Search

Recent comments

- no shipping.....

8 hours 44 min ago - digging graves....

8 hours 56 min ago - BS draft...

9 hours 3 min ago - tankers ablaze....

9 hours 50 min ago - shoes....

11 hours 48 min ago - new map....

12 hours 23 min ago - weapongeddon....

12 hours 39 min ago - squirming....

12 hours 55 min ago - UK kills russians...

17 hours 36 min ago - fury shit....

17 hours 46 min ago

Democracy Links

Member's Off-site Blogs

the most dangerous moment is when everything looks normal....

America’s national debt has crossed $38 trillion — and this time, the danger isn’t the headline number.

The real threat is what’s happening quietly behind the scenes.

For the first time in more than 75 years, global institutions, foreign central banks, and large asset managers are systematically reducing exposure to dollar-denominated assets. Not publicly. Not dramatically. But deliberately.

Why BlackRock Just Moved $2.1 Trillion Out of America (And What It Means for You)

In this video, we break down a five-hundred-year historical pattern that has repeated every time a global reserve currency collapsed — from Spain, to the Dutch Republic, to the British Empire — and explain why the United States is now deep into Stage Three: the Silent Exodus.

By the end of this video, you’ll understand:

The four-stage cycle that precedes every reserve-currency collapse

Why debt-driven empires fail the same way every time

How capital flight actually begins — and why it’s invisible to the public

Why foreign holders are quietly selling U.S. Treasuries

What rising interest costs mean for a $38T debt load

Why printing money delays collapse but worsens the outcome

What Stage Four historically looks like — and why it destroys the middle class

How previous societies that ignored these signals lost decades of wealth

This is not about politics.

This is not about ideology.

This is historical pattern recognition, backed by data, balance sheets, and precedent.

Empires don’t fall suddenly — they fall predictably.

And the most dangerous moment is when everything still looks normal.

DISCLAIMER (PLEASE READ):

This video is provided for educational and informational purposes only.

Nothing contained herein constitutes financial advice, investment advice, legal advice, or tax advice.

The views expressed are general analysis based on historical patterns and publicly available data and should not be relied upon for making financial decisions.

All investments involve risk, including the potential loss of principal.

You are solely responsible for your financial choices.

Always conduct your own research and consult with a qualified, licensed financial professional before making investment or financial decisions.

Historical patterns do not guarantee future results.

https://www.youtube.com/watch?v=7iHuk5G1h-I

====================

Pepe Escobar: How BRICS May Deliver Structural Shock to US Dollar System...

The oligarchy that really controls the Empire of Chaos has hit the panic button, as the structural contours of Hegemony seriously wobble.

The petrodollar is one of the key features of this Hegemony: a recycling machine channeling non-stop buying of US Treasuries then spent on Forever Wars. Any player even thinking of diversifying from this infernal machine is met with asset freezes, sanctions – or worse.

At the same time, the Empire of Chaos cannot demonstrate raw power by bleeding itself dry in the black soil of Novorossiya. Dominance requires ever-expanding – plundered - resources, side by side with that non-stop printing of US dollars as a reserve currency to pay for astronomic bills. Additionally, borrowing from the world works as imperial financial containment of rivals.

But now a choice becomes imperative – an inescapable structural constraint. Either keep astronomical spending on military dominance (enter Trump’s proposed $1.5 trillion budget for the Department of War.) Or keep ruling the international financial system.

The Empire of Chaos cannot do both.

And that’s why, when the math was done, Ukraine became expendable. At least in theory.

Against the weaponization of the US Treasury bond system – de facto monetary imperialism - BRICS incarnate the strategic choice of the Global South, coordinating a drive towards alternative payment systems.

The straw that broke the steppe camel’s back was the freezing – actually stealing – of Russian assets after the expulsion of a nuclear/hypersonic power, Russia, from SWIFT. Now it’s clear that Central Banks everywhere are going for gold, bilateral deals and considering alternative payment systems.

As the first serious structural shock to the system since the end of WWII, BRICS is not overtly trying to overturn the system – but to build a viable alternative, complete with large-scale infrastructure financing bypassing the US dollar.

Venezuela now illustrates a critical case: Can a major oil producer survive outside of the US dollar system – without being destroyed?

The Empire of Chaos has ruled, “No”. The Global South must prove it wrong. Venezuela was not that critical on the geopolitical chessboard as it represented just 4% of China’s oil imports. Iran in fact is the crucial case, as 95% of its oil is sold to China and settled in yuan, not US dollars.

Iran though is not Venezuela. The latest coordinated intel op/terror attacks/regime change attempt on Iran – complete with a pathetic mini-Shah refugee in Maryland – miserably failed. The threat of war, though, remains.

BRICS Pay, The Unit, or CIPS?

The US dollar now represents less than 40% of global currency reserves - the lowest in at least 20 years. Gold now accounts for more global foreign exchange reserves than the euro, the yen and the pound combined. Central Banks are stockpiling gold like crazy, while BRICS accelerates the test of alternative payment systems in what I previously defined as "the BRICS lab".

One of the scenarios being directly proposed to BRICS, and designed as an alternative to cumbersome SWIFT, which does at least $1 trillion in transactions a day, features the introduction of a non-sovereign, blockchain-based trade token.

That’s The Unit.

The Unit, correctly described as “apolitical money”, is not a currency, but a unit of account used for settlement in trade and finance between participating countries. The token could be pegged to a commodity basket or a neutral index to prevent domination by any single country. In this case it would work like the IMF’s Special Drawing Rights (SDRs), but within a BRICS framework.

Then there’s mBridge – not part of the “BRICS lab” - which features a multi-central bank digital currency (CBDC) shared among participating central banks and commercial banks. mBridge includes only five members, but that includes powerful players such as the Digital Currency Institute of the People's Bank of China and the Hong Kong Monetary Authority. Other 30 countries are interested to join.

mBridge tough was the inspiration behind BRICS Bridge, still being tested, which aims to speed up a range of international payment mechanisms: money transfers, payment processing, account management.

It’s a very simple mechanism: instead of converting currencies into US dollars for international trade, BRICS countries exchange their currencies directly.

The New Development Bank (NDB), or the BRICS bank, established in Shanghai in 2015, should be the key connectivity node of BRICS Bridge.

But that, for the moment, is on hold – because all the NDB’s statutes are linked to the US dollar, and that must be reassessed. With the NDB integrated into the broader financial infrastructure of BRICS member-nations, the bank should be able to handle currency conversion, clearing, and settlement under BRICS Bridge. But we’re still very far away from that.

BRICS Pay is a different animal: a strategic infrastructure for building a self-described “decentralized, sustainable, and inclusive” financial system across BRICS+ nations and partners.

BRICS Pay is on pilot mode all the way to 2027. By then the member-nations should start discussing a deal to set up a settlement unit for intra-BRICS trade no later than 2030.

Once again, that will not be a global reserve currency; but a mechanism offering a “parallel, compatible option” to SWIFT within the BRICS ecosystem.

BRICS Pay, for the moment, is also a very simple system: for instance, tourists and business travelers may use it without opening a local bank account or exchanging currency. They simply link their Visa or Mastercard to the BRICS Pay app and use it to pay via QR code.

And that’s exactly the crucial problem: how to circumvent Visa and Mastercard, under US financial system vigilance, and incorporate BRICS members cards such as Union Pay (China) and Mir (Russia).

Overall, for bigger and more complex transactions, the problem of bypassing SWIFT persists. All these “BRICS lab” tests need to solve two key problems: messaging interoperability – via secure, standardized data formats; and processing the actual settlement, as in how funds move via Central Bank accounts bypassing the inevitable threat of sanctions.

Internalization of The Yuan, Or a New Reserve Currency?

The inestimable Prof. Michael Hudson is on the global forefront of studying solutions to minimize US dollar hegemony. He is adamant that “the line of least resistance is to follow the already-in-place Chinese system.” That means CIPS - the China International Payment System, or Cross-Border Interbank Payment System, yuan-based, and already extremely popular, used by participants in 124 nations across the Global Majority.

Prof. Hudson insists “it's very hard to create an alternative. The Unit's principle (his emphasis), reported to be 40% gold and the rest in member currencies is fine. But this is best done through a new Keynes-style central bank to denominate debts and claims for payment to settle imbalances among member countries - along the lines of the Bancor.”

The Bancor was proposed by Keynes in Bretton Woods in 1944 – to prevent serious discrepancies in external balances, protectionism, tariffs and the scam of nations built up as tax havens. It’s no wonder the hyper-Hegemonic US at the end of WWII vetoed it.

In a new paper on the Weaponization of Oil Trade as the Bedrock of the US World Order, first published at democracycollaborative.org, Prof. Hudson clarifies how “Russian and Venezuelan freedom to export oil has weakened the ability of US officials to use oil as a weapon to squeeze other economies by threatening them with the same withdrawal of energy that has wrecked German industry and price levels. This supply of oil not under US control thus was held to be an infringement of the US rules-based order.”

And that brings us to one of the key reasons for the BRICS drive towards alternative payment systems: “The US foreign policy of creating choke points to keep other countries dependent on oil under US control, not oil supplied by Russia, Iran or Venezuela, is one of America’s key means of making other countries insecure.”

Prof. Hudson succinctly lines up the five imperatives for the Empire of Chaos: “control of the world’s oil trade is to remain a US privilege”; “oil trade must be priced and paid for in US dollars”; the petrodollar must rule, as “international oil-export earnings are to be lent to, or invested in, the United States, preferably in the form of US Treasury securities, corporate bonds and bank deposits”; “green energy alternatives to oil are to be discouraged”; and “no laws apply to or limit US rules or policies.”

Paulo Nogueira Batista Jr, one of the co-founders of the NDB, and its vice-president during 2015-2017, advances in parallel with Prof. Hudson, designing a viable path towards a new international currency in a paper that he is currently finalizing.

Considering that the US dollar system is “inefficient, unreliable and even dangerous”, and has become “an instrument of blackmail and sanctions”, Batista Jr cuts to the chase along the same lines of Prof. Hudson, arguing that “the only scenario that may present some viability would be the large-scale internationalization of the Chinese currency (…) But there is a long way to go before it can replace the dollar in a significant way. And the Chinese are reluctant to try.”

Batista Jr then proposes a solution similar to Prof. Hudson’s: “A group of countries in the Global South, something like 15 to 20 countries, which would include most of the BRICS and other emerging middle-income nations”, could be at the forefront of creating a new currency.

Yet “a new international financial institution would therefore have to be created – an issuing bank, whose sole and exclusive function would be to issue and put into circulation the new currency.”

That sounds very much like Bancor: “This issuing bank would not replace the national central banks and its currency would circulate in parallel with the other national and regional currencies existing in the world. It would be restricted to international transactions, with no domestic role.”

Batista Jr clarifies that “the currency would be based on a weighted basket of the currencies of the participating countries and would therefore fluctuate on the basis of changes in these

currencies. Since all currencies in the basket would be floating or flexible, the new currency would also be a floating currency. The weights in the basket would be given by the share of each country's PPP GDP in the total GDP.”

Inevitably, “the high weight of the Chinese currency, issued by a country with a solid economy, would favor confidence in the backing and in the new reserve currency.”

Batista Jr is fully aware of “the risk that the initiative will provoke negative reactions from the West, which would resort to threats and sanctions against the countries involved.”

Yet the time for action is pressing: “Will we gather economic, political and intellectual efforts to get out of this trap?

The costs of maintaining Hegemony are becoming prohibitive. BRICS, gathering forces for the annual summit later this year in India, must capitalize on the fact that we are fast approaching the structural change moment when the Empire of Chaos loses the ability to unilaterally enforce its will – except via all-out war.

=======================

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

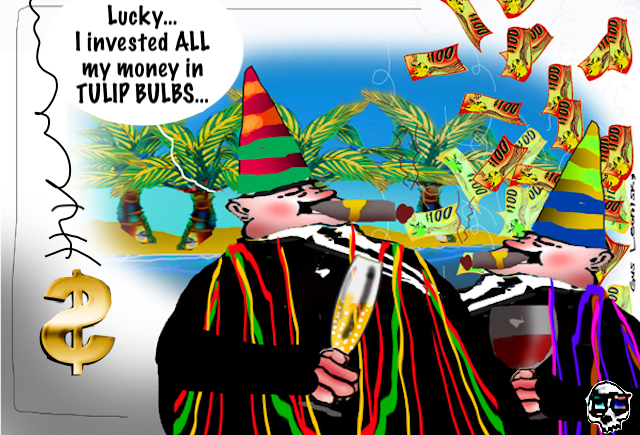

POLITICAL CARTOONIST SINCE 1951.

PLEASE, PANIC QUIETLY....

- By Gus Leonisky at 15 Jan 2026 - 6:06pm

- Gus Leonisky's blog

- Login or register to post comments

2023.....

America’s Debt Reaches Record Levels — Here’s How to Cope

BY ANDREW LISA

Apr 6, 2023

America’s debt situation is officially a crisis. A new report triggered a national conversation about the state of borrowing in the U.S., and the results are that in most measurable categories, the masses are breaking all the wrong records.

Learn: Why Stealth Wealth Is the Best Way To Handle Your Money

Discover: 3 Signs You’re Serious About Raising Your Credit Score

If you feel like you’re drowning in debt, you can take cold comfort in the fact that you have a whole lot of company.

First, a Look at Some Very Scary NumbersOn April 3, a respected weekly global markets newsletter called The Kobeissi Letter (TKL) tweeted some alarming statistics that several top financial publications quickly ran with. The tweet read:

“Auto loan and credit card interest rates just hit a new record high. Average interest rates:

Credit Card: 24.5%

Used Cars: 14.0%

New Cars: 9.0%

Meanwhile, we have record levels of debt:

Total Household Debt: $16.5 trillion

Auto Loans: $1.6 trillion

Credit Card Debt: $986 billion

The worst part?

Student loans just hit a record $1.6 trillion.

Interest on student loans has been suspended since 2020 but is set to resume this year.

The debt crisis is real.”

Unfortunately, It’s Mostly All TrueFirst, are the TKL numbers real?

Different analysts and organizations often report conflicting statistics. For example, Forbes says the average credit card rate is more like 20.4% than 24.5%, and LendingTree says it’s 23.65%. But even the St. Louis Fed’s lowball of 19.07% would be an all-time record high.

When factoring in the multitudes who have shaky credit, Car and Driver roughly confirmed the new and used car loan averages that TKL published.

The New York Fed reports that total household debt is even higher than TKL reports — $16.9 trillion instead of $16.5 trillion — and confirms the claim of $986 billion in credit card debt exactly.

As for student debt, the Education Data Initiative says that TKL’s $1.6 trillion figure is low — it’s actually more like $1.76 trillion.

So, whether the TKL data is accurate to the dollar is inconsequential. Its central thesis as described in its closing statement is indisputable: “The debt crisis is real.”

High Inflation Plus Stagnant Wages Equals Record DebtHigh inflation is the obvious culprit for America’s growing debt — but inflation is manageable when income rises along with prices. The problem, according to the Economic Policy Institute, is that wages haven’t increased in any meaningful way for decades.

“The fact that such an overwhelming majority of Americans are currently in debt says a lot about the disparity between wages and the cost of living,” said Jake Hill, CEO of DebtHammer. “Inflation has driven the cost of living higher and higher over the years, but wages have consistently failed to keep up. However, personal debt has now reached crisis levels in this country for many and is an indication that something must be done to help the average American live more comfortably.”

Carter Seuthe, CEO of Credit Summit Consolidation, agrees.

“This long-lasting inflationary period has essentially caused the cost of everything to go up,” he said. “Everyday necessities like groceries, gas, and even rent and utilities have increased in price — but for most Americans, salaries aren’t increasing alongside that. So, many people are relying on credit cards to buy the things they need simply in order to survive. Credit cards provide access to the funds people need but don’t actually have right now. This is causing increased debt that will likely take years or even decades to fully get out of.”

Revisit Your Debt — and Your BudgetIf your household is part of America’s debt crisis, start with the unenviable task of confronting what you owe, to whom you owe it and the rates you’re paying for each of your debts. Then and only then can you come up with a strategy to get out from under.

“I would advise people to prioritize repaying different kinds of debt according to their respective interest rates, with priority being given to those debts with the highest rate of interest,” said Tim Doman, an investment analyst, former private equity investment fund executive and the newly appointed CEO of TopMobileBanks. “Therefore, if someone has both student loan debt and credit card debt, they should focus on repaying the credit card debt first. When it comes to taking action, I recommend developing a budget that takes into account debt payments, as well as other regular expenses. This will help an individual to determine how much loans cost per month and then calculate how much can be realistically saved and invested in order to work towards their financial goals.”

With a Long Enough Perspective, a Bright Side EmergesAfter you get over the initial shock of America’s stunning level of debt, you can find some peace of mind in the historical context that surrounds it.

“I think it’s important to always look at data on a relative basis,” said Chikako Tyler, chief financial officer at California Bank & Trust. “In absolute terms, credit card debt balances are at an all-time high. We are also seeing an increase in credit card debt as a percentage of all consumer debt if you compare the second half of 2022 relative to 2020-2021 when consumers were flush with stimulus checks. However, when you look at historical data and in the context of all consumer debt across the country, credit card debt as a percentage of all consumer debt has been declining over the last two decades. Also, again, in the context of longer-term trends, credit card delinquency rates are still historically low. That said, there is no doubt that the cost of living has increased faster than wages. This had led to consumers needing to tap into their credit cards, leading to the overall increase in debt.”

https://www.aol.com/america-debt-reaches-record-levels-171247231.html

SINCE THEN [2023], THE AMERICAN DEBT HAS BALLOONED LIKE AN ATMOSPHERIC PROBE... FULL OF RUBBISH FROM NORTH KOREA....

$38 TRILLION and growing!

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.