Search

Recent comments

- energy vs energy....

7 hours 32 min ago - killing kids....

10 hours 29 min ago - the die is cast....

12 hours 21 min ago - SICKO.....

12 hours 42 min ago - be brave, albo....

15 hours 12 min ago - epstein class....

16 hours 17 min ago - in writing....

16 hours 28 min ago - hoped....

18 hours 28 min ago - murdering kids....

19 hours 29 min ago - saving....

19 hours 57 min ago

Democracy Links

Member's Off-site Blogs

from the subprime zone .....

Almost everything seems to be going wrong for the American economy at once. People are buying less, but most things are costing more. Mortgage rates are rising, the dollar is falling and prices of key commodities like oil are leaping from one record high to the next.

On Thursday, the dollar plumbed new lows against the Japanese yen and several other major currencies; the price of an ounce of gold jumped above $1,000 for the first time; and lenders raised home loan rates once again. Government figures showed retail sales fell in February as consumers cut back on cars, furniture and electronics.

Stocks fell sharply after the retail sales report was released early in the day, and a large investment fund said it was nearing collapse. The volatility that has defined the market lately continued unabated.

The Standard & Poor’s 500-stock index fell 2 percent in the morning, then rebounded partly in reaction to a report that said banks were nearing the end of subprime mortgage losses. It was up nearly 1 percent in the afternoon before paring that gain to close up 0.5 percent, to 1,315.48 points. The Dow Jones industrial average closed up 35.5 points, to 12,145.74 points.

A toxic blend of economic and financial developments is testing policy makers and lawmakers who are struggling to contain the slump brought on by the collapse of the mortgage market, a downturn that now looks sure to push the economy into a recession. Though current conditions are a far cry from the 1970s, resurgent inflation is raising the threat of stagflation — a condition in which unemployment and the price of goods and services both rise.

Economy Hammered By Toxic Blend Of Ailments

---------

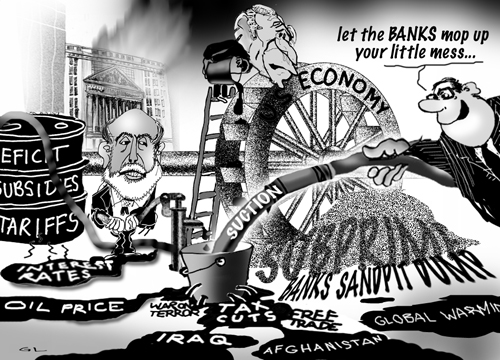

Gus: me thinks the role of the banks is equal to the ineptitude of the Federal management... Too much 'laisser-faire' in the 'free Market' for too long and then trying to prime the pump into a leaky bucket... from which the banks suck the blood before it reaches the ones who have been tricked into the sand pit of subprime...

- By Gus Leonisky at 14 Mar 2008 - 8:28pm

- Gus Leonisky's blog

- Login or register to post comments

The worry is that...

The worry is that if Bear Stearns collapsed, it would be forced to sell its assets, such as sub-prime mortgage securities, into the market at cut down prices.

This would have lowered their value even further.

And that could have affected the solvency of many other big US banks.

And if other big banks went bust, then credit would dry up rapidly across the whole economy, slowing economic activity.

That is why the New York Federal Reserve felt it had no choice but to intervene to support a short-term rescue deal.

But there may be other banks that are already at risk of reaching a similar position to Bear Stearns.

the yoyo is yoyoing down...

By MICHAEL M. GRYNBAUM

Stocks ended the day down sharply on Wall Street on Friday after JPMorgan Chase and the Federal Reserve moved to bail out Bear Stearns, the troubled investment bank.

An early-morning bounce gave way to a vertigo-inducing drop after Bear’s announcement, which ignited fears that large banks remain vulnerable to the continuing credit crisis. The Dow Jones industrials plunged 300 points, recovered much of that ground and then sank anew.

In the final hour of trading, the market pulled back from its deepest losses, with the Dow closing at 11,951.09, a decline of 194.65, or 1.6 percent.

The Standard & Poor’s 500-stock index, a broader measure of the stock market, was down 2.1 percent, and the Nasdaq composite index lost 2.3 percent. . Major European markets closed off about 1 percent.

The news from Bear Stearns came after the bank had insisted for days that its finances were in adequate shape. But the situation rapidly changed.

“Our liquidity position in the last 24 hours had significantly deteriorated,” Bear’s chief executive, Alan Schwartz, said in a statement. “We took this important step to restore confidence in us in the marketplace, strengthen our liquidity and allow us to continue normal operations.”

So far, that confidence has been elusive. Bear Stearns’s stock price was down more than 45 percent, to about $31 a share, after falling as low as $26.85, its lowest level in nearly a decade. Shares of JPMorgan lost 4 percent. Financial services firms took a direct hit, losing the most of any sector in the S.&P. 500.

the bear, the bull and the ox...

Death of the hedge fund?

Big banks are getting tough with the lucrative hedge fund sector at a difficult time for the industry. By Stephen Foley and Nick Clark

In the giant casino that is the world's financial markets, hedge funds are some of the ballsiest gamblers, raising vast amounts of debt so that they can place bigger and more potentially lucrative bets.

One might have thought theirs would be the first activity to be reined in when the credit crisis struck and Wall Street banks began rationing debt for mortgage borrowers, robust businesses and fellow financial institutions. In fact, surprisingly few hedge funds had their wings clipped by lenders last year. Even when funds had a month or two of big losses, their banks looked through the difficulties and extended more credit. Now that has changed – and how.

It was lights out yesterday for Carlyle Capital Corporation (CCC), the most high-profile casualty so far of the turmoil that is sweeping the $1.9 trillion hedge fund industry. Having failed to put up the extra collateral required when its mortgage investments lost value, the fund pleaded for days with its lenders – among them Citigroup, UBS and Merrill Lynch, some of the biggest financial losers from the credit crisis to date – for a reprieve. But no. There was no restructuring deal, and the banks will seize its assets in the coming days.

----------------------

Betting on a market where one can have a bearing in the result of the bet by confidence manipulation is the most insane way to run the affairs of the world. If a few were doing as an entertaining pass-time, it could be said to be Casino "Royal"... but as more people do it with addiction, it becomes Casino "undemocratic". And yet, the banks, the governments, the institutions have all allowed the system to be "modified', to be "influenced by" the bets placed by hedge funds because it's a way to siphon off excess confidence when done in a "moderate way"... But the success of "hedge funds" at raking in the money in the past has expose their role of scavengers. Eventually when you kill all to survive you kill yourself. Good riddance should hedge funds swallow their own dust. The money market needs a bit of "civilising". In the tradition of Ted Wheelwright , Latham exposes the theme of human capital versus capitalism... a less-greedy theme that many economists of the right-wing shot down in flame before getting their own pants on fire for having been too greedy — a situation we are witnessing now and getting worse.

Sure, as Gus the Elder would say, removing greed out of Capitalism could amount to removing the balls of a young bull, but that may turn the bleating beast into a strong ox that will pull your cart without having second thoughts about frolicking cows in the green meadows... Rather than a bear or a bull market, we need an "ox market"... My thought of the day for what it's worth.

Bart Bush Simpson

President Bush made his most striking acknowledgment yet of the country’s economic troubles on Friday, even as he defended his administration’s responses so far and warned against more drastic steps by the government to intervene.

Speaking to the Economic Club of New York at a midtown Manhattan hotel, Mr. Bush said that the economy was now having “a tough time.”

At the same time, however, he compared the government’s reaction to driving through a “rough patch” of road.

“If you ever get stuck in a situation like that, you know it’s important not to overcorrect,” Mr. Bush said. “If you overcorrect, you end up in a ditch.”

Mr. Bush spoke only moments after the Federal Reserve intervened to help the investment bank Bear Stearns secure financing to stave off collapse. A day earlier Mr. Bush’s Treasury Secretary, Henry M. Paulson Jr., announced a series of regulatory steps to tighten rules for credit agencies, mortgage brokers and banks — limited steps that Mr. Bush on Friday said were an appropriate response to the economic turmoil.

“Today’s actions are fasting moving,” he said, “but the chairman of the Federal Reserve and the secretary of the treasury are on top of them and will take the appropriate steps to promote stability in our markets.”

---------------

Gus: "If you overcorrect, you end up in a ditch." Sure Mr president little Bush, but if you avoid a ditch by plunging into a precipice, it's better to overcorrect... That would sure arrest the profiteers, the loan-sharks and the leeches that are draining your costly half-baked attempts, as soon as they hit the streets.

Hit them with stringent regulations, strangle their greedy necks (strangle your own at the same time), prime the pump from the bottom with social reform for a more equitable system, chastise the banks for having goofed, and suddenly you'd become Superman... But as you know, things like that, such as rising above the clouds are all in the mind... and it seems you can't rise beyond that little cheat, Bart Simpson...

dancing on hot coals...

Fed Chief Shifts Path, Inventing Policy in Crisis

By EDMUND L. ANDREWS

Published: March 16, 2008

WASHINGTON — As chairman of the Federal Reserve, Ben S. Bernanke has long argued that a central bank should base its policies as much as possible on consistent principles rather than seat-of-the-pants judgment.

But now, as the meltdown in credit markets threatens major institutions on Wall Street and a recession appears inevitable, Mr. Bernanke is inventing policy on the fly.

“Modern monetary policy-making puts a lot of weight on rules, but there is no rule book for an economic crisis,” said Douglas W. Elmendorf, a senior fellow at the Brookings Institution and a former Fed economist.

---------------

Confidence at this late stage in the game gets trickier by the minute... Most people build their hopes and expectation on the lasting impressions of illusions. If these illusions are not sustainable anymore, then the house made of cards collapses into quicksand. New illusions need to be spruiked fast and "solid" foundation restored. The bulls need to be neutered and made to work harder for their supper: the banks, the con-artists, the hedgers, the subprime sellers, etc... all of them need to be less "ballsey" and pull their weight without bucking. As mention in a couple of blog above, we need an "ox" market. call it Oxen Market if you will... Get rid of Bulls and Bears...

Policy one : help those in need at the bottom of the pile.

Policy two: remove the presently accepted ability for anyone to "rob" anyone else using market forces as a tool.

Policy three: remove the Casino roulette bets from the stock market. Oxen market

Policy four: become smarter in the face of the greater onslaught: global warming

Policy five: put the brakes on GM crops

Policy six: remove war as a civilised option to solve conflict.

Enacting at least two of these would steady the ship.

stealing from poor to give to...

WASHINGTON — As President Bush welcomed the Federal Reserve’s sweeping intervention in the financial markets, his administration faced accusations Monday that it supported the bailout of a prestigious investment bank while doing little to address the hardships faced by Americans facing foreclosures on their homes.

---------------------

Once upon this time, Robin Bush, his mate the sheriff of Cheneyham and their merry associated lordship bankwakers have enacted a grand plan to give bugger all to the poor — who cannot help themselves being poor (the poor buggers, they stink...) — to give their fat rich prestigious friends, those who profit massively from the constant wars with the porridge — in a spot of bother about a few innovative cookbooks on the stockcube market that had gone subprime — a generous golden hand-full of gold from the coffers of the kingdom, filled by sucking the blood of those who actually work — some being enslaved believers of Moral Singalongding... some being punished for believing in equalising knee-capping their glorious captains of deceit.

"investment banking is the life blood of ripping you off" said Robin Bush to the dumb peasants not plucking pheasants anymore, while Maid Marionrice and Brother Littlegates were visiting their archfoes, the ruffian Ruskies, in the land of the dancing bears to sell them an umbrella.

Meanwhile in the land of Pommylandwood, a former guard to princess Didi, told a court that the butler did it — that the butler stole the ring of her finger as she laid dead and then the devious butler — possibly at the secret service of Prince Bigears, also known as the estrange Prince Tampon — burned all kinds of her paperwork, of no importance to anyone since the priceless princess never went to the ball after that.

Then the earf could catch on fire, as the Olmet Earl of Jioojioo, defied all, but strangely with the support of all, to build more rabbit warrens on lands that did not belong to him...

And we all lived happy everafter in the best of the worlds, where black is not quite white, round is as squarish as can be and Alice was Mr Faust on a good global warming day.

stakes in the banks...

US President George W Bush has unveiled new steps to tackle the global financial crisis, including plans to buy stakes in US banks.

He said the US government will directly inject capital into financial institutions to help thaw frozen credit markets, create jobs and fuel economic growth.

The Federal Deposit Insurance Corporation (FDIC) will also guarantee most new debt issued by banks and expand insurance to cover non-interest bearing accounts.

Mr Bush said the buying of shares was an essential short term measure to ensure the viability of America's banking system.

----------------------

Last time, the banks helped themselves to the loot... see toon at top. And read all the comments below... Please note the dates...

the yo-yo is yoyoing up!

Stocks skyrocketed nearly 11 percent today in the second-biggest point gain ever for the Dow Jones industrial average, buoyed by signs of improving credit conditions and expectations that the Federal Reserve would slash a key interest rate tomorrow.

Investors were cheered by reports that the Fed was making progress in unlocking corporate debt markets through its program to buy commercial paper, or loans used for everyday operations, and by developments at major blue-chip companies Boeing and General Motors.

GM chairman and chief executive G. Richard Wagoner Jr. was in Washington over recent days negotiating with Treasury officials for government money to help finance a proposed merger with Chrysler, said an industry source briefed on the matter.

---------------------

It's mug sellers' market one day, it's a mug buyers' market the next... Hot and cold shower as used in loony houses to make the inmates realise they exist at the mercy of the psychopathic guards... who keep turning on the taps of whatever... Fanbloodytastic!!!

Getting rid of a bull market

yo-yoing...

The Australian share market completed an extraordinary roller-coaster ride, finishing only 0.4 per cent lower after slumping more than 3 per cent earlier in the day.

The All Ordinaries had lost more than 140 points at the peak of its falls before 11:00am (AEST).

However, it finished 17 points lower at 4,326, while the ASX 200 index lost 11 points to 4,305.

The early local falls were mainly matching the fortunes of overseas markets - the Dow Jones industrial average slumped 3.6 per cent overnight, which was its biggest one-day fall in a year.

Winners and losersThe biggest decline on the market was among health stocks.

That was largely due to a profit warning from Sonic Healthcare, which said its earnings may be as much as 20 per cent below previous forecasts.

That sent its shares down more than 20 per cent - they closed at $10.07.

In contrast, Sigma Pharmaceuticals was up more than 37 per cent today to 48 cents.

The same company that fell 48 per cent in one day during late March after posting a surprise $390 million loss has now received a 60 cent a share takeover offer that values the company at $707 million.

Telstra was another major drag on the market, falling 2.3 per cent to $2.95.

The major banks were the main reason for the extreme bounce on the market.

-------------------------

Gus: nothing new in the battle between the panic merchants and the short changers — and the banks... see toon at top

two leaks "plugged" in one day...

Congress Passes Financial Regulation Bill

By DAVID M. HERSZENHORN

WASHINGTON — Congress on Thursday gave final approval to an overhaul of the nation’s financial regulatory system, intended to address the causes of the 2008 economic crisis and rewrite the rules for a more complex — and mistrustful — era on Wall Street.

The vote by the Senate was 60 to 39, with three Republicans from the Northeast joining with the Democrats in voting to advance the legislation.

One Democrat, Senator Russ Feingold of Wisconsin, voted against the bill, saying it was still not strong enough to prevent future crises. And the seat held by Senator Robert C. Byrd, Democrat of West Virginia, who died last month, is vacant.

"We want to make sure this disaster never happens again," the Senate majority leader, Harry M. Reid of Nevada, said after the vote. "The solution has to start here."

Mr. Reid added, "No more bailouts. No bank is too big to fail."

The House approved the bill in June by a vote of 237 to 192, and there, too, only three Republicans voted in favor.

The legislation now heads to President Obama for his signature, and the White House said it was already planning a ceremony next week to mark the completion of another landmark piece of legislation, following the enactment of the historic health care bill in March and last year’s economic stimulus program.

Mr. Obama’s press secretary, Robert Gibbs, said that the regulatory overhaul was an achievement that Democrats would promote throughout the fall election season. “We cannot continue to operate using the same rules that got us into this recession,” Mr. Gibbs said. “I think this will be a vote Democrats will talk about through November.”

But like those other big laws that Mr. Obama can claim as victories, the passage of a new regulatory regime hardly guarantees that it will be effective. And, despite lingering public anger at Wall Street, the political implications for the midterm elections are highly uncertain. Most Republicans voted resoundingly, and confidently, against the bill.

Even Senator Christopher J. Dodd, Democrat of Connecticut and chairman of the banking committee who was a main author of the bill, acknowledged that Americans will probably not know for years — perhaps not until the next financial crisis strikes — if the response by Congress this year was sufficient, or falls short despite the best intentions.

--------------------------

Gus: after having fixed these two major nose bleeds, we can go back to making sure we protect the planet from human greed and its associated destructive practices... It's the only planet we've got... see toon at top...

a gruen transfer...

Dr Nicholas Gruen has written a proposal to increase competition in the banking sector.

http://www.abc.net.au/bestof/#s3073977

Gus: add insurance to the mix and...

see toon at top...