployment, a sharp rise in unemployment would have been very costly for families and for the Australian economy."

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

- By Gus Leonisky at 20 May 2025 - 5:37pm

- Gus Leonisky's blog

- Login or register to post comments

Recent comments

1 hour 3 min ago

1 hour 10 min ago

1 hour 46 min ago

3 hours 19 min ago

7 hours 39 min ago

7 hours 45 min ago

7 hours 57 min ago

8 hours 16 min ago

8 hours 22 min ago

11 hours 31 min ago