Search

Recent comments

- epibatidine....

4 min 50 sec ago - cryptohubs...

1 hour 3 min ago - jackboots....

1 hour 11 min ago - horrid....

1 hour 19 min ago - nothing....

3 hours 42 min ago - daily tally....

5 hours 4 min ago - new tariffs....

6 hours 55 min ago - crummy....

1 day 1 hour ago - RC into A....

1 day 3 hours ago - destabilising....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

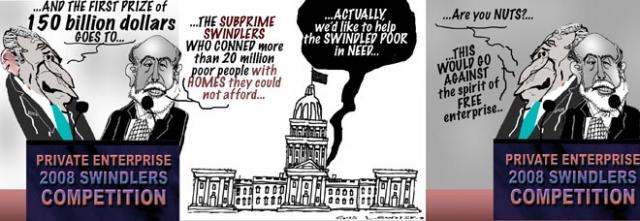

foxes & henhouses .....

He will soon play a major role in deciding the fate of one such bill, to help struggling homeowners, that the House passed, 266 to 154, on Thursday.

But over the years, his critics say, Mr. Shelby’s ties to the mortgage industry and the Alabama real estate market, and the generous campaign donations he receives from financial services companies, have distorted his perspective and led him to delay critical legislative remedies.

Indeed, Mr. Shelby’s legislative and business worlds have often intersected. For instance, while on the Banking Committee, he financed an apartment complex he owns in Tuscaloosa with a $5 million loan from Freddie Mac, the same government-sponsored mortgage company whose regulation his committee is reshaping.

Even his efforts to steer federal money to the University of Alabama, where a recently built $60 million science building is named after Mr. Shelby and his wife, Annette, have benefited him. The tens of millions in earmarks have helped the university, his alma mater, grow and attract more students. The tenants of his apartment complex are mostly students.

Mr. Shelby said in an interview his business dealings posed no conflict.

“It doesn’t affect me at all. I’m going to put the interests of the nation first,” he said. His stubbornness over housing laws, he said, stems from his free-market philosophy and opposition to using tax dollars to bail out people who acted recklessly. “We can’t bail out everything,” he added.

Others see it differently. “Senator Shelby would have prevented anything going through that the industry was not happy with,” said Representative Brad Miller, Democrat of North Carolina, who has pushed legislation to crack down on predatory lending, an effort that has stalled in the Senate in part because of Mr. Shelby’s reservations. “That’s the sense from all the people who are involved in the issue.”- By Gus Leonisky at 10 May 2008 - 10:05pm

- Gus Leonisky's blog

- Login or register to post comments

experts fiddling in dumb greed...

From Bob Ellis

Why do banks and economists so often get it wrong when ordinary people queuing for petrol can see what the trouble is - the war, the greed of Big Oil, the shareholders, the CEOs, the banks, the craze for privatisation, the mania for water views - and usually get it right? Why are people better economists than economists? Why is it clear to them that putting the cost of living up causes inflation, but not clear to Glenn Stephens?

It's partly, I think, because economists are fond of saying 'funnily enough'. By driving prices up, funnily enough, we're fighting inflation. By sending businesses broke, and evicting families into the street, we're helping the economy. By this recession, funnily enough, the recession we had to have, we're helping the economy. They're keen on paradox, anomaly, mysterious excuses, demented alibis and secret languages. They're keen on appeals to the 'unseen hand' and 'necessary market corrections' when things, in fact, are simpler than that. They're dead obvious in fact.

When you have less money to spend, you spend less money. And if you spend less money, many small businesses go to the wall; and fearing they're going to the wall, put prices up. Putting prices up is called inflation. So you cause inflation by taking people's money away, although Glenn Stephens thinks you fight inflation by taking people's money away. You cause the thing you fear. And then, having caused it in October, you cause it again in January, and then February. Why is the 'funnily enough' remedy for inflation not working? You well may ask. Why, indeed, has it not worked these past five years? You well may ask. Because it's the wrong remedy, just as it was in October. You don't fight inflation by putting prices up. Have you got that? Say it after me.

You don't fight inflation by putting prices up. You fight it by bringing prices down. Start with interest rates and see how you go. How hard is it to get your brain around this? The Fed and the Bank of England understand it. The nouveau capitalists of China understand it. The average housewife queueing to buy milk understands it. Why not Glenn Stephens? Why not his Board?

------------------

Gus: I feel many ex-conomists are ex-perts in crunching figures to a pulp, so things don't make sense anymore. If things made sense, anyone could be an economist or a hedger, stuffing the system to death by having a system of people crunching numbers, exclusively... What a strange planet it would be... But looking at it, everyone could be a farmer — small and self-sustainable sure, but at least we could survive. Thus, ex-conomists use the dull wizardry of the useless art that shifts numbers from one accounting bucket to another — effectively reducing the happiness of people in general (especially removing the ability of — and the numbers of — those who try to be self-sustainable) to increase the size of the greedy buckets who do not care what's in the buckets as long as the bucket keep shifting stuff, uselessly or not. There is no "economy" if money does not keep shifting around in a social system. Thus the ex-conomists major role is to make sure the money movement is at a steady pace, not too fast, not too slow — a pace at which they jealously ensure the rich profit from the cake and others toil for making it (with the hope of eating the cake and buckley's of doing so) — in a system which would totally seize up economically if everyone was happy and satisfied (or self-sustainable).

This happy satisfaction would be the pits for ex-conomists. They need people to be dependent and greedy. They would be left stranded without having to fiddle in a happy repleted, but with no economy, society. Anathema of the greatest order in a world of dumb greed, where ex-conomists fiddle greed-values like flies moving on the smelly butt of cattle (doing their bit in the recycling of s...t), while the rich keep on smiling, dangling small glittering carrots — for a hefty profit — to the gullible but greed inspired dumb crowd...

What do I know?... I am still at the bottom of the pile, trying to get out of the s...t... May be I should have sold my greedy soul to... Anyone? Anyone?... An economist? Hello?

moral banknotes

By DAVID BROOKS [NYT]

Published: June 10, 2008

The people who created this country built a moral structure around money. The Puritan legacy inhibited luxury and self-indulgence. Benjamin Franklin spread a practical gospel that emphasized hard work, temperance and frugality. Millions of parents, preachers, newspaper editors and teachers expounded the message. The result was quite remarkable.

The United States has been an affluent nation since its founding. But the country was, by and large, not corrupted by wealth. For centuries, it remained industrious, ambitious and frugal.

Over the past 30 years, much of that has been shredded. The social norms and institutions that encouraged frugality and spending what you earn have been undermined. The institutions that encourage debt and living for the moment have been strengthened. The country’s moral guardians are forever looking for decadence out of Hollywood and reality TV. But the most rampant decadence today is financial decadence, the trampling of decent norms about how to use and harness money.

dancing with the bears...

In Washington, financial speculators have fat targets on their backs.

They are being blamed for high gas prices, soaring grocery bills and volatile commodity markets, and lawmakers are lashing out at market regulators for not cracking down on them more vigorously.

“You study it, but you don’t act against this incredible increase in speculation,” Senator Carl Levin, Democrat of Michigan, complained to a senior official of the Commodity Futures Trading Commission at a recent Senate hearing. “Unless the C.F.T.C. is going to act against speculation, we don’t have a cop on the beat.”

Just this week, Senator Joseph I. Lieberman, the Connecticut independent, said he was working on a proposal to ban large institutional investors from the commodity markets entirely. The same day, the Bush administration endorsed another Senate proposal to create a new federal interagency task force to investigate commodity speculation. At least four public hearings have explored the topic in just the last two months, and Senator Lieberman will hold another session on June 24.

Although it is common in tough financial times to blame the speculators, this escalating hostility toward them is starting to worry people with years of knowledge about how commodity markets work. Because without speculators, they say, these markets do not work at all.

Speculators, people willing to risk their capital in search of high profits, are central to healthy commodity markets, they say, and broad-brush restrictions on them could damage markets that are already under pressure from rising global demand for food and fuel.

Even in Washington, there is widespread agreement that no single factor is responsible for rising food and energy prices. The hungry, high-growth economies of India and China are fundamentally affecting worldwide demand, while uncooperative weather and government policies on trade and ethanol are among the many factors affecting supply.

Commodities, priced in American dollars, tend to rise in price as the dollar weakens, making commodities a popular haven for investors fearful of inflation.

But beneath all these external factors is the simple seesaw of the marketplace: For every person who buys oil at $130 a barrel, there must be another person willing to sell at that price — and, odds are, at least one of them will be a speculator.

Before it was a Beltway epithet, “speculator” was simply a type of trader in the commodity futures markets. Unlike hedgers — the farmers, miners, refineries and other commercial interests that actually make or use the commodities themselves — the speculators, like day traders in the stock market, are simply trying to profit from changing prices.