Search

Recent comments

- devil and devil....

45 min 23 sec ago - bully don.....

4 hours 41 min ago - impeached?....

9 hours 28 min ago - 100.....

17 hours 41 min ago - epibatidine....

23 hours 33 min ago - cryptohubs...

1 day 31 min ago - jackboots....

1 day 39 min ago - horrid....

1 day 47 min ago - nothing....

1 day 3 hours ago - daily tally....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

addicted to gambling? go to gambling anonymous for treatment....

The EU’s determination to further fund Kiev’s military and prop up its imploding economy has been presented as a kind of victory. “Europe has delivered,” German Chancellor Friedrich Merz proclaimed, in celebration of a new cash facility for Kiev.

The grim reality behind the grandstanding: What’s in the EU’s new cash delivery to Kiev

How the latest loan for Ukraine will work, and what impact it could have on an ailing bloc, is not something its leaders are happy to discuss

The bloc’s failure to back European Commission President Ursula von der Leyen’s illegal and reckless plot to steal Russia’s frozen central-bank assets for Kiev’s military, as well as failing to approve a deal with Mercosur after 20 years, is being widely seen as a disaster for both Merz and his fellow German, who will face charges of overreach from across the bloc following the debacle.

Thin on the ground, however, are details about how the new cash trough for Kiev will be delivered, what impact will it have and who, in the end, will pay.

RT takes a look at the grim reality behind the EU’s grandstanding.

What exactly is the loan?

Having failed to come to an agreement on using Russia’s frozen central bank assets, the EU went a different route: an interest-free €90 billion ($105 billion) loan to Ukraine backed by the EU’s budget. What this means in practice is that the European Commission will be issuing bonds on behalf of the EU. A bond backed by the EU budget means that it is serviced and repaid through the EU budget, which is ultimately funded by member states. Three member states (Hungary, Slovakia, and the Czech Republic, reportedly those who came up with the compromise) opted out.

The bonds will likely be issued across multiple maturities (e.g. 5y, 10y, 20y) and structured as a program rather than a single issuance. The main buyers of these bonds will be institutional investors (pension funds, insurance companies, asset managers, and sovereign wealth funds). The proceeds from the sales will flow into EU accounts, where they will be disbursed to Ukraine.

Who is really paying?

Theoretically, Ukraine is supposed to repay the loan, but the likelihood of that is widely seen as vanishingly small. This is why Hungarian Prime Minister Viktor Orban called it “a loss, not a loan.”

But it won’t be bondholders taking this loss. Because the loan is backed by the EU budget, even if Ukraine does not pony up the cash the bloc is still committed to repaying both principal and interest out of future EU budget resources. What is important is that if the EU budget is insufficient in a given year, member states will have to increase contributions, reallocate spending, or roll over existing debt. All of those options come at a price. The European taxpayer is the ultimate bag-holder here, however obscured that fact may be.

What is important to understand is that this is not a jointly guaranteed Eurobond with explicit national guarantees but rather a budgetary obligation.

Why will this cost a lot more than €90 billion?

The loan to Kiev is for €90 billion but there is one nuance here. The EU is taking a massive loss on the carry. A negative carry means borrowing at one rate and lending at a lower rate (a positive carry is the exact opposite – when you borrow cheap and lend at a higher rate).

Assuming a plausible issuance mix across the yield curve, the weighted average coupon rate paid to investors may end up around 2.8% (initial issuance – give or take). That puts the negative carry at around €2.5 billion per year. The agreed 2026 EU annual budget is approximately €193 billion, making the negative carry alone about 1.3% of the EU’s per annum budget.

Is this a lot? Yes and no. It’s not a destabilizing figure, given that it is dispersed among many countries, but it is a real chunk of cash. More importantly, it is not merely a one-time stimulus but a standing fiscal commitment for a bloc whose fiscal position is already deteriorating.

What is Ukraine’s fiscal position?

Ukraine’s official budget for next year projects a $42 billion deficit. However, this is widely believed to be a significant understatement of the shortfall, because it does not include a significant number of supplemental military expenses. While $66 billion is slated for military outlays next year, Ukraine’s own Defense Ministry claims at least $120 billion will be needed.

According to EU estimates, meanwhile, Ukraine needs a total of $160 billion in additional combined financial and military support over 2026-2027. If no additional aid were forthcoming, the bloc estimated that Kiev would run out of cash by mid-2026.

The loan approved this week will float Ukraine for a while and stave off an immediate crisis in 2026. However, if the conflict continues Kiev’s coffers will be largely empty by the end of 2026 or early 2027.

Isn’t the EU already deeply indebted?

As of the end of June 2025, the EU had outstanding bonds totaling €661.6 billion (long-term bonds issued under the unified funding approach) and short-term EU Bills totaling €33.3 billion. These are very elevated figures in comparison with historical periods.

Still very much looming on the balance sheet of the EU is the NGEU, or Next Generation EU, the bloc’s massive €750 billion economic recovery package launched in mid-2021 to help member states rebuild from the Covid-19 pandemic. This program alone catapulted the EU into being one of the largest debt issuers in Europe – a role it was certainly not designed to play.

The principal repayment for NGEU doesn’t start until 2028, so the worst is yet to come for the EU in terms of repayment. Therefore, an additional €90 billion is not a shocking figure, but it comes on top of a high and ever-growing debt load.

Finally, what impact does this have on the peace process?

Vladimir Zelensky now has lined his pockets going into talks with US President Donald Trump, meaning he has the cash to negotiate his position and will feel empowered to reject the idea of peace before Christmas so coveted by Trump.

The EU has found €90 billion to pour into Ukraine only months after key figures in Zelensky’s circle were exposed as corrupt grafters who have stolen countless millions of dollars. Zelensky, who had been facing a burgeoning crisis from many sides, has been given a little more rope.

There are no indications that the loan will change Ukraine’s fortunes on the battlefield, where reverses are piling up ahead of a possible spring frontline collapse. The EU’s loan facility has rubber stamped corruption in Kiev and prolonged an un-winnable war.

The deeper message here, however, is probably more subtle: the EU is slipping further toward a regime of forcing national budgets to backstop the bloc’s geopolitical ambitions.

This can’t end well.

https://www.rt.com/russia/629784-loan-eu-ukraine-cash/

MAKE A DEAL PRONTO BEFORE THE SHIT (WW3) HITS THE FAN:

NO NATO IN "UKRAINE" (WHAT'S LEFT OF IT)

THE DONBASS REPUBLICS ARE NOW BACK IN THE RUSSIAN FOLD — AS THEY USED TO BE PRIOR 1922. THE RUSSIANS WON'T ABANDON THESE AGAIN.

THESE WILL ALSO INCLUDE ODESSA, KHERSON AND KHARKIV.....

CRIMEA IS RUSSIAN — AS IT USED TO BE PRIOR 1954

TRANSNISTRIA TO BE PART OF THE RUSSIAN FEDERATION.

RESTORE THE RIGHTS OF THE RUSSIAN SPEAKING PEOPLE OF "UKRAINE" (WHAT'S LEFT OF IT)

RESTITUTE THE ORTHODOX CHURCH PROPERTIES AND RIGHTS

RELEASE THE OPPOSITION MEMBERS FROM PRISON

A MEMORANDUM OF NON-AGGRESSION BETWEEN RUSSIA AND THE USA.

A MEMORANDUM OF NON-AGGRESSION BETWEEN RUSSIA AND THE EU.....

EASY.

THE WEST KNOWS IT.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

- By Gus Leonisky at 20 Dec 2025 - 8:03am

- Gus Leonisky's blog

- Login or register to post comments

belgian asset.....

Belgian PM mocks Politico after being labelled ‘Russia’s most valuable asset’

Bart De Wever has ridiculed the outlet, which branded him “Russia’s most valuable asset”

Belgian Prime Minister Bart De Wever mocked Politico on Thursday after the outlet branded him “Russia’s most valuable asset,” joking that he was heading back to his “dacha in St. Petersburg” to join “neighbours” Gérard Depardieu and Bashar al-Assad.

Axel Springer-owned Politico, which has a staff of some 350 in its European bureau alone, took a personal swipe at the “bespectacled 54-year-old” “eccentric figure at the EU summit table, with his penchant for round-collared shirts, Roman history and witty one-liners.” The piece was authored by four of its reporters in early December, just as de Wever’s opposition to the asset-theft plan was becoming a significant thorn in the side of Merz and von der Leyen.

Following the collapse of the German-backed plan at a disastrous EU Summit for Merz and von der Leyen, De Wever addressed one of the authors of the article head on.

“Politico, you published some very nice articles with some very nice titles, claiming that I was Russia’s most valuable asset? I like that one a lot. I will remember that one. But go ahead with your question anyway, because as I said, a real politician lets go of his emotions, even if these emotions are pure anger, vengeance, and maybe even violence.”

Winding up his tirade and leaning fully into the sarcasm, De Wever delivered his closing flourish.

“But now I have to go to my dacha in St. Petersburg,” he said, “where my neighbor is Gerard Depardieu, and across the street there is Bashar al-Assad. And I think I can become mayor of that little village. Maybe that could be your title.”

Depardieu, a French actor, was granted Russian citizenship by President Vladimir Putin in 2013, though he does not live in Russia full time. Assad was given asylum by Russia after being overthrown last December by forces led by the Islamist group Hayat Tahrir al-Sham. He and his family now live in Moscow.

https://www.rt.com/news/629788-belgium-de-wever-politico-tirade/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

start now....

V. Putin Gives European ‘Warmongers’ a Reality Check: A Timely Attitude Adjustment—NOT Mincing Words!

Henry Kamens

Europe’s warmongering elite just received a reality check from Moscow — and their reaction reveals how deeply the continent’s politics are tied to keeping the conflict alive.President Vladimir Putin’s blunt warning to Europe exposes a widening gap between Western peace rhetoric and a political reality in which European elites are increasingly invested in prolonging the Ukraine conflict rather than resolving it.

Russian President Vladimir Putin has delivered one of his bluntest warnings to Europe to date, telling Western leaders that if they truly want a war with Russia, they can “start right now.”

In a recent media exchange, Putin stressed that Moscow is ready for any scenario but made clear that a direct conflict with Europe would not resemble Russia’s special operation (SMO) in Ukraine… And once it starts, there might not be anyone left on the European side to negotiate with in ending it.

By cautioning that if the continent chooses the path of war with Moscow, Russia is fully prepared to respond, and that it will not be like the special operation in Ukraine, which is being carried out in a surgical fashion, Putin has just handed Europe’s political class a blunt reality check, warning that their war talk has consequences they’re not prepared to face.

While Moscow avoids diplomatic sugarcoating, NATO leaders keep preaching “peace” while undermining every path toward it. Europe’s loudest warmongers are the ones most threatened by a real peace deal — and their political survival depends on keeping the conflict alive.

Europe’s Rhetoric vs. Reality

Abrupt de-escalation could disrupt political networks, financial commitments, networks of patronage, and long-standing networks tied to the conflictEuropean leaders continue to insist they support peace — yet their own behaviour proves otherwise. Rather than engaging in diplomacy, they have effectively written themselves out of any negotiations through a mix of political bravado, unfulfilled threats, and posturing that leaves them with little credibility and few options.

Putin, for his part, did not mince words about Kiev’s leadership or its detachment from the battlefield situation.

“I think the Ukrainian leadership appears focused on issues other than the active combat zone and seems to be living on another planet,” he said. “Perhaps travelling and begging for money leaves little time for dealing with domestic matters, either in the economy or on the front line.”

He added that Ukraine’s leadership once believed in a “strategic defeat of Russia,” but now clings to illusions that no longer align with reality: “They withdrew from this process of their own accord… and now, seeing that the outcome does not please them, they have begun to sabotage the efforts of the current US administration and President Trump to achieve peace.”

They [Europeans] embraced the concept of inflicting a strategic defeat on Russia and, by all appearances, continue to live under this illusion. Intellectually, they understand – they understand perfectly well – that this possibility has long since vanished, that it was never feasible; they once believed what they desired, but they still can’t and won’t admit it. They withdrew from this process of their own accord – that is the first point.

Now, seeing that the outcome does not please them either, they have begun to sabotage the efforts of the current US administration and President Trump to achieve peace through negotiation. They themselves abandoned peace talks and are now impeding President Trump.

They have no peace agenda; they are on the side of war. Even when they ostensibly attempt to introduce amendments to Trump’s proposals, we see this clearly – all their amendments are directed towards one single aim: to completely obstruct this entire peace process, to put forward demands that are utterly unacceptable to Russia (they understand this), and thereby subsequently to place the blame for the collapse of the peace process upon Russia. That is their objective. We see this plainly.

Let it be!

Therefore, if they truly wish to return to reality, based on the situation that has developed “on the ground,” as they say in such cases – let it be, we have no objection. Putin accused Kyiv of actively blocking potential negotiations: “They have no peace agenda; they are on the side of war. Even when they ostensibly attempt to amend Trump’s proposals, all their amendments are aimed at obstructing the entire peace process.”

He added that these efforts include setting deliberately unacceptable conditions so that blame for stalled talks can later be shifted onto Moscow. Such comments, perhaps based on greater self-reflection and candor, are what drew such swift and toxic reactions from European leaders who have long accused the Kremlin of issuing destabilizing threats.

NATO’s incoming Secretary-General Mark Rutte

NATO’s incoming secretary-general, Mark Rutte, argued that the statement should be understood in the context of what he described as ongoing “hybrid threats” from Russia — including political pressure, energy manipulation, and cyber activity — particularly as Europe heads into the winter months.

Rutte claimed the peace process in Ukraine remains fragile and warned that if negotiations stall, Putin “falsely believes that Russia can outlast the West.” He said that Western support for Kyiv will continue, pointing to ongoing U.S. military aid funded in part by Canada and several European governments. Economic pressure on Moscow, he noted, is also set to intensify as the EU and Washington coordinate additional sanctions with the stated goal of ensuring “maximum impact” on the Russian economy.

The exchange/question and answer, given by the face of NATO, Rutte, underscores the increasingly tense messaging between Moscow and Western capitals as the war in Ukraine approaches another winter season with no clear diplomatic breakthrough in sight. But Rutte failed to mention that it is the same Europeans, peace-loving Europeans, especially of the smaller and most vocal of NATO members, who are doing their utmost to derail Trump’s peace proposal, and that any peaceful settlement in Ukraine puts many European politicians, and their backhander cash flows, in harm’s way, threatening their political careers as well.

It is all about keeping the money and weapons flowing to Ukraine

Mark Rutte fails to consider an important dimension of the political landscape. Many of its members contend that certain European governments are reluctant to endorse rapid peace initiatives — including proposals associated with former U.S. President Donald Trump — because abrupt de-escalation could disrupt political networks, financial commitments, networks of patronage, and long-standing networks tied to the conflict.

Mark Rutte said that Putin’s remarks should be understood alongside what he described as “ongoing hybrid pressure” exerted by Russia — including “disinformation,” energy leverage, and cyber activity. He added that Europe “will not be intimidated” and that allied support for Ukraine “will continue for as long as needed.”

Europe’s Political Class

Officials in Germany, Poland, and the Baltic states condemned Putin’s remarks as “irresponsible,” accusing the Kremlin of trying to stoke public anxiety ahead of winter, when energy costs and Ukraine’s military needs typically increase.

For parts of Europe’s political class, peace carries risks that war does not. Analysts noted that Putin’s comments follow a familiar Russian tactic of issuing stark warnings as relations with the West deteriorate. The tone, they said, reflects Moscow’s unease over new Western weapons for Kyiv — including longer-range systems — and talk of deeper European defense cooperation.

Experts also warned that such rhetoric usually reinforces NATO threat assessments rather than easing them. “Putin’s statements may be intended as deterrence,” one European security official said, “but they often have the opposite effect, bolstering arguments for continued military aid to Ukraine.”

There is no sign of an imminent Russia-NATO clash, but the trajectory remains troubling. With both sides dug in and European leaders resisting political compromise, the conflict may drag on longer than necessary.

Marcus Aurelius once wrote: “Our life is what our thoughts make it.”

Europe’s political class seems unwilling — or unable — to change the thoughts that keep this conflict alive. Peace offers them little, while war offers political coherence, funding corrupt money flow pipelines, and scapegoating external enemies in a never-ending blame game. A lasting peace is not a dividend — it is a liability. And until that calculus changes, the people most affected by this conflict will continue to pay the highest price.

Europe wants to weaken Russia and gain time for rearmament, and then draw Russia into open conflict. This could be a war with a limited number of NATO countries, or in regions of the world that are strategic for Russia, such as the Caucasus.

Massive brainwashing of the population is on the rise in the EU. It is as if the population is being prepared for the inevitable war that NATO and the EU need to justify their very existence and to assure the political survival of European elites.

Henry Kamens, columnist and expert on Central Asia and the Caucasus

https://journal-neo.su/2025/12/18/v-putin-gives-european-warmongers-a-reality-check-a-timely-attitude-adjustment-not-mincing-words/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

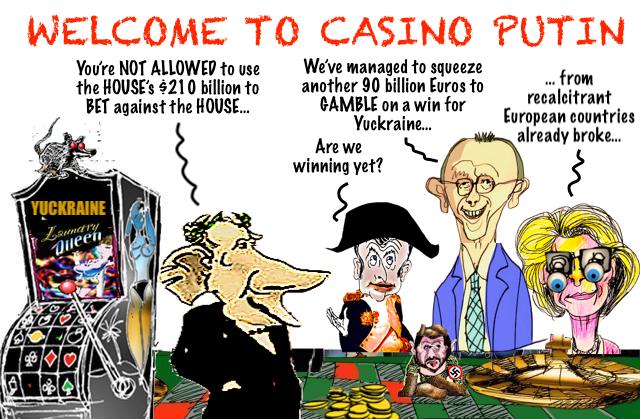

a gambler?

THIS ARTICLE BY A BRITISH REPORTER MENTIONS PUTIN AS A GAMBLER.... AT THIS STAGE, ONE SHOULD SAY PUTIN OWNS THE CASINO — AND THE USA, EUROPE, YUCKRAINE AND THE UK ARE THE GAMBLERS AT HIS RUSSIAN ROULETTE TABLE... BUT YOU CAN'T STOP THE WESTERN PRESS FROM MISUNDERSTANDING THE STAKES: THE HOUSE NEVER [RARELY] LOSES....

----------------------

John Simpson: 'I've reported on 40 wars but I've never seen a year like 2025'

John Simpson

BBC world affairs editor

........

But could the war turn into a nuclear confrontation?

We know President Putin is a gambler [READ COMMENT ABOVE]; a more careful leader would have shied away from invading Ukraine in February 2022. His henchmen make bloodcurdling threats about wiping the UK and other European countries off the map with Russia's vaunted new weapons, but he's usually much more restrained himself.

While the Americans are still active members of Nato, the risk that they could respond with a devastating nuclear attack of their own is still too great. For now.

China's global roleAs for China, President Xi Jinping has made few outright threats against the self-governed island of Taiwan recently. But two years ago the then director of the CIA William Burns said Xi Jinping had ordered the People's Liberation Army to be ready to invade Taiwan by 2027. If China doesn't take some sort of decisive action to claim Taiwan, Xi Jinping could consider this to look pretty feeble. He won't want that.

You might think that China is too strong and wealthy nowadays to worry about domestic public opinion. Not so. Ever since the uprising against Deng Xiaoping in 1989, which ended with the Tiananmen massacre, Chinese leaders have monitored the way the country reacts with obsessive care.

I watched the events unfold in Tiananmen myself, reporting and even sometimes living in the Square.

The story of 4 June 1989 wasn't as simple as we thought at the time: armed soldiers shooting down unarmed students. That certainly happened, but there was another battle going on in Beijing and many other Chinese cities. Thousands of ordinary working-class people came out onto the streets, determined to use the attack on the students as a chance to overthrow the control of the Chinese Communist Party altogether.

When I drove through the streets two days later, I saw at least five police stations and three local security police headquarters burned out. In one suburb the angry crowd had set fire to a policeman and propped up his charred body against a wall. A uniform cap was put at a jaunty angle on his head, and a cigarette had been stuck between his blackened lips.

It turns out the army wasn't just putting down a long-standing demonstration by students, it was stamping out a popular uprising by ordinary Chinese people.

China's political leadership, still unable to bury the memories of what happened 36 years ago, is constantly on the look-out for signs of opposition - whether from organised groups like Falun Gong or the independent Christian church or the democracy movement in Hong Kong, or just people demonstrating against local corruption. All are stamped on with great force.

I have spent a good deal of time reporting on China since 1989, watching its rise to economic and political dominance. I even came to know a top politician who was Xi Jinping's rival and competitor. His name was Bo Xilai, and he was an anglophile who spoke surprisingly openly about China's politics.

He once said to me, "You'll never understand how insecure a government feels when it knows it hasn't been elected."

As for Bo Xilai, he was jailed for life in 2013 after being found guilty of bribery, embezzlement and abuse of power.

Altogether, then, 2026 looks like being an important year. China's strength will grow, and its strategy for taking over Taiwan - Xi Jinping's great ambition - will become clearer. It may be that the war in Ukraine will be settled, but on terms that are favourable to President Putin.

He may be free to come back for more Ukrainian territory when he's ready. And President Trump, even though his political wings could be clipped in November's mid-term elections, will distance the US from Europe even more.

From the European point of view, the outlook could scarcely be more gloomy.

If you thought World War Three would be a shooting-match with nuclear weapons, think again. It's much more likely to be a collection of diplomatic and military manoeuvres, which will see autocracy flourish. It could even threaten to break up the Western alliance.

And the process has already started.

=======================

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

========================

LOOKING FROM THE WRONG SIDE OF THE TELESCOPE AND SEEING LITTLE-LITTLE OF THE GEOPOLITICAL SMASHBOARD:

John Simpson CBE, the BBC’s World Affairs Editor, is a household name and the most distinguished foreign correspondent of the age. Recognised as the “David Attenborough” of news, John is a multi-award winning, veteran news broadcaster (and accomplished author) who has covered almost every major event of the world from the 1960s to the present day.

His seminal reports on the Big moments of recent history make up an illustrious list to include the Iranian Revolution, the First and Second Gulf Wars, the Fall of the Soviet Union and the Berlin Wall, the end of Apartheid in South Africa, the Genocide in Rwanda, the wars in the former Yugoslavia and the Tiananmen Square massacre in Beijing.

John Simpson’s stories of war and revolution are many and varied: he walked into Taliban-occupied Kabul at the head of the BBC news team in 2001, having previously infiltrated Afghanistan dressed in a burka. He accompanied the Ayatollah Khomeini on his plane from Paris to Tehran to depose the Shah of Iran, he danced on top of the Berlin Wall in 1989; he watched at close range the missiles raining down on Baghdad in the First Gulf War.

An eye-witness of the many wars in the Middle East and Afghanistan, the Irish troubles and the South African and Rhodesian struggles, as well as the many other major revolutions in the former East Block of Europe and Latin America, it is safe to assume that ‘whatever the Headline of the Daily news might be, John will be there.’

John Simpson has reported from 140 countries and interviewed 200 world leaders and dictators ranging from Michael Gorbachev and Vladimir Putin, Nelson Mandela, British Prime Ministers and U.S. Presidents to Fidel Castro, Colonel Gaddafi, Robert Mugabe and Saddam Hussein.

He met successive heads of the IRA, Hezbollah, Hamas, Taliban and of the Medellin and the Cali Drug Cartels at the height of their power. Osama bin-Laden offered to pay anyone to kill him in 1989.

He also interviewed Yasser Arafat under Israeli bombs in West Beirut and the slain Prime Minister of Israel Yitzhak Rabin in Jerusalem.

It hasn’t just been war and strife: John Simpson has rounded Cape Horn in a small boat and man hauled a sledge in the Arctic. He lived with a previously uncontacted tribe in the farthest reaches of the Amazon. He reported on the first sunrise of the new Millennium on a desert island in the South Pacific.

John was made a CBE for his reporting in 1991. He has won numerous awards, such as three Baftas, the International Emmy and Peabody in the U.S., the RTS Journalist of the Year, twice, – to name but a few.

Twelve universities have awarded him honorary doctorates, St. Andrews, Nottingham, Southampton, Exeter and Leeds, to name some. He was also made a Freeman of the City of London. He is an Honorary Fellow of Magdalene College, Cambridge.

John Simpson has written multiple books incl. his memoir “A Mad World, My Masters,” which was in the Sunday Times Best Seller List for 6 months, “Moscow, Midnight” and “Our Friends from Beijing”, which was published in the summer of 2021.

He was amused by being on GQ Best-Dressed Men of the Year list.

In 2022, John’s new current affairs programme ‘Unspun World with John Simpson’ started airing weekly on BBC2.

https://krugercowne.com/talent/john-simpson-cbe/

THERE IS NO POINT BEING THERE IF ONE UNDERSTANDS NOTHING, APART FROM PENNING BEAUTIFULLY EXPRESSED EMOTIONS.... THIS IS THE PURPOSE OF SOAP OPERAS....